My two obsessions keep colliding: another blockchain real estate startup, but instead of it being tokenization of virtual real estate that exists in the digital world, it's the digitization of physical real estate speculation shoved onto the blockchain:

lofty.ai

lofty.ai

Lofty is doing TWO things that are worth discussing separately:

1) It's an AI program that tries to predict housing prices:

drive.google.com/file/d/1AMszNo…

This is what Zillow tried and failed at, but we shouldn't take Zillow's failure as evidence it can't be done.

1) It's an AI program that tries to predict housing prices:

drive.google.com/file/d/1AMszNo…

This is what Zillow tried and failed at, but we shouldn't take Zillow's failure as evidence it can't be done.

Matt Levine had a good take on this:

bloomberg.com/opinion/articl…

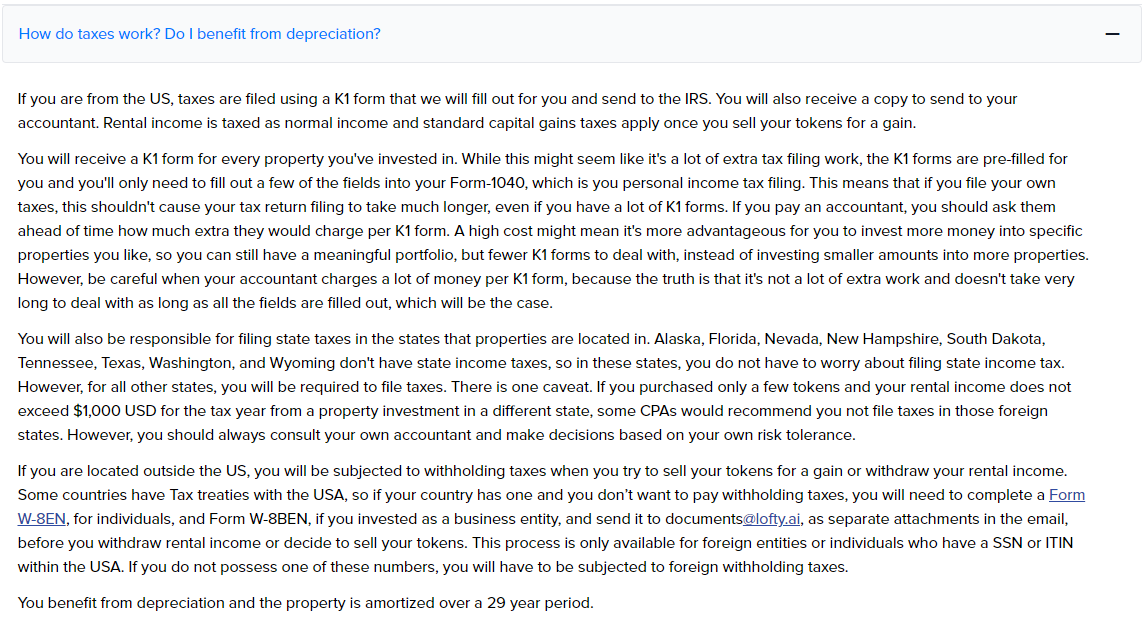

2) It's using fractionalized ownership of tokens to allow multiple people to own the same property, and pay out rents automatically to token holders.

bloomberg.com/opinion/articl…

2) It's using fractionalized ownership of tokens to allow multiple people to own the same property, and pay out rents automatically to token holders.

The whole thing is very hands off. The properties themselves are turned into investments, you're not even allowed to visit the property that you "own"

Why do we need blockchain for this?

Basically they say they don't need to build as much infrastructure, they can outsource it to the blockchain, and they pass the savings on to you.

Don't seem to be any answers about what happens if your tokens are hacked.

Basically they say they don't need to build as much infrastructure, they can outsource it to the blockchain, and they pass the savings on to you.

Don't seem to be any answers about what happens if your tokens are hacked.

If this succeeds, then everyone can look forward to increasingly liquid and cheap credit flowing into housing -- the world's #1 asset class -- to drive prices ever more skyward

• • •

Missing some Tweet in this thread? You can try to

force a refresh