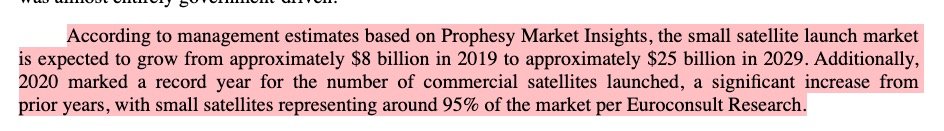

I was sifting through @VirginOrbit investor deck (because I am a masochist obviously) and I came across the 25B$ market projection for "Small-Satellite launch" by 2030. The reference source is "Prophesy Market Insights". So I looked it up on Google. 1/

virginorbit.com/wp-content/upl…

virginorbit.com/wp-content/upl…

When I first saw the reference in the SEC filing for the merger I thought it was a typo. But when I see it spelt the same way in the investor deck I don't know what to think. Because the term "prophesy market insights" only yields 3 results on Google. 2/

google.com/search?q=%22pr…

google.com/search?q=%22pr…

So let's assume that it is indeed a typo (if so, it is repeated twice, in two similarly important documents), and let's correct it to "Prophecy Market Insights". This name actually yields a positive result. 3/

prophecymarketinsights.com

prophecymarketinsights.com

This company sells market reports on everything. With the search tool I could find what seems to be the source for market intelligence of @VirginOrbit, with the 7,8B$ small satellite launch market in 2019. I've tweeted about it.

4/

prophecymarketinsights.com/market_insight…

4/

https://twitter.com/LionnetPierre/status/1470220337732374534

prophecymarketinsights.com/market_insight…

Now let's dig some more, and see what may qualify this company as the preferred market intelligence source of @VirginOrbit. There is also a more recent report on "Global Nanosatellite and Microsatellite trends". What does it say? 5/

prophecymarketinsights.com/market_insight…

prophecymarketinsights.com/market_insight…

According to this report, the market for satellites <100kg in 2020 was worth 1,5B$. I am speechless. For the record, in 2020 there were 220 satellites launched in that mass range, for a total of 3,5 tons. Accordingly, this would set the average value of each satellite at 7M$. 6/

At that price point each nano/microsatellite would cost >400k$/kg, i.e. the price of the most expensive space programmes in the World such as SBIRS, Helios, Keyhole or Falconeye. 7/

illdefined.space/2021/01/11/see…

senat.fr/rap/a13-158-8/…

iceye.com/satellite-data…

atalayar.com/en/content/ext…

illdefined.space/2021/01/11/see…

senat.fr/rap/a13-158-8/…

iceye.com/satellite-data…

atalayar.com/en/content/ext…

Moreover, 30% of the 220 nano/microsats of 2020 were launched for commercial constellations (notably Spire and Planet), and their value is more or less known (200-400k$/each or 40-80k$/kg). Similarly 13 were deployed for Satellogic, at a unit value <1M$.

8/

8/

The most expensive satellites in this group of 220 were probably the few larger ones launched for NRO, DARPA, NASA and Blacksky, whose values may go as high as 50M$ each (or 100 to 300k$/kg). 9/

This is why I believe that estimating this segment at 1,5B$ in 2020 is completely excessive. My current estimate is that in 2020 the total value of satellites <100kg was 407M$ for an average of 116k$/kg. They were launched at a total cost of 142M$, or about 40$/kg in LEO.

10/

10/

Now I am curious to know why @VirginOrbit is using the services of this market research boutique, instead of the usual space market experts such as @NSR_satcom, @euroconsultEC and @brycespactech 11/

satnews.com/story.php?numb…

brycetech.com/reports

euroconsult-ec.com/press-release/…

satnews.com/story.php?numb…

brycetech.com/reports

euroconsult-ec.com/press-release/…

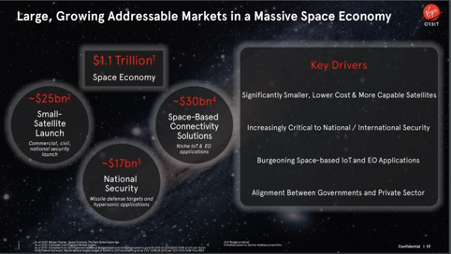

Is it because the estimates of these consultancies, despite being less conservative than mine, are still way below the business case that @VirginOrbit management wants to present to potential investors? This is an IPO worthy question.

12/

12/

IMO the reality of @VirginOrbit is that it operates in an accessible launch market segment that is currently worth 250M$/year for less than 15t to launch, already crammed with competition (with more to come), and with a potential for CAGR below 5%/year, at best. 13/

I think that prospecting launch revenues in excess of 350M$ as soon as 2024 is unsupported by any figure rooted in today's market reality. The 'proliferation' of small satellites only exists in Powerpoint and/or will not be accessible to @VirginOrbit 14/

virginorbit.com/wp-content/upl…

virginorbit.com/wp-content/upl…

Furthermore, all small launch players are targeting a reduction of their launch prices (small launchers are among the most expensive in the market today >>20k$/kg). If lower prices become the market baseline all potential for revenue growth will be wiped out. 15/

• • •

Missing some Tweet in this thread? You can try to

force a refresh