Here is the most painful piece I have ever written: "Sovereignism Part 8: Everywhere and Nowhere" exploring market dynamics, the nature of fiat, #Bitcoin, and the mass-psychosis of totalitarianism.

breedlove22.substack.com/p/sovereignism…

Quick thread of a few excerpts from this written work⬇️

breedlove22.substack.com/p/sovereignism…

Quick thread of a few excerpts from this written work⬇️

"Humans not only trade goods, and the ideas on which they are based, but they also imitate one another’s actions in waves of mimetic exchange—imitative patterns of action directly responsible for the development and propagation of ritual, culture, and social institutions."

"As covered previously in this series, political statism is a mass-psychosis premised on the profitability of property violation. This psychotic mode of human organization—a watered-down version of outright slavery—is dependent on a general ignorance and passivity among people."

"The end result for every state across history is mass-suffering, collapse, or defeat in war. Statism has always been a self-defeating enterprise, because it is based on the falsehood of fiat: an assertion about reality made in an attempt to override reality."

"A mass-cerebral aneurysm, totalitarianism is the inevitable end game of statism. The reason is fairly straightforward: the initial act of coercion, no matter where it originates, must mimetically propagate and become magnified in the market process."

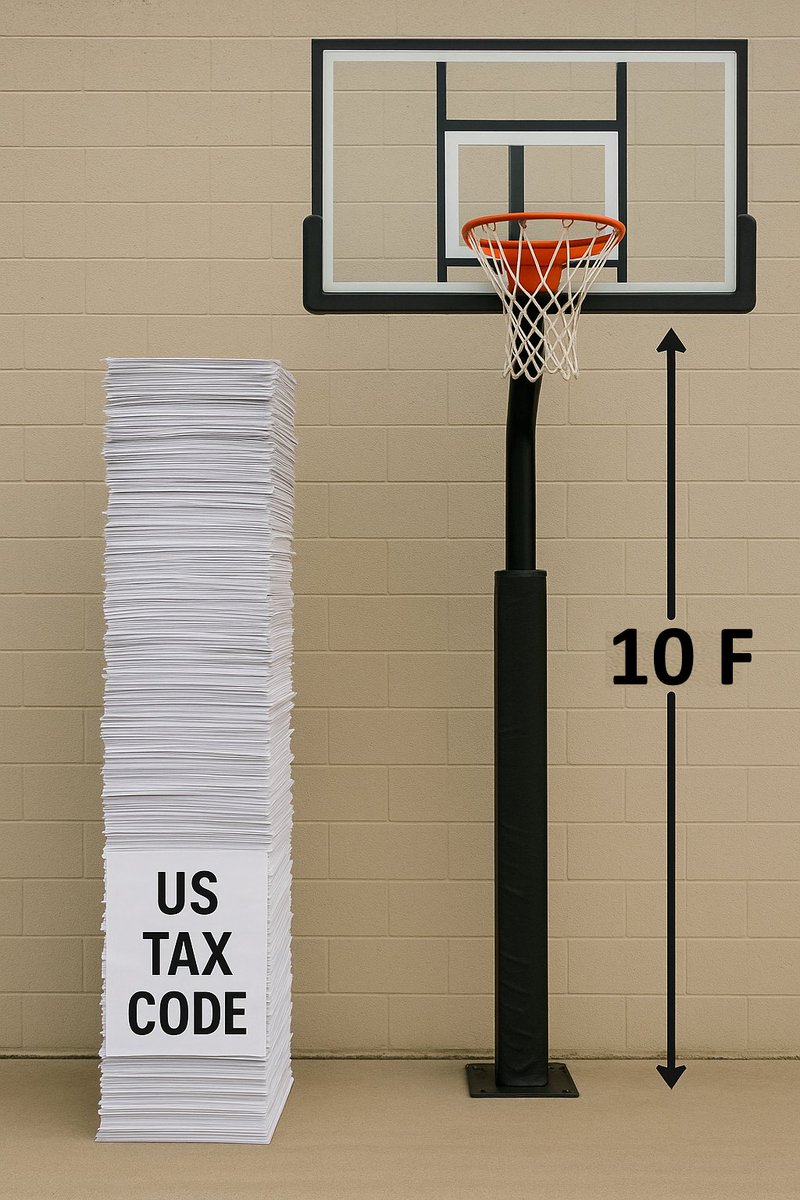

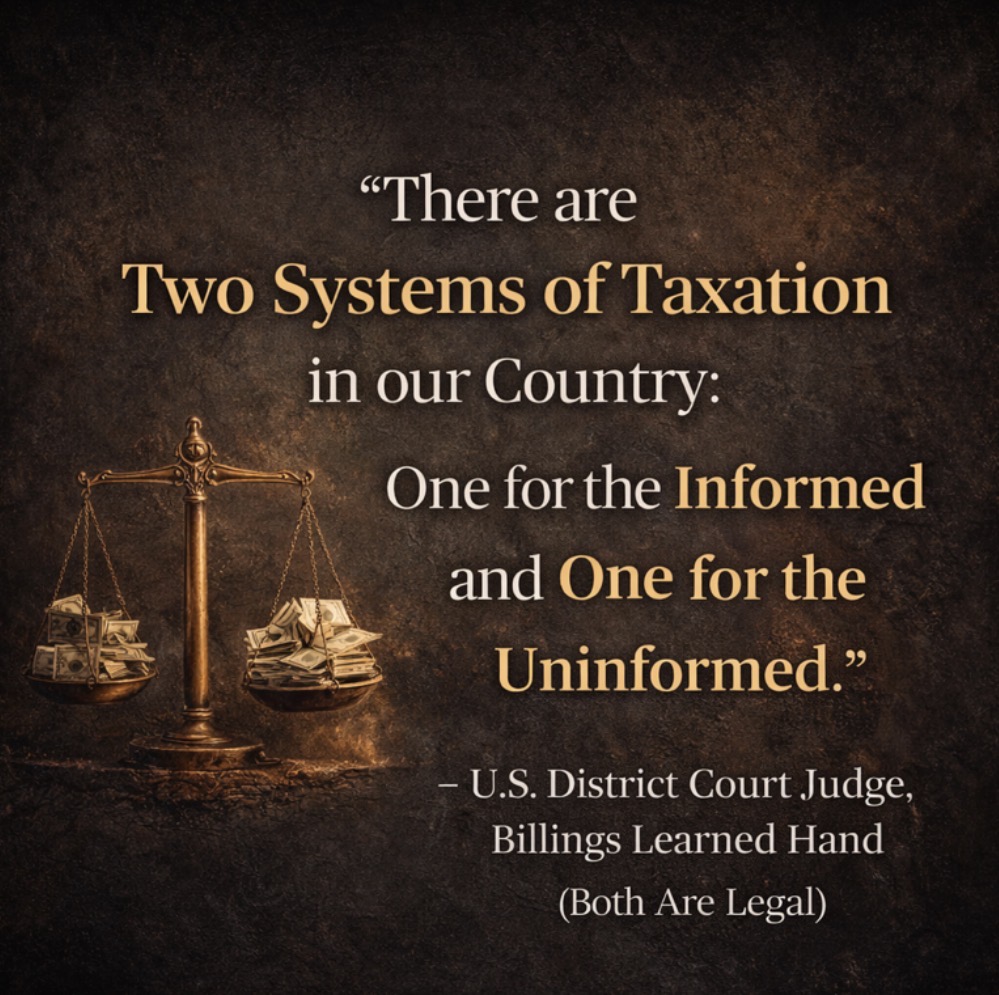

"As a coercion-based business strategy, statism strives to grow tax revenues until there is total submission to state power. In its final form, statism becomes the de facto super-dominant social institution, giving way to the most dangerous mass-psychosis of all—totalitarianism."

No pain, no gain. I hope this resonates as the topic is quite relevant to the madness we see unfolding worldwide today. Knowledge is power, and with great power comes great responsibility. Individuals taking responsibility for themselves and their actions is the path to healing.

Subscribe to The Freedom Analects for access to all my latest written work as it is released, it is free and will hopefully help free your mind:

breedlove22.substack.com

breedlove22.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh