1/ When people think about cross-chain interoperability, it's usually in reference to token bridges

But that's just the initial version of the multi-chain ecosystem

Cross-chain state synchronization and automation will enable a new generation of cross-chain smart contracts

But that's just the initial version of the multi-chain ecosystem

Cross-chain state synchronization and automation will enable a new generation of cross-chain smart contracts

2/ Token bridging has allowed the multi-chain ecosystem to flourish as user can switch environments

But ironically, in many ways, this has lead to greater isolation

If your assets are on chainA, you can only use your assets within dApps on chainA

But ironically, in many ways, this has lead to greater isolation

If your assets are on chainA, you can only use your assets within dApps on chainA

3/ Sure you can manually bridge tokens to another environment, interact with dApps there, and then bridge your tokens back

But this involves a lot of friction, higher fees, and is generally not an ideal UX

Interacting across chains needs to be seamless

But this involves a lot of friction, higher fees, and is generally not an ideal UX

Interacting across chains needs to be seamless

4/ Cross-chain token bridges will continue to exist, no doubt about that

However, they will complimented and even extended with further functionality for both users and devs

There's two primary components to this

However, they will complimented and even extended with further functionality for both users and devs

There's two primary components to this

5/ Cross-chain state synchronization:

The ability for dApps to be split into modular components that live on different blockchains, while all staying in sync in regards to what the dApp's global state is (user balances, user roles, parameters, etc)

This can take many forms

The ability for dApps to be split into modular components that live on different blockchains, while all staying in sync in regards to what the dApp's global state is (user balances, user roles, parameters, etc)

