The media are full of predictions for 2022. Some seem quite simple to make: the pandemic gets into an endemic; US-China tensions will rise; Macron will be reelected; countries (especially the US) will fail to implement their insufficient but promised greening measures;.. 1\10

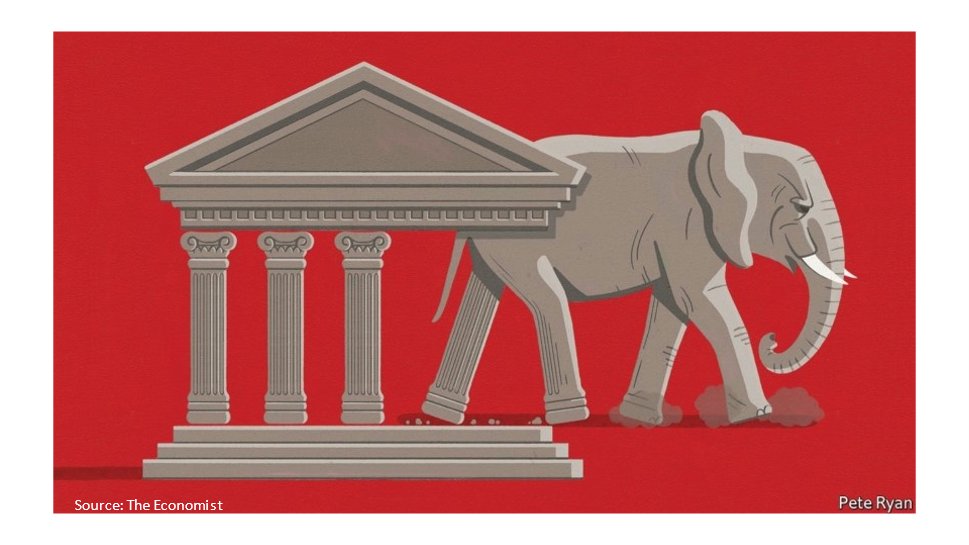

Republicans, helped by rigged electoral laws & gerrymandering, will win Congress in November, and the American system's crisis will worsen. More dysfunctional Government and increased number of American writings on risks to democracy and even civil war down the road !! 2\

Others are not so easy: Will Putin get something in Ukraine and stop squeezing natural gas supply to Europe even if Nordstream2 is not authorized?. In Italy, will Draghi leave the Government, possibly to the Presidency, there will be elections, and Salvini will become PM? 3\

On the economy, growth will be slightly shaved due to the pandemic, the more restrictive fiscal and monetary policies everywhere, the higher geopolitical tensions, the consumption deceleration as the US saving rate is already at pre-pandemic levels and may go up now. 4\

Inflation in the US will be above 3% in 2022 but lower in the Euro Area, where the yearend level will be below 2%. The FED will increase rates ( not 3 times), but the ECB will hold them as the European situation is very different from the US on several counts: ..5\

a) In the US, inflation has been higher and broader. In Nov, 6,8% with Food at 6.1% (Meat, poultry & eggs 12.8%!) and energy 33%. In the EA, respectively, 4.9%, 2.2% and 27.4%. Since 2019 the US average annual inflation 3.2 % in the US and 1.3% for the EA (IMF) …6\

b) Inflation expectations from financial markets, for both 5Y & 10Y, are better anchored in the EA than in the US. c) the US GDP is already at the trend growth before the pandemic, whereas the EA is still quite away from that. Omicron is having worse effects in Europe.7\

d) Wages have been increasing more in the US than in Europe because of the still unexplained so-called Big Resignation− the fact that the number of persons employed is still over 4 million below the number for early 2020, and the participation rate has decreased. 8\

Turning to financial markets, the main point is the expected increase of bond yields from still low levels compared with 2018/9 and especially disconnected from the spike in inflation and the market noise around it. The FED policy rates moves will aggravate that development 9\

The increase in rates and market yields will negatively affect stock prices, particularly in the US, where a correction may happen. The problem for Europe is that despite the lower inflation and ECB not moving rates, there will be, as ever, a strong contagion from the US 10\10

• • •

Missing some Tweet in this thread? You can try to

force a refresh