Yesterday was #MathematicsDay. One math formula we keep hearing when investing is compounding. No doubt you'd have heard this quote attributed to Albert Einstein:

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

A lot of people know about compounding but very few people take advantage of it.

Why?

Partly because of human nature. We are hardwired to seek the pleasure of living in the present than the pain of prioritizing the future. It physically hurts to even think about the future.

Why?

Partly because of human nature. We are hardwired to seek the pleasure of living in the present than the pain of prioritizing the future. It physically hurts to even think about the future.

Though the notion of compounding has become a cliché, it doesn't make it any less true. Very few things happen overnight in life, except for winning a lottery.

The good things in life take time, and the key is to realize this and not interrupt compounding, not just in investing.

The good things in life take time, and the key is to realize this and not interrupt compounding, not just in investing.

Though we speak about compounding mostly in the context of investing, there are examples of the wonders of compounding everywhere.

Take human progress itself, it's the best example of compounding.

The reason why we live so long today is due to the slow compounding of medical and scientific advancements over centuries.

The average Life expectancy in the early 1900s was just 25 years. It's 70 today🤯

The reason why we live so long today is due to the slow compounding of medical and scientific advancements over centuries.

The average Life expectancy in the early 1900s was just 25 years. It's 70 today🤯

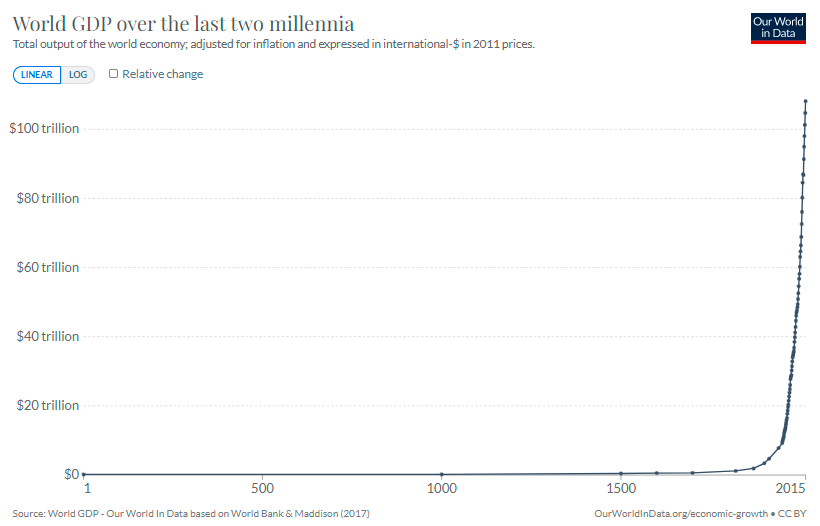

The global GDP is also a story of slow and steady compounding over decades. It's pretty similar to a long term investment in a mutual fund.

So why don't people grasp compounding?

It's tough for people to prioritize tomorrow vs today. Moreover, understanding exponential growth can be unintuitive. If compounding was maybe called "paisa double", more people would understand it.

It's tough for people to prioritize tomorrow vs today. Moreover, understanding exponential growth can be unintuitive. If compounding was maybe called "paisa double", more people would understand it.

Another factor maybe is the noisy environment we live in. We are constantly bombarded with information and prompts. Everybody is egging you to do something. Saying no and not doing something almost feels like an achievement these days.

One other reason is also that returns from compounding take time. It's slow and mind-numbingly boring.

Nothing happens in the initial years, and then there's exponential growth. But most people would've given up by then.

Here's an example👇

Nothing happens in the initial years, and then there's exponential growth. But most people would've given up by then.

Here's an example👇

Morgan Housel had written about the beautiful story of Ronald Read in his book. Ronald was a janitor and a gas station attendant, where he worked as a mechanic. When Ronald died, he made the headlines because he had built a fortune of $8 million🤯

The best part about the story is the simplicity. Ronald lived a frugal life. Despite his small salary, he kept investing whatever he could in blue-chip companies like P&G, JP Morgan, J&J etc. Most importantly, he left the investments alone and did nothing. This became $8 mn💰

Perhaps the most important lesson about compounding is that it doesn't just apply to investments but to everything in life. Small actions over a long time in pretty much anything you do can compound and pay off exponentially 🚀

Eat well, get some exercise, and sleep well might seem like the most boring advice ever, but few other easy actions can increase the odds of you living longer and healthier.

These three boring actions compound over time.

These three boring actions compound over time.

The same goes for other things like reading, picking up new skills and hobbies. Reading 10-20 pages a day means you can read a couple of books a month. Spending 10-15 mins a day learning a new thing means you would've learnt something new in a few months.

So, if all this is so obvious, why don't people do it? And no, you can't just push yourself to do new things. It doesn't work like that.

There are a few lessons here from all the fantastic research that has been done about habit formation.

There are a few lessons here from all the fantastic research that has been done about habit formation.

In the book Tiny Habits, @bjfogg explains that repetitive behaviour results from 3 things—Motivation, Ability, and a Prompt (B=MAP).

So, if you want to build a habit, you need to design your environment in a way that makes it easy for you to perform an action.

So, if you want to build a habit, you need to design your environment in a way that makes it easy for you to perform an action.

Finally, coming back to investing, the biggest reason most people don't make money is that they misbehave.

One of the best ways to ensure you don't do silly things is to:

1. Automate as much as possible. SIPs, Step-up SIPs, setting up mandates etc

One of the best ways to ensure you don't do silly things is to:

1. Automate as much as possible. SIPs, Step-up SIPs, setting up mandates etc

2. Invest & uninstall investing apps. Stop tracking your NAVs & portfolio every day.

3. Sometimes ignorance is bliss. If you don't know the daily market movements, you aren't missing anything. This also means you won't be prompted to tinker with your portfolio.

3. Sometimes ignorance is bliss. If you don't know the daily market movements, you aren't missing anything. This also means you won't be prompted to tinker with your portfolio.

The best place to learn about compounding is the personal finance module on Varsity.

zerodha.com/varsity/module…

zerodha.com/varsity/module…

• • •

Missing some Tweet in this thread? You can try to

force a refresh