This can take many forms

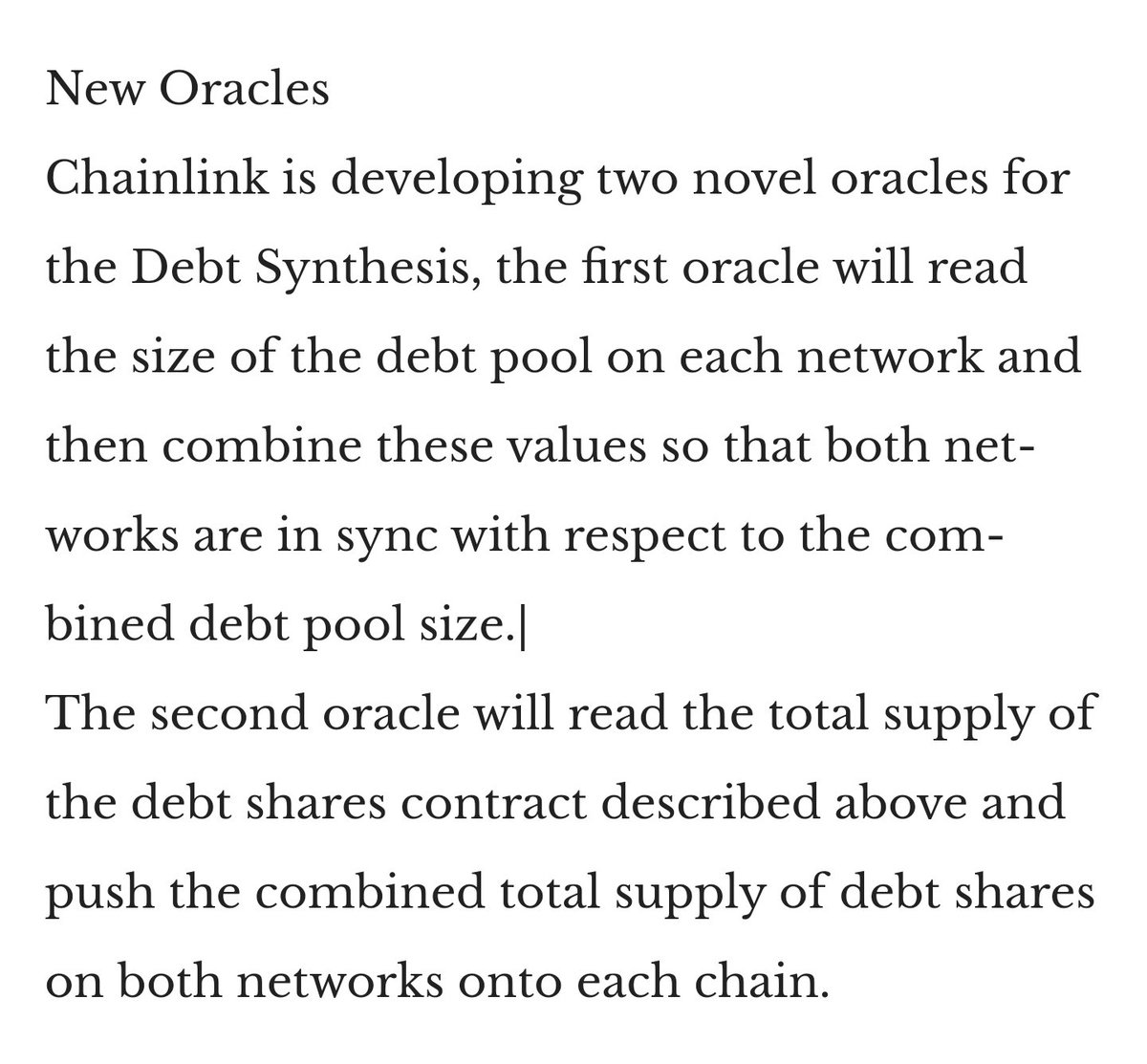

6/ One example of this is @synthetix_io, a synthetic asset protocol that exists on Ethereum and Optimism

Chainlink oracles will be used to sync the state of the debt pool across both chains, making synths on both chains fungible and backed by all stakers

blog.synthetix.io/debt-pool-synt…

Chainlink oracles will be used to sync the state of the debt pool across both chains, making synths on both chains fungible and backed by all stakers

blog.synthetix.io/debt-pool-synt…

7/ As a result, stakers will be able to choose which network they want to stake on, and users can choose which network to trade synths on

Two deployments of the protocol, but both have the same view on the state of the debt pool

This can scale to more chains as well

Two deployments of the protocol, but both have the same view on the state of the debt pool

This can scale to more chains as well

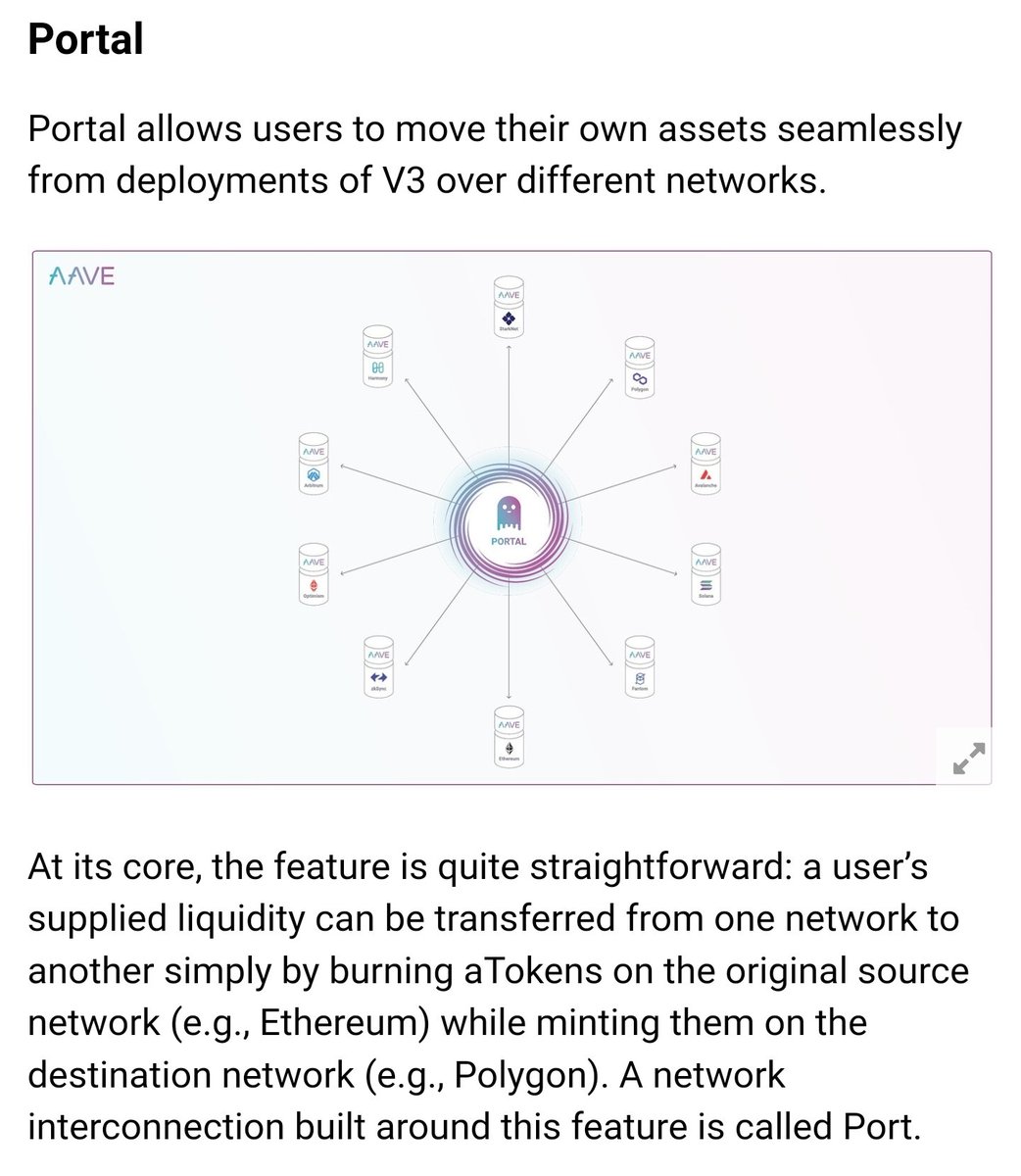

8/ @AaveAave is another example where deployments of Aave exist already exist on multiple chains (Ethereum, Polygon, Avalanche, etc)

Aave v3 will enable deposited liquidity to be transfered across chains without withdrawing by burning and minting tokens

governance.aave.com/t/introducing-…

Aave v3 will enable deposited liquidity to be transfered across chains without withdrawing by burning and minting tokens

governance.aave.com/t/introducing-…

9/ I believe this model could be further extended through cross-chain money markets, where users supply collateral on one chain and borrow tokens on another chains

State synchronization ensures ensures positions are collateralized and can be liquidated as necessary

State synchronization ensures ensures positions are collateralized and can be liquidated as necessary

10/ This would significantly reduce the friction of cross-chain yield farming by using your holdings as collateral and borrowing a different asset with the highest yield on another chain's DeFi ecosystem

Keep exposure to your asset of choice, farm where you like with any asset

Keep exposure to your asset of choice, farm where you like with any asset

11/ Much of this is something that be achieved today with Chainlink, as the network already support multiple blockchains and can transmit data from any source

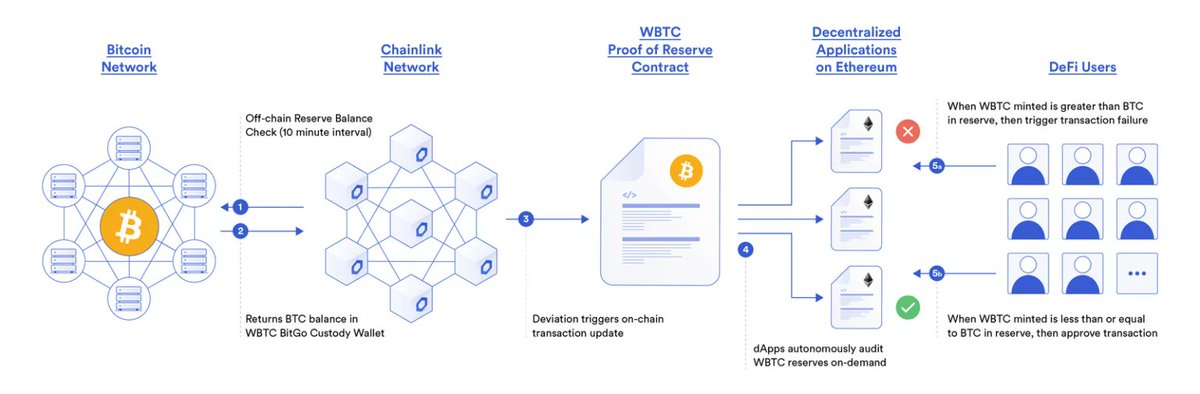

Proof of Resevere of cross-chain wrapped tokens is a practical application of this

blog.chain.link/chainlink-proo…

Proof of Resevere of cross-chain wrapped tokens is a practical application of this

blog.chain.link/chainlink-proo…

12/ Automation:

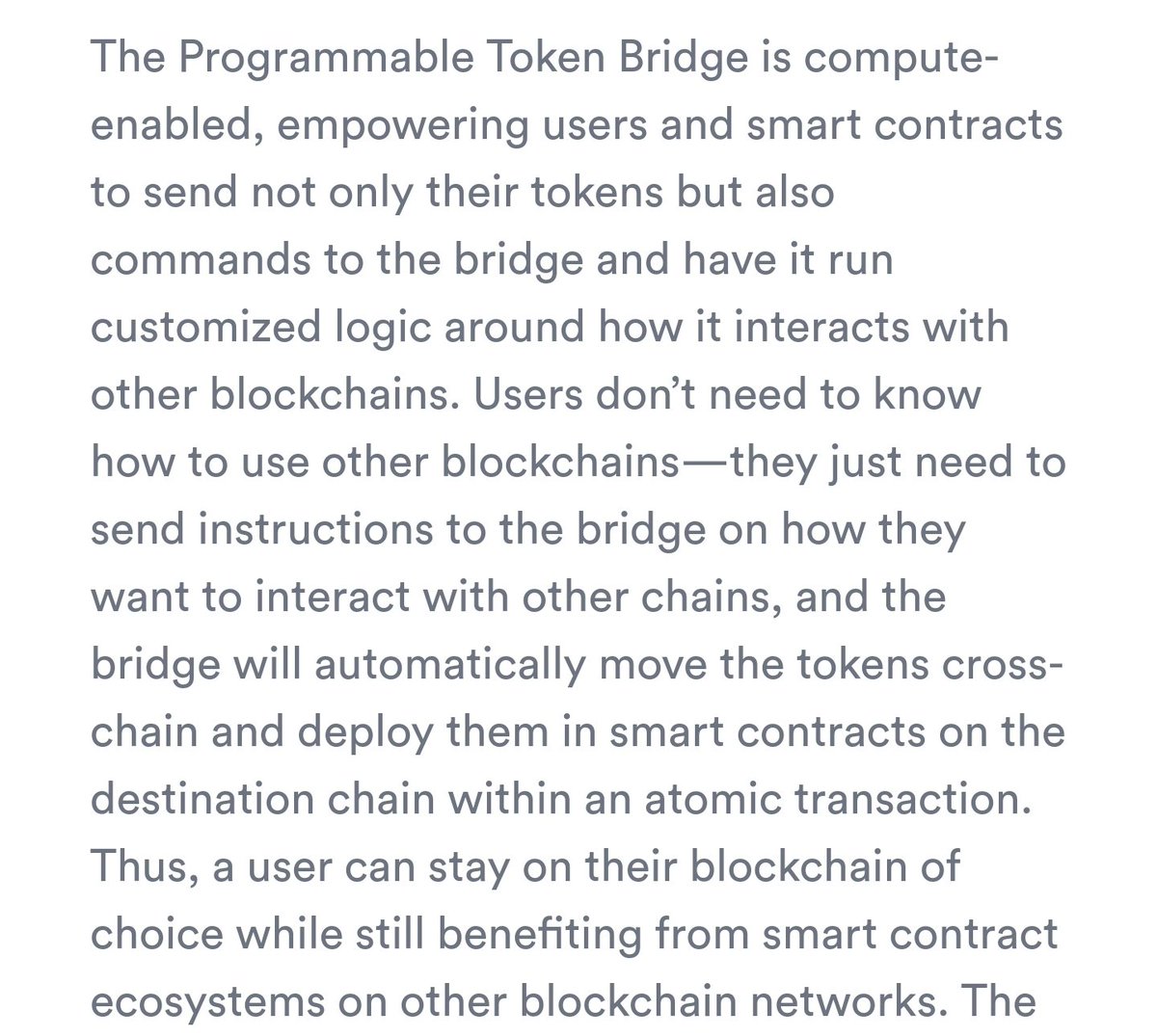

Token bridges can be extended further by supporting the transfer of both tokens and data/commands across chains

The latter can describe what to do with such tokens once bridged into the new environment

Token bridges can be extended further by supporting the transfer of both tokens and data/commands across chains

The latter can describe what to do with such tokens once bridged into the new environment

13/ At the most basic level, this allows users to stay within their preferred on-chain environment and yet gain the ability to interact with dApps on any blockchain

Users don't need to know how to use other blockchains or even know that they're using multiple blockchains

Users don't need to know how to use other blockchains or even know that they're using multiple blockchains

14/ If I have assets on chainA and want to deposit directly into a dApp on chainB, normally you'd have to manually bridge, wait, and then make another transaction

But this can be simplified so you make one transaction and now you're in the application

But this can be simplified so you make one transaction and now you're in the application

15/ This can also involve more advanced strategies such sending tokens to a bridge that then automatically allocates those tokens into yield farms with the highest yield, shifting across farms and chains as needed to chase yields, and returning the tokens after the yield is dry

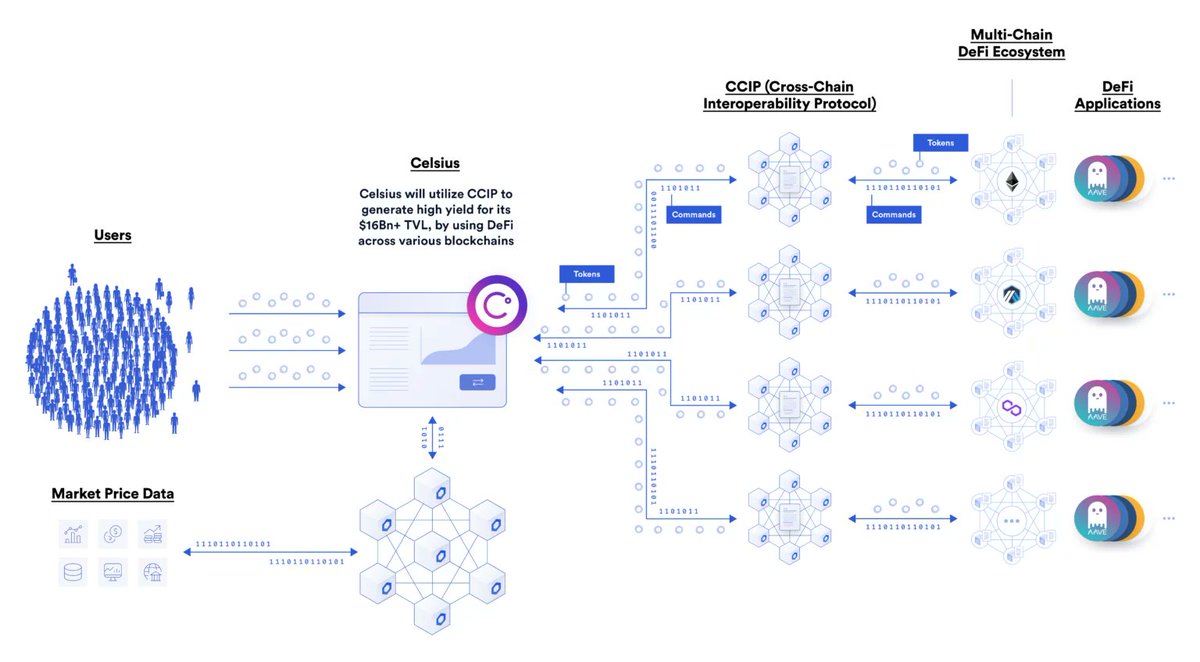

16/ This is exactly the type of functionality that's enabled by the Cross-Chain Interoperability Protocol (CCIP)

A standard for cross-chain messaging, on which any number of compute-enabled token bridges can be created

blog.chain.link/introducing-th…

A standard for cross-chain messaging, on which any number of compute-enabled token bridges can be created

blog.chain.link/introducing-th…

17/ With the introduction and evolution of CCIP, I believe we'll see more cross-chain smart contracts

As well as a significant decrease in friction when interacting with the multi-chain ecosystem

CCIP will power both bridges and dApps alike

As well as a significant decrease in friction when interacting with the multi-chain ecosystem

CCIP will power both bridges and dApps alike

18/ Ultimately, this goes back to the thesis that oracles provide not only data delivery

But also trust-minimized off-chain computation and cross-chain interoperability for any smart contract

Extending the capabilities of blockchains so they can reach their true potential

But also trust-minimized off-chain computation and cross-chain interoperability for any smart contract

Extending the capabilities of blockchains so they can reach their true potential

• • •

Missing some Tweet in this thread? You can try to

force a refresh