The Reliance $4 billion bond issue, at 2.8% to 3.75% is a solid achievement - it will reduce their interest cost (will be used to reduce current borrowing) and they're naturally hedged with their exports.

Disclosure: we are interested.

Disclosure: we are interested.

Okay since SO MANY PEOPLE seem to have problems with Reliance borrowing money at these obscenely low rates, a thread on why.

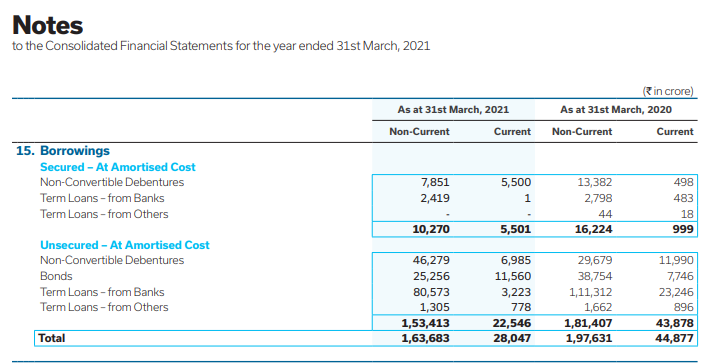

Reliance has 80,000 cr. of term loans from banks.

Reliance has 80,000 cr. of term loans from banks.

Banks cannot lend at less than "MCLR" - a rate below which NO loan can be given. Bank MCLRs are currently 7%+ for indian banks.(see image) Reliance says it borrows between 0.31% and 8.34% (annual report)

If Reliance pays back some term loans it has at high rates, and gets long term loans at 2.9% to 3.8% fixed USD, that's pretty good for the interest rate profile.

Another thing to note is: Fixed rates, 10/30/40 year profile. Unless long term rates come down heavily in India for corporates, the term is useful

• • •

Missing some Tweet in this thread? You can try to

force a refresh