another potentially weird jobs report from the looks of it

*U.S. DEC. PAYROLLS INCREASE 199,000; EST. 450,000

but

*U.S. DEC. UNEMPLOYMENT RATE FALLS TO 3.9% VS 4.2%

*U.S. DEC. PAYROLLS INCREASE 199,000; EST. 450,000

but

*U.S. DEC. UNEMPLOYMENT RATE FALLS TO 3.9% VS 4.2%

Also worth noting that average hourly earnings had a SOLID beat.

+0.6% m/m, compared with estimates for +0.4%

+4.7% y/y, compared with estimates for +4.2%

ECI, which Powell singled out as a crucial data point, is coming at the end of the month.

+0.6% m/m, compared with estimates for +0.4%

+4.7% y/y, compared with estimates for +4.2%

ECI, which Powell singled out as a crucial data point, is coming at the end of the month.

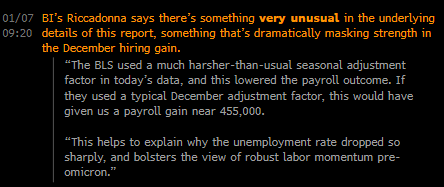

just to close the loop on the weirdness of this report (h/t @Riccanomix)

• • •

Missing some Tweet in this thread? You can try to

force a refresh