1/ new research from @CoinSharesCo @jbutterfill on quantum compute as a threat to bitcoin's security model

tl;dr - scary in theory, exceptionally unlikely in practice. also, the entire financial services / internet economy would be FUBAR.

read on 👇

coinshares.com/research/bitco…

tl;dr - scary in theory, exceptionally unlikely in practice. also, the entire financial services / internet economy would be FUBAR.

read on 👇

coinshares.com/research/bitco…

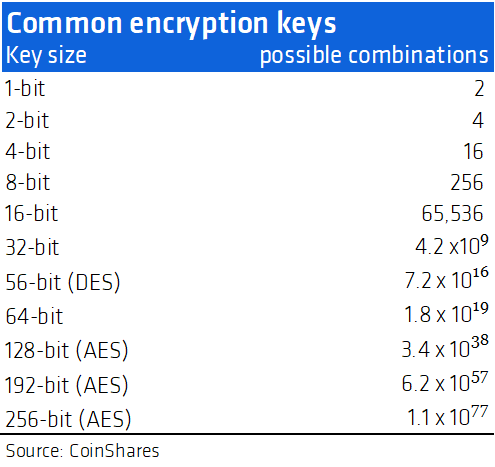

2/ cracking encryption is HARD. 128-bit encryption has 340 undecillion (36 zeros) variants. that's... a lot.

context - a computer that could test 1 trillion keys per second would take 10.79 quintillion years to crack it, which is 785 million times the age of the universe 🪐💫👩🚀

context - a computer that could test 1 trillion keys per second would take 10.79 quintillion years to crack it, which is 785 million times the age of the universe 🪐💫👩🚀

3/ Bitcoin uses SHA-256 cryptography for mining, and for public key obfuscation in the transaction process, and it should therefore be secure in a post-quantum world

4/ also, the bitcoin protocol isn't static. it's being developed constantly by @bitcoincoreorg and others.

at CoinShares, we fund bitcoin core development via the @mitDCI (i also contribute personally)

other orgs include @ChaincodeLabs, @bitcoinbrink, @HRF, and many others!

at CoinShares, we fund bitcoin core development via the @mitDCI (i also contribute personally)

other orgs include @ChaincodeLabs, @bitcoinbrink, @HRF, and many others!

5/ there is a growing body of work on mitigation strategies i.e. @imperialcollege proposed a soft fork to allow security upgrades

really smart people working at the edge of cryptography and computation are thinking about this and actively designing potential network upgrades

really smart people working at the edge of cryptography and computation are thinking about this and actively designing potential network upgrades

6/ existing financial infrastructure is at *far* greater risk than Bitcoin

we are in a race to deploy post-quantum cryptography in the next decade - how will we modify all existing systems that use public key cryptography, including all devices that connect to the internet?

we are in a race to deploy post-quantum cryptography in the next decade - how will we modify all existing systems that use public key cryptography, including all devices that connect to the internet?

7/ read the full piece here - coinshares.com/research/bitco…

and let us know what other questions or considerations we should be writing about. we know this is a common question and concern, but one we feel is quite misunderstood.

and let us know what other questions or considerations we should be writing about. we know this is a common question and concern, but one we feel is quite misunderstood.

• • •

Missing some Tweet in this thread? You can try to

force a refresh