How to leverage $LunaX with the @mirror_protocol 'Delta Strategy'?

A.K.A. Boost your returns on top of staking in 2 simple steps...

🧵👇

A.K.A. Boost your returns on top of staking in 2 simple steps...

🧵👇

As you may know, the proposal to include $LunaX on

@mirror_protocol has passed.

Soon, you'll be able to use it as collateral on Mirror.

What's the advantage?

Meet the 'Delta Neutral Strategy'.

It allows to make more out of mAssets, regardless if they go up or down:👇

@mirror_protocol has passed.

Soon, you'll be able to use it as collateral on Mirror.

What's the advantage?

Meet the 'Delta Neutral Strategy'.

It allows to make more out of mAssets, regardless if they go up or down:👇

Here’s how the Delta Strategy works:

The basic idea is that you can get in with any mAsset price.

This is achieved by simultaneously taking short and long positions.

By doing it, you can take advantage of the ups and downs of the assets at the same time.

Here's how:

The basic idea is that you can get in with any mAsset price.

This is achieved by simultaneously taking short and long positions.

By doing it, you can take advantage of the ups and downs of the assets at the same time.

Here's how:

First, stake $LUNA and get $LunaX at Stader.

You can do it today in the Liquid Staking section.

With LunaX, you get to enjoy instant liquidity benefits...

Auto-compounded yield...

Less slashing risks...

And airdrop rewards...

Next:

You can do it today in the Liquid Staking section.

With LunaX, you get to enjoy instant liquidity benefits...

Auto-compounded yield...

Less slashing risks...

And airdrop rewards...

Next:

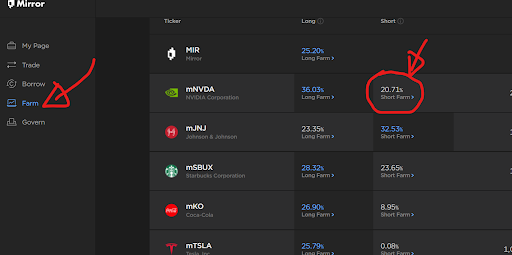

Once $LunaX becomes available on @mirror_protocol...

Go to the farm section and pick your favorite mAsset.

Once chosen, click to short farm it.

Let's choose mNVDA as an example:

Go to the farm section and pick your favorite mAsset.

Once chosen, click to short farm it.

Let's choose mNVDA as an example:

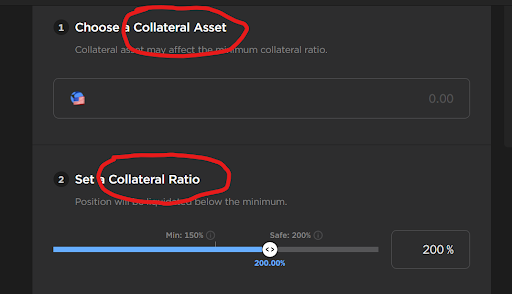

Soon, you'll be able to use $LunaX as collateral to any mAsset.

Meanwhile, Mirror will be shorting it to prevent price variations.

The best part?

Once active, you can pick LunaX from the first dropdown.

Then, set a collateral ratio according to your risk appetite...

Meanwhile, Mirror will be shorting it to prevent price variations.

The best part?

Once active, you can pick LunaX from the first dropdown.

Then, set a collateral ratio according to your risk appetite...

A quick bonus:

Once you've chosen the position...

You'll also start getting $MIR rewards during the time you decide to keep it.

Keep in mind:

Your shorting returns will be locked for two weeks after you choose it.

Here's the most interesting part:

Once you've chosen the position...

You'll also start getting $MIR rewards during the time you decide to keep it.

Keep in mind:

Your shorting returns will be locked for two weeks after you choose it.

Here's the most interesting part:

Your mAsset price may go up, but also down, remember?

In order to neutralize this risk, you also need to buy the same mAsset and provide liquidity with it.

This is called 'long farming'.

As you may expect, you´ll receive $MIR rewards for that too.

Here's how to do it:

In order to neutralize this risk, you also need to buy the same mAsset and provide liquidity with it.

This is called 'long farming'.

As you may expect, you´ll receive $MIR rewards for that too.

Here's how to do it:

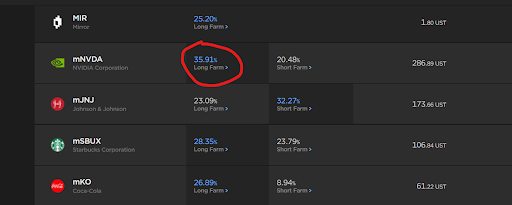

First, buy the same amount of the mAsset you chose in the 'Trade' tab.

Next, head to 'Farm' again and choose the long farm option.

Remember:

We are still talking about the same mAsset.

In this example it's mNVDA:

Next, head to 'Farm' again and choose the long farm option.

Remember:

We are still talking about the same mAsset.

In this example it's mNVDA:

Let's recap:

Once enabled, you will be able to use the $LunaX + Delta Strategy.

This means auto-compounded staking rewards and Airdrops.

Use $LunaX as collateral on @mirror_protocol to boost your returns.

Get $MIR and $SD.

And benefit from both ups and downs of mAssets!

Once enabled, you will be able to use the $LunaX + Delta Strategy.

This means auto-compounded staking rewards and Airdrops.

Use $LunaX as collateral on @mirror_protocol to boost your returns.

Get $MIR and $SD.

And benefit from both ups and downs of mAssets!

All of this will be possible very soon.

Our teams are working hard to make this integration happen...

And enhance @terra_money possibilities even further.

While you wait for it, remember:

Our teams are working hard to make this integration happen...

And enhance @terra_money possibilities even further.

While you wait for it, remember:

1% of $SD tokens are up for farming in the Luna <> LunaX LP.

Catch them before they're gone:

terra.staderlabs.com/pools

Catch them before they're gone:

terra.staderlabs.com/pools

• • •

Missing some Tweet in this thread? You can try to

force a refresh