I've been trying several wallets lately.

This week I started using the XDEFI wallet for my $LUNA & $UST instead of Terra Station.

The main reason: it wasn't possible to have several wallets in the same account on Terra Station (which is important for DeFi degens).

/THREAD

This week I started using the XDEFI wallet for my $LUNA & $UST instead of Terra Station.

The main reason: it wasn't possible to have several wallets in the same account on Terra Station (which is important for DeFi degens).

/THREAD

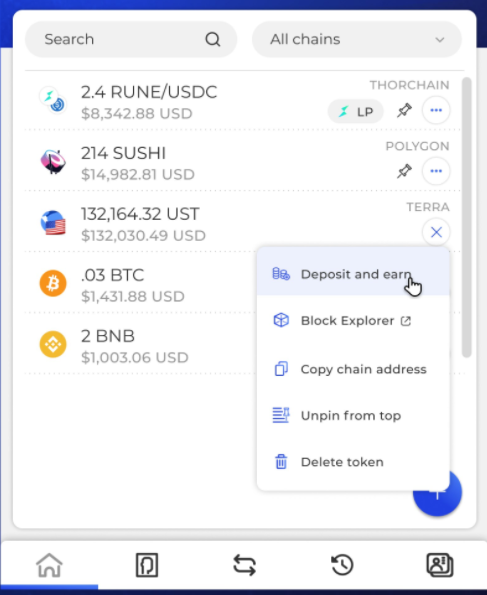

Look at the screenshot below.

I have 4 different accounts within my XDEFI wallet (4 different Terra addresses) for different purposes.

Let me explain what I use them for:

Main account: sending/receiving money

NFT storage: where I store my NFT's

/1

I have 4 different accounts within my XDEFI wallet (4 different Terra addresses) for different purposes.

Let me explain what I use them for:

Main account: sending/receiving money

NFT storage: where I store my NFT's

/1

Burner account: when I participate in NFT mints or staking/yield farming

Anchor Protocol: This is where store my UST on Anchor

When I used Terra Station I had 4 different wallets, and I couldn't be logged in at the same time (which annoyed me).

/2

Anchor Protocol: This is where store my UST on Anchor

When I used Terra Station I had 4 different wallets, and I couldn't be logged in at the same time (which annoyed me).

/2

Another cool function is that you can deposit your $UST directly into Anchor Protocol (see screenshot) from the XDEFI wallet.

Yes, you can also do this at Terra Station.

But it was important for me to have this function in XDEFI in order to replace Terra Station.

/3

Yes, you can also do this at Terra Station.

But it was important for me to have this function in XDEFI in order to replace Terra Station.

/3

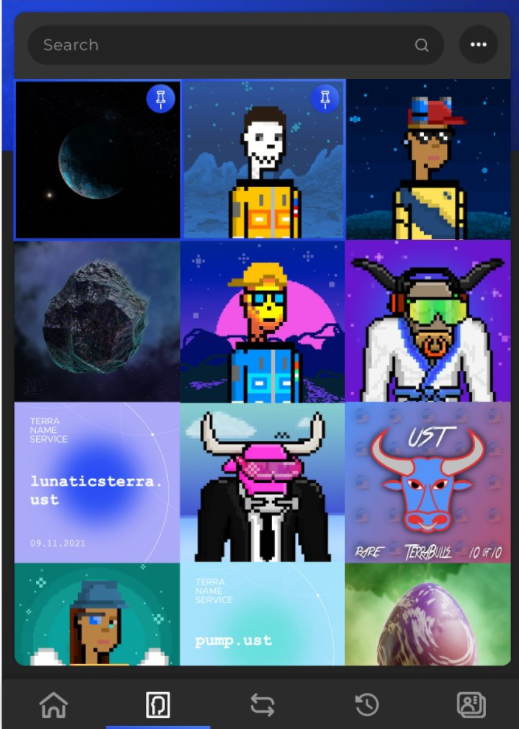

NFT integration:

The XDEFI team said in a podcast that their goal was to be the best wallet for LUNAtics.

I feel they're really trying here, and it's super cool to watch my NFT's in my wallet.

Soon you can also buy/sell your NFT's directly on Random Earth from the wallet.

/4

The XDEFI team said in a podcast that their goal was to be the best wallet for LUNAtics.

I feel they're really trying here, and it's super cool to watch my NFT's in my wallet.

Soon you can also buy/sell your NFT's directly on Random Earth from the wallet.

