1/

Get a cup of coffee.

In this thread, I'll walk you through a simple way to compare the effectiveness of *dividends* vs *share buybacks*.

Get a cup of coffee.

In this thread, I'll walk you through a simple way to compare the effectiveness of *dividends* vs *share buybacks*.

2/

In a capitalist society, businesses are supposed to work their magic like so:

Step 1. Get capital from owners.

Step 2. Earn a return on that capital through business operations. And,

Step 3. Over time, give back MORE capital to owners than what they put in.

In a capitalist society, businesses are supposed to work their magic like so:

Step 1. Get capital from owners.

Step 2. Earn a return on that capital through business operations. And,

Step 3. Over time, give back MORE capital to owners than what they put in.

3/

Publicly traded companies have 2 main ways of doing Step 3 (giving back money to the owners):

(a) Dividends, and (b) Share Buybacks.

Which is better?

Well, that depends on the circumstances.

And this thread will help you evaluate these circumstances.

Publicly traded companies have 2 main ways of doing Step 3 (giving back money to the owners):

(a) Dividends, and (b) Share Buybacks.

Which is better?

Well, that depends on the circumstances.

And this thread will help you evaluate these circumstances.

4/

The easiest way to understand the concepts here is through an example.

Imagine that company XYZ will earn $1B in Free Cash Flow (FCF) every year from now until eternity.

Also, let's say that XYZ currently has 100M shares outstanding. So, FCF *per share* is $1B/100M = $10.

The easiest way to understand the concepts here is through an example.

Imagine that company XYZ will earn $1B in Free Cash Flow (FCF) every year from now until eternity.

Also, let's say that XYZ currently has 100M shares outstanding. So, FCF *per share* is $1B/100M = $10.

5/

Suppose XYZ's managers are not able to find good ways to re-invest this FCF back into the business.

So, they just want to return the money back to XYZ's owners (ie, shareholders).

Should they do this via dividends or buybacks?

Suppose XYZ's managers are not able to find good ways to re-invest this FCF back into the business.

So, they just want to return the money back to XYZ's owners (ie, shareholders).

Should they do this via dividends or buybacks?

6/

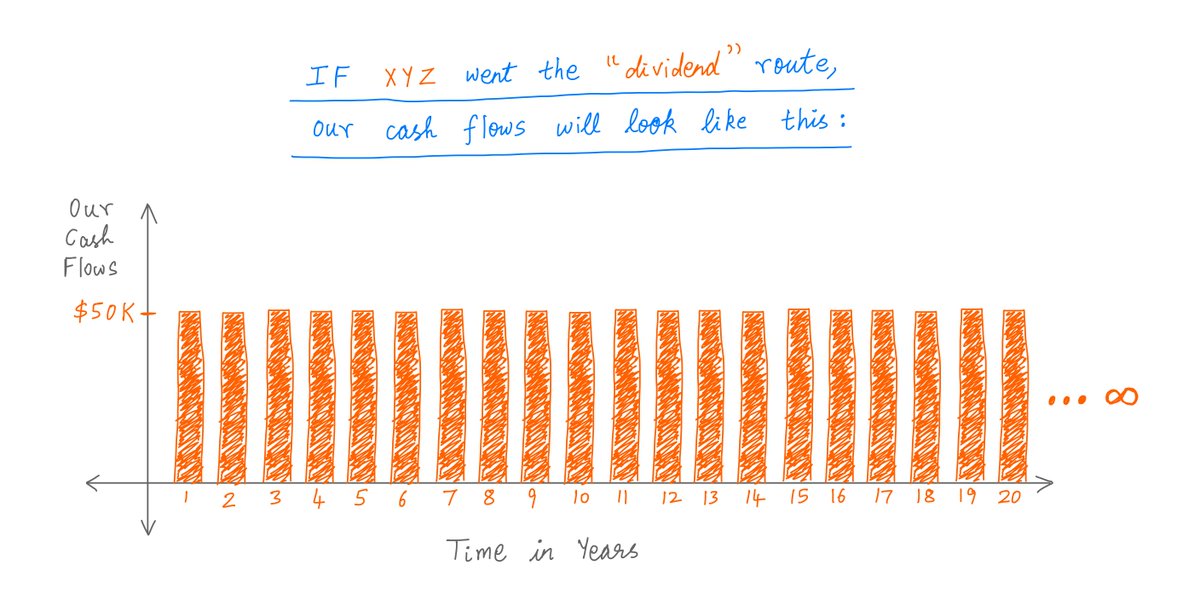

A dividend is straightforward.

XYZ just issues a $10 per share dividend check to each shareholder each year.

For example, suppose we own 5000 shares of XYZ. Then, we'll get 5000 * $10 = $50K per year in dividends.

Our "cash flows" from XYZ will thus look like this:

A dividend is straightforward.

XYZ just issues a $10 per share dividend check to each shareholder each year.

For example, suppose we own 5000 shares of XYZ. Then, we'll get 5000 * $10 = $50K per year in dividends.

Our "cash flows" from XYZ will thus look like this:

7/

What if XYZ decided to do buybacks instead?

The idea here is: *some* of XYZ's owners *buy out* the others -- to the tune of $1B per year.

For example, suppose XYZ is able to buy back its shares at 20 times FCF.

That means, each year, XYZ will retire 5% of its shares:

What if XYZ decided to do buybacks instead?

The idea here is: *some* of XYZ's owners *buy out* the others -- to the tune of $1B per year.

For example, suppose XYZ is able to buy back its shares at 20 times FCF.

That means, each year, XYZ will retire 5% of its shares:

8/

In effect, this is 5% of XYZ's owners selling their ownership interest in XYZ to the other 95% of XYZ's owners -- for $1B each year.

Thus, over time, the owners who *don't* sell their shares back to XYZ will see their percentage ownership of the company go up.

In effect, this is 5% of XYZ's owners selling their ownership interest in XYZ to the other 95% of XYZ's owners -- for $1B each year.

Thus, over time, the owners who *don't* sell their shares back to XYZ will see their percentage ownership of the company go up.

9/

Suppose these buybacks go on for 10 years.

Then, by the end of Year 10, XYZ's share count would have shrunk by ~40%. That's what 5% per year does:

Suppose these buybacks go on for 10 years.

Then, by the end of Year 10, XYZ's share count would have shrunk by ~40%. That's what 5% per year does:

10/

We started Year 1 with 100M shares outstanding. So, by the end of Year 10, we'll have roughly 60% of 100M = 60M shares outstanding.

That means, from Year 11 onwards (assuming no more buybacks are done), FCF per share will be $1B/60M ~= $16.7.

We started Year 1 with 100M shares outstanding. So, by the end of Year 10, we'll have roughly 60% of 100M = 60M shares outstanding.

That means, from Year 11 onwards (assuming no more buybacks are done), FCF per share will be $1B/60M ~= $16.7.

11/

Starting Year 11, this $16.7 per share can be dividended out to owners.

Assuming we're still holding on to our 5000 shares at that time, we can expect to receive 5000 * $16.7 = ~$83.5K in dividends each year from XYZ.

Like so:

Starting Year 11, this $16.7 per share can be dividended out to owners.

Assuming we're still holding on to our 5000 shares at that time, we can expect to receive 5000 * $16.7 = ~$83.5K in dividends each year from XYZ.

Like so:

12/

So, here's what we have:

IF XYZ does dividends: we get $50K *every* year.

IF XYZ does buybacks: we get NOTHING for the first 10 years, but ~$83.5K per year from Year 11 onwards.

We now have to decide which of these cash flow streams is "better".

So, here's what we have:

IF XYZ does dividends: we get $50K *every* year.

IF XYZ does buybacks: we get NOTHING for the first 10 years, but ~$83.5K per year from Year 11 onwards.

We now have to decide which of these cash flow streams is "better".

13/

Clearly, if we value the *immediacy* of our cash flows, we'd prefer dividends to buybacks.

Because, with dividends, we get paid from Year 1.

Whereas with buybacks, we have to wait 11 long years before seeing a dime.

Clearly, if we value the *immediacy* of our cash flows, we'd prefer dividends to buybacks.

Because, with dividends, we get paid from Year 1.

Whereas with buybacks, we have to wait 11 long years before seeing a dime.

14/

On the other hand, with buybacks, we *eventually* get MORE money: ~$83.5K per year instead of $50K.

So, if we value the *size* of our cash flows more than their *immediacy*, we'd prefer buybacks.

On the other hand, with buybacks, we *eventually* get MORE money: ~$83.5K per year instead of $50K.

So, if we value the *size* of our cash flows more than their *immediacy*, we'd prefer buybacks.

15/

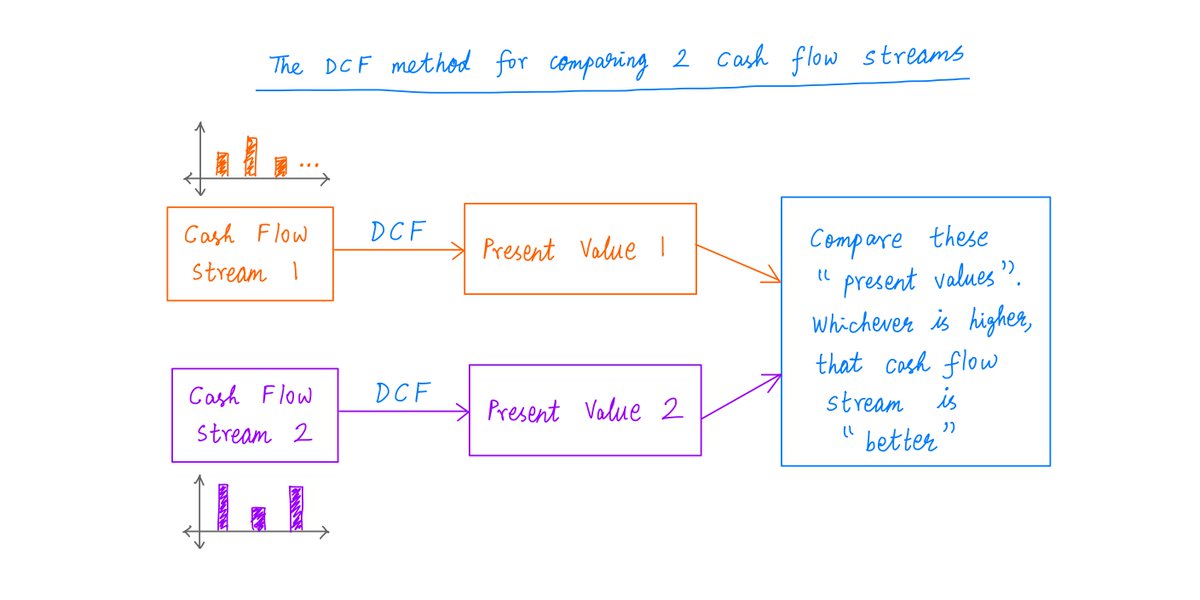

In finance and investing, there's a standard way to calculate such "immediacy" vs "size" trade-offs.

It's called DCF: Discounted Cash Flow analysis.

The idea is: we take our 2 cash flow streams and reduce each to a single number -- called its "present value".

In finance and investing, there's a standard way to calculate such "immediacy" vs "size" trade-offs.

It's called DCF: Discounted Cash Flow analysis.

The idea is: we take our 2 cash flow streams and reduce each to a single number -- called its "present value".

16/

Then, it's just a question of comparing the 2 present values.

Whichever cash flow stream has the higher present value is "better".

For more:

Then, it's just a question of comparing the 2 present values.

Whichever cash flow stream has the higher present value is "better".

For more:

https://twitter.com/10kdiver/status/1292130833273257984

17/

The DCFs above take an important input called the "discount rate".

This is the number that quantifies our "immediacy" vs "size" trade-off.

The HIGHER our discount rate, the MORE we value "immediacy" over "size". And thus, the more we will prefer dividends to buybacks.

The DCFs above take an important input called the "discount rate".

This is the number that quantifies our "immediacy" vs "size" trade-off.

The HIGHER our discount rate, the MORE we value "immediacy" over "size". And thus, the more we will prefer dividends to buybacks.

18/

In this example, for all discount rates *above* ~5.26% per year, we'd prefer dividends.

And for discount rates *below* ~5.26%, we'd prefer buybacks.

In this example, for all discount rates *above* ~5.26% per year, we'd prefer dividends.

And for discount rates *below* ~5.26%, we'd prefer buybacks.

19/

This means our *opportunity cost* is ~5.26% per year.

That is, if we know of *other* investment opportunities that can get us MORE than ~5.26% per year, then we'd prefer XYZ to give us dividends.

But if we're NOT aware of such opportunities, we'd prefer buybacks.

This means our *opportunity cost* is ~5.26% per year.

That is, if we know of *other* investment opportunities that can get us MORE than ~5.26% per year, then we'd prefer XYZ to give us dividends.

But if we're NOT aware of such opportunities, we'd prefer buybacks.

20/

This is a key point in the "dividends vs buybacks" debate.

Some owners (eg, those who find ~5.26%/year an easy hurdle) may rationally prefer dividends. Other owners may *equally* rationally prefer buybacks.

Different owners have different investing abilities/circumstances.

This is a key point in the "dividends vs buybacks" debate.

Some owners (eg, those who find ~5.26%/year an easy hurdle) may rationally prefer dividends. Other owners may *equally* rationally prefer buybacks.

Different owners have different investing abilities/circumstances.

21/

The company's managers, in all likelihood, won't be able to please ALL owners.

So, if we're active investors, it falls to us to develop self-awareness and find companies whose policies suit us well.

The company's managers, in all likelihood, won't be able to please ALL owners.

So, if we're active investors, it falls to us to develop self-awareness and find companies whose policies suit us well.

22/

Also, the *price* at which a company can buy back its shares is crucial.

The HIGHER the price the company has to pay, the fewer the number of shares that will be retired, the smaller our "opportunity cost" hurdle, and the MORE likely we are to prefer DIVIDENDS.

Also, the *price* at which a company can buy back its shares is crucial.

The HIGHER the price the company has to pay, the fewer the number of shares that will be retired, the smaller our "opportunity cost" hurdle, and the MORE likely we are to prefer DIVIDENDS.

23/

Many managers view dividends as "obligations".

If they give owners a $10/share dividend this year, they'll have to do the same next year. Otherwise, the market could "punish" the stock.

So, managers are reluctant to raise dividends too quickly, even if they have the FCF.

Many managers view dividends as "obligations".

If they give owners a $10/share dividend this year, they'll have to do the same next year. Otherwise, the market could "punish" the stock.

So, managers are reluctant to raise dividends too quickly, even if they have the FCF.

24/

By contrast, buybacks are viewed as "residual".

That is, any FCF that remains *after* dividends tends to be almost automatically allotted to buybacks -- without much regard for price.

This can be sub-optimal for the owners.

By contrast, buybacks are viewed as "residual".

That is, any FCF that remains *after* dividends tends to be almost automatically allotted to buybacks -- without much regard for price.

This can be sub-optimal for the owners.

25/

Also, some companies buy back shares just to offset the dilution caused by Stock Based Compensation (SBC) -- sometimes paying fancy prices to do so.

This can add INSULT (buybacks at prices that don't make sense) to INJURY (excessive SBC).

For more:

Also, some companies buy back shares just to offset the dilution caused by Stock Based Compensation (SBC) -- sometimes paying fancy prices to do so.

This can add INSULT (buybacks at prices that don't make sense) to INJURY (excessive SBC).

For more:

https://twitter.com/10kdiver/status/1330218917579677697

26/

Also, taxes can be a concern.

Buybacks are often touted as the "tax efficient" way to return capital to owners.

And there is some truth to that.

But NOT at *any* price.

Dividends can sometimes make more sense for most owners -- in spite of tax disadvantages.

Also, taxes can be a concern.

Buybacks are often touted as the "tax efficient" way to return capital to owners.

And there is some truth to that.

But NOT at *any* price.

Dividends can sometimes make more sense for most owners -- in spite of tax disadvantages.

27/

One Tweet Summary:

To see whether a company's "return of capital" -- ie, dividends vs buybacks -- policy makes sense for us, we:

(a) estimate our (after tax) cash flow streams in both cases,

(b) compare them via DCFs, and

(c) calculate our "opportunity cost" hurdle.

One Tweet Summary:

To see whether a company's "return of capital" -- ie, dividends vs buybacks -- policy makes sense for us, we:

(a) estimate our (after tax) cash flow streams in both cases,

(b) compare them via DCFs, and

(c) calculate our "opportunity cost" hurdle.

28/

Here's something new.

Join me tomorrow (Sun, 2021-Dec-12) at 4pm ET via the Callin' app. We'll discuss the concepts in this thread, you can ask me questions, etc.

For FREE. 😀

(Callin' is like Twitter Spaces, with some advanced features.)

Link: callin.com/?link=nNFjuOiS…

Here's something new.

Join me tomorrow (Sun, 2021-Dec-12) at 4pm ET via the Callin' app. We'll discuss the concepts in this thread, you can ask me questions, etc.

For FREE. 😀

(Callin' is like Twitter Spaces, with some advanced features.)

Link: callin.com/?link=nNFjuOiS…

29/

If you're still with me, thank you very much.

I hope this thread helped you sharpen your thinking on the ways that companies use to return capital back to their owners.

Please stay safe. Enjoy your weekend!

/End

If you're still with me, thank you very much.

I hope this thread helped you sharpen your thinking on the ways that companies use to return capital back to their owners.

Please stay safe. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh