Since 2004, a massive oil spill has plagued the Gulf of Mexico.

But the owner of the company responsible for that spill has reaped a huge benefit from this environmental nightmare, allowing her to avoid paying a penny in federal income tax for 14 years.🧵

propublica.org/article/a-mass…

But the owner of the company responsible for that spill has reaped a huge benefit from this environmental nightmare, allowing her to avoid paying a penny in federal income tax for 14 years.🧵

propublica.org/article/a-mass…

2/ Patrick Taylor started New Orleans-based Taylor Energy in 1979, and the oil exploration company eventually made him the richest man in Louisiana. His wife Phyllis was dubbed the "gentle dove" of New Orleans for her philanthropy.

3/ Then came 2004.

First, Hurricane Ivan swept the legs out from under a Taylor Energy drilling platform, kicking off what would become the country's longest-running oil spill.

A couple months later, Patrick Taylor died and Phyllis took over the company.

First, Hurricane Ivan swept the legs out from under a Taylor Energy drilling platform, kicking off what would become the country's longest-running oil spill.

A couple months later, Patrick Taylor died and Phyllis took over the company.

4/ Deaths create a spectacular tax boon for the wealthy, what some experts consider one of the largest loopholes in the code.

5/ Had Patrick Taylor sold his company while he was alive, the Taylors would've had to pay a huge tax on the capital gains. But because there's no estate tax for property transferred to a spouse, Phyllis inherited the $1.6B company tax-free.

6/ The 2004 spill went largely unnoticed by the general public and it had yet to be cleaned up by 2008 when Phyllis Taylor sold all of the company’s oil rigs & other assets EXCEPT for the damaged rig.

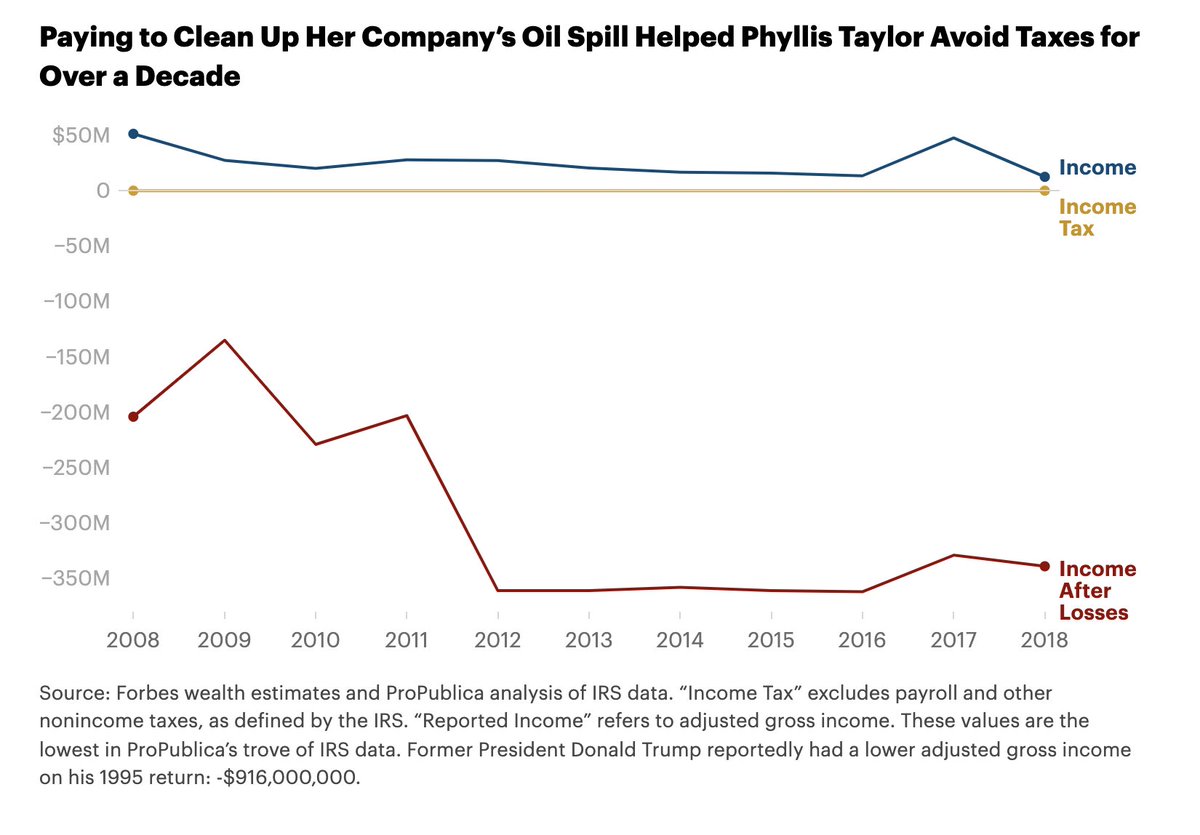

7/ Despite the $1.25B price tag on that sale (of which Phyllis received $1.2B, according to Taylor Energy’s CEO), she reported a loss of $211 million to the IRS.

