I'll start writing some 2022 predictions in this thread, will see what I come up with before the year end 👇

Will be interesting to see next year what I was most wrong about

Will be interesting to see next year what I was most wrong about

1. Optimistic rollups will take off, but ZK rollups won't really.

2. Layer 2 tokens will surpass $50bn in total market cap.

3. Ethereum (ETH) won't flip bitcoin (BTC).

4. But no Ethereum killer (SOL, AVAX, LUNA, ADA etc.) will flip ETH either.

5. Taproot won't amass more than 20% adoption.

6. DeFi will continue to not happen on Bitcoin.

7. LN adoption will be underwhelming. We won't surpass 6000 BTC in public LN channels.

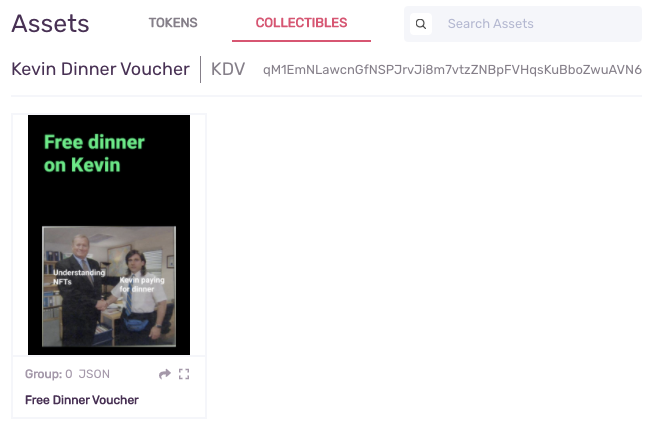

8. Stablecoins won't migrate back to BTC. USDT adoption on LN won't get traction.

9. Polygon's ZK rollup tech acquisitions won't go anywhere.

10. People will find new exciting use cases for NFTs. It turns out, jpegs was just the first iteration.

11. There will be a lot more thots in crypto. Related to the above.

12. For Ethereum-based rollups, it will look like they will solve fees & congestion in the beginning, but before the year has come to an end signs of problematic clogging will be visible again.

13. "Data availability (DA)" will be the big theme for 2022. Chains that specialize in it will get traction. Some rollups will choose to bridge to Ethereum, but use other solutions as the DA layer.

14. The Rainbow model for bitcoin will stay intact.

(And I mean actually stay intact, not stay intact because I make up new numbers).

(And I mean actually stay intact, not stay intact because I make up new numbers).

15. We will have the technology ready for low-fee payments in highly private dollar synthetics with some amount of decentralization and censorship resistance to them. But they won't yet become very commonplace in darknet markets in 2022.

16. Yes, the Merge will happen and it will be successful. There may be some resistance from PoW miners, but any remaining PoW-chainsplit of Ethereum will swiftly fall into irrelevance. No catastrophic attacks on ETH2 PoS occur.

https://twitter.com/zndtoshi/status/1476071632808681476

17. There will be no new Bitcoin softfork upgrade in 2022.

18. There will be new signs of institutional bitcoin adoption. A very large pension fund investment or something along those lines--something that kickstarts the MicroStrategy narrative again which mostly fizzled out in 2021.

19. OHM fails.

20. I would like to say ”2022 is the year of the Coordicide” but probably better to not get your hopes up. 30% chance it happens near the end of the year, more likely 2023.

https://twitter.com/phippes_iota/status/1476110495404994561

21. $AVAX will join the top 10. $ADA will drop out of it.

https://twitter.com/nooq___/status/1476115434642550786

22. Richard Heart forks BSC. It will have a $100 billion market cap but be placed at spot #202 on CoinMarketCap.

23. DeFi won’t happen there. And outside of DeFi, EVM/SC platforms have no real use case.

https://twitter.com/DanyEid_/status/1476118040223916035

24. $ATOM (#30) overtakes Litecoin $LTC (#19)

https://twitter.com/decalmagic/status/1476119920995823620

25. NEAR is great but nothing will happen on it

https://twitter.com/danse_le_mia/status/1476119583685808128

26. This will never happen again

https://twitter.com/crypt0pde/status/1476118764781543424

27. Something inbetween. No mega bear market, no supercycle.

https://twitter.com/scrooge0x/status/1476122902642798592

28. My take on RGB is that it is an incomprehensible mess and my prediction for it is that it will not deliver anything at all like Ethereum in 2022.

https://twitter.com/jokoono/status/1476490084631433222

29. After $100K failed, he said that he meant ”$100K on average this cycle”. So he will say S2F is still valid no matter the price in 2022 because the price could go to $300K in 2023 and solve the average. He will block more people than I have followers.

https://twitter.com/Justbeentoldoff/status/1476495096266829829

30. 5 of these predictions will be incorrect, but not 6. This will be the 5th incorrect prediction.

https://twitter.com/jsizzlinghot/status/1476514435384713218

• • •

Missing some Tweet in this thread? You can try to

force a refresh