People forget just how completely non-obvious the entire digital revolution was every step of the way.

1995: WWW will fail

2002: Google will fail

2007: iPhone will fail

2013: Facebook will fail

1995: WWW will fail

2002: Google will fail

2007: iPhone will fail

2013: Facebook will fail

Virtually every sentence was wrong in this one. It's like the opposite of the Sovereign Individual.

"Yet Nicholas Negroponte, director of the MIT Media Lab, predicts that we'll soon buy books & newspapers straight over the Intenet. Uh, sure."

newsweek.com/clifford-stoll…

"Yet Nicholas Negroponte, director of the MIT Media Lab, predicts that we'll soon buy books & newspapers straight over the Intenet. Uh, sure."

newsweek.com/clifford-stoll…

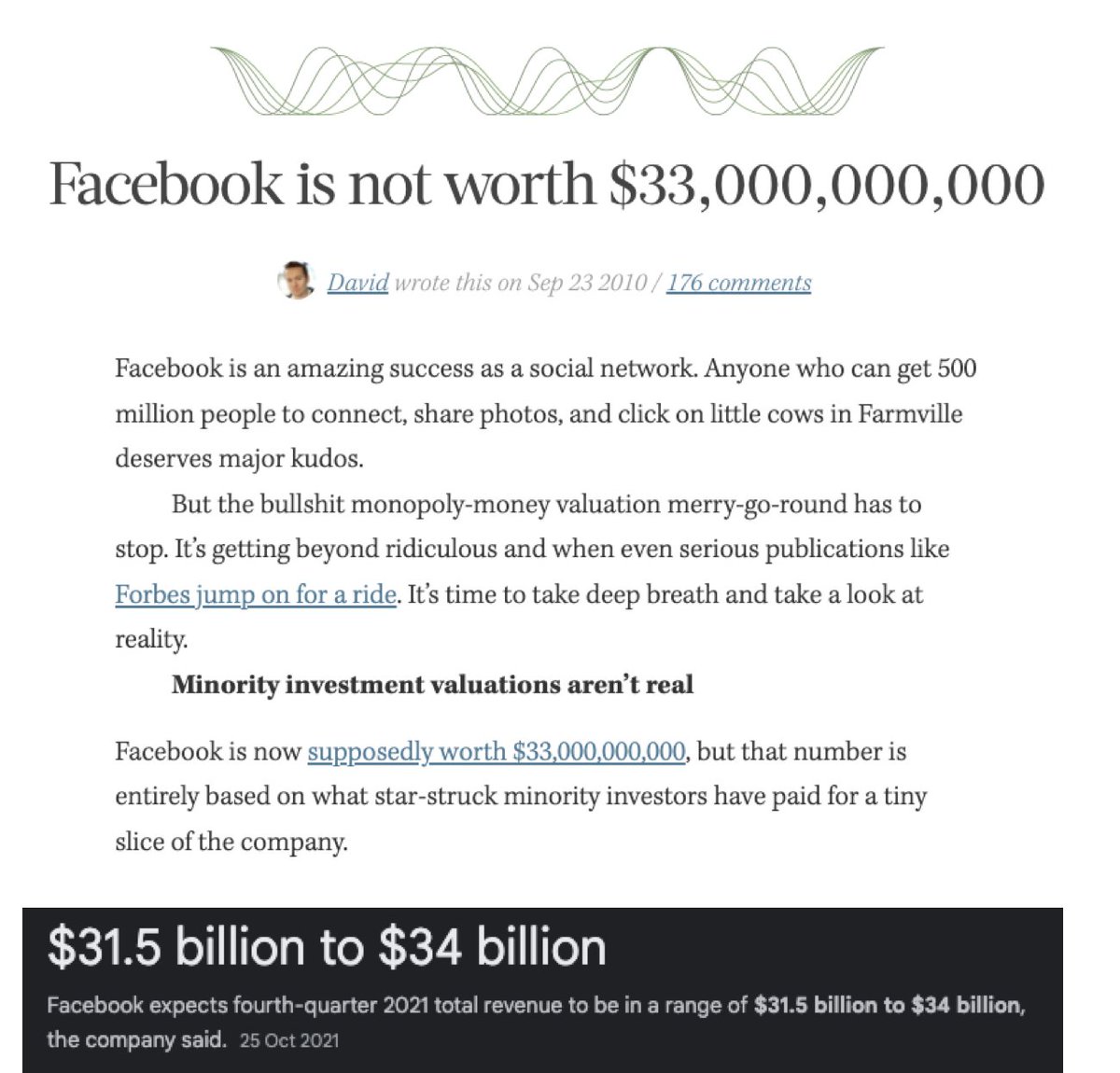

For example, they were calling Facebook a fad all the way till 2013. Then they flipped to calling it a threat to democracy.

To calibrate, in 2010, it was supposedly a joke that Facebook (already with 500M+ users) was worth $33B. It just made ~$33B in revenue in one quarter.

To calibrate, in 2010, it was supposedly a joke that Facebook (already with 500M+ users) was worth $33B. It just made ~$33B in revenue in one quarter.

People want to rewrite history to say that old inventions were "obviously useful" right away. That is rarely the case. Go look at contemporary sources. Most useful things were born kicking and screaming.

The @pessimistsarc twitter account is excellent on this.

The @pessimistsarc twitter account is excellent on this.

There was an early interview with Steve Jobs on the personal computer that I can't find now. He was trying to persuade people that these devices that physicists used for doing calculations would be useful at home.

One of his go-to examples was *recipes*. Limited utility then...

One of his go-to examples was *recipes*. Limited utility then...

Even more recent history is forgotten. Tech wasn't culturally central in 2008! It was only after the iPhone and the financial crisis that the true rise of the internet happened.

McCullough's book is good on the lead up to this. amazon.com/How-Internet-H…

McCullough's book is good on the lead up to this. amazon.com/How-Internet-H…

People who were wrong rarely end up admitting they were wrong.

But people who were right, and who took financial risk on their belief, end up making 1000X as much.

In theory, one could put that 1000X to work documenting just how wrong the technological conservatives were...

But people who were right, and who took financial risk on their belief, end up making 1000X as much.

In theory, one could put that 1000X to work documenting just how wrong the technological conservatives were...

• • •

Missing some Tweet in this thread? You can try to

force a refresh