1/ Had a great catch up with @bigsuey and @shanedowney8 at @Hut8Mining this week. Check out some of the key points discussed during the call, in the thread below:

2/ On the topic of performance over the last 12 months, $HUT has had an extraordinary year led by CEO, @JaimeLeverton. Although they were unable to gain the early advantage achieved by $RIOT and $MARA’s, they were approved, in June, to list on the NASDAQ Global Select Market.

3/ This top tier of the NASDAQ, has now enabled $HUT to gain attention and attract investment from many of the N American Fund Managers, ensuring that the stock is one of the most daily traded mining stocks.

4/ They have recently achieved success in access to the S&P TSX Composite, and as the first miner or even Blockchain company to gain access to this indices, a large majority of pension funds build their mandate around.

5/ The next target for the Board could be the Russell 2000 and achieve the further exposure already obtained by $MARA and $RIOT, this year. This would again provide even more opportunity for large funds to hold this Stock in their portfolios.

6/ Of the current listed miners in N America, $HUT 8 achieved the second highest annual reported revenues, behind @HiveBlockchain over the 12 months as at Sep 30, 2021. $HUT currently also owns more self mined #Bitcoin than any other publicly traded company with 5518 #Bitcoin.

7/ Of the #Bitcoin hodl, currently 2000 #Bitcoin is providing staking revenues of around 2% with $GLXY and Genesis Global Capital. $HUT can even recover their staking investment within an extremely short time scale, should they need to use it for other opportunities.

8/ From an Operation Performance, and since the appointment of @JaimeLeverton, in December 2020, her focus during Q1-Q3 last year, has been to understand the rebuilding and reframing this business, with the first priority to get the cost of power down.

9/ In Q4 2021, Q1 and Q2, this year, the focus has switched with $HUT now going on an energy efficient supercycle. This can be seen with their recent energy contracts now achieving CAN 2.7c kWh, effectively half the price $MARA announced in its agreement with @Core_Scientific.

10/ In terms of efficiency this last 12 months $HUT, carrying a considerable amount of legacy equipment, has not produced the same levels of #Bitcoin by EH deployed in comparison to $BITF, $HIVE or $IREN. Contracted Hash Rate, though, is currently 4.5EH rising to 6.0EH by end Q2.

11/ $HUT has sites in Alberta, CA, supported by 109 MW of power, and has recently signed an agreement with Validus, for the building of a third site, in North Bay, Ontario. The lease agreement commenced this month, for a term of 5 years at a monthly rent of $250k.

12/ All ties with their founding partner, Bitfury, have now ended, and the final nominees to the Board, having left this month, as planned, with all shares held, now sold, thus enabling $HUT to now become more creative, with effectively, a great new team, in this sector.

13/ Diversification has been high on the agenda of @JaimeLeverton with $HUT now an approved Micro BT repair shop. They not only repair their own units but those of their competitors too. Whilst not a significant income stream, it does provide a strategic advantage with Micro BT.

14/ Hosting revenues provide a flexibility to $HUT and although in recent months, have reduced, it did provide the opportunity for the purchase of hosted rigs from Foundry/DSG. Although not as profitable, regular revenue streams can be achieved, when excess power is available.

15/ $HUT are also like other miners looking to potentially diversify into DeFi are closely watching the opportunities in this space.

Although #Ethereum mining could literally go to POS now, there’s a fairly strong belief in the community, that this won’t happen during 2022.

Although #Ethereum mining could literally go to POS now, there’s a fairly strong belief in the community, that this won’t happen during 2022.

16/ If I need to take anything from the call with @Hut8Mining, currently, is that they are a company not wishing to constantly put out ‘PR Headlines’ of mass purchasing of new miners, but a company that is extremely agile in this space and wants to be viewed on its achievements.

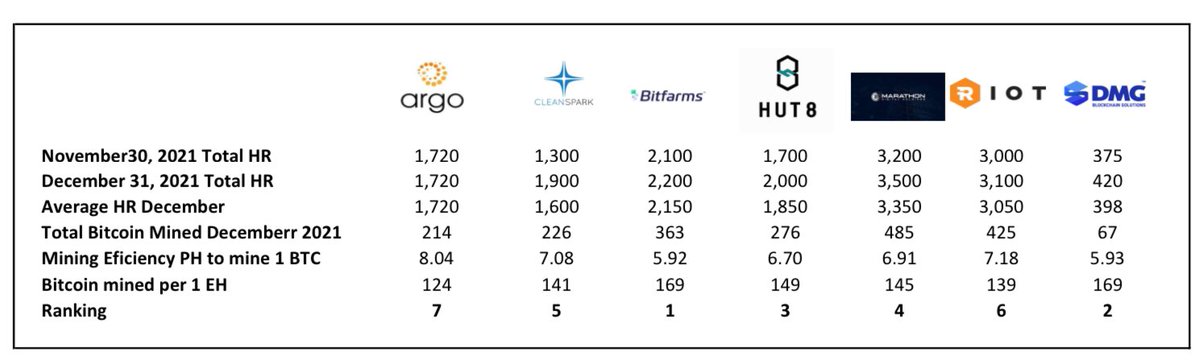

17/ $HUT December #Bitcoin mining performance was an improvement on recent months. This was probably helped by the commencement of their #Ethereum mining, which has a gross margin in excess of 90%. As more miner orders are added over the next 6 months, efficiency will improve.

18/ Their financial performance over the last reported Qtr, ending September 30, 2021, provided a EBITDA of $53,108, putting them well placed in comparison to their peer miners, @ArgoBlockchain, @Bitfarms_io and @HiveBlockchain

19/ 2021 was a great year for $HUT8 and moving into 2022, it looks to be another exciting year for @JaimeLeverton and the team at @Hut8Mining, in this technology space.

They will be judged on achieving their ambitious Strategic Growth plan and improved monthly performance.

They will be judged on achieving their ambitious Strategic Growth plan and improved monthly performance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh