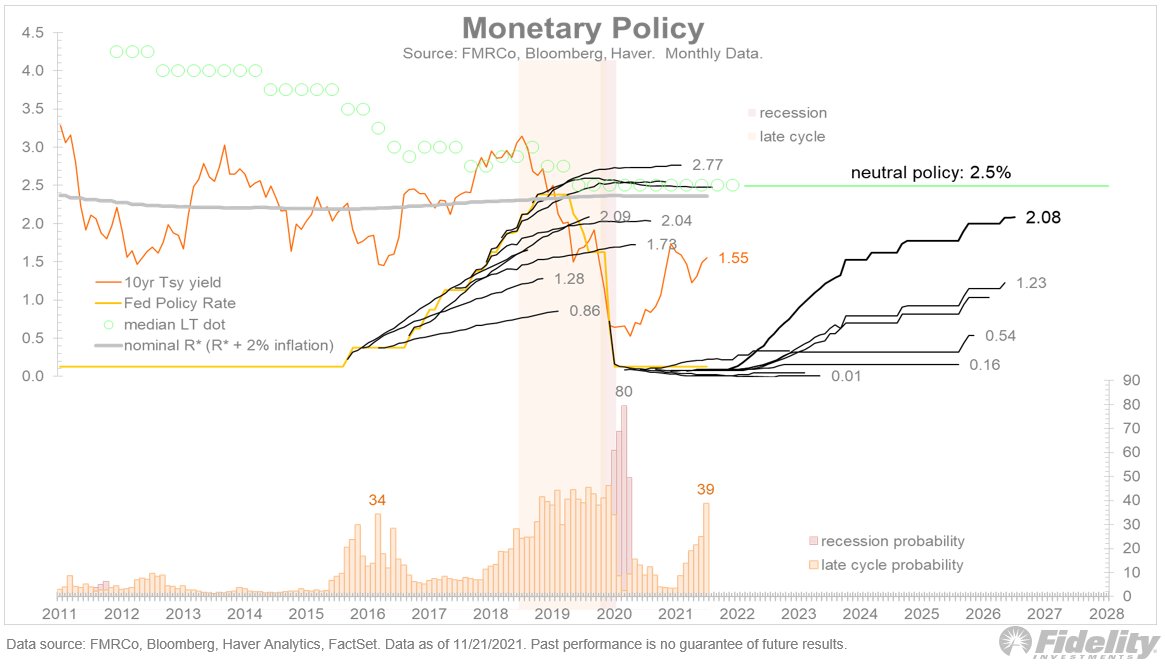

Following up on my previous thread, which pondered what it takes to force the Fed's hand, this chart shows the 2015-18 tightening cycle in detail, and illustrates how much financial conditions have played a role in Fed policy. (THREAD)

The top panel shows the official Goldman Sachs series overlaid on my constituent factors. The bottom panel shows the Fed Funds target rate and a series of forward curves taken at different points in time. /2

During the 2014-16 phase, the spike in financial conditions was driven mostly by credit spreads and the dollar (and eventually stocks). In December 2015 the Fed finally raised the Fed Funds rate for the first time since the Great Financial Crisis. /3

Within two weeks, financial conditions seized up as the dollar and high yield energy spreads soared. The S&P 500 had a drawdown of 15% in February 2016. This was enough to force the Fed’s hand and to put the tightening cycle on hold. /4

Then financial conditions improved dramatically, and this gave the Fed the conditions needed to resume its policy normalization a year later (December 2016). It was the great cycle-extender. /5

The Fed eventually took rates back up to neutral and even shrank its balance sheet in 2018. But by then financial conditions were tightening again, and the Fed pushed policy rates to above neutral. That was a bridge too far for the market. /6

The stock market’s sudden 20% drawdown drove financial conditions to more restrictive levels. Again the Fed pivoted, and by early 2019 it was cutting rates. /7

This history shows that a tightening of financial conditions can force the Fed to pivot, and it was the forward curve that provided the clue. Will it happen again? Possibly. But… /8

Even after last Friday’s rout, the FCI remains at an historically loose extreme. A lot will need to happen to the markets for financial conditions to seize up enough to change the Fed’s course. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh