How to "forecast" token price variations based on social sentiment?

A.K.A: Picking the right tokens without tech skills and using alternative tools.

STEP-BY-STEP GUIDE: 👇

A.K.A: Picking the right tokens without tech skills and using alternative tools.

STEP-BY-STEP GUIDE: 👇

Have you noticed?

Some people manage to pick the right projects with no tech skills at all.

How is that even possible?

Meet social sentiment.

An alternative way to analyze projects and ecosystems, pick tokens and even "forecast" price variations.

Here’s how:

Some people manage to pick the right projects with no tech skills at all.

How is that even possible?

Meet social sentiment.

An alternative way to analyze projects and ecosystems, pick tokens and even "forecast" price variations.

Here’s how:

It’s no secret:

Token price variations don’t only respond to tokenomics and fundamentals.

Quite the contrary:

Most of the time, it’s the market mood that moves the needle the most.

Even in spite of fundamentals!

So how do you measure that?

Token price variations don’t only respond to tokenomics and fundamentals.

Quite the contrary:

Most of the time, it’s the market mood that moves the needle the most.

Even in spite of fundamentals!

So how do you measure that?

One of the basic tools is @LunarCrush.

Here's how it works:

With Lunar Crush, you can instantly analyze the way people see and talk about a project.

As a rule of thumb:

Positive sentiment spikes = More FOMO

More FOMO = Buying pressure = Higher price

For example:

Here's how it works:

With Lunar Crush, you can instantly analyze the way people see and talk about a project.

As a rule of thumb:

Positive sentiment spikes = More FOMO

More FOMO = Buying pressure = Higher price

For example:

Let’s say we want to analyze $LUNA.

Where should we start?

Let’s hit “galaxy score” at Lunar Crush:

This metric tells you whether Terra is doing well or not based on metrics like:

- Social content about Terra

- Social interaction with the content

- Price trend of $LUNA

Where should we start?

Let’s hit “galaxy score” at Lunar Crush:

This metric tells you whether Terra is doing well or not based on metrics like:

- Social content about Terra

- Social interaction with the content

- Price trend of $LUNA

This of course is the first step.

(and it doesn't replace any other type of analysis).

The social content and engagement on Terra gives a fair idea of the market sentiments.

If the overall sentiments are positive, they usually correlate with the price trend.

Check it out:

(and it doesn't replace any other type of analysis).

The social content and engagement on Terra gives a fair idea of the market sentiments.

If the overall sentiments are positive, they usually correlate with the price trend.

Check it out:

Our next stop: Alt Rank.

This metric takes into account all market sentiments and price movements.

It also tells you how Terra is ranked compared to the other 3,399 protocols it tracks.

As you can see, Terra ranks 2nd!

No wonder $LUNA is going up against the market.

This metric takes into account all market sentiments and price movements.

It also tells you how Terra is ranked compared to the other 3,399 protocols it tracks.

As you can see, Terra ranks 2nd!

No wonder $LUNA is going up against the market.

Remember:

This analysis doesn't replace all the other tools available.

Yet, it shows one thing:

How people actually feel about a project.

Let's take a look at the "Correlation Rank".

This metric indicates how the market sentiments are correlated to $LUNA's price.

This analysis doesn't replace all the other tools available.

Yet, it shows one thing:

How people actually feel about a project.

Let's take a look at the "Correlation Rank".

This metric indicates how the market sentiments are correlated to $LUNA's price.

If the market sentiment grew at the same pace as $LUNA's price, the score would be 5.

Here, the Correlation Rank is 3.6.

Which means:

Although the price isn't growing exactly the same as market sentiments...

Both are pretty close and correlate to each other.

Next stop:

Here, the Correlation Rank is 3.6.

Which means:

Although the price isn't growing exactly the same as market sentiments...

Both are pretty close and correlate to each other.

Next stop:

Social Volume:

This indicates how many times a coin/token is mentioned across social media.

In our case, many folks have been talking about $LUNA in the last weeks.

See how the social volume spiked while the price was going up?

This indicates how many times a coin/token is mentioned across social media.

In our case, many folks have been talking about $LUNA in the last weeks.

See how the social volume spiked while the price was going up?

Social Dominance:

This metric indicates how often people talk about $LUNA.

This is compared to all the tokens in the database.

In other words:

It shows how familiar people are about $LUNA compared to all other cryptocurrencies.

Here's how it looks:

This metric indicates how often people talk about $LUNA.

This is compared to all the tokens in the database.

In other words:

It shows how familiar people are about $LUNA compared to all other cryptocurrencies.

Here's how it looks:

This one is interesting:

Bullish Sentiment.

This metric goes through all Terra's social posts.

Some of them are bullish.

Some of them are negative.

The balance is another clear indicator of which is taking the lead.

Many times sentiments drive price, remember?

Bullish Sentiment.

This metric goes through all Terra's social posts.

Some of them are bullish.

Some of them are negative.

The balance is another clear indicator of which is taking the lead.

Many times sentiments drive price, remember?