8/

How?

Because the law allows owners of private companies a lot of leeway in determining the value of their assets. And according to Taylor Energy's former CEO, these assets were sold at a premium.

How?

Because the law allows owners of private companies a lot of leeway in determining the value of their assets. And according to Taylor Energy's former CEO, these assets were sold at a premium.

9/

“I did the valuation. I know what the assets were worth and know what we sold them for. We did not take a loss. Period,” John Pope, Taylor Energy’s former CEO, told ProPublica.

“I did the valuation. I know what the assets were worth and know what we sold them for. We did not take a loss. Period,” John Pope, Taylor Energy’s former CEO, told ProPublica.

10/ The upshot of the claimed loss: Taylor paid no federal income tax in a year when she realized an enormous gain.

She even got a remarkable extra goodie: refunds on $30 million in taxes she’d paid in previous years.

She even got a remarkable extra goodie: refunds on $30 million in taxes she’d paid in previous years.

11/ After the 2008 sale of its oil operations, Taylor Energy remained a company devoted to one thing: cleaning up the still-flowing spill. It had claimed to be trying to plug the leaking oil well but seemed to make no progress.

12/ It soon reached an agreement with federal regulators to create a $666M trust to cover the cleanup cost.

But as the company's sole owner, its income & losses flowed through to Phylis's personal taxes.

She could write off the costs of the cleanup against her own income.

But as the company's sole owner, its income & losses flowed through to Phylis's personal taxes.

She could write off the costs of the cleanup against her own income.

13/ While fines and penalties are not tax-deductible expenses, the costs of cleaning up an environmental disaster are.

Such write-offs are legal, qualifying as “ordinary and necessary” business expenses.

Such write-offs are legal, qualifying as “ordinary and necessary” business expenses.

14/ In the years after establishing the cleanup trust, Taylor Energy spent money trying to stop the spill, but claimed it couldn't have foreseen such an accident and that stopping the leak was technologically impossible.

15/ As the cleanup dragged on, Phyllis was able to use her company's losses to negate her taxable income.

According to IRS files, between 2005-2018, she reported $444M in income, but never paid a cent in federal income tax during that time.

According to IRS files, between 2005-2018, she reported $444M in income, but never paid a cent in federal income tax during that time.

16/ Representatives for Taylor did not respond to repeated requests for comment for this story.

propublica.org/article/a-mass…

propublica.org/article/a-mass…

17/ In 2012, the Coast Guard finally ordered Taylor to install a dome to contain the leak, but three years later, when Taylor Energy settled a lawsuit that forced it to start publicly disclosing more about its efforts, the company had not even finished the design.

18/ It's been more than 17 years, but the spill has still not been fixed. A different company eventually put a dome over the spill, containing but not stopping the leak.

19/ Read the full investigation from @paulkiel @JeffErnsthausen & @eisingerj here:

propublica.org/article/a-mass…

propublica.org/article/a-mass…

@paulkiel @JeffErnsthausen @eisingerj 20/ The Taylor story was Part 3 of a Secret IRS Files trilogy on losses (and big gains).

Read Part 1 here:

propublica.org/article/these-…

Read Part 1 here:

propublica.org/article/these-…

@paulkiel @JeffErnsthausen @eisingerj 21/ And then read Part 2 of this miniseries:

propublica.org/article/when-y…

propublica.org/article/when-y…

@paulkiel @JeffErnsthausen @eisingerj 22/ These reports are all part of the ongoing Secret IRS Files project, available here:

propublica.org/series/the-sec…

propublica.org/series/the-sec…

@paulkiel @JeffErnsthausen @eisingerj 23/ Sign up at the link below to be notified when the next Secret IRS Files story publishes.

OR

Text “IRS” to 917-746-1447 to get the next story texted to you.

propublica.org/newsletters/th…

OR

Text “IRS” to 917-746-1447 to get the next story texted to you.

propublica.org/newsletters/th…

• • •

Missing some Tweet in this thread? You can try to

force a refresh