/4

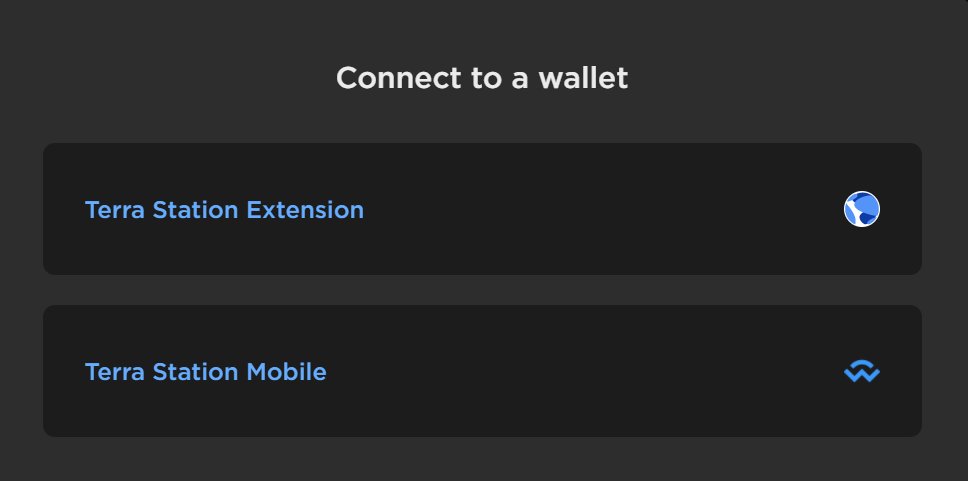

I'm not going to make a guide on how to set up the wallet, because I'm sure you manage that on your own if you go to xdefi.io

Tips: When you try to connect your wallet to a dApp you have to press the "Terra Station extension" button.

cont.

/5

Tips: When you try to connect your wallet to a dApp you have to press the "Terra Station extension" button.

cont.

/5

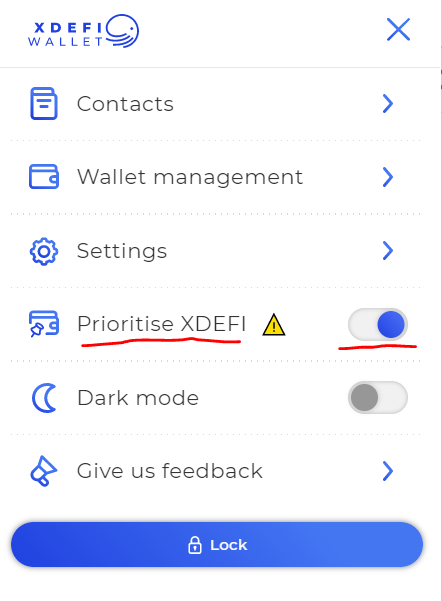

Normally your Terra Station wallet will pop-up, but if you go into the XDEFI wallet and choose "prioritise XDEFI" you will set your XDEFI wallet as your main wallet.

Soon we will see a XDEFI-symbol as well on dApps, but until then just use the method described above.

/6

Soon we will see a XDEFI-symbol as well on dApps, but until then just use the method described above.

/6

There will also be Astroport and Wormhole native integrations coming soon

3 things I hope will be integrated with @xdefi_wallet:

1. Yield-strategies: integrate Mirror Protocol strategies, Nexus Mirror UST Vault, Kinetic Money self-repaying looping, etc. (tbh, I don't know..

/7

3 things I hope will be integrated with @xdefi_wallet:

1. Yield-strategies: integrate Mirror Protocol strategies, Nexus Mirror UST Vault, Kinetic Money self-repaying looping, etc. (tbh, I don't know..

/7

if this is possible, but would be so cool to do everything from a wallet).

2. Overview: another thing I hope for is that XDEFI could integrate something like Apeboard in the wallet (not necessarily Apeboard.finance, but at least a way too have an overview over...

/8

2. Overview: another thing I hope for is that XDEFI could integrate something like Apeboard in the wallet (not necessarily Apeboard.finance, but at least a way too have an overview over...

/8

all your Terra-assets in all different yield-farms, staking pools etc. in the same clean was as Apeboard offers.

3.Cross-chain swap: Imagine that you have $ETH-tokens in your XDEFI-wallet, but you want to swap them to $UST.

/9

3.Cross-chain swap: Imagine that you have $ETH-tokens in your XDEFI-wallet, but you want to swap them to $UST.

/9

The normal procedure is to use bridge.terra.money, but it would be awesome if a cross-chain swap was integrated into @xdefi_wallet to make it less hassle.

Thoughts @xdefi_wallet?

Would love to have your inputs on this.

/10

Thoughts @xdefi_wallet?

Would love to have your inputs on this.

/10

That was it!

I hope you learned something new.

If you want more updates on DeFi and crypto, subscribe to my newsletter here:

getrevue.co/profile/route2…

/11

I hope you learned something new.

If you want more updates on DeFi and crypto, subscribe to my newsletter here:

getrevue.co/profile/route2…

/11

If you liked this thread, I would love it if you could share it with other people by retweeting the first tweet:

/12

https://twitter.com/Route2FI/status/1474045014468616196?s=20

/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh