It is never too late to make a U-turn on the wrong path, says a Turkish proverb.

And yes, Jerome Powell surprised markets after his Omicron comment (many thinks that is dovish) by speaking hawkishly about pace of tapering picking up!

And yes, Jerome Powell surprised markets after his Omicron comment (many thinks that is dovish) by speaking hawkishly about pace of tapering picking up!

https://twitter.com/EconguyRosie/status/1465729833867137030

Inflation is at 6.2%YoY, and no matter whether u think it is transitory or not, it is way past 2% mandate & way higher than zero policy rate.

CPI hasn’t peaked btw. Even if it slows, still high. Look at European CPI.

This isn’t just supply side issues, demand is strong

CPI hasn’t peaked btw. Even if it slows, still high. Look at European CPI.

This isn’t just supply side issues, demand is strong

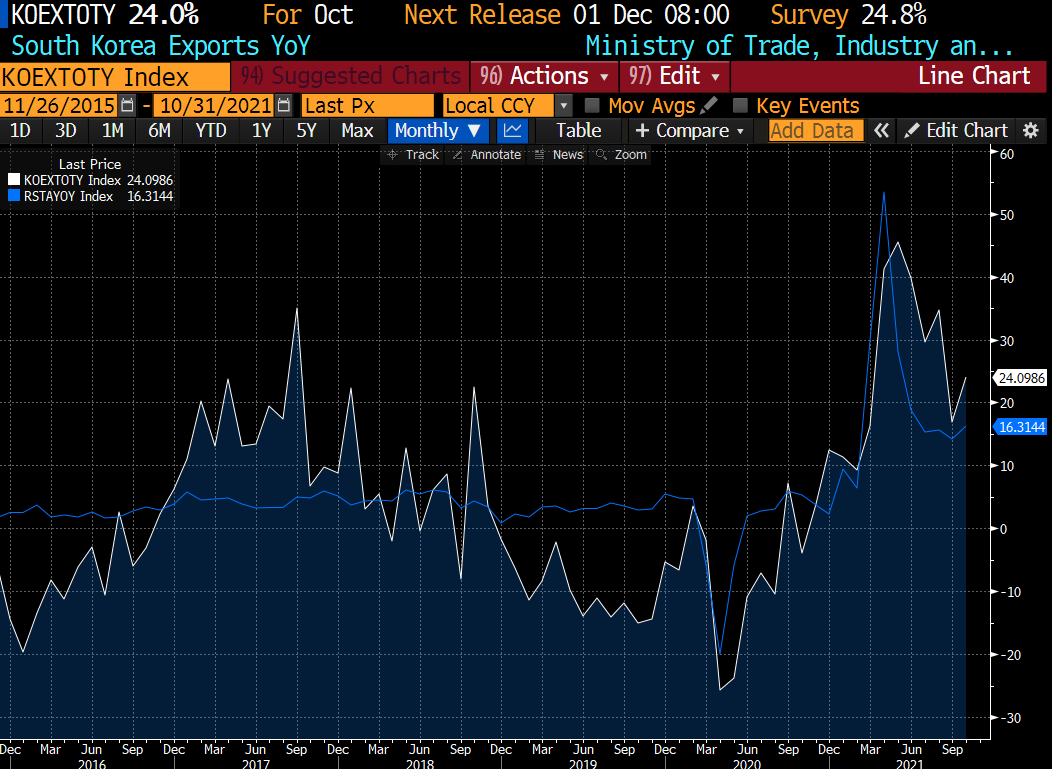

How do I know that? Very simple, we have the same issues here in Asia regarding supply shocks.

PPI off the chart. Have u seen China PPI?

But CPI weak. Why? Demand has been weak & so outweigh supply side shocks.

US CPI is a combo of demand & supply.

Fed is behind the curve.

PPI off the chart. Have u seen China PPI?

But CPI weak. Why? Demand has been weak & so outweigh supply side shocks.

US CPI is a combo of demand & supply.

Fed is behind the curve.

And so now that he is reappointed & inflation is TOXIC politically, whether u are appointed by the president or elected, because it affects ordinary people & voters.

So u better start acting like you care. And saying transitory isn’t going to cut it if people’s pockets worse.

So u better start acting like you care. And saying transitory isn’t going to cut it if people’s pockets worse.

The Fed is doing the right thing by withdrawing some liquidity from the market & introducing risks to RISK asset like equities so not to create a moral hazard. Need to deflate the bubble slowly to avoid a sudden pop. This is good systemic risk management & the right thing to do.

• • •

Missing some Tweet in this thread? You can try to

force a refresh