A bit over a year ago there was a lot of discussions about #BitcoinCash and the topic of a #Roadmap. Back then, I spent some time with @im_uname to get his views on the path forward but after some exploring of the subject we put it aside.

This thread is a look back on our notes.

This thread is a look back on our notes.

From a scalability perspective, there's a lot more that can be done, but there was mempool improvements, unconfirmed chain limits was removed and I think there was some delays in transaction relay that was addressed too.

There has been improvements to extensibility and script: we should have native introspection, multiplication and 64-bit integers after the May 2022 upgrade. Work has been put down to re-evaluate safe script limits, but unclear when/if it will be complete.

From the payments perspective, double-spend proofs are live and used in the wild, and the reusable payment codes has seen some work.

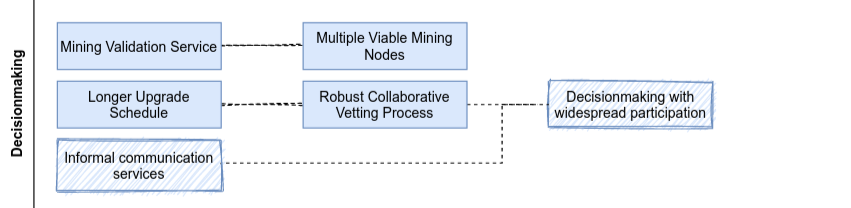

In terms of concensus and decisionmaking, there is now a mining validation service and recently @SoftwareVerde mined a mainchain block. Informal upgrade schedule is longer and more predictable, and in part due to the CHIP process we have had a wider participation of stakeholders.

As for supporting more usecases, we can now use multiple OP_GROUP outputs, and the discussions around tokenization schemes and how to implement induction proofs is making progress and is being discussed on a deep level.

On the infrastructure side, both a scalenet and new testnet has been set up, and an upgrade/consensus testnet has been proposed to help make future update more consistent.

All in all, looking back it seems that #BitcoinCash is still progressing in a significant manner, and I would like to reach out and give a big thanks to all those that helped make this happen.

Final note: the changes that did happen did not come about as a result of some roadmap, but from a large number of individuals/organizations working in their own capacity to address matters they felt were important.

• • •

Missing some Tweet in this thread? You can try to

force a refresh