is $40k the new $30k? The Fed’s hawkish stance on inflation has had broad impact. With the liquidity-driven momentum plays under pressure, it’s not a total shock that crypto has corrected. So what’s next for bitcoin? (THREAD)

Bitcoin has reached a line in the sand at $40k and is now technically oversold. Like $30k, the $40k level seems to be a pivotal support area. /2

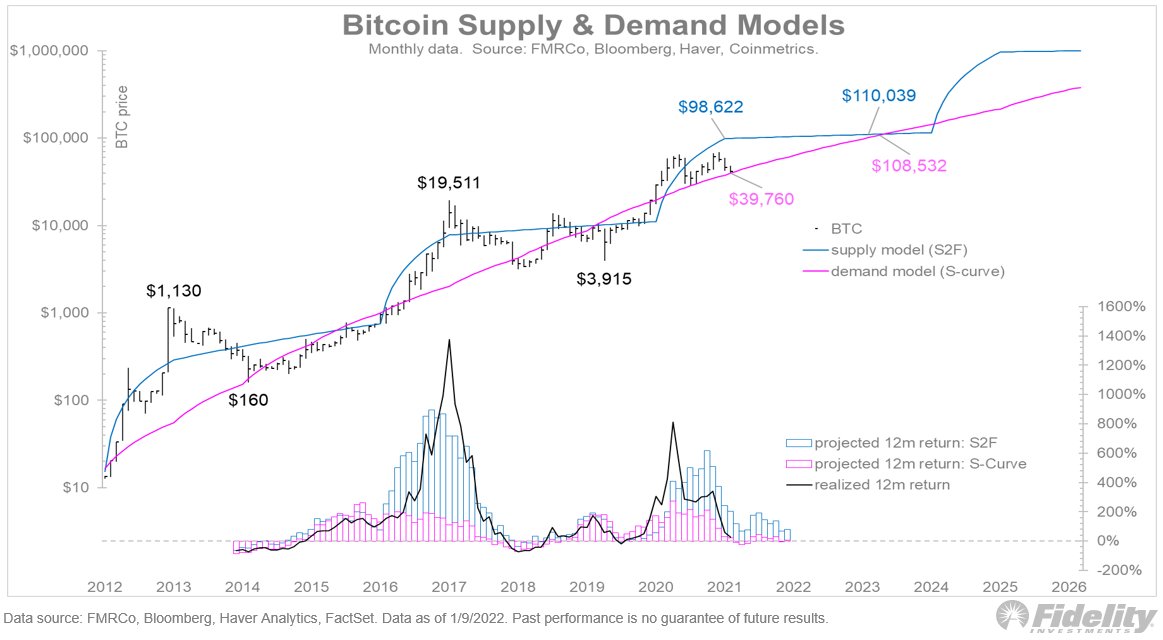

The $30k level in 2021 provided support based on my demand model (S-curve model). That same level looks to have moved up to $40k, providing fundamental support once again. It’s a moving target which generally provides a fundamental anchor for price. /3

I like to compare Bitcoin to that other more traditional store-of-value, gold. Here we see that the btc/gold ratio has fallen back to the breakout zone from last year. Technically the ratio is moderately oversold (bottom panel). /4

All in all, these charts tell me that Bitcoin should have both technical and fundamental support at $40k. It doesn’t mean it can’t go lower, but it looks like $40k is the new $30k. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh