2021 - Year End Mega-Thread.

List of Books. Subscriptions. Newsletters. Websites. Stock Picking Patterns. Fund Managers, Businesses I Invested heavily, etc.

List of Books. Subscriptions. Newsletters. Websites. Stock Picking Patterns. Fund Managers, Businesses I Invested heavily, etc.

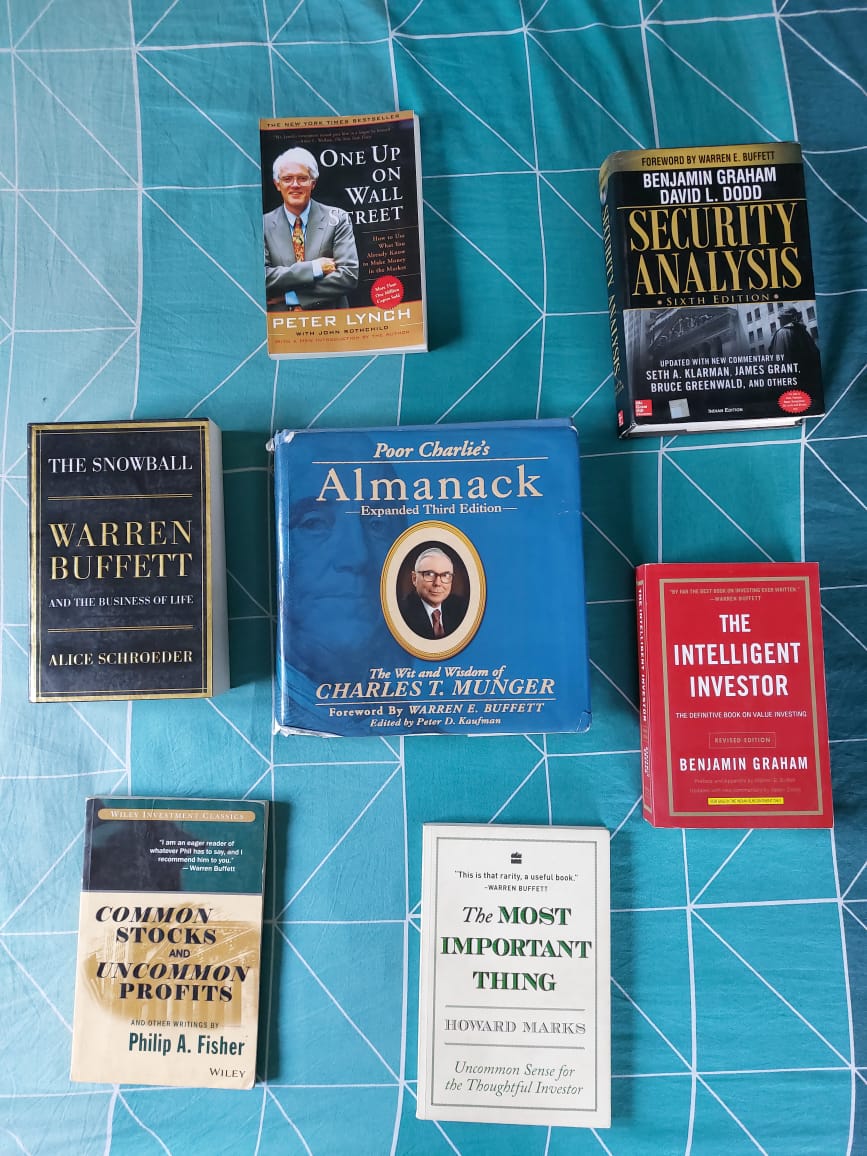

Books i love to re-read irrespective of market cycles:

1) The Snowball.

(compounding)

2) You can be a stock market genius.

(Special situation)

3) The Little book that builds wealth.

(Moats)

4) Margin of Safety.

(Valuation)

5) Black Swan.

(High Improbable Events)

1) The Snowball.

(compounding)

2) You can be a stock market genius.

(Special situation)

3) The Little book that builds wealth.

(Moats)

4) Margin of Safety.

(Valuation)

5) Black Swan.

(High Improbable Events)

6) Zebra in the lion country.

(Smallcap investing)

7) The investment checklist.

(Imp of checklist)

8) Value Migration.

(Mega Shifts in business landscape)

9) The Outsiders.

(Capital Allocation)

10) Megatrends.

(Trends of new world)

11) Poor Charlie's Almanack.

(Mental Models)

(Smallcap investing)

7) The investment checklist.

(Imp of checklist)

8) Value Migration.

(Mega Shifts in business landscape)

9) The Outsiders.

(Capital Allocation)

10) Megatrends.

(Trends of new world)

11) Poor Charlie's Almanack.

(Mental Models)

Books on Indian Investing:

1) Masterclass with Super Investors.

(Collection of India's best stock market investors)

2) Bulls Bears & other Beasts.

(Brief history of Indian stock market)

3) India's Money Monarchs.

(Collection of India's best stock market veterans)

1) Masterclass with Super Investors.

(Collection of India's best stock market investors)

2) Bulls Bears & other Beasts.

(Brief history of Indian stock market)

3) India's Money Monarchs.

(Collection of India's best stock market veterans)

Reading Material from Global Investors:

1) BRK Annual Meetings Transcripts & Letters to shareholders.

2) Prem Watsa's Newsletters.

3) Howard Marks Memos.

4) LiLu Himalaya Capital.

5) Jeff Bezos Amazon.

6) Nomad Investment & Terry Smith's Newsletters. (Recently started reading)

1) BRK Annual Meetings Transcripts & Letters to shareholders.

2) Prem Watsa's Newsletters.

3) Howard Marks Memos.

4) LiLu Himalaya Capital.

5) Jeff Bezos Amazon.

6) Nomad Investment & Terry Smith's Newsletters. (Recently started reading)

Reading Material on Indian Investing:

1) Dr. Vijay Malik's Articles.

2) Safal Niveshak's Articles.

3) Motilal Oswal's Wealth Creation Studies.

4) Sanjay Bakshi's Articles & Videos.

5) Samit Vartak's Articles.

1) Dr. Vijay Malik's Articles.

2) Safal Niveshak's Articles.

3) Motilal Oswal's Wealth Creation Studies.

4) Sanjay Bakshi's Articles & Videos.

5) Samit Vartak's Articles.

Additional Reading Newsletters:

1) The Motley Fool.

2) Farnam Street Newsletters.

3) MoneyLife Articles.

4) Marcellus Investment Newsletters.

5) Porinju Veliyath's Newsletters.

6) Seeking Alpha.

7) The Ken.

1) The Motley Fool.

2) Farnam Street Newsletters.

3) MoneyLife Articles.

4) Marcellus Investment Newsletters.

5) Porinju Veliyath's Newsletters.

6) Seeking Alpha.

7) The Ken.

Reports & Websites:

1) B&K Securities - one of the best in the industry.

2) Spark Capital.

3) Ambit.

4) Phillip Capital.

5) Mosl Institutional Reports.

6) BSE/NSE Corporate Announcements.

7) IBEF.

8) BuffettFaq.

9) Ramesh Damani Chats. Transcripts on Rediff.

1) B&K Securities - one of the best in the industry.

2) Spark Capital.

3) Ambit.

4) Phillip Capital.

5) Mosl Institutional Reports.

6) BSE/NSE Corporate Announcements.

7) IBEF.

8) BuffettFaq.

9) Ramesh Damani Chats. Transcripts on Rediff.

Viewing Library:

1) Mohnish Pabrai.

2) The Knowledge Project.

3) PPFAS.

4) CFA Society.

5) Alpha Moguls.

6) Talks at Google.

7) WealthTrack.

8) The Investor's Podcast.

9) Wizards of Dalal Street.

10) Coffee Can Investing.

11) PMS/AIF.

One percent show.

SOIC Videos.

(Recent adds)

1) Mohnish Pabrai.

2) The Knowledge Project.

3) PPFAS.

4) CFA Society.

5) Alpha Moguls.

6) Talks at Google.

7) WealthTrack.

8) The Investor's Podcast.

9) Wizards of Dalal Street.

10) Coffee Can Investing.

11) PMS/AIF.

One percent show.

SOIC Videos.

(Recent adds)

Fund Managers whom i closely track:

1) Malabar Investments - Sumeet Nagar.

2) Nalanda Capital - Pulak Prasad.

3) Equity Intelligence - Porinju Veliyath.

4) Sageone - Samit Vartak.

5) Unifi Capital - GMaran.

1) Malabar Investments - Sumeet Nagar.

2) Nalanda Capital - Pulak Prasad.

3) Equity Intelligence - Porinju Veliyath.

4) Sageone - Samit Vartak.

5) Unifi Capital - GMaran.

Advisors:

1) Niveshaay Investment Advisors - Arvind Kothari.

(scuttlebutt)

2) Concept Investwell Securities - Siddharth Mandalaywala. (compounders and megatrends)

1) Niveshaay Investment Advisors - Arvind Kothari.

(scuttlebutt)

2) Concept Investwell Securities - Siddharth Mandalaywala. (compounders and megatrends)

Patterns to generate investment ideas:

1) Megatrends

(Renewables/Insurance/Diagnostics)

2) Demergers (Aarti Surf)

3) Management Change

4) Restructuring (Kirloskar Pneumatic)

5) Compounders at beaten valuations (United Spirits)

6) Hidden Gem Business/Intelligent Fanatics (Neogen)

1) Megatrends

(Renewables/Insurance/Diagnostics)

2) Demergers (Aarti Surf)

3) Management Change

4) Restructuring (Kirloskar Pneumatic)

5) Compounders at beaten valuations (United Spirits)

6) Hidden Gem Business/Intelligent Fanatics (Neogen)

Top Meterics:

1) Management Quality.

2) Business Quality.

3) Valuation.

4) Runway.

5) Allocation.

1) Management Quality.

2) Business Quality.

3) Valuation.

4) Runway.

5) Allocation.

Subscription:

1) Screener.

(Quick stock screening)

2) VCcircle.

(PE/VC Deals)

3) Value Research's Magazines. (Tons of wisdom)

4) Safal Niveshak's Investing course.

(One of the best in the industry)

5) Moneycontrol.

6) M&A Critique. (Deals)

7) Equitymaster.

8) Capitaliq.

1) Screener.

(Quick stock screening)

2) VCcircle.

(PE/VC Deals)

3) Value Research's Magazines. (Tons of wisdom)

4) Safal Niveshak's Investing course.

(One of the best in the industry)

5) Moneycontrol.

6) M&A Critique. (Deals)

7) Equitymaster.

8) Capitaliq.

Twitter Handles:

1) Ian Cassel.

2) Morgan Housel.

3) Dmuthuk.

4) Brian Feroldi.

1) Ian Cassel.

2) Morgan Housel.

3) Dmuthuk.

4) Brian Feroldi.

Businesses where i allocated heavily in 2021:

1) Neogen Chemicals.

2) Sanghvi Movers.

3) Kingfa.

4) United Spirits.

5) Syngene.

1) Neogen Chemicals.

2) Sanghvi Movers.

3) Kingfa.

4) United Spirits.

5) Syngene.

Investing errors i made in this bull market:

1) Poor allocation in good stock.

2) Exiting early.

1) Poor allocation in good stock.

2) Exiting early.

• • •

Missing some Tweet in this thread? You can try to

force a refresh