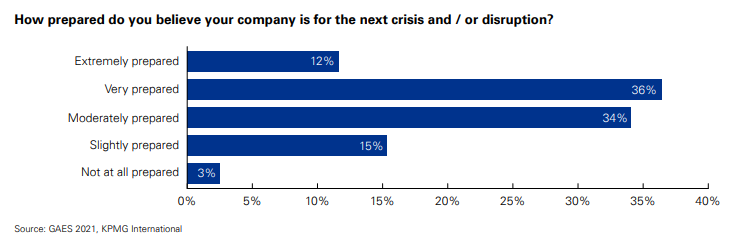

🧵1/ Some findings from @KPMG annual Global Automotive Exec Survey. Highlights on strategy, electric vehicles, commodities here. Start: 48% of execs say they're very/extremely prepared for the next crisis (or disruption - rather different those) home.kpmg/xx/en/home/ins…

🧵2/ Auto execs are quite concerned about commodity and component supply continuity home.kpmg/xx/en/home/ins…

🧵3/ By 2030 - execs think that most big markets will be ~50% EV sales...but Japan(!) same as China and US, and US ahead of W. Europe...and with massive quartile variation home.kpmg/xx/en/home/ins…

🧵4/ Can battery EVs be widespread without government intervention? Yes home.kpmg/xx/en/home/ins…

🧵5/ Should governments also provide direct consumer subsidies to battery electric vehicles? Also yes (if you know executives in *any* business, these two findings make total sense: we can do it without you, but you should help us anyways) home.kpmg/xx/en/home/ins…

🧵6/ How long are drivers going to wait for an EV charge? 30 minutes or less home.kpmg/xx/en/home/ins…

🧵7/ By 2030 more than 3/4 of auto sales will be completed online (cannot argue with this expectation) home.kpmg/xx/en/home/ins…

🧵8/ If auto execs could double their existing R&D budget, where's it gonna go?

1. New powertrain tech

2. Autonomy

3. Connected tech

home.kpmg/xx/en/home/ins…

1. New powertrain tech

2. Autonomy

3. Connected tech

home.kpmg/xx/en/home/ins…

🧵9/ Are y'all auto exec gonna make tech acquisitions? Yes and Yes (and a third of total sees acquisitions as "a critical part of our strategy" home.kpmg/xx/en/home/ins…

🧵10/ Nonstrategic/noncore business divestment is coming home.kpmg/xx/en/home/ins…

Lots more in there. Take a look. home.kpmg/xx/en/home/ins… /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh