1) Short thread on Threshold Income errors I've seen & raised at last night's webinar for @CwmTafMorgannwg

Some have incorrectly added salary sacrifice arrangements to their taxable income to assess Annual Allowance Taper causing a potential overpayment of £,000s in tax

Some have incorrectly added salary sacrifice arrangements to their taxable income to assess Annual Allowance Taper causing a potential overpayment of £,000s in tax

2) Annual Allowance Taper applies only if:

Threshold Income is more than £200k (previously £110k - 2016/17 to 2019/20), AND

Adjusted Income is more than £240k (previously £150k)

Threshold Income is more than £200k (previously £110k - 2016/17 to 2019/20), AND

Adjusted Income is more than £240k (previously £150k)

3) Annual Allowance Taper can reduce your annual allowance down to £4,000 (previously £10k)

The Annual Allowance Taper rules are set out in the Pension Tax Manual PTM057100, which can be found here:

gov.uk/hmrc-internal-…

The Annual Allowance Taper rules are set out in the Pension Tax Manual PTM057100, which can be found here:

gov.uk/hmrc-internal-…

4) The rules governing Threshold Income do reference adding 'relevant salary sacrifice arrangements', however this does NOT include salary sacrifice for typical NHS salary sacrifice arrangements such as:

NHS Car Lease, Childcare Vouchers, Cycle to Work Scheme

NHS Car Lease, Childcare Vouchers, Cycle to Work Scheme

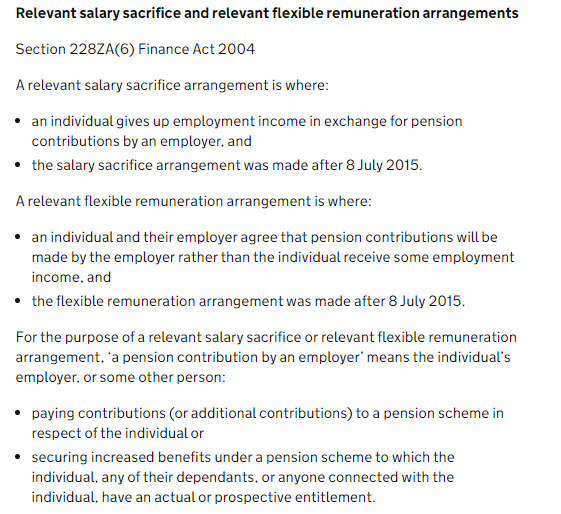

5) 'Relevant salary sacrifice arrangements' only refer to circumstances where an individual gives up employment income in exchange for a pension contribution AND the arrangement was made after 8th July 2015

This does NOT apply to the typical NHS salary sacrifice arrangements

This does NOT apply to the typical NHS salary sacrifice arrangements

6) If you have added NHS salary sacrifice arrangements to your Threshold Income, you could have paid too much annual allowance charge historically, particularly if that was the factor that led to breaching the Threshold Income level

7) There is still time to rectify errors within the last 4 years, you can retrospectively amend your self assessment.

In addition, the recalculation of your Annual Allowance for 2015-2022, as part of the McCloud remedy, could also provide an opportunity to correct mistakes

In addition, the recalculation of your Annual Allowance for 2015-2022, as part of the McCloud remedy, could also provide an opportunity to correct mistakes

• • •

Missing some Tweet in this thread? You can try to

force a refresh