Alright señores y señoritas, after seeing the support and encouragement to continue in 2022, 365 days of supply chain is BACK...

Check out 2022 here 👇🏽

Check out 2022 here 👇🏽

https://twitter.com/santoshsankar/status/1345205315592183808?t=g7W9cQfzKKBRKVZYhrTuTw&s=19

01/ Many of the cyber security vulnerabilities (zero days) in modern electronics equipment are hardware modifications inserted along the supply chain - component, assembly, or distribution level

That serves as a conduit to insert malicious software, spy, etc on the target party

That serves as a conduit to insert malicious software, spy, etc on the target party

02/ If Pitchbook data is remotely correct (namely not including buyout deals), 2021 was the breakout year for supply chain technology

04/ According to the International Road Transport Union, 1 in 5 trucking jobs are going unfilled

This is expected to worsen due to fears of contracting COVID, quarantine requirements when crossing borders, and stress from servicing a burdened system

Even wage ⏫ aren't helping

This is expected to worsen due to fears of contracting COVID, quarantine requirements when crossing borders, and stress from servicing a burdened system

Even wage ⏫ aren't helping

05/ Economists from the NY Fed have created a new index of supply chain stress

It uses 27 inputs including manufacturing, cross border transportation, and nation-specific indices

libertystreeteconomics.newyorkfed.org/2022/01/a-new-…

It uses 27 inputs including manufacturing, cross border transportation, and nation-specific indices

libertystreeteconomics.newyorkfed.org/2022/01/a-new-…

07/ Had dinner with execs from a high growth international forwarder last night:

- invoicing UX can be competitive advantage/retention tool

- still lots of spreadsheets floating around- oppty for better tech-driven process/prop tech

- exceptions = risk; hard to automate

- invoicing UX can be competitive advantage/retention tool

- still lots of spreadsheets floating around- oppty for better tech-driven process/prop tech

- exceptions = risk; hard to automate

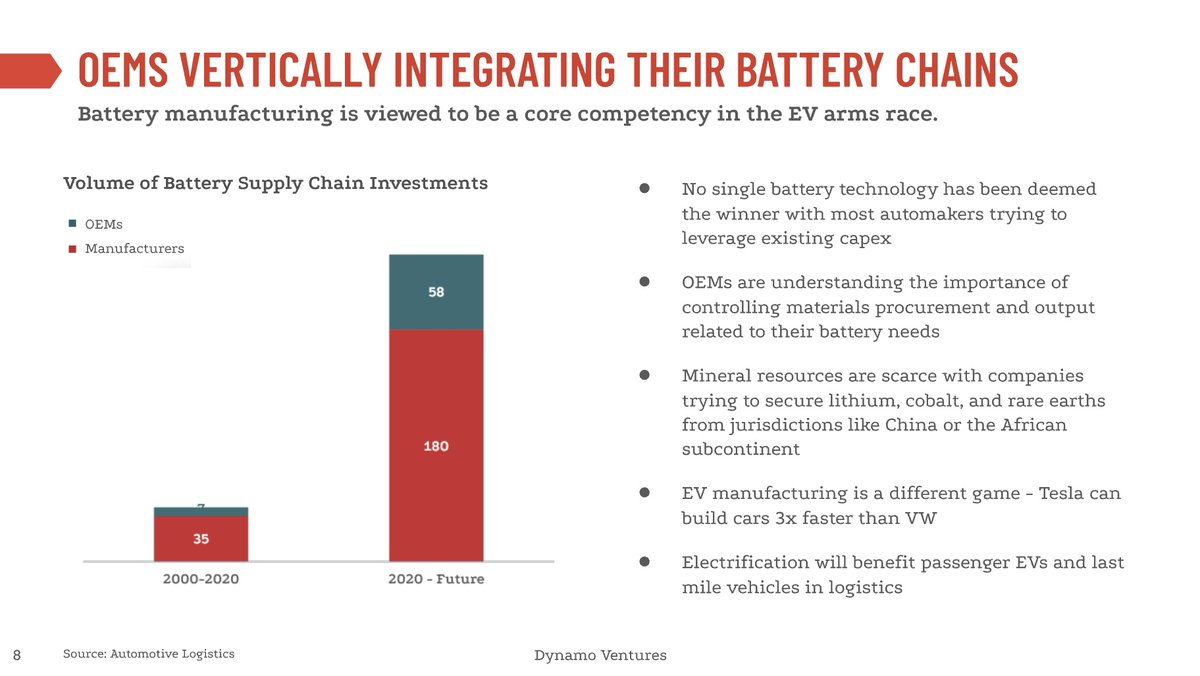

08/ The interesting evolution in automotive is the ramp in battery supply chains investments by OEMs

There's a recognition that competency and control matter

There's a recognition that competency and control matter

09/ According to Alphaliner, MSC is the top container liner in the world as measured by TEU capacity:

🇮🇹MSC- 4,284,728

🇩🇰Maersk- 4,282,840 (1,888 less than MSC)

Both have a market share of 17%

🇮🇹MSC- 4,284,728

🇩🇰Maersk- 4,282,840 (1,888 less than MSC)

Both have a market share of 17%

10/ 2.23M TEUs are expected to be imported into the US this month

+ 2.3% MoM

+8.6% YoY

+ 2.3% MoM

+8.6% YoY

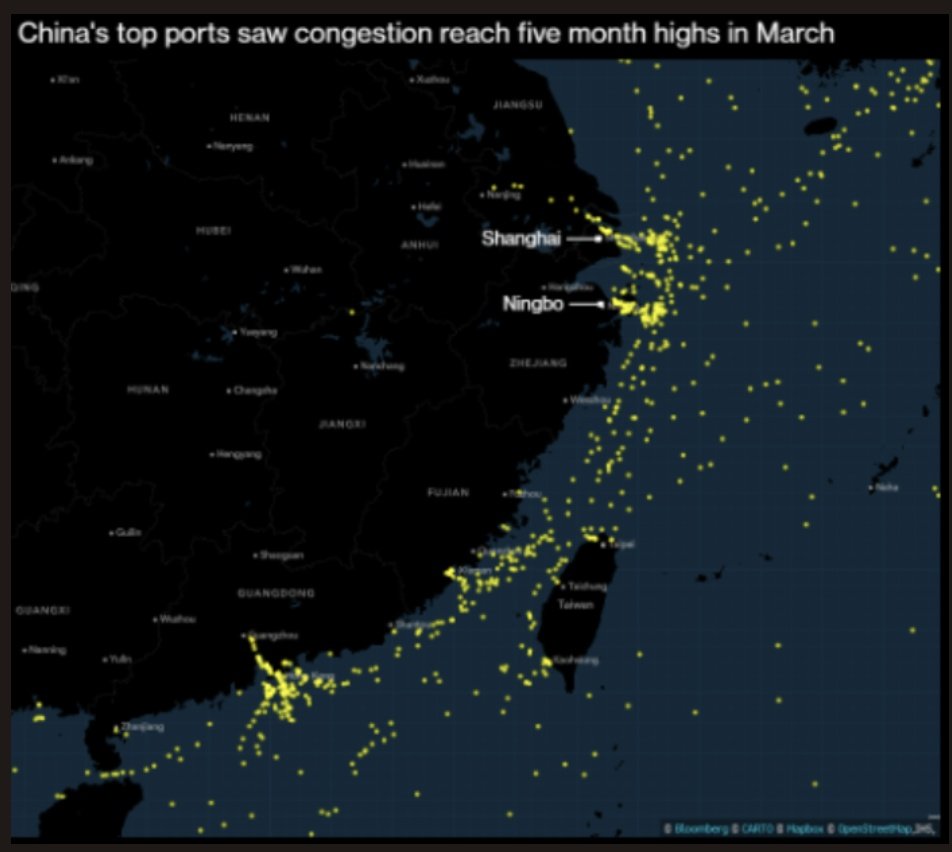

12/ As China grapples with Omicron & headlines raise the spectre of a deeper manufacturing interruption

🇨🇳China accounts for ~29% of global manufacturing output

🏭Tianjin (14M people) accounts for ~2% of all Chinese exports

⚓Port of Ningbo slowdowns can impact $4B of trade/wk

🇨🇳China accounts for ~29% of global manufacturing output

🏭Tianjin (14M people) accounts for ~2% of all Chinese exports

⚓Port of Ningbo slowdowns can impact $4B of trade/wk

13/ Class 8 truck orders totalled 365k units in '21 according to FTR

Momentum is supposed to continue given OEMs have large commitments to fleet who are running trucks past their trade in cycle

Production is still limited by component and subassembly supply shortages

Momentum is supposed to continue given OEMs have large commitments to fleet who are running trucks past their trade in cycle

Production is still limited by component and subassembly supply shortages

14/ Hong Kong's Zero COVID policy is stressing air cargo...

Capacity ~20% of pre-pandemic levels/had got back up to ~70% in Q4

Transport costs expected +30-40%

Product costs expected +10-30%

bloomberg.com/news/articles/…

Capacity ~20% of pre-pandemic levels/had got back up to ~70% in Q4

Transport costs expected +30-40%

Product costs expected +10-30%

bloomberg.com/news/articles/…

15/ A program passed by Congress Nov '21 will go into effect allowing <21 yr olds to apprentice as truck drivers with an experienced CDL

- Probationary periods of 120-280 hrs

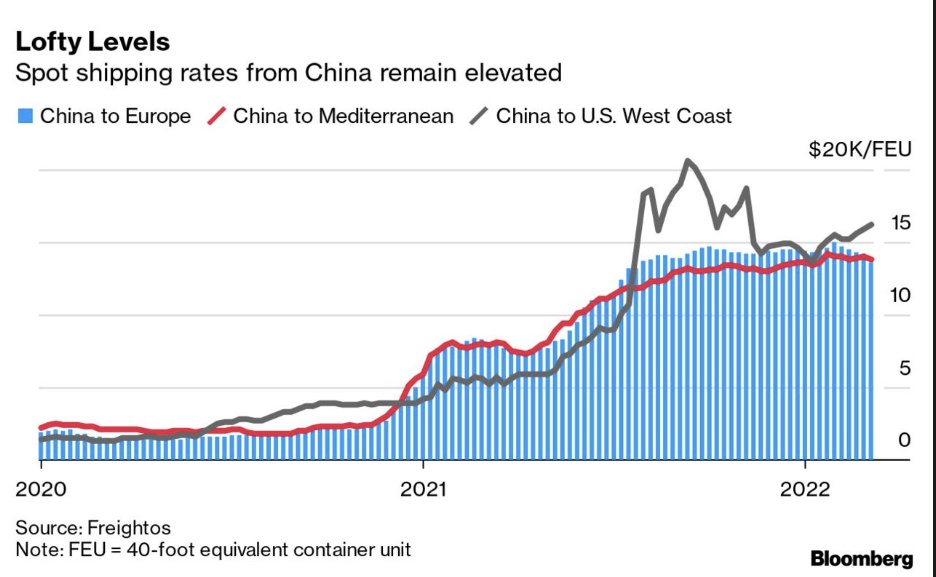

- Max speed of 65 mph

- Max 3k apprentices over 3 yr period

- Trucks must have specific capabilities

- Probationary periods of 120-280 hrs

- Max speed of 65 mph

- Max 3k apprentices over 3 yr period

- Trucks must have specific capabilities

16/ PortMiami is the #10 Port in the US based on '20 data. Some fun facts:

🍌Fruits & veggies are the most popular import by TEU

👕Apparel & textile are the most popular export by TEU

🇭🇳46% of trade is with LatAm

🍌Fruits & veggies are the most popular import by TEU

👕Apparel & textile are the most popular export by TEU

🇭🇳46% of trade is with LatAm

17/ Unladen liability is a type of commercial auto insurance that covers a specific unit whenever it's not loaded

18/ On average a containership will be fueled to 3M gallons but usage is impacted by speed, distance, and payload

19/ Expect LTL rates to soften in January but generally persist around the highs observed in December '21 for much of this quarter

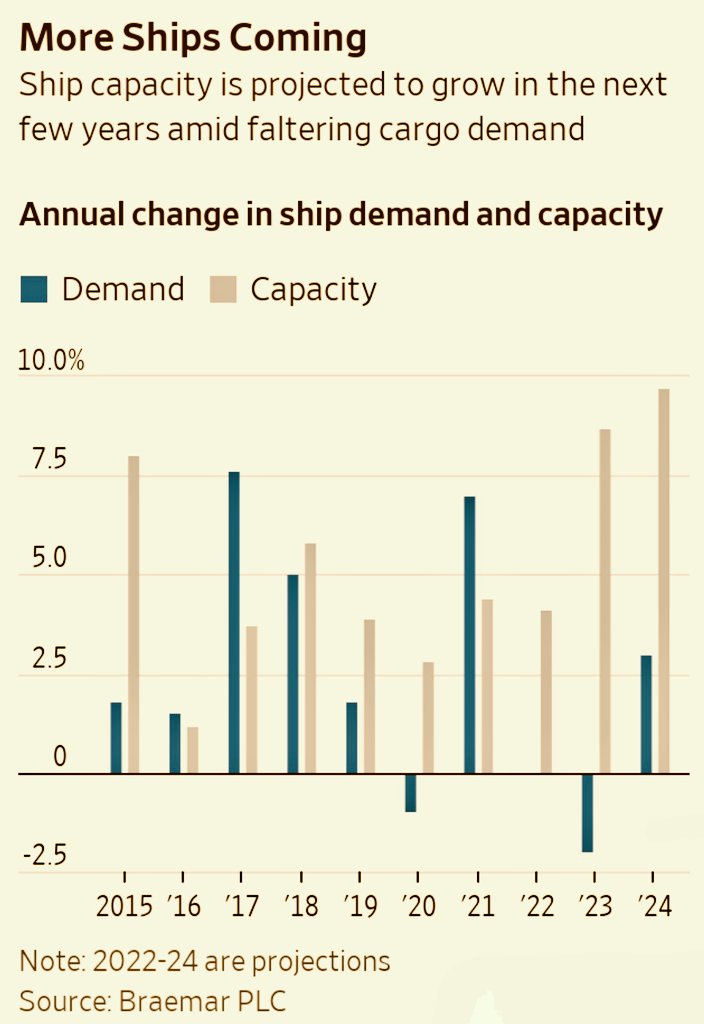

21/ Container lines ordered 555 new ships in 2020 (+400% YoY)

22/ Food delivery is a $150B industry with associated delivery costs accounting for ~50% of the unit economics, driving restaurants to frequently operate at a loss

23/ Intermediaries tend to thrive when markets are tight (demand>supply)

The future won't see the NVO go away but abstracted to a role akin to customer success with the goal of using technology to drive operating leverage (⬆️ revenue/employee)

The future won't see the NVO go away but abstracted to a role akin to customer success with the goal of using technology to drive operating leverage (⬆️ revenue/employee)

https://twitter.com/PeterTirschwell/status/1485246323377020928?t=1qJIjUNPeGgDAtKbFT7YVA&s=19

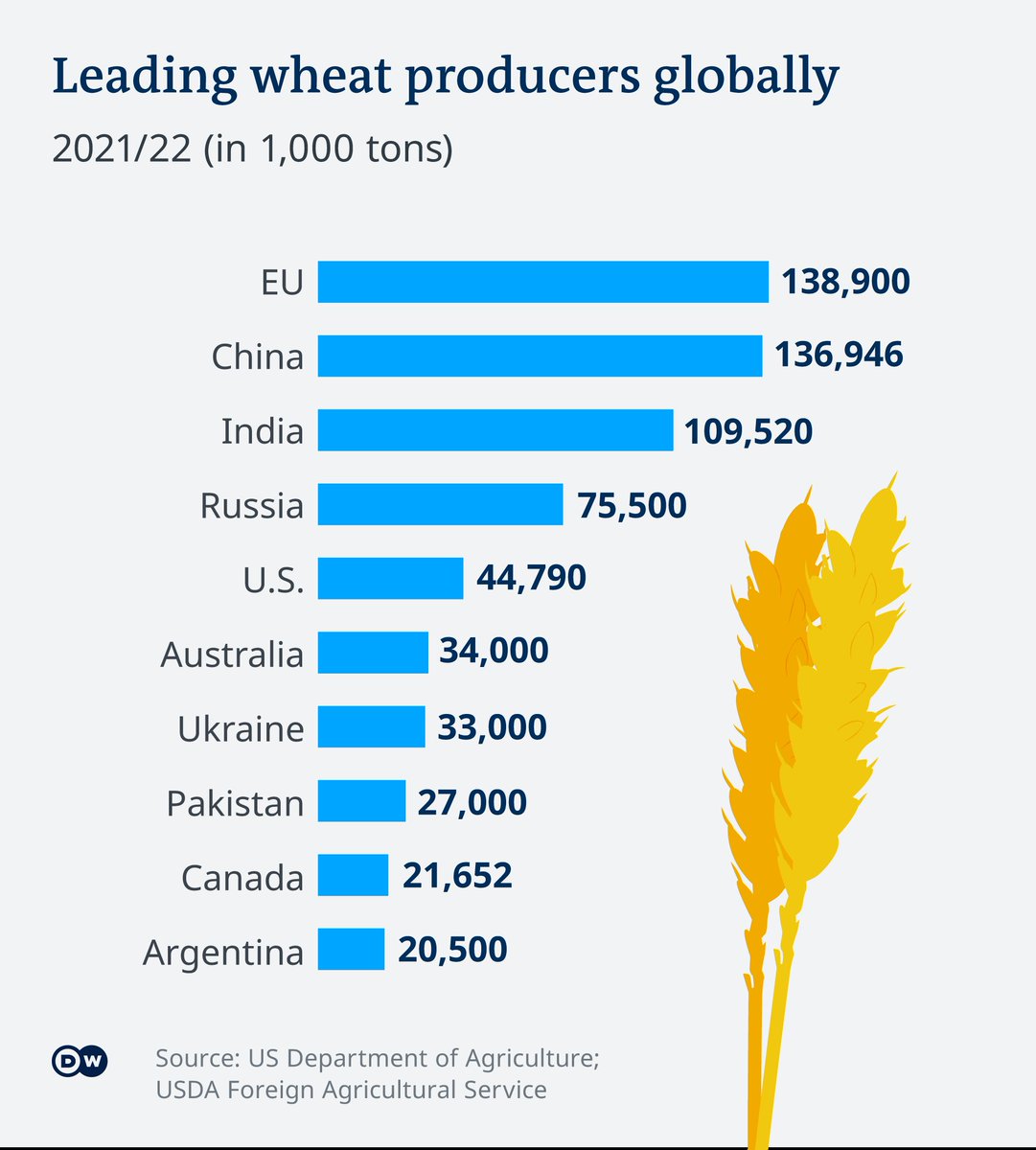

24/ As tensions between 🇷🇺 and 🇺🇦 escalate, some might be questioning why Russia cares?

One major reason has to do with supply chain. Ukraine

- strategically buffers Europe and Russia

- is strong in ag and industrial. Provided majority of wheat to USSR

One major reason has to do with supply chain. Ukraine

- strategically buffers Europe and Russia

- is strong in ag and industrial. Provided majority of wheat to USSR

26/ The COVID vaccine mandate for truckers crossing the US-Canada border is causing an increase in transportation costs that driving the price of household goods and grocery prices 2-3% higher

28/ The Big Mac Index is going to see an increase this year as McDonald's expects input prices to double this year across ingredients, non-food materials, and labor

29/ Not wordle (or a fact) but a reminder that supply chain is life

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

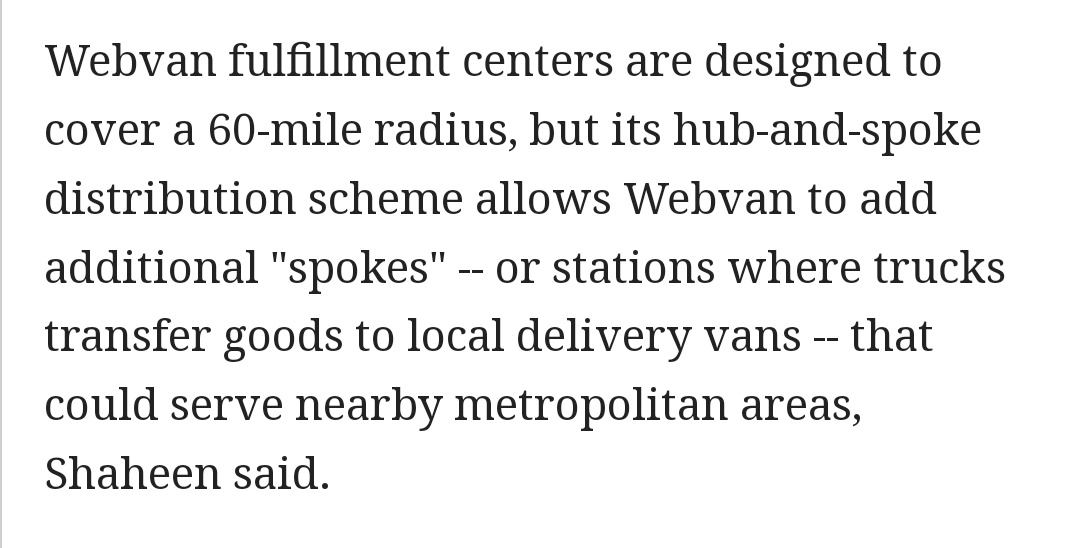

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

🚛📦🚢✈️🏭🚛📦🚢✈️🏭

30/ Fast grocery unit economics as demonstrated by NYC-based Fridge No More

As a note, the business spent $70 on marketing to win the average customer

On a net basis, the company lost $78/customer that stayed for the 10 month period through September

As a note, the business spent $70 on marketing to win the average customer

On a net basis, the company lost $78/customer that stayed for the 10 month period through September

32/ 99% of goods in Africa are moved using small to large commercial vehicles rather than trains or planes as might be normal in the US or Europe

A reason why we're excited to continue the journey with @amitrucks!

techcrunch.com/2022/02/01/ken…

A reason why we're excited to continue the journey with @amitrucks!

techcrunch.com/2022/02/01/ken…

33/ With warehouse vacancies in the low single digits in major regions, capacity is coming online creatively

1- 3PLs building up vs out (we thought this would have been more common by now in cities)

2- small retailers repurposing vacant retail in towns

nytimes.com/2022/02/01/bus…

1- 3PLs building up vs out (we thought this would have been more common by now in cities)

2- small retailers repurposing vacant retail in towns

nytimes.com/2022/02/01/bus…

34/ TIL that over a third of shipments in the EU are booked using truck when intermodal would be better on service and/or cost

35/ The FMCSA maintains a robust database of the safety performance of every commercial motor carrier. They dub this the Safety Measurement System

Check out FedEx 👇🏽

ai.fmcsa.dot.gov/SMS/Carrier/23…

Check out FedEx 👇🏽

ai.fmcsa.dot.gov/SMS/Carrier/23…

36/ “Over the holidays, we saw higher costs driven by labor supply shortages and inflationary pressures, and these issues persisted into Q1 due to Omicron"

From $AMZN quarterly results

They've raise avg wages to $18/hr in many markets and offered signing bonuses as high as $3K

From $AMZN quarterly results

They've raise avg wages to $18/hr in many markets and offered signing bonuses as high as $3K

37/ Hydrogen appears to be the way to a greener future in freight. It will gradually ramp with use of Blue H initially (from nat gas but CO2 is sequestered) and overtime Green H (from renewable electric and water)

freightwaves.com/news/could-blu…

freightwaves.com/news/could-blu…

38/ In honor of @flexport raising at a $8B valuation, today's fact is related to international logistics

There's still a long wait for imported containers at America's busiest port

There's still a long wait for imported containers at America's busiest port

40/ @Maersk's 7 point star logo made it's debut after Peter Maersk Moller, one of the founders spent the night praying for his sick wife. He viewed her recovery as God answering his prayers

The logo was first revealed on the ship "Laura" in 1886

The logo was first revealed on the ship "Laura" in 1886

41/ Is this permanent or temporary as congestion works it's way through the system? Most experts think normalized service is at least 6 mos out and reliant on ports working through the backlog

42/ Free Trade Zones are areas where goods may be manufactured, stored, etc and then re-exported without any duties

43/ The logistics of making fake snow at the Olympics

44/ The Super Bowl is the 2nd biggest eating day of the year with nearly $12B spent on food items like wings, chips, and beer. That's over 30k truckloads with beer accounting for 27k truckloads according to @MyBlueGrace

45/ "Product Information Management (PIM) is the process of managing all the information required to market and sell products through distribution channels. This product data is created by an internal organization to support a multichannel marketing strategy."

