1/ Some takeaways on global e-commerce:

E-commerce’s business looks super simple (for 3P, just GMV * take rate), but a lot can be learned on the key assumptions:

- GMV (gross vs. net)

- Take rate (gross vs. net)

- Upside from Ads (%? when?)

- LT profitability (5%? really?)

E-commerce’s business looks super simple (for 3P, just GMV * take rate), but a lot can be learned on the key assumptions:

- GMV (gross vs. net)

- Take rate (gross vs. net)

- Upside from Ads (%? when?)

- LT profitability (5%? really?)

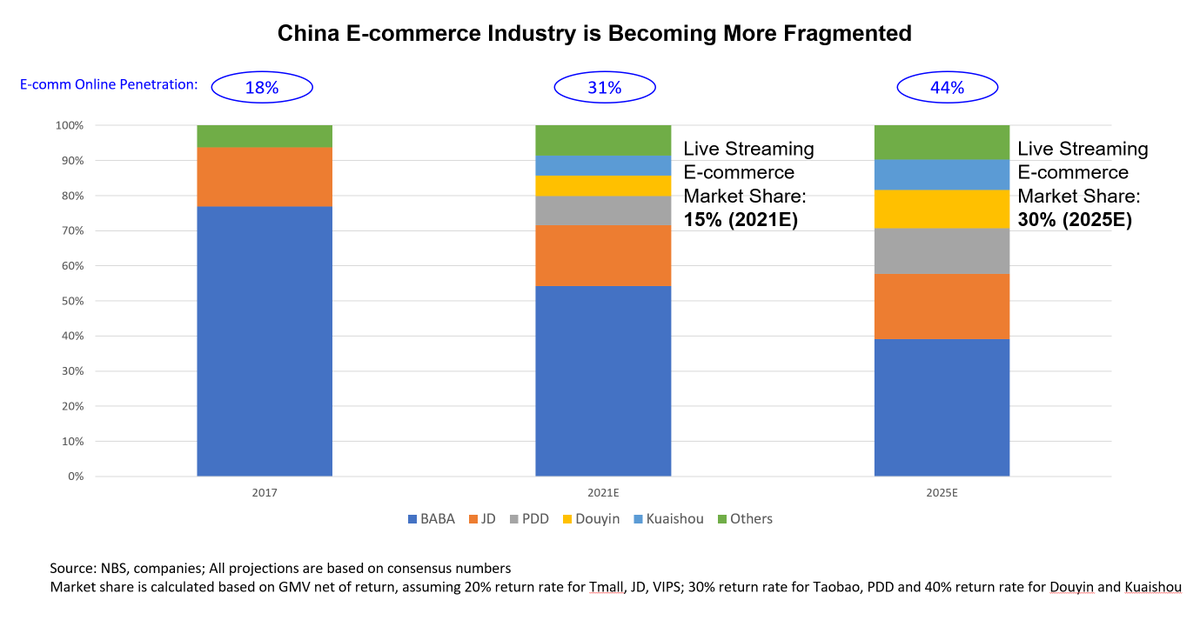

2/ Big Picture

- E-comm is a $5trn market globally

- Est. 30% is 1P

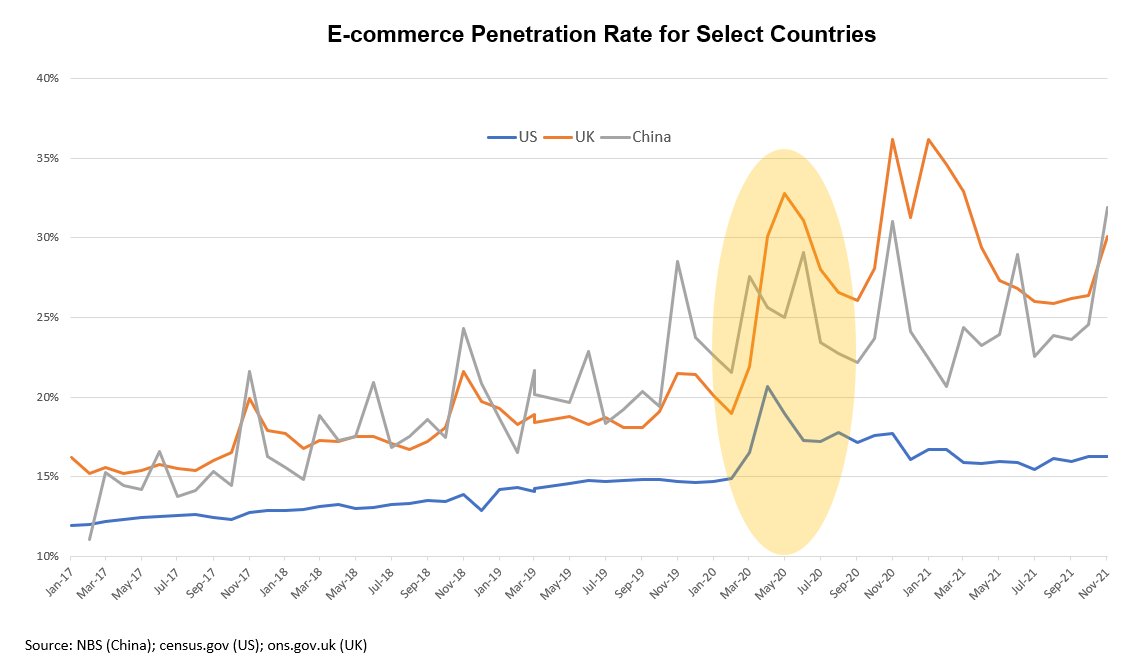

- Online penetration varies: US 16%; China 30%; LatAm & SEA: 10-15%

- Growth varies

- #1 market leader typically captures 50% (AMZN 40%; BABA 60%) of the market but can enjoy 2-4x the amount of profit dollars

- E-comm is a $5trn market globally

- Est. 30% is 1P

- Online penetration varies: US 16%; China 30%; LatAm & SEA: 10-15%

- Growth varies

- #1 market leader typically captures 50% (AMZN 40%; BABA 60%) of the market but can enjoy 2-4x the amount of profit dollars

3/ Big Picture (con'd)

1P vs 3P

1P:

- 3C + FMCG

- Brand matters, consumer preferences are uniform

- Win on quality, price, and service (logistics) quality; not on SKU variety

3P:

- Beauty + Apparel; Suitable for long-tail merchants

- Easier to scale; win on selection/variety

1P vs 3P

1P:

- 3C + FMCG

- Brand matters, consumer preferences are uniform

- Win on quality, price, and service (logistics) quality; not on SKU variety

3P:

- Beauty + Apparel; Suitable for long-tail merchants

- Easier to scale; win on selection/variety

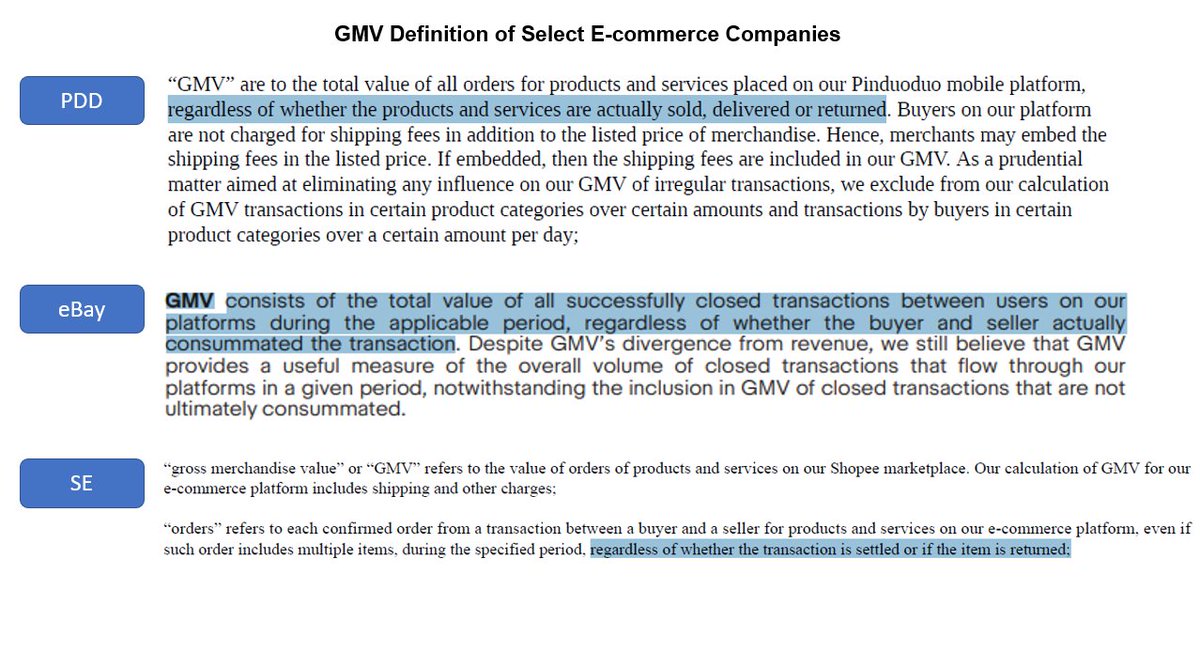

4/ GMV

A. Read the footnote

Most include unsold, unsettled, and returned items.

B. Special cases

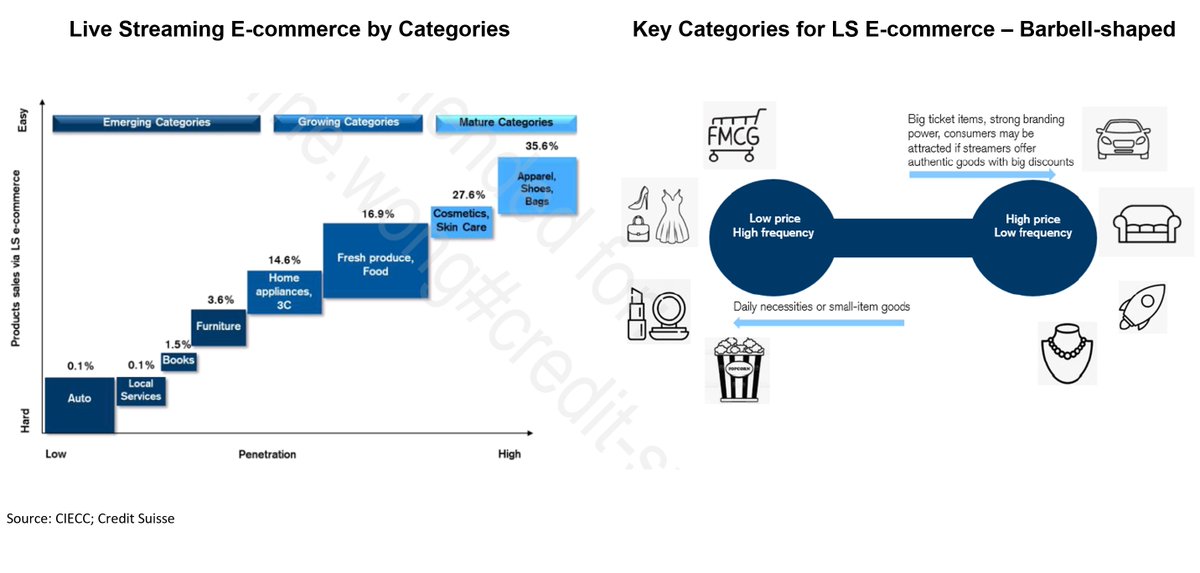

- Live-streaming (LS) e-comm: high return

- PDD: inflated bc “No shopping cart”+“team order”

Rule of thumb: 20% discount average from GMV to NMV. 40-50% for PDD, 40% for LS e-comm

A. Read the footnote

Most include unsold, unsettled, and returned items.

B. Special cases

- Live-streaming (LS) e-comm: high return

- PDD: inflated bc “No shopping cart”+“team order”

Rule of thumb: 20% discount average from GMV to NMV. 40-50% for PDD, 40% for LS e-comm

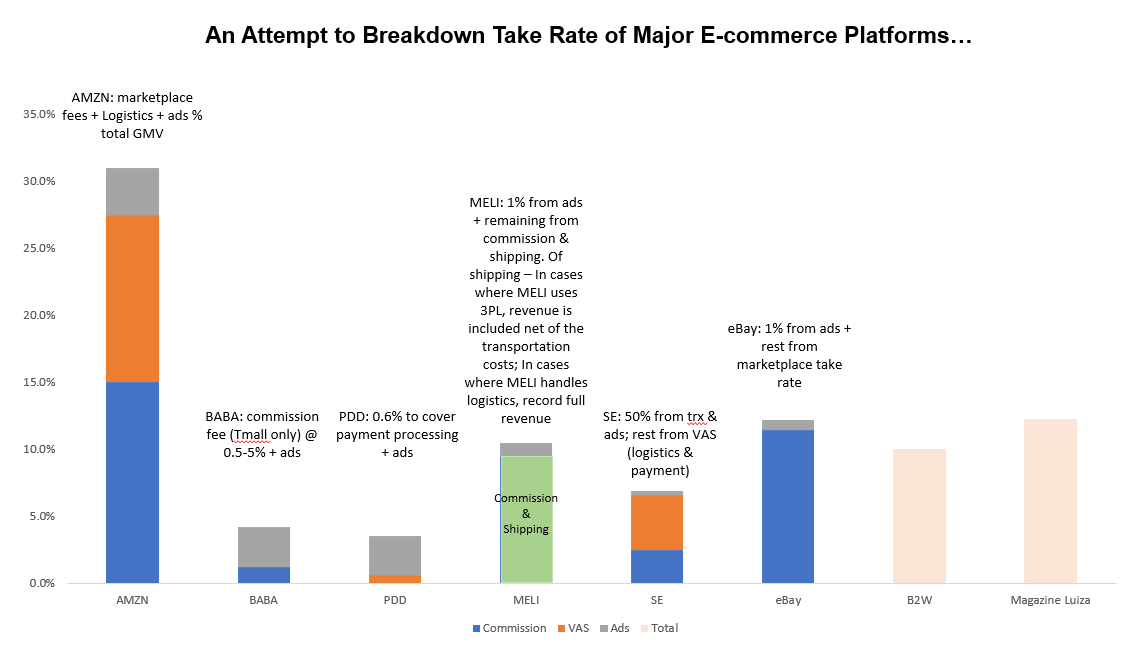

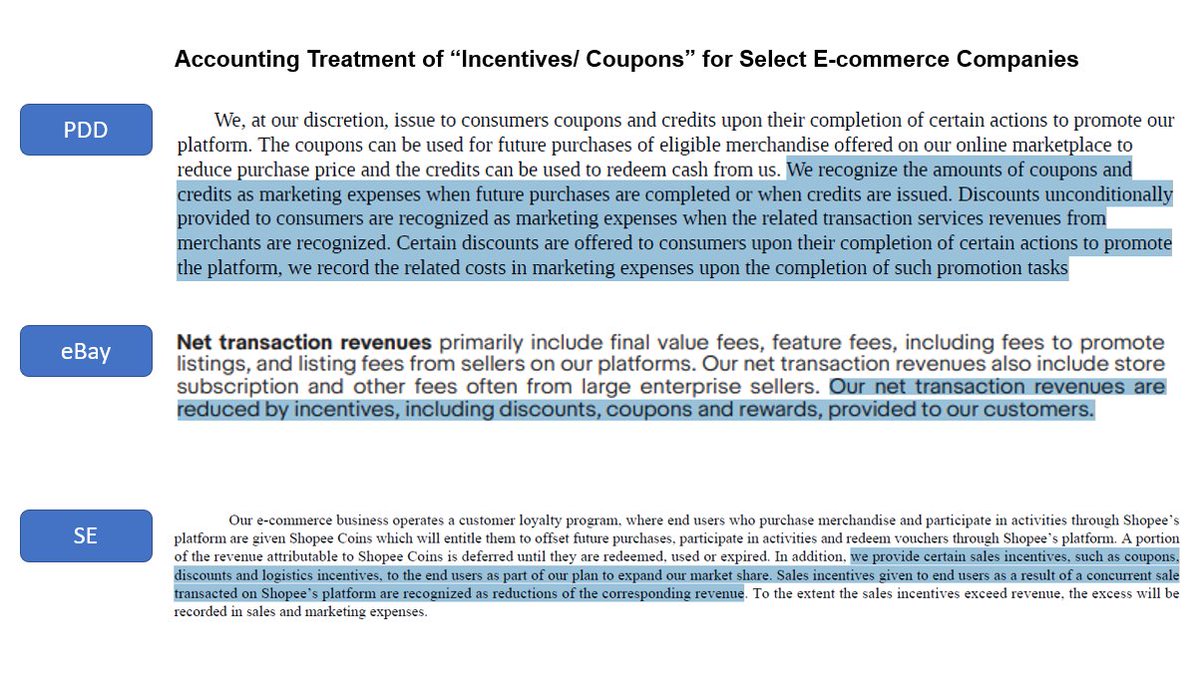

5/ Take Rate

GROSS take rate can be very misleading...

- Some include fulfillment/logistics/payment processing as a part of take rate vs. some don’t…

- Some treat sales incentives as contra revenue vs. others treat them as marketing expenses…

Use NET! Do the adjustments...

GROSS take rate can be very misleading...

- Some include fulfillment/logistics/payment processing as a part of take rate vs. some don’t…

- Some treat sales incentives as contra revenue vs. others treat them as marketing expenses…

Use NET! Do the adjustments...

6/ Take Rate (cont'd)

Rule of thumb:

- Commission: C2C (low), B2C (high); 3C (low), beauty and apparel (high)

- VAS: payment (50bps) + logistics/fulfillment – by default is a zero margin pass-through (!)

- Ads: high margin

Be careful of what's driving the take rate increase...

Rule of thumb:

- Commission: C2C (low), B2C (high); 3C (low), beauty and apparel (high)

- VAS: payment (50bps) + logistics/fulfillment – by default is a zero margin pass-through (!)

- Ads: high margin

Be careful of what's driving the take rate increase...

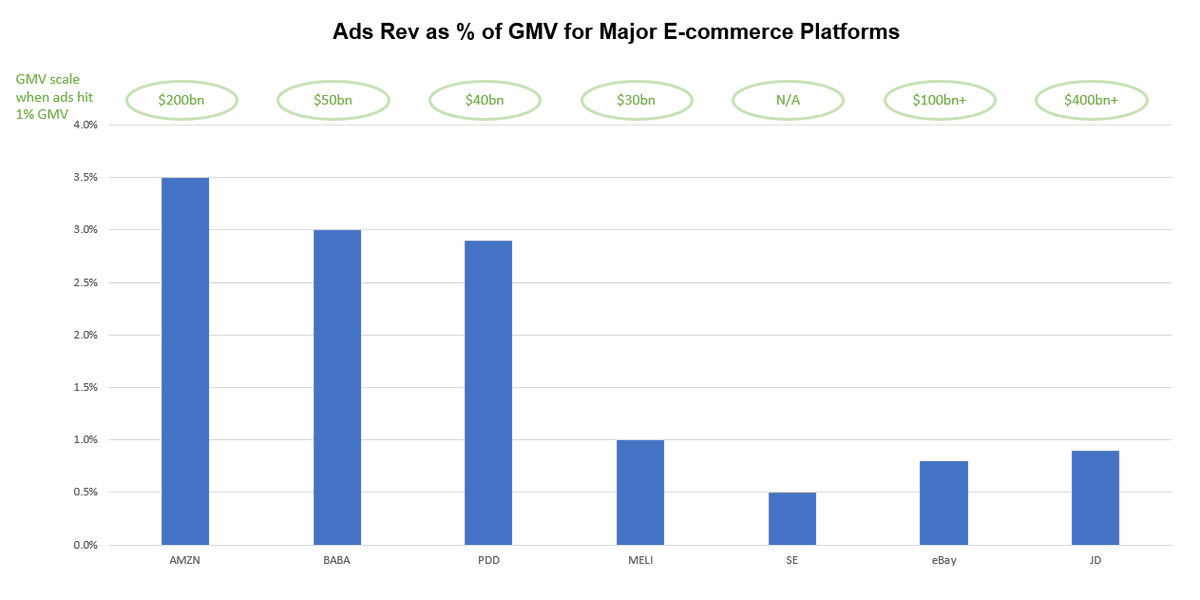

7/ Ads

- Super high margin😍

- Mostly performance ads

- Not available until 1) clear market leadership is established, 2) market is mature/ merchants are educated

- Most platforms hit 1% with $50B+ of GMV

- Super high margin😍

- Mostly performance ads

- Not available until 1) clear market leadership is established, 2) market is mature/ merchants are educated

- Most platforms hit 1% with $50B+ of GMV

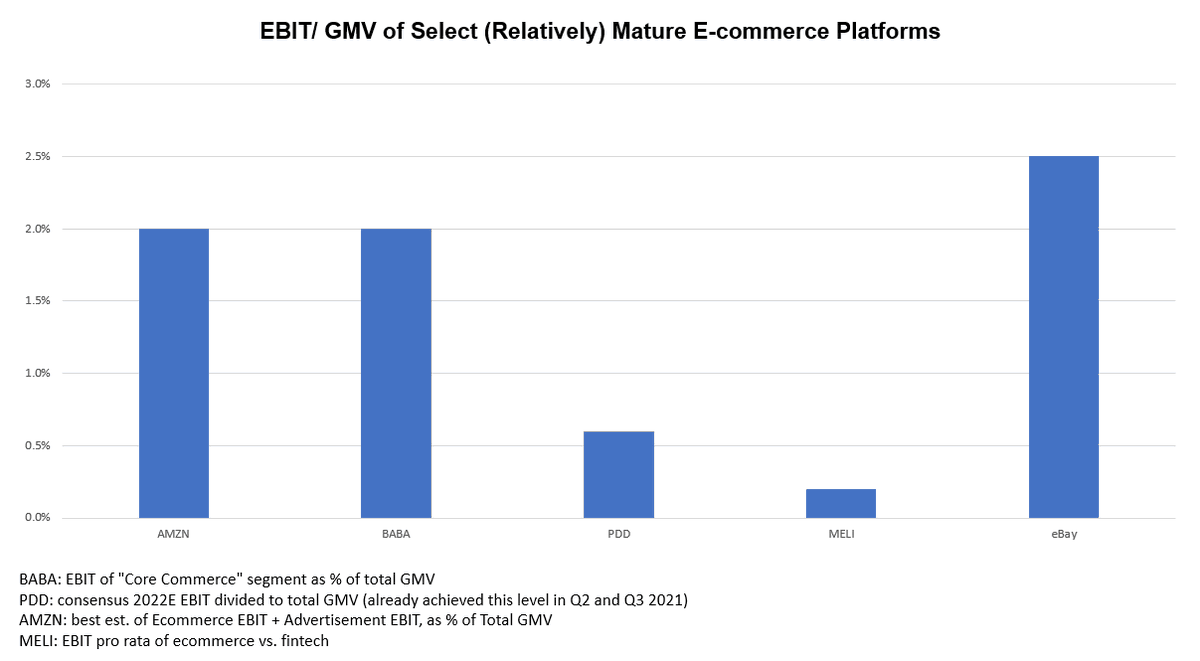

8/ LT Profitability

5% EBIT/ GMV has been the "magic number" most marketplace names (incl. 3P e-comm, food delivery and ride railing) have guided towards

Is it really achievable?🧐

Most mature e-comm platforms seem to be at 2-3% today

(end)

5% EBIT/ GMV has been the "magic number" most marketplace names (incl. 3P e-comm, food delivery and ride railing) have guided towards

Is it really achievable?🧐

Most mature e-comm platforms seem to be at 2-3% today

(end)

• • •

Missing some Tweet in this thread? You can try to

force a refresh