Another tip:

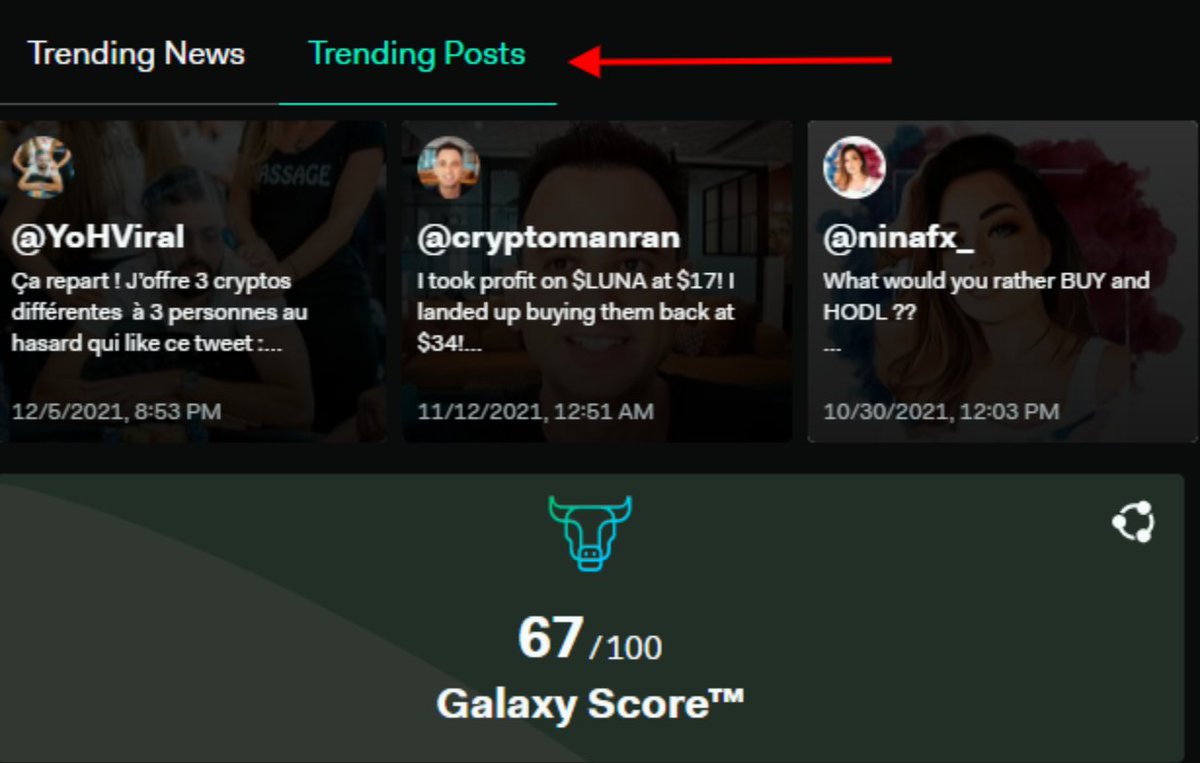

You can also view the top trending posts about Terra.

Why does this matter?

Trending posts give an indication of broader market sentiments.

If many are engaging with a positive post on Terra...

It's pretty safe to see folks are bullish on it:

You can also view the top trending posts about Terra.

Why does this matter?

Trending posts give an indication of broader market sentiments.

If many are engaging with a positive post on Terra...

It's pretty safe to see folks are bullish on it:

On top of that:

You can view who are the top Terra influencers and what they think.

This helps to identify the right people to follow.

It also cuts out bad information that could lead you to wrong decisions.

Here's how it looks:

You can view who are the top Terra influencers and what they think.

This helps to identify the right people to follow.

It also cuts out bad information that could lead you to wrong decisions.

Here's how it looks:

With Lunar Crush, you don't only find social facts.

You also get relevant market sentiments that drive a project.

This helps to identify trends and take better decisions.

This, of course, is not financial advice and doesn't replace other methods.

The most important thing?

You also get relevant market sentiments that drive a project.

This helps to identify trends and take better decisions.

This, of course, is not financial advice and doesn't replace other methods.

The most important thing?

If you already have a bag of $LUNA, it's time to put it into work.

At Stader Labs we take care of your staking with:

- Auto-compounded rewards

- 1-click airdrop claiming

- Automatic validator behavior monitoring

- Top-quality validator buckets

- And much more.

Plus:

At Stader Labs we take care of your staking with:

- Auto-compounded rewards

- 1-click airdrop claiming

- Automatic validator behavior monitoring

- Top-quality validator buckets

- And much more.

Plus:

You are still on-time to farm our $SD tokens.

With 5+ million TVL, the price is still $0.73.

So catch them before they're gone.

Stake now:

terra.staderlabs.com/pools

With 5+ million TVL, the price is still $0.73.

So catch them before they're gone.

Stake now:

terra.staderlabs.com/pools

• • •

Missing some Tweet in this thread? You can try to

force a refresh