46/ Supply chain helps businesses deliver the value they promise to customers and as a major corporate function, finally seen its fair share of attention from brilliant/ambitious founders as well as VCs

Via @mims @WSJLogistics

Via @mims @WSJLogistics

47/ According to the National Association of Manufacturers, counterfeit products cost US manufacturers $131B in 2019, and that doesn't count eComm and consumer brands that buy finished products from overseas

Check out Factored Quality who make QA simple!

factoredquality.com

Check out Factored Quality who make QA simple!

factoredquality.com

48/ It looks like supply chain normalization is a ways off. Or maybe this is the new normal? @flexport

49/ Inflation continues to churn higher and a prolonged Russia/Ukraine conflict could make it worse

The pair of them account for about 25% of global grain exports. Sanctions, fallout, etc will stress supply and impact everything from cereal to chicken availability and prices

The pair of them account for about 25% of global grain exports. Sanctions, fallout, etc will stress supply and impact everything from cereal to chicken availability and prices

50/ Studies estimate that the global computer vision market is expected to grow from $11B in 2019 to nearly $18B by 2024

Driving the growth is end market demand for robotics and automated inspection applications across automotive, pharma, and food

Driving the growth is end market demand for robotics and automated inspection applications across automotive, pharma, and food

51/ Happy Sunday. Share this over family dinner to start the week off right (in a supply chain state of mind)

https://twitter.com/typesfast/status/1495188420519362562?t=2ornoOY_q8CYjaOKVHXO4Q&s=19

52/ Only 5% of road freight forwarders/brokers in the EU can quote and book shipments via intermodal despite the cost, service, and emissions benefits

53/ According to a @BlueYonder survey of UK decision makers, 80% boosted spending in their supply chains, with one in 10 investing more than $25M

While firms are managing in the shirt term, focus is on addressing systemic problems or shifts in industry

Via @business

While firms are managing in the shirt term, focus is on addressing systemic problems or shifts in industry

Via @business

55/ Research from ATRI suggests that trucking insurance premiums are ⏫ nearly 50% in the last decade, far outpacing the # of accidents

Severity of damages are ⏫ >50% vs avgs in certain states driving losses & rate hikes

Trucking liability = low frequency/high severity

Severity of damages are ⏫ >50% vs avgs in certain states driving losses & rate hikes

Trucking liability = low frequency/high severity

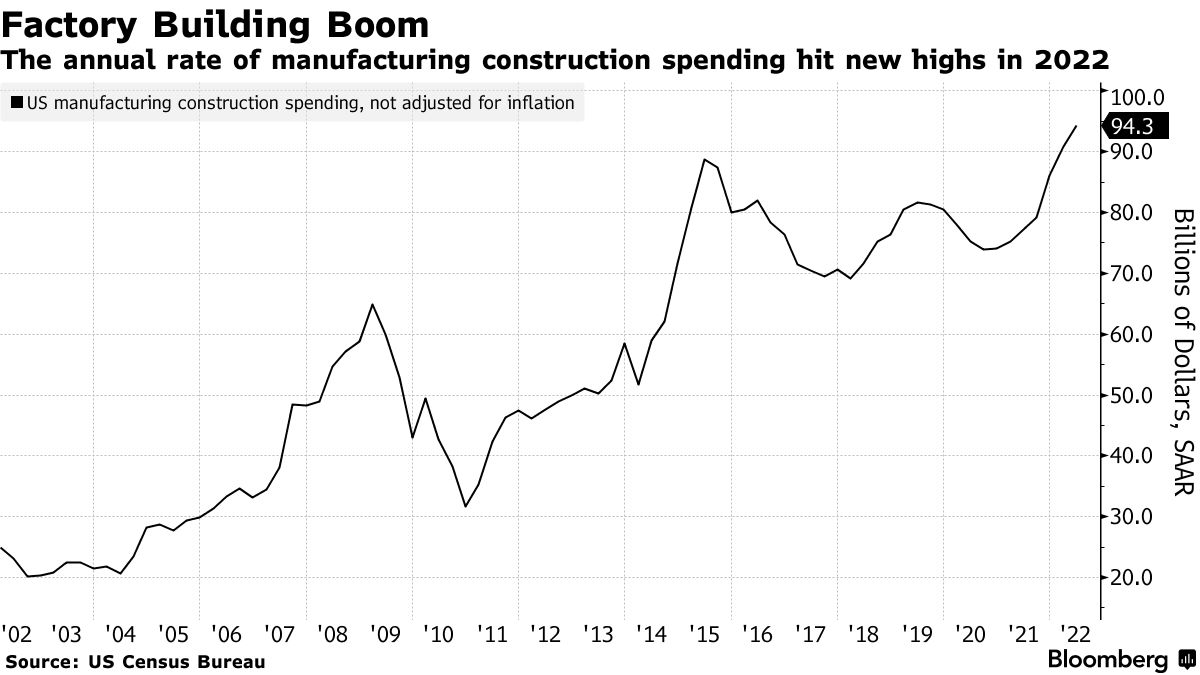

56/ The Russian-Ukraine conflict could further exacerbate semiconductor supply chains as Ukraine supplies >90% of neon used in production while Russia supplies 35% of palladium

reuters.com/breakingviews/…

reuters.com/breakingviews/…

58/ A relatively new freight train line from China travels through Kazakhstan, Azerbaijan, Georgia, Turkey, Bulgaria, Serbia, Hungary and Slovakia as an alternative to the 2 major Russian routes

asia.nikkei.com/Spotlight/Belt…

asia.nikkei.com/Spotlight/Belt…

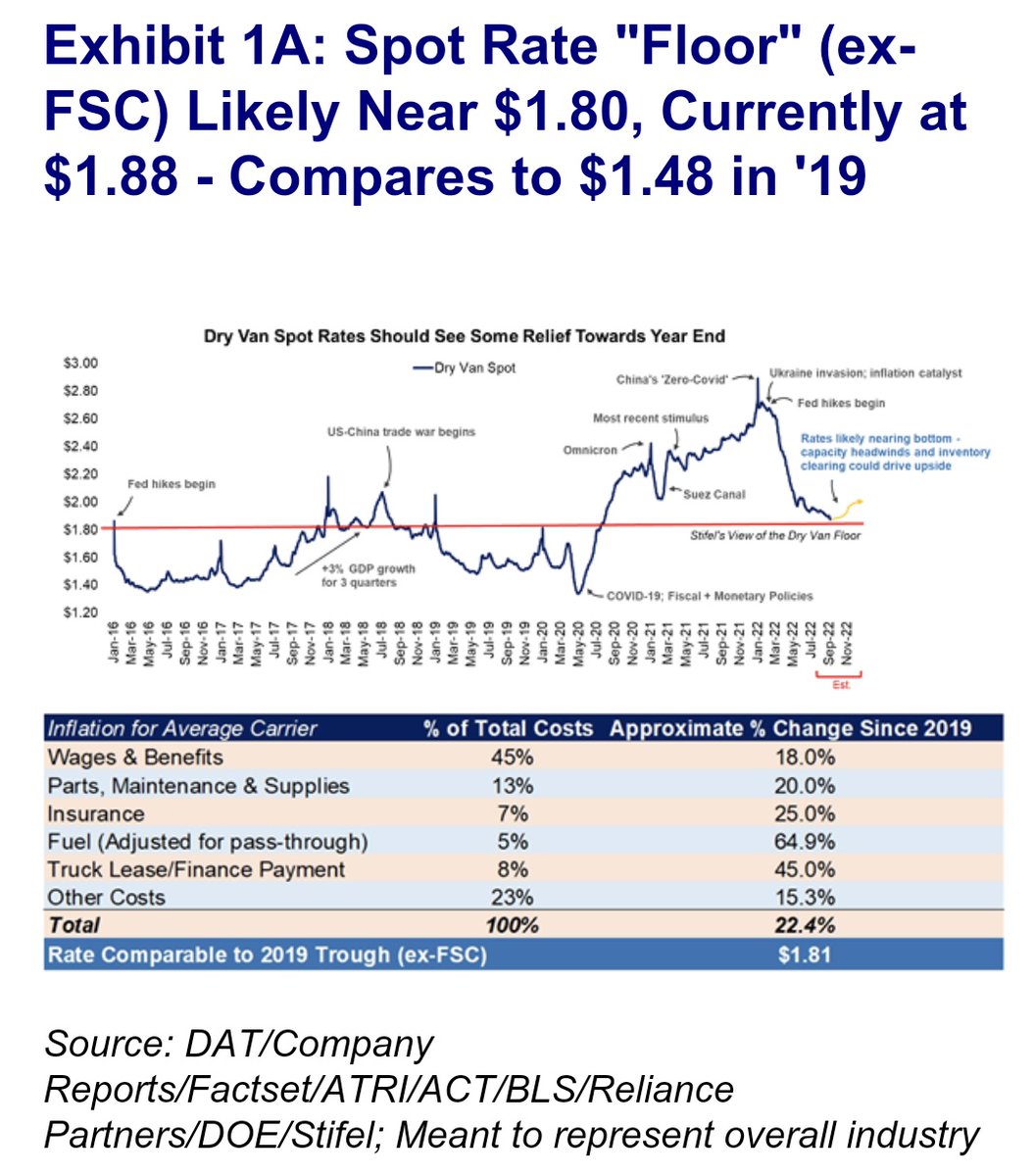

59/ Latest analysis from Stifel shows that trucking is tolerant to periods of conflict & ⏫ energy prices

Trucking outperforms the broader market by 5-50% in prior conflicts

Fuel is a pass thru cost so not negative to trucking as long as production & retail consumption continue

Trucking outperforms the broader market by 5-50% in prior conflicts

Fuel is a pass thru cost so not negative to trucking as long as production & retail consumption continue

60/ Fact of the day brought to you by @chartrdaily via @reillybrennan @trucksvc

CC/ @cmoon6 @realBobbyHealy

@tavowzg

CC/ @cmoon6 @realBobbyHealy

@tavowzg

https://twitter.com/reillybrennan/status/1498654990537211909?t=ZMUDoUC9V4CkcuABYD4Frw&s=19

62/ ICYMI...

https://twitter.com/santoshsankar/status/1499091583324409857?t=VZBjdsVj3_4_CAWsBhfgvA&s=19

63/ @freightos estimates 10k containers move from Asia to Europe by rail. A shift to ocean would drive further rate increases as capacity is already stressed

Russian-Ukraine conflict will prolong inflation. Pass-along of freight costs will be brutal

Russian-Ukraine conflict will prolong inflation. Pass-along of freight costs will be brutal

64/ Food challenges ahead? 😓

https://twitter.com/JessicaNutt96/status/1499917743608504323?t=JXwJv-RvNeDfymbnCHQpng&s=19

65/ If building new, a manufacturing facility can take 4-5 yrs to get online (not including planning time that might take 2-3 yrs alone)

Companies are putting in the work...

Companies are putting in the work...

https://twitter.com/cmroberson06/status/1500455268777447424?t=kigNsxdmuXFqE_DqGeYyWA&s=19

66/ Data from @kielinstitute suggests that the Ukraine-Russia conflict has already impacted trade MoM in Feb:

🇷🇺 -12%

🇺🇸 -4%

🇪🇺 -3%

🇺🇦 & Neighbors -4% with imports -2%

Last ship to call at the Port of Odessa was on 2/24

🇷🇺 -12%

🇺🇸 -4%

🇪🇺 -3%

🇺🇦 & Neighbors -4% with imports -2%

Last ship to call at the Port of Odessa was on 2/24

67/ How high can it go? Consumers will eventually stop spending because the juice isn't worth the squeeze

68/ IATA measures show that air demand in January was -3%, capacity was +11%, load factors -5% to 55% all YoY

Capacity is still -9% vs pre-COVID

Expect demand to normalize +5% this year

Ukrainian-Russia conflict will dampen demand slightly, heavy lift capacity might be reduced

Capacity is still -9% vs pre-COVID

Expect demand to normalize +5% this year

Ukrainian-Russia conflict will dampen demand slightly, heavy lift capacity might be reduced

69/ Japan accounts for 45% of industrial robots shipped

70/ Ukrainian and Russian seafarers make up 14.5% of the global shipping workforce

As a result, the ongoing conflict could further exacerbate maritime logistics as labor supply pressures accelerate

As a result, the ongoing conflict could further exacerbate maritime logistics as labor supply pressures accelerate

71/ There's currently a baby formula shortage (25% stock outs on avg) that's a result of:

🐮 ingredients and packaging shortages stemming from COVID

👩🏭 labor shortages among manufacturers, retail, logistics providers

🚚 increased transportation lead times

🐮 ingredients and packaging shortages stemming from COVID

👩🏭 labor shortages among manufacturers, retail, logistics providers

🚚 increased transportation lead times

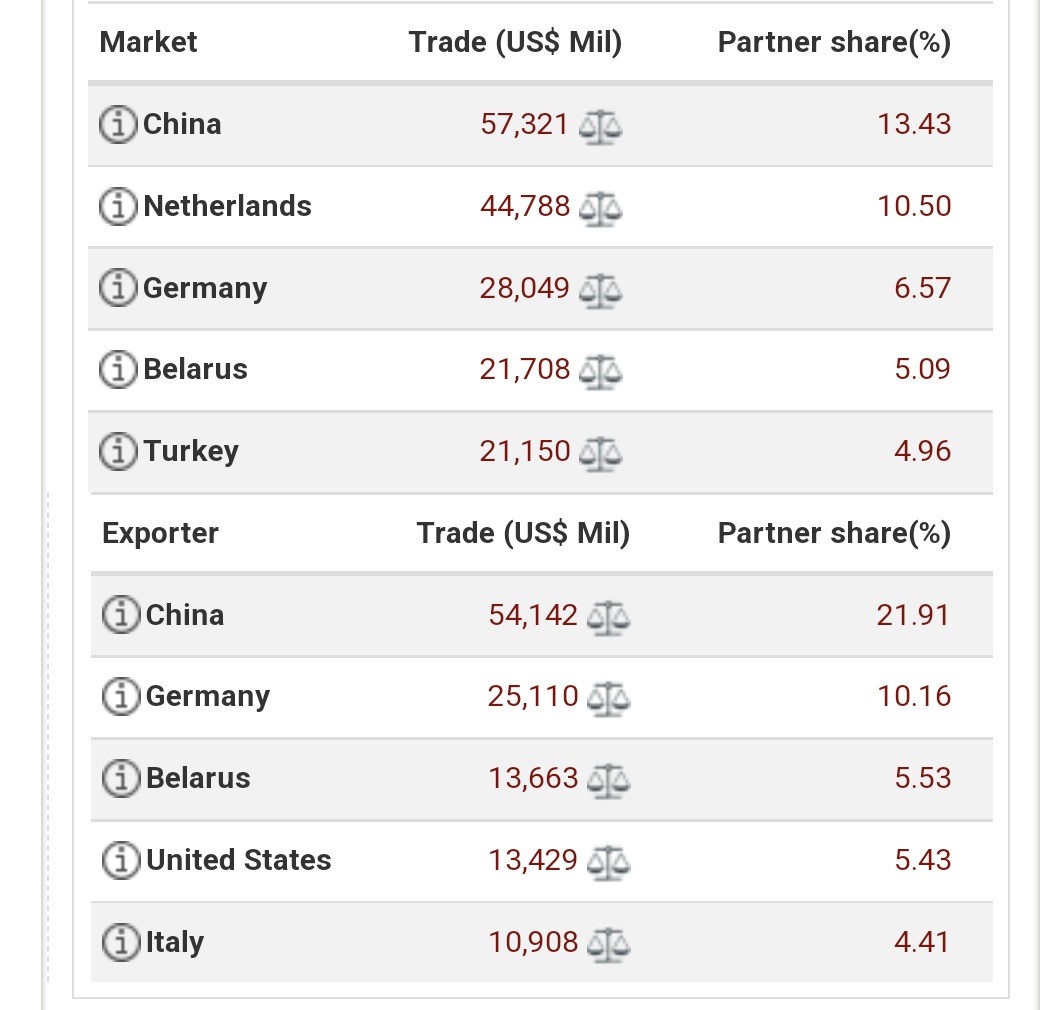

72/ Russia's Top 5 Import and Export Partners

Interesting knock-on effects for the Dutch, Germans, Italians, and us Americans!

Interesting knock-on effects for the Dutch, Germans, Italians, and us Americans!

73/ FedEx Ground exclusively uses contractors to deliver packages

As a result those contractors handle about 60% of total FedEx package volumes

As a result those contractors handle about 60% of total FedEx package volumes

74/ Shenzhen accounts for over 1/3 of Chinese cross border eComm trade and is home to the world's 4th largest port

Elongated lockdowns will be devastating for locals and overseas consumers

Elongated lockdowns will be devastating for locals and overseas consumers

75/ Amazon has 80 air freighters, more than double relative to '20

In concert, daily flights by Amazon Air are up to ~180 vs ~75

In concert, daily flights by Amazon Air are up to ~180 vs ~75

76/ How bulk carrier ships that hold commodities like grains, fertilizer, ore, etc are launched

https://twitter.com/MachinePix/status/1504497720647692297?t=RpZGUlq64GTOFvOMrHuoGQ&s=19

77/ Canadian Pacific has 3k Teamsters employees that could be locked out on 3/20 if an agreement isn't reached

A lockout would pressure transport of potash (ahead of spring planting), energy (in face of rising prices), and consumer goods

A lockout would pressure transport of potash (ahead of spring planting), energy (in face of rising prices), and consumer goods

78/ For every seated truck, there's 50 truckloads that need to be moved

A seated truck is one with a driver

Autonomy will help in the mid to long term but more systemic changes are needed to even allow for that. Some shifts would also align with making trucking a palatable job

A seated truck is one with a driver

Autonomy will help in the mid to long term but more systemic changes are needed to even allow for that. Some shifts would also align with making trucking a palatable job

79/ Incoterms define the responsibilities of buyers and sellers in global trade

@VizionAPI with a primer on which terms are important for sea trade

vizionapi.com/blog/what-are-…

@VizionAPI with a primer on which terms are important for sea trade

vizionapi.com/blog/what-are-…

81/ >1M containers with automotive parts & consumer electronics from China to Europe are shifting away from intermodal to ocean transport to avoid routes thru Russia

Costs? Going up

Lead times? Going up

Carbon emissions? Going up

Costs? Going up

Lead times? Going up

Carbon emissions? Going up

82/ A 🧵 on logistics relating to the Russia-Ukraine conflict...

https://twitter.com/TrentTelenko/status/1507056013245128716?t=tcFDWK-fwNxCV-rjfTFV6g&s=19

83/ Higher diesel prices disproportionately impact smaller fleet who lack the leverage in relationships to pass on part of the cost increase and are also unhedged

Worth noting fuel surcharges are up 19¢ and 33¢, MoM and YoY

Worth noting fuel surcharges are up 19¢ and 33¢, MoM and YoY

84/ A few people have asked me to explain fuel surcharges

These are fees paid by shippers to carriers to cover the increase in fuel prices beyond the agreed upon base rate

These are fees paid by shippers to carriers to cover the increase in fuel prices beyond the agreed upon base rate

85/ In honor of spending my next several days in Mexico, a fun fact...

The Mexican road network is extensive with a length >250k connecting most locations. The majority of the total network is rural

The Mexican road network is extensive with a length >250k connecting most locations. The majority of the total network is rural

86/ There are an estimated 1.1M tractors in the Mexican over-the-road market

Long tail...

Small transporters account for nearly 60% of that capacity

Add medium-sized transporters and that number goes to 80%

Long tail...

Small transporters account for nearly 60% of that capacity

Add medium-sized transporters and that number goes to 80%

88/ LTL can benefit from higher fuel prices unlike FTL peers because it's harder to allocate fuel surcharges due to the complexity of their networks and services

Note, this assumes that a LTL provider is generally efficient

Note, this assumes that a LTL provider is generally efficient

89/ Harbor pilots are responsible for navigating ships into port (take over from the ship's captains and crew)

At the Port of LA, they are municipal employees that make > $400k/yr and quite a common rate across other US ports. This job is very risky

Via @mims 'Arriving Today'

At the Port of LA, they are municipal employees that make > $400k/yr and quite a common rate across other US ports. This job is very risky

Via @mims 'Arriving Today'

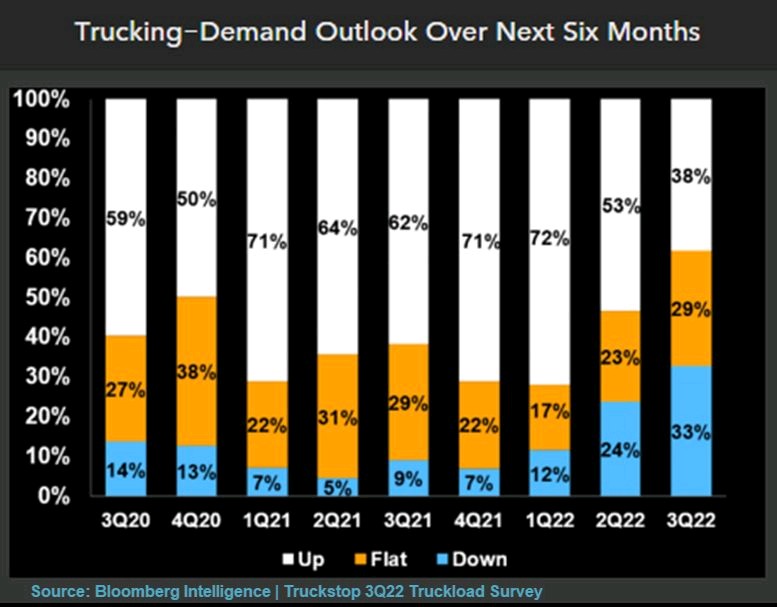

90/ Data suggests we are in a freight recession... 🚚🐌📉

https://twitter.com/FreightAlley/status/1510764776527380480?t=Rx_uCq4ijRB4IiAei7Vk9w&s=19

91/ "Companies analyzed by Goldman Sachs are aiming for inventory-to-sales ratios roughly 5% higher than before the pandemic on average, according to the report."

See @ThisIsDynamo post on this from 2020...

dynamo.vc/blog-posts/the…

See @ThisIsDynamo post on this from 2020...

dynamo.vc/blog-posts/the…

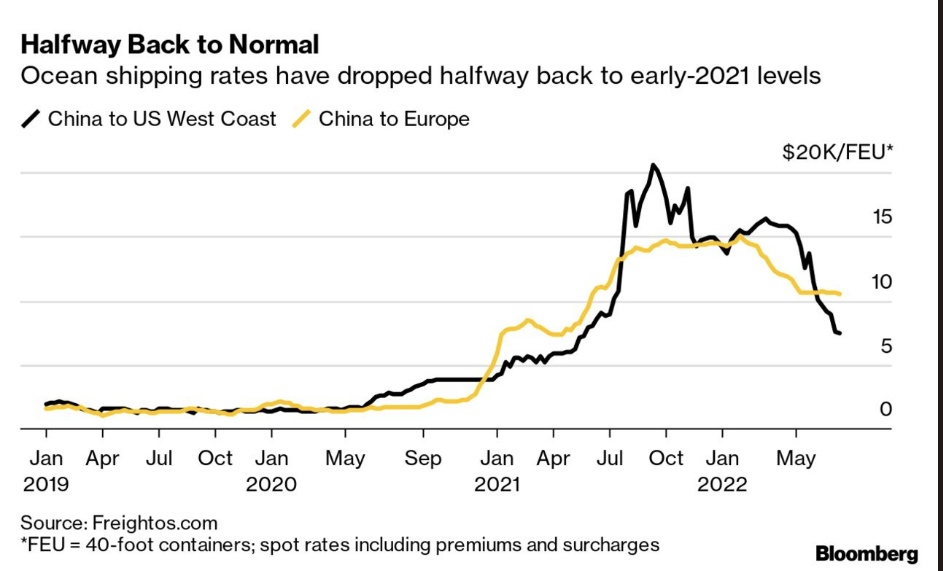

92/ Contrary to popular belief and the easily manipulable government metrics, port congestion isn't on a secular decline...

https://twitter.com/flexport/status/1509703728189820937?t=Wn9pj-fA0zbfXm__0uXk0w&s=19

93/ 4.57 loads were available for each truck on DAT in March (vs 7.33 in Feb)

*Spot truckload

Via @WSJLogistics

*Spot truckload

Via @WSJLogistics

94/ 15% of US and UK companies have moved production closer to home with 25% wanting to do so

Via @Proxima_Group

Via @Proxima_Group

97/ Money, money, money!

https://twitter.com/sonalibasak/status/1512077218083606538?t=KmE9tVzZiettvpXdhX8WGA&s=19

98/ Contrary to popular belief, the majority of US trucking demand is unrelated to our addiction to Chinese-made goods 👇🏽

https://twitter.com/FreightAlley/status/1512845919246602246?t=ZFHFnvXsaBv3dNtdxF3wlw&s=19

99/ Rough estimates suggest about a quarter of all EU truck drivers are Polish or Ukranian

The Russia/Ukranian conflict will pressure driver supply and therefore supply chains for the foreseeable future

The Russia/Ukranian conflict will pressure driver supply and therefore supply chains for the foreseeable future

100/ Ironically, those businesses who were able to stock up inventories through the pandemic might be the ones who are challenged in the coming quarters. Those who couldn't will be better off

Retailers are more suspectible to obsolete stock vs other categories

Retailers are more suspectible to obsolete stock vs other categories

101/ It costs to make a BLT Sandwich are up almost 60% since early 2019

Food inflation is real and not going away anytime soon. Dissecting the supply chain, ingredient, factory and warehouse labor, and transportation costs are all up

Food inflation is real and not going away anytime soon. Dissecting the supply chain, ingredient, factory and warehouse labor, and transportation costs are all up

102/ New research suggests a growth in automated microfulfillment centers from 86 in 2022 to over 7k by 2030

Automated microfulfillment enables rapid last mile fulfillment because they slot into relatively small places, uphold SKU density, and delivery density

Automated microfulfillment enables rapid last mile fulfillment because they slot into relatively small places, uphold SKU density, and delivery density

103/ I floated the idea of a "demand holiday" to clear out supply chain congestion. Was radical but maybe more realistic than my other idea for new mega ports

Turns out that nature heals itself- high input & transport costs? Historic inflation - that ought to dry up demand

Turns out that nature heals itself- high input & transport costs? Historic inflation - that ought to dry up demand

104/ eComm is expected to drive a 36% increase in last mile delivery vehicles from 5.3M to 7.2M between '19-'30

Via @wef

Via @wef

105/ Research suggests China's truck traffic is down 40% due to their strict COVID lockdowns. Tough year for economic growth

106/ The supply chain that delivers the chocolate consumed on Easter generally begins as early as November with processing cocoa beans, confectionary ops, and forward-stocking by mid February to key demand centers

107/ In the next 3-9 mos (or whenever 🇨🇳 achieves some trade normalcy), there will be a deluge of freight in the US

We must be cautious of not claiming this vol underpins a stronger econ- the demand for these goods originated months ago/bullwhip effect

We must be cautious of not claiming this vol underpins a stronger econ- the demand for these goods originated months ago/bullwhip effect

https://twitter.com/RodZeidan/status/1515275175528308744?s=20&t=4eOV4NnKj7P31H86c_grOQ

108/ while eComm sales have given back some of it's COVID gains, shopping in person might be transient as people reacclimate to norms

Note this might also be driven by long lead times or lack of products online. We've experienced this as have our friends and family, elsewhere

Note this might also be driven by long lead times or lack of products online. We've experienced this as have our friends and family, elsewhere

109/ In 1 week, the checkpoints at the Mexico/Texas border caused nearly $250M of losses related to spoilage of produce. Note about $9B of produce is imported from Mexico into the US each year

This is against the backdrop of food prices going up 8.8% in March

This is against the backdrop of food prices going up 8.8% in March

110/ A reminder that Tim Cook is actually a supply chain person...

Supply chain is the core driver of customer experience

wsj.com/articles/the-c…

Supply chain is the core driver of customer experience

wsj.com/articles/the-c…

112/ From @VizionAPI data...

Top US ports by volume YTD 2022

1. New York

2. Los Angeles

3. Long Beach

4. Savannah

5. Houston

Corroborates major shippers telling us they're shifting away from West Coast in anticipation of a longshoremen strike

Top US ports by volume YTD 2022

1. New York

2. Los Angeles

3. Long Beach

4. Savannah

5. Houston

Corroborates major shippers telling us they're shifting away from West Coast in anticipation of a longshoremen strike

113/ When considering what's coming ahead for US ports, see what's happening in China...

https://twitter.com/WHByers/status/1517711921226596352?t=AdpAE_aUBCV-dFb2JaEPPQ&s=19

114/ PMI measures business trends in manufacturing. Latest measures show a waning outlook in Apr vs Mar

Germany: 54.5 vs 55.1*

US: 55.1 vs 57.7

UK: 57.6 vs 60.9

Broad EU 55.8 vs 54.9 due to tourism and France seeing notable improvement due to rising factory productivity

Germany: 54.5 vs 55.1*

US: 55.1 vs 57.7

UK: 57.6 vs 60.9

Broad EU 55.8 vs 54.9 due to tourism and France seeing notable improvement due to rising factory productivity

115/ @VizionAPI data shows that the Port of NY/NJ dwell time was the lowest of top 5 ports at 4.8 days

5 supply chain execs at major BCOs volunteered that they will be shifting volumes from West to East Coast ports in anticipation of a labor strike

How will dwell times trend?

5 supply chain execs at major BCOs volunteered that they will be shifting volumes from West to East Coast ports in anticipation of a labor strike

How will dwell times trend?

117/ Late night fact 👇🏽

https://twitter.com/AlecStapp/status/1519662830680780801?t=dqNfEJ1d-Wep18bEtrKPvw&s=19

119/ Rising and persistently high diesel prices are not good for trucking nor is it good for our wallets

120/ Railways are going all-in on IoT. IoT is often the bridge to operational visibility - important in light of rail operators coming under fire for poor service

railway-technology.com/analysis/inter…

railway-technology.com/analysis/inter…

121/ Talked to the owner of a 150 truck fleet today. Mentioned that more harmful to his biz than recent increase in diesel prices, is the inability for his maintenance network to get spare parts. Said he estimates 15-20% of assets have been idled for >3 mo for fleets his size

122/ It's taking >1 full quarter for manufacturers to get the materials they need to produce goods...

123/ @A3Robotics estimates that the North American robot market grew 28% in 2021 vs 2020

Underpinning this was strong eComm growth, rising demand for warehousing and fulfillment, and labor market strains

Underpinning this was strong eComm growth, rising demand for warehousing and fulfillment, and labor market strains

124/ Exploring supply chain in a galaxy far, far away...

The GR-75 medium transport vessel is the workforce of the Galactic Republic used for resupply during the Clone Wars. It was first seen in the Empire Strikes Back

#MayThe4thBeWithYou

The GR-75 medium transport vessel is the workforce of the Galactic Republic used for resupply during the Clone Wars. It was first seen in the Empire Strikes Back

#MayThe4thBeWithYou

125/ Global air cargo demand slowing...

03/22 -5.2%

03/21 +22.1%

03/20 -15.2%

03/19 +0.1%

03/18 +1.7%

Q1 is seasonally slow - usually flat YoY growth - rather than a decline

03/22 -5.2%

03/21 +22.1%

03/20 -15.2%

03/19 +0.1%

03/18 +1.7%

Q1 is seasonally slow - usually flat YoY growth - rather than a decline

126/ Digital freight forwarders (and brokers but not depicted here) have received major VC interest in the last 7-8 years

Also 👀 @sennderofficial #weAreDynamo

Also 👀 @sennderofficial #weAreDynamo

127/ Prized thoroughbreds are often transported in a 18 wheeler outfitted with a "box stall" that's a 1st class experience allowing the horse all the amenities of staying in a barn

Most important is disinfecting the rig between transports to avoid spread of infection/disease

Most important is disinfecting the rig between transports to avoid spread of infection/disease

129/ Another nearshoring data point via @WSJLogistics this AM...

Roughly 2/3 of 🇺🇲 and 🇪🇺 manufacturers say they will bring some of their Asian production home by 2025, 1/5 say they will bring back most or all of it, according 125 companies surveyed by BCI in Q4 21

Roughly 2/3 of 🇺🇲 and 🇪🇺 manufacturers say they will bring some of their Asian production home by 2025, 1/5 say they will bring back most or all of it, according 125 companies surveyed by BCI in Q4 21

130/ Research from Wayne State University suggests that a truck driver will seek more rest when per-mile rates are >60¢

131/ Vacancy rates for logistics properties in the US fell to 3.4% in Q1 while average asking rents rose 7%, the largest QoQ increase in >20 yrs

Via @JLL

Via @JLL

132/ The ports of Louisiana handle over 60% of grain exports in the US

Learned at #HeartlandSummit2022

Learned at #HeartlandSummit2022

133/ There's currently a baby formula shortage with US retailers stocking >40% less than norm

This has been exacerbated from a major plant shutdown related to a bacteria outbreak. Given demand is constant, other factories don't have excess capacity to ramp up to address the need

This has been exacerbated from a major plant shutdown related to a bacteria outbreak. Given demand is constant, other factories don't have excess capacity to ramp up to address the need

134/ Warehouses have realized retention is easier than acquisition in the current labor environment. Here's what they're trying out to keep their best staff

Via @instawork

Via @instawork

136/ @truck_insurance estimates there are 27k freight brokerages in the US

137/ While strong imports are great for a consumption and import-heavy economy, we shouldn't be fooled into thinking this is economic strength

We must account for the bullwhip- much of this was ordered 6-9 mos ago and only now making it's way to buyers

Via @business

We must account for the bullwhip- much of this was ordered 6-9 mos ago and only now making it's way to buyers

Via @business

138/ Ukraine accounts for 12% of global wheat production and 17% of global corn production

95% is shipped via the Black Sea that's currently blocked by Russian forces

95% is shipped via the Black Sea that's currently blocked by Russian forces

139/ Supply chain financing helps companies manage cash flow by having a third party pay a supplier or vendor quickly. Equally, a supplier themselves might arrange for this

The payment is at a discount to the total invoice value - this is the financial intermediary's margin

The payment is at a discount to the total invoice value - this is the financial intermediary's margin

140/ Our Q1 LP update indicated a build up of inventory based on channel checks with our networks- ahead of the formal data. Some will support resilience, a meaningful portion appears seasonal and will go obsolete

Walmart ⏫ 32%

Target ⏫ 43%

wsj.com/articles/ameri…

Walmart ⏫ 32%

Target ⏫ 43%

wsj.com/articles/ameri…

141/ If you believe that some % of cost increases get pushed on to customers, inflation is just getting started

And inflation still has some room to run given on going supply chain issues...

And inflation still has some room to run given on going supply chain issues...

142/ Following up on inventory, per our prior blog posts as well as LP updates, some companies are carrying 3-6 mos of inventory to remain resilient in face of ongoing supply chain challenges

Kodak- 6 mo vs 3 mo

Olaplex- 7 mo vs 4 mo

wsj.com/articles/compa…

Kodak- 6 mo vs 3 mo

Olaplex- 7 mo vs 4 mo

wsj.com/articles/compa…

143/ Did you know passenger flights from select countries need to be inspected for illicit cargo?

144/ A recent @trckstopdotcom survey suggests that 51% of small fleet owners are considering leaving the market in the next 12 months due to high fuel prices

This is despite >30% reporting strong demand and are making 50-75% more

This is despite >30% reporting strong demand and are making 50-75% more

145/ Barring select geos that are seeing secular population growth (even prior to COVID), our convos suggest housing is slowing. Supply chain is demonstrating this as well...

https://twitter.com/FreightAlley/status/1529102137837244416?t=kBeWLl_UQ8R3KKLGljS0iw&s=19

146/ The labor negotiations with the Longshore-men could delay the US supply chain recovery

The agreement covers 22k workers who handle over 40% of container freight from Asia into West Coast ports

For now, both sides are agreeing to move goods as normal

The agreement covers 22k workers who handle over 40% of container freight from Asia into West Coast ports

For now, both sides are agreeing to move goods as normal

147/ During the last 5 years, there's been an increase in cargo theft during #MemorialDayWeekend with nearly $17M of cargo stolen

Food & beverage, household goods, and electronics were the primary targets

Via @Verisk

Food & beverage, household goods, and electronics were the primary targets

Via @Verisk

148/ Cargo eBikes could save 1.2 lbs of carbon/mile. Consider the average Doordash delivery is 6.8 mi, that's 8 lbs saved per trip

149/ The Defense Logistics Agency (DLA) is the military supplier with operations across 48 states and 28 countries to provide >$41B in goods and services

150/ The US beat Great Britain in the Revolutionary War was due to the challenges of resupply across the Atlantic. Demand wasn't the issue but weather, poor replenishment ops, price gouging, and insecure routes

#MemorialDayWeekend

#MemorialDayWeekend

151/ While lumber prices are lower, prices for nails and labor are higher - driving pallet prices to all time highs

152/ Food distributor Sysco is shifting truck drivers and warehouse to a 4-day work week

Sysco now delivers 6 days/week instead of 5 days/week with 14k vehicles in the network

Will be interesting to see how this plays out 🤔

Sysco now delivers 6 days/week instead of 5 days/week with 14k vehicles in the network

Will be interesting to see how this plays out 🤔

153/ "The top 10 ocean carriers control 80% of the industry. Nine of them are further organized into three alliances. In 2021, they earned $150 billion in profits." Via @rrpre

154/ Walmart has 4.7k stores in the US with 90% of Americans living within 10 miles of one

A natural leverage point for last mile operations. On the pick up side, consider that 25% of all click and collect spend went to Walmart last year - great operating leverage

A natural leverage point for last mile operations. On the pick up side, consider that 25% of all click and collect spend went to Walmart last year - great operating leverage

155/ Why you want to call your congressperson and ask them to support drone delivery...

https://twitter.com/realBobbyHealy/status/1532742804652310529?t=rAtYgkyQ2Vbs1M6bSvuu3g&s=19

156/ Mexico is seeing export strength as near shoring ramps with the likes of Mattel and Tesla expanding primary or third party relationships

In Jan and Feb Mexico saw a total of $80B in exports after ho-hum expectations for the year

In Jan and Feb Mexico saw a total of $80B in exports after ho-hum expectations for the year

157/ Retail inventories are substantially higher than sales require. Safety stock will drive overall levels higher but this seems a bit much

On WMT-

"20% of the inventory are items we wishe we didn’t have, the rest are goods we need to restock or for later in the year"

On WMT-

"20% of the inventory are items we wishe we didn’t have, the rest are goods we need to restock or for later in the year"

158/ While I think fuel cells win the day in heavy duty trucks, the market is saying otherwise (for now 😁)

159/ An interesting corollary on why I'm pro-fuel cell

They have greater range but also my research suggests greater suitability to haul heavy loads over long distances

They have greater range but also my research suggests greater suitability to haul heavy loads over long distances

160/ YIL that over one third of luxury products are damaged thru the supply chain

In an effort to maintain brand value, they are generally destroyed rather than resold or liquidated

In an effort to maintain brand value, they are generally destroyed rather than resold or liquidated

162/ Idling capital equipment and heavy machinery contributes to 20% of costs or $300B, globally in losses

164/ Increase in interest rates will drive...

Higher inventory carrying costs on costlier financing

Lower inventories as companies find it hard to pass along costs

Less fleets in long tail due to costly or a lack of working capital

Higher inventory carrying costs on costlier financing

Lower inventories as companies find it hard to pass along costs

Less fleets in long tail due to costly or a lack of working capital

166/ Abbott produces 9.3M lbs of baby formula per month out of a single facility in Michigan when operating at max capacity

168/ It takes USPS an average of 2.4 days to deliver mail and packages cross-country according to a recent study

about.usps.com/newsroom/natio…

about.usps.com/newsroom/natio…

169/ According to research from the Kansas City Fed, a 15% increase in shipping costs has historically led to a 0.10% increase in core inflation after a year

170/ Over here 👇🏽

https://twitter.com/mercoglianos/status/1538937463820926976?t=bIz3kppfvhz74ELFCL9Qyw&s=19

172/ UPS is piloting the eQuad, a battery-assisted cargo bike

The eQuad takes more space than a bike and will have a payload of parcels shuttled around using existing bike lanes and infrastructure

jalopnik.com/ups-is-testing…

The eQuad takes more space than a bike and will have a payload of parcels shuttled around using existing bike lanes and infrastructure

jalopnik.com/ups-is-testing…

173/ US business logistics costs are up 22% in 2021 to $1.9T or 8% of GDP. This compares to the pre-COVID, 2019 figure of $1.6T or 7.6% of US GDP

The primary drivers are transportation costs and inventory carrying costs

logisticsmgmt.com/article/u.s._l…

The primary drivers are transportation costs and inventory carrying costs

logisticsmgmt.com/article/u.s._l…

174/ US intermodal is ~6.25% of the US long haul trucking market. It's historically been around 6.5% with a COVID peak of approx 7%

176/ The bicycle supply chain is healing

Lead times the last couple years were 12 mos and in many cases required manufacturers to swap out groupsets

Convos with craft manufacturers suggest lead times average 4-6 wks now

Lead times the last couple years were 12 mos and in many cases required manufacturers to swap out groupsets

Convos with craft manufacturers suggest lead times average 4-6 wks now

177/ "Revocations of trucking authorities reached a record high in May, hitting nearly 9.3k. The yellow bar represents 4k revocations from entities that failed to file a required form, even counting that out, the net revocations peaked" via @rrpre

freightwaves.com/news/a-great-p…

freightwaves.com/news/a-great-p…

178/ Overlap in FedEx's networks...

The company is spending $2B over the next 5 yrs to consolidate this footprint and operate Express, Ground, and Freight in a more integrated fashion

The company is spending $2B over the next 5 yrs to consolidate this footprint and operate Express, Ground, and Freight in a more integrated fashion

180/ Amazon cancels or delays at least 16 warehouses this year as consumer demand softens

freightwaves.com/news/amazon-ca…

freightwaves.com/news/amazon-ca…

181/ Georgia Ports seeing volumes at all time highs 👇🏽

https://twitter.com/arijashe/status/1542897421335887872?t=DxWGomLIlW-KsGtzmUBZxw&s=19

182/ Shipping a fruit cup of pears🍐...

https://twitter.com/RyanRadia/status/1438679465664696321?t=g1ODIM7vypU4TZaiEPDXbA&s=19

183/ ILWU/PMA negotiations continue after the prior deal expired on Friday with the Longshoremen asking for 10% raises and protection from automation

As a note, Longshoremen salaries range from $100-130k or 2x the median US salary

As a note, Longshoremen salaries range from $100-130k or 2x the median US salary

184/ There are roughly 33k drayage trucks in California

185/ "The difference this year is that imports to the East Coast began arriving even earlier as shippers sought to avoid potential disruption related to West Coast longshore labor contract negotiations, which began in May."

Via @JOC_Updates

Via @JOC_Updates

186/ The construction of new manufacturing facilities in the US is up 116% in the last year. This covers a combo of new facilities (nearshoring) as well as expanding existing capacity

From @DodgeData via @business

From @DodgeData via @business

187/ The beauty of being a market leader with a strong moat is that you can monetize inflation

Walmart will charge suppliers it transports freight for 2 new fees

🛍️Collection fee on COGS it receives

⛽Fuel surcharge on cost of fuel

Amazon did similar earlier in the year

Walmart will charge suppliers it transports freight for 2 new fees

🛍️Collection fee on COGS it receives

⛽Fuel surcharge on cost of fuel

Amazon did similar earlier in the year

188/ Global air cargo volumes are down 8% with pricing up 13% YoY as cargo demand softens but capacity increases with more passenger flights coming back online

aircargonews.net/data/air-cargo…

aircargonews.net/data/air-cargo…

189/ Dwell times at Port of LA/LB are back up to Feb highs. 60% of the aging containers are designated as rail cargo and the source of the longer wait

190/ "While the number of carriers is falling, their ranks remain high compared to the pre-pandemic norm. The nearly 8k carriers authorized in June is the lowest since Feb 2021, but the average from 2015 thru June 2020 was much lower, around 3k/mo" fleetowner.com/news/article/2…

191/ 47% of chemical tanker capacity are stuck at port. These tankers move inputs into a variety of processes and could have a drag on industrial production - one of the last bright spots in the economy

193/ In 2021, the global pool of shipping containers increased 13% to 50M TEU (3x the normal trend) leading to a potential surplus of 6M TEU

Via @PortTechnology

Via @PortTechnology

194/ New warehouses are typically 32 ft tall with larger warehouses having clearance as much as 40 ft

This compares to an average height of 25 ft 15-20 yrs ago

This compares to an average height of 25 ft 15-20 yrs ago

195/ While there are excess containers in the system, the upcoming IMO 2023 requirements around slow steaming of some ships will allow the industry to absorb the glut

New container production of 2.5-4M TEUs in '22-23 will be focused largely on replacement rather than expansion

New container production of 2.5-4M TEUs in '22-23 will be focused largely on replacement rather than expansion

196/ USDA data from 2019 estimates that the US has 3.7B ft² of refrigerated warehouse capacity

This spans 912 units across the country with usable space accounting for 80% of total square footage

This spans 912 units across the country with usable space accounting for 80% of total square footage

197/ A warehouse is painted every 6-8 yrs on average

198/ Truck production data via @Stifel from ACT Research

Backlogs remain high while lead times are down YoY

Backlogs remain high while lead times are down YoY

199/ "80% of supply chain execs said their supply chain costs have risen by between 20-60% between December 2020 and December of 2022"

supplychainbrain.com/articles/35306…

supplychainbrain.com/articles/35306…

201/ Rate reversal despite stable volumes/demand. It might be that expectations for imports are rosier than what's actually being booked

202/ Demand for supply chain finance is up nearly 40% in the last 2 years

Underpinning this...

🛒 Large increases in inventory purchases due to demand and stock out risk

⌛Huge delays in receiving inventory that impacts cash cycles

Underpinning this...

🛒 Large increases in inventory purchases due to demand and stock out risk

⌛Huge delays in receiving inventory that impacts cash cycles

203/ Interesting to see the PMI/GDP relationship here

https://twitter.com/WilliamsonChris/status/1550478953881784321?t=7uBw3b8SD1BcGJEatO33DQ&s=19

204/ Amazon's new Rivian delivery trucks have a tight integration with the former's delivery management system that includes planning, routing, charging, and optimizing the cargo hold/cabin

businessinsider.com/amazon-creatin…

businessinsider.com/amazon-creatin…

205/ The Rhine covers 800 miles with the lionshare of the 195M tons of EU barge freight moved on the river

The river is facing historically low water levels jeopardizing on-going usage for large shippers such as BASF and Thyssenkrupp

The river is facing historically low water levels jeopardizing on-going usage for large shippers such as BASF and Thyssenkrupp

206/ North American cross border freight exceeded $86B in May, +21% YoY

via @WSJLogistics from the Bureau of Transportation Statistics

via @WSJLogistics from the Bureau of Transportation Statistics

207/ Amazon is due to open 250 warehouses, FCs, and delivery stations this year after delaying, closing, cancelling, or subleasing> 50 facilities

208/ Via @LogTechEric weekly newsletter

Forwarders are going digital in a major way. Looking back, we'll see COVID as a major forcing function

ericjohnson.substack.com/p/forwarders-a…

Forwarders are going digital in a major way. Looking back, we'll see COVID as a major forcing function

ericjohnson.substack.com/p/forwarders-a…

209/ East Coast schedule reliability last month slipped to 18.7% from 20% in May as US BCOs have direct volumes away from West Coast ports due to the ongoing ILWA negotiations

Via @JOC_Updates

Via @JOC_Updates

210/ Maersk announced that it will begin charging customers on 1/1/23 to adhere with the EU emissions trading system

Summary charges:

🇨🇳Asia-North Europe: $172 per FEU and $258 per reefer

🇺🇲North Europe-US: $182 per FEU and $280 per reefer

Summary charges:

🇨🇳Asia-North Europe: $172 per FEU and $258 per reefer

🇺🇲North Europe-US: $182 per FEU and $280 per reefer

211/ "The top causes of poor logistics visibility in the US are unplanned IT outages (68%), adverse weather (62%), loss of talent (51%), cyber-attacks (50%), fire (44%). Nearly 30% of companies don’t analyze the cause."

Via @VizionAPI

vizionapi.com/blog/the-ultim…

Via @VizionAPI

vizionapi.com/blog/the-ultim…

212/ "Jawaharlal Nehru Port handles around 50% of the total containerized cargo volume across the major ports of India."

The investment by CMA CGM will take capacity from 1.5M to 1.8M TEU with thruout set to over double in 10 yrs

splash247.com/cma-cgm-ventur…

The investment by CMA CGM will take capacity from 1.5M to 1.8M TEU with thruout set to over double in 10 yrs

splash247.com/cma-cgm-ventur…

214/ Project logistics is about managing cargo transportation to the construction site for a specific construction project

215/ Over 70% of Maersk's container volumes are covered by long term container contracts

Container rates are below spot rates but up nearly $2k vs comparable contract costs in 2021

Container rates are below spot rates but up nearly $2k vs comparable contract costs in 2021

216/ "Intermodal Association of North America (IANA) said during the first half of 2022 that it had 2,600 new motor carriers register for interchange agreements to haul containers, a 30% increase in the number of intermodal carriers." via @cmroberson06

linkedin.com/pulse/freight-…

linkedin.com/pulse/freight-…

217/ In last mile, greenhouse gas emissions per parcel were 84% lower for drones than for diesel trucks. Drones also consumed up to 94% less energy per parcel vs trucks.

Via @realBobbyHealy from @Nature

nature.com/articles/d4158…

Via @realBobbyHealy from @Nature

nature.com/articles/d4158…

218/ Data suggests that a robust driver compliance and safety program can improve driver retention by >7%

219/ According to @Logrockinc, a strong driver compliance and safety program can save a fleet nearly $15k/month in costs!

220/ "ATA said in its annual salary survey that average wages for drivers of big rigs across the sector reached about $69,700 in '21, up 11% YoY"

Note, carriers continue to say their labor costs have increased YTD

Via @WSJLogistics

wsj.com/articles/truck…

Note, carriers continue to say their labor costs have increased YTD

Via @WSJLogistics

wsj.com/articles/truck…

221/ Biofuels will help the shipping industry leverage the same assets while also achieving their decarbonization goals

freightwaves.com/news/a-shell-e…

freightwaves.com/news/a-shell-e…

222/ 2021 was the costliest year for trucking fleets as the marginal costs per mile grew nearly 13% YoY to $1.855

@Truck_Research @fleetowner

fleetowner.com/operations/art…

@Truck_Research @fleetowner

fleetowner.com/operations/art…

223/ The OG battery "supply chain" 👇🏾

https://twitter.com/reillybrennan/status/1558086831098527745?s=20&t=n650xeuwuMUVNN8JjDMPmA

224/ "The @amazon trucking network presents over 10^88 or ten octovigintillion possible routing solutions."

For comparison, “This is an especially large number, when you consider that there are 10^82 atoms in the visible universe.”

amazon.science/latest-news/ho…

For comparison, “This is an especially large number, when you consider that there are 10^82 atoms in the visible universe.”

amazon.science/latest-news/ho…

226/ "there are signs that demand from US consumers isn’t sustainable- [...] and helps explain why spot container-shipping rates are still falling. US ports will see less retail cargo entering the country in the 2nd half of the yr, according to the @NRFnews."

via @business

via @business

227/ Current port status from @Maersk via @SteamLogistics (who is the fastest growth company in TN according to @Inc 👊🏽)

228/ Index from @flexport tracking the decline of spend on goods - something we've had a read-through on @ThisIsDynamo by speaking to our network but also monitoring earnings updates from major retailers

229/@Gap is opening up it's fulfillment network of 13 facilities/9M sq ft and 9k employees to third parties

Is this a pivot in-the-making? Will other retailers follow as a way to further sweat historic supply chain capex?

gapinc.com/en-us/gpsplatf…

Is this a pivot in-the-making? Will other retailers follow as a way to further sweat historic supply chain capex?

gapinc.com/en-us/gpsplatf…

230/ We believe companies will carry slightly more inventory going forward as they balance financial efficiency with resiliency

That said, current levels suggest meaningful write offs on the horizon

That said, current levels suggest meaningful write offs on the horizon

231/ 👇🏽 #nearshoring @ClayKatzman

https://twitter.com/DisruptorStocks/status/1561374211121242115?t=fAA2svTeBhH7cpgi5OQB1Q&s=19

233/ A 115k rail workers in the US are at risk of striking if the Class I railroads don't act on recommendations to increase pay - the largest increase in 4 decades

The raise would amount to a near 25% compounded hike by 2024 and $5k bonuses

The raise would amount to a near 25% compounded hike by 2024 and $5k bonuses

234/ "We heard from assembly/production facility mgrs that wages continue to ⬆️ but staffing is not improving and that automation is increasing as a priority. This could reintro some pressure on driver hiring as wages for drivers have ↔️ while comp job wages are ⬆️" -@Stifel

236/ In Europe, nearly 25% of kilometers driven are empty with >40% of truck trips partially empty

237/ Wages in American manufacturing are surprisingly high. According to @ShopFloorNAM, 2020 wages and benefits were >$92k

238/ While FedEx Ground is in the midst of a dispute with a vocal contractor, it's worth noting that the network relies on 6k members to operate it's parcel network

240/ A study from @UMich suggests that a fully electric @USPS delivery fleet would result in up to 63% lower greenhouse gas emissions than the agency estimated, over the lifetime of the fleet (assuming figure improvements to EVs and the grid)

sciencedaily.com/releases/2022/…

sciencedaily.com/releases/2022/…

241/ Rise and shine! The air cargo industry appears to be normalizing to historically seasonal patterns via @JOC_Updates

Softening demand might be due to lower business & consumer confidence, inflation, geopolitical, and on-going SC disruptions

Softening demand might be due to lower business & consumer confidence, inflation, geopolitical, and on-going SC disruptions

242/ Companies ordered a record 12k robots in Q2, +25% YoY, valued at $585M

Rising labor costs in a tight labor market underpins demand with 40% of orders originating outside of the automotive industry

Via @A3Robotics

Rising labor costs in a tight labor market underpins demand with 40% of orders originating outside of the automotive industry

Via @A3Robotics

243/ Today's fact(s) courtesy of @LogTechEric...

https://twitter.com/LogTechEric/status/1564669636339277825?s=20&t=maHFJMt3rus-H2eIbwQj7w

246/ Foreign Direct Investment in China is not as strong as government suggests given mainland companies are routing funds via HK back to their businesses

248/ In the face of foreign automakers leaving Russia, production fell nearly 97% YoY to 3.7k units in May

The country is now seeking $10B from the federal budget to build out an automotive supply chain to build a homegrown capacity and competency

The country is now seeking $10B from the federal budget to build out an automotive supply chain to build a homegrown capacity and competency

249/ Spoke to the CEO of a large forwarder and he said large customers are trying to cope with inventory gluts. He expects writedowns over the next quarter

They're reducing, deferring, or where possible, canceling orders that's reducing bookings

They're reducing, deferring, or where possible, canceling orders that's reducing bookings

250/The freight forwarders' cost stack...

Digital players' investment "below the line" should over time manifest in larger operating profits as revenue scales

Digital players' investment "below the line" should over time manifest in larger operating profits as revenue scales

251/ As of Q2, there was 3.3M ft² of cold storage under construction in the United States. Compare that to 300k ft² being built in 2019

According to @CBRE via @JOC_Updates

According to @CBRE via @JOC_Updates

252/ Stagnant West Coast, Overburdened East Coast

https://twitter.com/A320Lga/status/1568363816941142018?t=ZgOn5WgVJO6H0eqvI2xChw&s=19

253/ Labor negotiations are slow to progress and are causing railroads to enact contingency plans 👇🏽

https://twitter.com/arijashe/status/1569015393918001153?t=yoxmZPsP9RYJcYYRcnd8GQ&s=19

254/ 80% of containers at the Port of LA-LB are waiting at least 5 days for their rail connection

Turns out that a gov't supply chain council can only do so much...

Turns out that a gov't supply chain council can only do so much...

255/ Runaway train of rail facts...

While TX seems obvious (due to the size) for most rail miles, IL is a surprise

For reference, TX is almost 5x larger than IL, CA is almost 3x larger than IL

While TX seems obvious (due to the size) for most rail miles, IL is a surprise

For reference, TX is almost 5x larger than IL, CA is almost 3x larger than IL

258/ Conversations with several large forwarders corroborates this 👇🏽

https://twitter.com/FreightAlley/status/1570753019998007296?t=T3JhQpo5KclLEop7m9nMiA&s=19

259/ August import information clean up 👇🏽

https://twitter.com/LogTechEric/status/1571230464408420354?t=lj47gzpv5TdtwTgrwBsf5g&s=19

260/ Regionalization has a strong baseline to grow from, consider that in 2021 alone, FDI in Mexico equated to $31.3B (fairly consistent with prior years)

Understand this opportunity in @ClayKatzman's recent exploration

dynamo.vc/blog-posts/a-d…

Understand this opportunity in @ClayKatzman's recent exploration

dynamo.vc/blog-posts/a-d…

261/ Exploring the tradeoffs between logistics spend and investing in nearshoring capabilities...

dynamo.vc/blog-posts/a-d…

dynamo.vc/blog-posts/a-d…

263/ "Amazon Air freighters avg ~194 flights/day during a week earlier this month, +3.8% from Mar, according to researchers with DePaul. That’s the smallest increase in the institute’s periodic snapshots, compiled once every 6 months since May '20."

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

265/ Is a butter shortage looming?

🥛Milk production -1% YTD vs 1-2% growth

🍨Butter churns are last to receive milk after bottlers, ice cream/yogurt/cheese makers

👨🏭Butter production down 5-10% due to labor shortage

🧈Butter cache is -21% YTD

wsj.com/articles/the-t…

🥛Milk production -1% YTD vs 1-2% growth

🍨Butter churns are last to receive milk after bottlers, ice cream/yogurt/cheese makers

👨🏭Butter production down 5-10% due to labor shortage

🧈Butter cache is -21% YTD

wsj.com/articles/the-t…

267/ Exports of Mexican-made trucks totaled 17,811 in August, with exports to the United States growing 72% YoY to 16,982 units, the highest monthly levels ever recorded

freightwaves.com/news/mexico-tr…

freightwaves.com/news/mexico-tr…

269/ China's status at the world's manufacturing floor is being tested but it's hard to ignore their commitment to automation to stay competitive

In '21, China got 243k robots (+45% YoY) or nearly half of all units sold. Electronics & auto led the push

m.slashdot.org/story/405125

In '21, China got 243k robots (+45% YoY) or nearly half of all units sold. Electronics & auto led the push

m.slashdot.org/story/405125

270/ Relief efforts in the aftermath of a hurricane oftentimes drive regional and even national strength in freight demand as supplies are rushed to the affected areas

Thoughts and prayers with those in the storm's way

Thoughts and prayers with those in the storm's way

271/ Trucks weigh-in at a station to make sure they aren't overweight relative to the roads they traverse. Also, most states tax based on tonnage - gotta get their 🧀

275/ In 2021, Australia exported about 50% of the worlds total lithium supply of ~500k tons

Lithium demand is expected to 3x as a key input for batteries as EV supply chains are furthered matured

Lithium demand is expected to 3x as a key input for batteries as EV supply chains are furthered matured

276/ Walmart is pulling all the stops to ensure customers have the goods they desire. Surprise-me-not, all the plans revolve around supply chain! Note the dwindling reliability of their container logistics via @2PMinc @web

2pml.com/2022/10/03/wal…

2pml.com/2022/10/03/wal…

277/ @WeAreSchneider scaling intermodal capabilities that provide cost savings as well as meaningful carbon reduction

PS- thanks for sponsoring @ThisIsDynamo Founders Camp 🙏🏽

schneider.com/company/corpor…

PS- thanks for sponsoring @ThisIsDynamo Founders Camp 🙏🏽

schneider.com/company/corpor…

278/ @Tesla announced their 1st Semi truck will be delivered in Dec to @pepsi

It will have a range of 300-500 mi based on model and accelerate 0-60 mph in 20 secs assuming 82k lb fully loaded truck

It will have a range of 300-500 mi based on model and accelerate 0-60 mph in 20 secs assuming 82k lb fully loaded truck

279/ Your guide to electric semis...

https://twitter.com/TimothyDooner/status/1578498625813913601?s=20&t=4GJl7f3e_H-wEEmFULl6hQ

281/ "German business expectations in September — no doubt weighed by the European energy crisis, on top of stresses shared around the world — sat almost 5 standard deviations below their comparable historic average."

bloomberg.com/graphics/globa…

bloomberg.com/graphics/globa…

282/ “It takes an 8% increase in fixed facility costs to equal the impact of just a 1% increase in transportation costs.” -@CBRE

More on nearshoring here 👇

dynamo.vc/blog-posts/a-d…

More on nearshoring here 👇

dynamo.vc/blog-posts/a-d…

283/ “Across all manufacturers, insufficient supply of labor and raw materials have been effectively unchanged since the third quarter of 2021 in terms of severity.” -Jason Miller, @michiganstateu

285/ "The backlog in barge movements, reductions in volume requirements, and inability to find alternative transportation options have pushed barge costs for shippers to new heights."

fb.org/market-intel/l…

fb.org/market-intel/l…

287/ TikTok is parlaying it's social media leadership into an eComm model that is already working in SE Asia. With that comes large supply chain ambitions...

axios.com/2022/10/11/tik…

axios.com/2022/10/11/tik…

288/ US river levels are so low that barges are grounded and unable to move freight. The last time this happened was in 1988. Rates are up nearly 2x in the last month and 4x in the last yr with few alternatives as US railroads grapple with labor challenges

Via @WSJLogistics

Via @WSJLogistics

289/ Texas has the most trucking accidents in the US

That's 137% more than the #2 state for truck accidents, California and >31x more than the safest state, South Dakota

That's 137% more than the #2 state for truck accidents, California and >31x more than the safest state, South Dakota

290/ As of midyear, BLS data suggested that the domestic supply chain had a shortage of 5.5M workers!

291/ A DHL electric delivery truck in NYC had a total daily mileage of 15.7 to 18.8 miles after monitoring a driver for 18 consecutive days

Electric for last mile

Via @MorningBrew

Electric for last mile

Via @MorningBrew

292/ Nearshoring supply chain will require meaningful investment in automation. As we've said before, China is aggressively automating the world's factory floor

294/ "According to the US Department of Transportation, over 98% of truck drivers have reported difficulty finding safe parking, up from 75% four years ago."

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

297/ If done properly, a warehouse needs to be cleaned and repainted every 5-6 yrs

A poorly painted warehouse might need attention every couple years

A poorly painted warehouse might need attention every couple years

299/ It appears that the consensus is that we're heading into a slower than normal holiday season

wsj.com/articles/truck…

wsj.com/articles/truck…

300/ Reynosa is a border city in Mexico that is home to 150 factories located in a tax-friendly trade zone in proximity to a major international border crossing with the US

303/ Fuel accounts for ~20% of trucking opex

Trucks use diesel that's up 33% in cost

That can swing many smaller fleet into loss making territory

Trucks use diesel that's up 33% in cost

That can swing many smaller fleet into loss making territory

304/ .@Maersk expects global container demand to be down 2-4% this year (prior range was a 1% decline/growth)

305/ US companies will restore 350k jobs in 2022 (+25% Y/Y)

It could reduce the share of freight originating from Asia by 40% by 2030

Via @Deloitte

It could reduce the share of freight originating from Asia by 40% by 2030

Via @Deloitte

309/ US warehousing sector job count -50k since June

“Cos had to scale up as best as they could by hiring workers to help with that increase in demand and such, and now that things are beginning to ease off, normalize, there’s not the need for as many workers.” -@cmroberson06

“Cos had to scale up as best as they could by hiring workers to help with that increase in demand and such, and now that things are beginning to ease off, normalize, there’s not the need for as many workers.” -@cmroberson06

311/ Global container shipping is soft as a bunny

China exports to US -13%, to EU -9%

Global box volumes -9.5% MoM in September

Asia to the US West Coast container prices -87% YoY according to Freightos

China exports to US -13%, to EU -9%

Global box volumes -9.5% MoM in September

Asia to the US West Coast container prices -87% YoY according to Freightos

315/ 60% of 200 freight forwarders, traders & shippers surveyed by Container xChange in October said they're grappling with geopolitical, economic & political risks which have imposed downward pressures on consumption & therefore demand for containers

via @CNBC

via @CNBC

317/ >27% of containers passed thru ports where China or Hong Kong-based firms were meaningful owners according to 2021 data from @DrewryShipping via @WSJ

319/ Avg warehouse vacancy rate across the US is "up" to 3.2% in Q3 from 3% in Q2 according @CushWake

1st increase in 2 yrs and below the 5% avg national vacancy rate during 2020

Some slack in the system may not be a bad thing eh? Shippers would welcome jt

1st increase in 2 yrs and below the 5% avg national vacancy rate during 2020

Some slack in the system may not be a bad thing eh? Shippers would welcome jt

320/

Annual growth in freighter capacity +6% during the last three years, double the rate before the COVID, the fastest in two decades

Demand -2.4% YoY, flat to 2019 levels

freightwaves.com/news/freighter…

Annual growth in freighter capacity +6% during the last three years, double the rate before the COVID, the fastest in two decades

Demand -2.4% YoY, flat to 2019 levels

freightwaves.com/news/freighter…

321/

"Peter Kraemer, chief supply officer at Budweiser’s parent company, said their team is expecting more beer to be drunk in Qatar during the four weeks of the World Cup than in an entire year."

Via @MorningBrew

#WorldCup2022

"Peter Kraemer, chief supply officer at Budweiser’s parent company, said their team is expecting more beer to be drunk in Qatar during the four weeks of the World Cup than in an entire year."

Via @MorningBrew

#WorldCup2022

323/ But there won't be a recovery in trucking volumes for some time...

https://twitter.com/FreightAlley/status/1593800417070223361?t=h9_I5uVAkDjU0KTYqjOTSg&s=19

324/ The US economy would lose $2B/day if railroad workers strike per @AAR_FreightRail

For context, US GDP averages $63B per day

Via @WSJ

For context, US GDP averages $63B per day

Via @WSJ

325/

"Ports on the US West Coast could permanently lose as much as 10% of the seaborne cargo that has been diverted to the Atlantic coast amid logistics bottlenecks, regulatory headwinds and labor uncertainty."

bloomberg.com/news/newslette…

"Ports on the US West Coast could permanently lose as much as 10% of the seaborne cargo that has been diverted to the Atlantic coast amid logistics bottlenecks, regulatory headwinds and labor uncertainty."

bloomberg.com/news/newslette…

328/ Frozen turkeys are less sensitive to demand dynamics as they can be consumed anytime between Thanksgiving thru Easter

Fresh turkeys have a 3 week shelf life so are more sensitive to consumption dynamics

🦃 #Thanksgiving

Fresh turkeys have a 3 week shelf life so are more sensitive to consumption dynamics

🦃 #Thanksgiving

329/ As a former Apple watcher, their supply chain in China yields gross margins unparalleled in hardware. Turns out that might be the end of an era with $1B/day in lost sales due to Chinese unrest over prolonged COVID shutdowns

https://twitter.com/kakashiii111/status/1596774390028718080?t=APebDLG5GtgqH823FCyWUg&s=19

330/ LTL rules tariffs define the things a carrier is responsible for when transporting freight

It lists charges based on shipment characteristics, core & ancillary services, liability, payments, etc

Via @FreightWaves

It lists charges based on shipment characteristics, core & ancillary services, liability, payments, etc

Via @FreightWaves

332/ 30% of freight tonnage is moved by rail in the US

336/ A thread on the outlook for container shipping in a thread about supply chain 🌀

https://twitter.com/PeterTirschwell/status/1599367943757828097?t=pfAmF7_-X7esLym96iRyXg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh