The Terra Degen Yield Strategy

This is a strategy on the Terra ecosystem that lets you increase your APY from 20% to 40% on Anchor Protocol by using a smart trick on Mirror Protocol.

A step-by-step thread on how to double your stablecoin-yield with low risk.

This is a strategy on the Terra ecosystem that lets you increase your APY from 20% to 40% on Anchor Protocol by using a smart trick on Mirror Protocol.

A step-by-step thread on how to double your stablecoin-yield with low risk.

First of all, this is not a delta-neutral strategy.

I used to love the delta-neutral version, but now the APY is reduced on Mirror, so it's not very effective anymore.

To understand Mirror better, I recommend you to check out this...

1/

I used to love the delta-neutral version, but now the APY is reduced on Mirror, so it's not very effective anymore.

To understand Mirror better, I recommend you to check out this...

1/

thread first before you read on:

Okay, let's dive into the strategy.

Let's say you have $100K (works with any amount, so follow the same steps if you have $1K too).

Anchor gives you 20% (which is good compared to the stock market).

But what if ...

/2

https://twitter.com/Route2FI/status/1454065822515830787?s=20

Okay, let's dive into the strategy.

Let's say you have $100K (works with any amount, so follow the same steps if you have $1K too).

Anchor gives you 20% (which is good compared to the stock market).

But what if ...

/2

you could get 40% without increasing your risk too much?

What we want to do in this strategy is to buy an asset that has low volatility (gold/silver).

We are then going to borrow it and sell it immediately for $UST which we will deposit into Anchor.

/3

What we want to do in this strategy is to buy an asset that has low volatility (gold/silver).

We are then going to borrow it and sell it immediately for $UST which we will deposit into Anchor.

/3

Step 1: Deposit $100,000 in Anchor Protocol here:app.anchorprotocol.com/earn

If you're unsure on how to do this and/or you want to know more about Anchor, see this thread:

/4

If you're unsure on how to do this and/or you want to know more about Anchor, see this thread:

https://twitter.com/Route2FI/status/1442835869879181312?s=20

/4

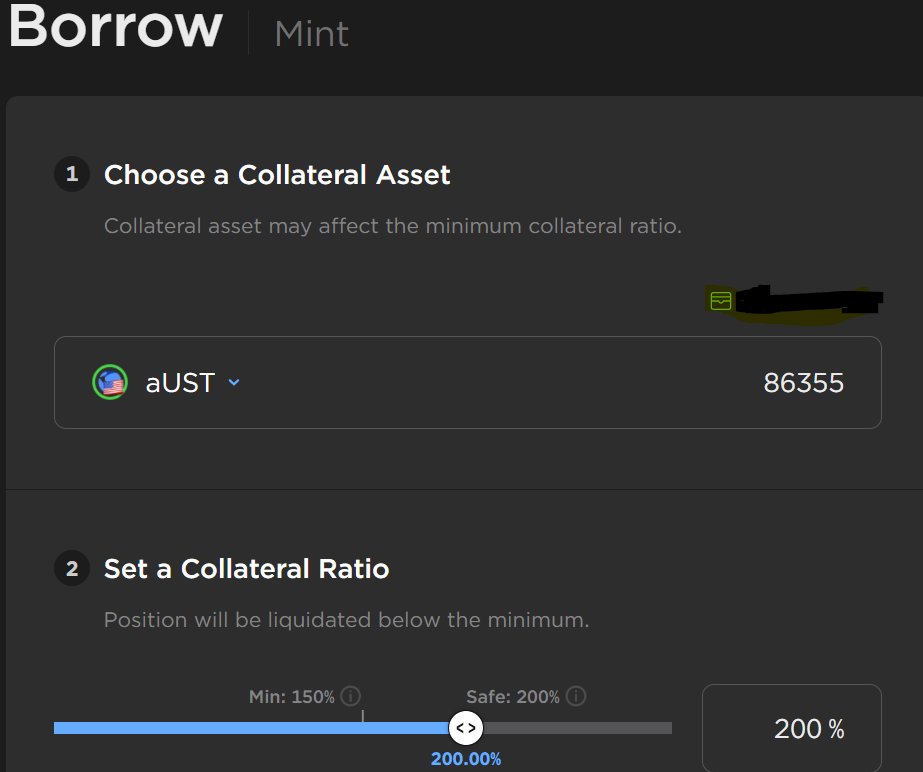

Step 2: Go to Mirror Protocol here: mirrorprotocol.app/#/borrow

In this example, I'm going to use $mSLV (silver).

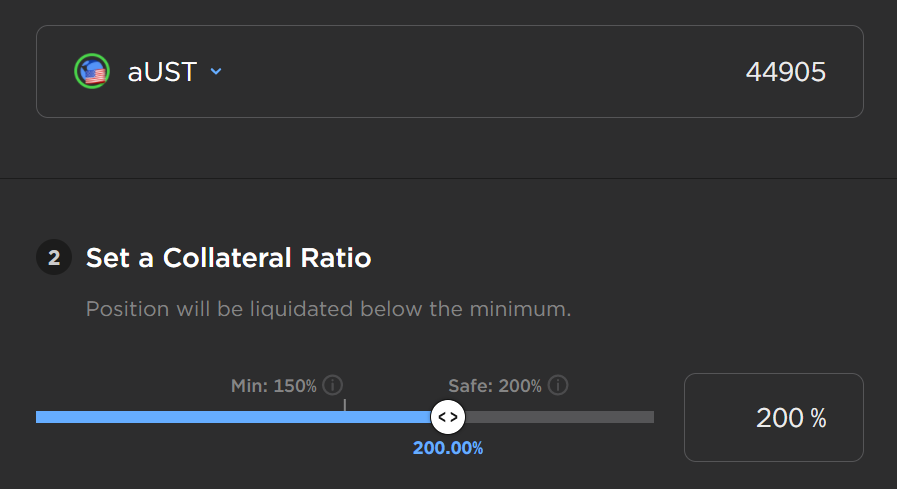

Use aUST as collateral and put in 86355 (equal to $100,000) because 1 aUST = 1.158 UST

/5

In this example, I'm going to use $mSLV (silver).

Use aUST as collateral and put in 86355 (equal to $100,000) because 1 aUST = 1.158 UST

/5

Set your collateral ratio to 200%.

Confirm your borrowed amount of 2399 $mSLV and press "Borrow".

/6

Confirm your borrowed amount of 2399 $mSLV and press "Borrow".

/6

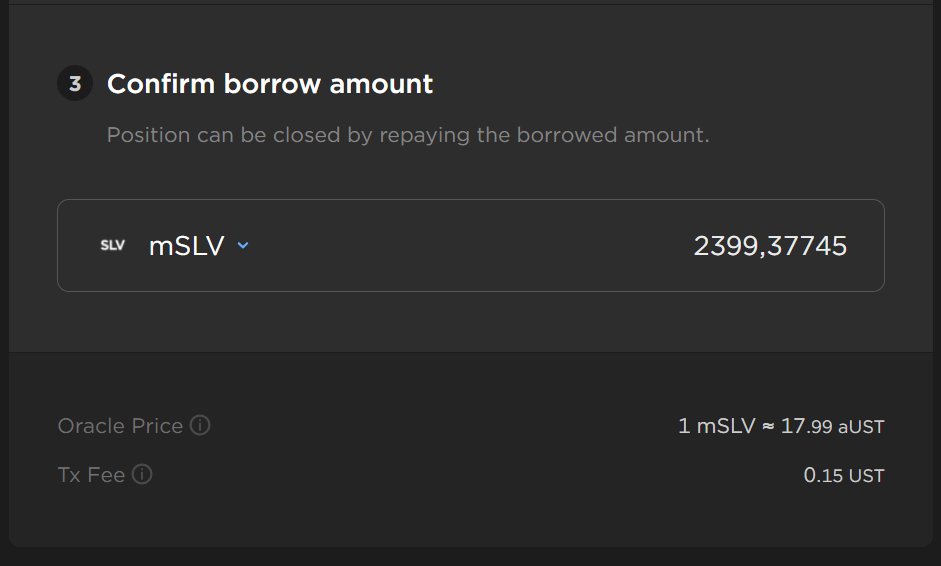

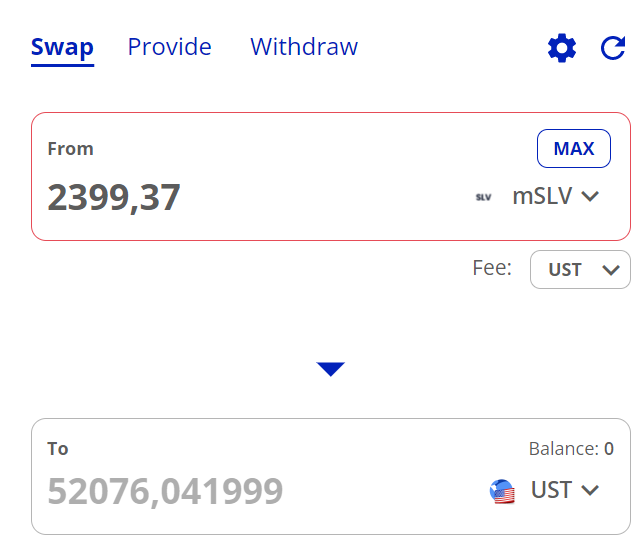

Step 3:

Go to app.terraswap.io/#Swap and swap your $mSLV for $UST

As you can see you actually get more than 50% of your $100,000 deposit back when you do this.

/7

Go to app.terraswap.io/#Swap and swap your $mSLV for $UST

As you can see you actually get more than 50% of your $100,000 deposit back when you do this.

/7

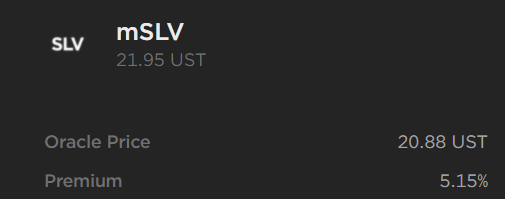

This is because the Oracle price of mSLV is 20.88 UST (the price you pay to borrow mSLV), but when you sell it on Terraswap you sell it for the market price: 21.95 UST (a 21.95% premium).

/8

/8

Step 4: All right, you now have $100,000 in Anchor Protocol and $52,000 in your wallet.

Deposit the $52,000 back in Anchor.

Your new balance should now be $152,000 (a 1.52x leverage).

Step 5: But why stop there? You have $52,000 extra in Anchor now (44,905 aUST) which...

/9

Deposit the $52,000 back in Anchor.

Your new balance should now be $152,000 (a 1.52x leverage).

Step 5: But why stop there? You have $52,000 extra in Anchor now (44,905 aUST) which...

/9

you can do the same thing with again.

Again, go to Mirror Protocol here: mirrorprotocol.app/#/borrow

Borrow mSLV for 44,905 and choose a collateral ratio of 200%.

10/

Again, go to Mirror Protocol here: mirrorprotocol.app/#/borrow

Borrow mSLV for 44,905 and choose a collateral ratio of 200%.

10/

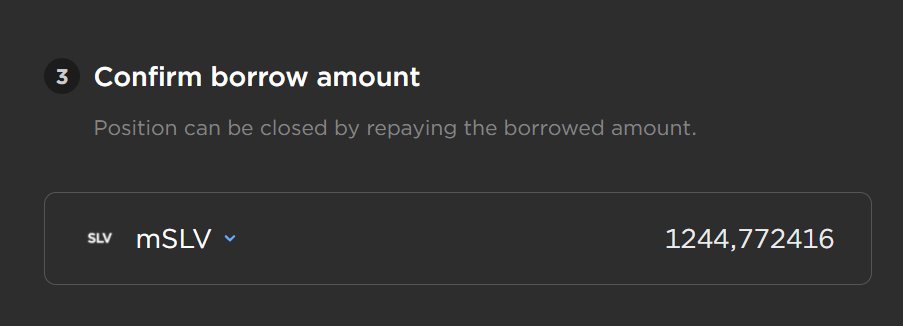

This should give you 1244 mSLV (see screenshot below).

Again you go to Terraswap, sell your 1244 mSLV for $27,173 UST (screenshot below).

/11

Again you go to Terraswap, sell your 1244 mSLV for $27,173 UST (screenshot below).

/11

Step 6: You go back to Anchor, deposit $27,173.

Your total balance should now be $152,000 + $27,000 = $179,000 (a 1.79x leverage).

Step 7: You see where we're going, anon. You have now done this 2 times, but you could repeat this over and over again. Every time...

/12

Your total balance should now be $152,000 + $27,000 = $179,000 (a 1.79x leverage).

Step 7: You see where we're going, anon. You have now done this 2 times, but you could repeat this over and over again. Every time...

/12

it's 50% less.

So the 3rd time you should get: $13,500 (balance in Anchor: $192,500)

4th looping: $6,750 (balance in Anchor: $199,250)

5th looping: $3,375 (balance in Anchor: $202,625)

...

/13

So the 3rd time you should get: $13,500 (balance in Anchor: $192,500)

4th looping: $6,750 (balance in Anchor: $199,250)

5th looping: $3,375 (balance in Anchor: $202,625)

...

/13

You could obviously continue, but let's stop it for now.

You have $202,625 in Anchor and should get a 19,5% APY which means you're earning: $39,500 per year (instead of $19,500 if you hadn't done this trick).

But let's look at the risks.

/14

You have $202,625 in Anchor and should get a 19,5% APY which means you're earning: $39,500 per year (instead of $19,500 if you hadn't done this trick).

But let's look at the risks.

/14

If you do the looping 5 times you owe Mirror Protocol 4,729 mSLV which should be equal to the $102,625 (that you've put into Anchor Protocol).

In other words, you are short on mSLV, which means you should hope that the price goes down or stay flat.

/15

In other words, you are short on mSLV, which means you should hope that the price goes down or stay flat.

/15

If the price of silver goes up a lot, you can get liquidated (a 33% price increase).

You can always rebalance this at My Page so that this won't happen: mirrorprotocol.app/#/my

/16

You can always rebalance this at My Page so that this won't happen: mirrorprotocol.app/#/my

/16

This strategy works when:

-The price of mSLV stays flat or goes down

-The price of mSLV doesn't increase more than the 19,5% you are earning extra per year

The breakeven point after 1 year is obviously if the price of mSLV is 19,5% higher...

/17

-The price of mSLV stays flat or goes down

-The price of mSLV doesn't increase more than the 19,5% you are earning extra per year

The breakeven point after 1 year is obviously if the price of mSLV is 19,5% higher...

/17

You have earned an extra $19,500, but you have to repay the mSLV that you borrowed at $102,625 + $19,500 = $122,125

Risks:

-Liquidation risk (33% price increase in mSLV).

This is because when mSLV goes up 33% your collateral value will decrease from...

18/

Risks:

-Liquidation risk (33% price increase in mSLV).

This is because when mSLV goes up 33% your collateral value will decrease from...

18/

200% to 150% (liquidation point in Mirror Protocol).

-Smart contract risk: You're both using Anchor + Mirror

-Oracle price failure: something happens to the Oracle and you have to pay more to pay back the mSLV that you've borrowed (this is not very likely to happen though)

/19

-Smart contract risk: You're both using Anchor + Mirror

-Oracle price failure: something happens to the Oracle and you have to pay more to pay back the mSLV that you've borrowed (this is not very likely to happen though)

/19

Did you find this strategy complex? Fear not, my brother @rebel_defi has made a Youtube video that explains it very well step by step:

/20

/20

Also a huge credit to @DrCle4n that was the first to write about this concept, see his write-up here: medium.com/@Cle4ncuts/cle…

/21

/21

To wrap it up:

-Great strategy for people that wants to use the Terra ecosystem

-Relatively risk-free

-If you want a higher yield you should check out $MIM - $UST Degenbox-strategy that is on Abracadabra, see my thread here:

/22

-Great strategy for people that wants to use the Terra ecosystem

-Relatively risk-free

-If you want a higher yield you should check out $MIM - $UST Degenbox-strategy that is on Abracadabra, see my thread here:

https://twitter.com/Route2FI/status/1458072000602202114?s=20

/22

-The $MIM - $UST is currently only available on the $ETH network, which means higher gas fees, but it is launching on the Fantom network soon which should be a game-changer

-In a couple of weeks kinetic.money will launch a simpler strategy that should also...

/23

-In a couple of weeks kinetic.money will launch a simpler strategy that should also...

/23

yield you 40% APY per year with less risk.

Personally, I like to combine several strategies, so this Mirror Degen strategy is definitely one I'm going to use a lot to get some extra stablecoin yield.

/24

Personally, I like to combine several strategies, so this Mirror Degen strategy is definitely one I'm going to use a lot to get some extra stablecoin yield.

/24

I hope you learned something new in this thread.

Follow me on @route2fi if you want to learn more about DeFi, web3 and crypto in general

I also have a free newsletter, which you can subscribe to here: getrevue.co/profile/route2…

/25

Follow me on @route2fi if you want to learn more about DeFi, web3 and crypto in general

I also have a free newsletter, which you can subscribe to here: getrevue.co/profile/route2…

/25

If you liked this thread, I would love it if you could share it by retweeting the first tweet:

/26

https://twitter.com/Route2FI/status/1473626708314136585?s=20

/26

• • •

Missing some Tweet in this thread? You can try to

force a refresh