1) Thread on cessation of temporary abatement rules

From 25th March some who gave up their retirement to help the NHS will have their NHS pension reduced if they carry on working🤦♂️

FOI data I've obtained shows there are 7,470 doctors and nurses who could be adversely impacted🤯

From 25th March some who gave up their retirement to help the NHS will have their NHS pension reduced if they carry on working🤦♂️

FOI data I've obtained shows there are 7,470 doctors and nurses who could be adversely impacted🤯

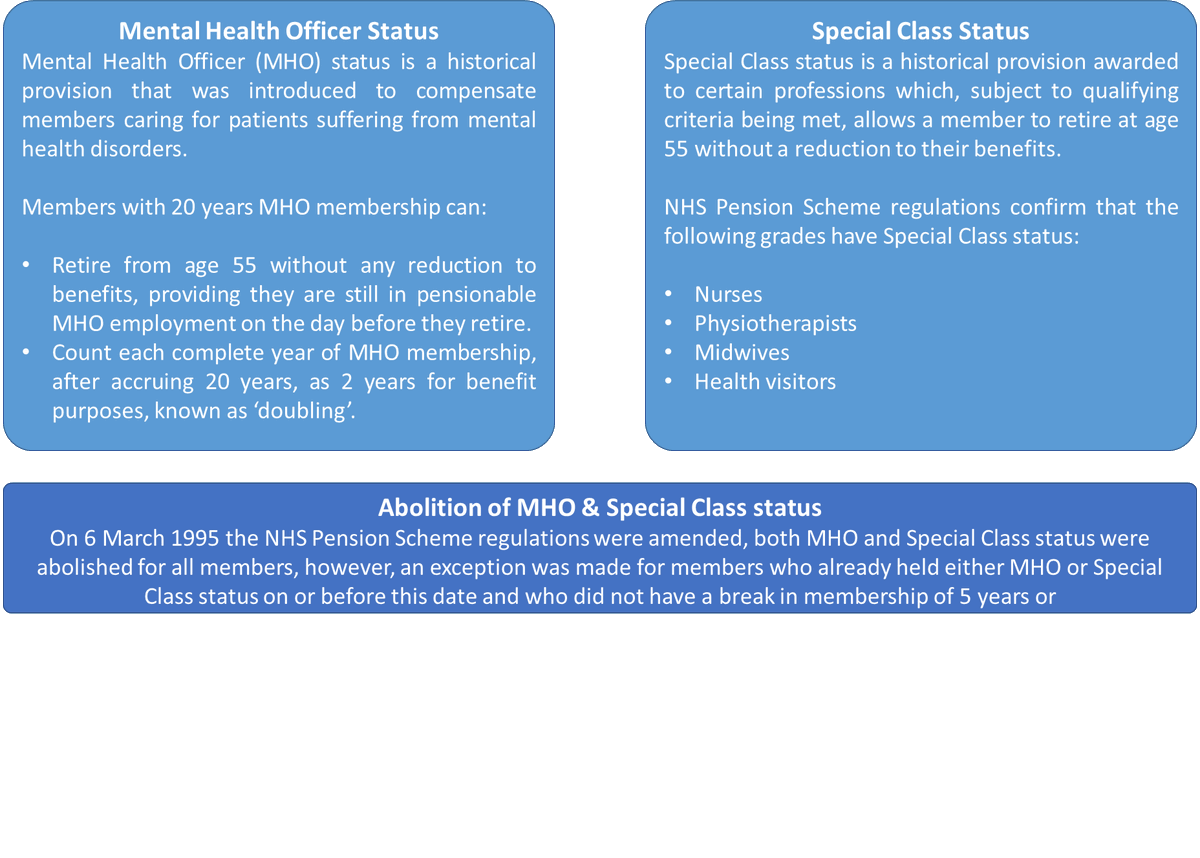

2) Abatement is the process that restricts the pension in payment for certain members who retire & return to work before 60

Abatement was suspended to encourage experienced workers with Special Class or Mental Health Officer status to return to work to help in the pandemic

Abatement was suspended to encourage experienced workers with Special Class or Mental Health Officer status to return to work to help in the pandemic

3) Those impacted will have few options and there are no good choices

This will either reduce the workforce or reduce the worker’s pension in payment which will impact morale

Why put staff, who gave up retirement to help, in this position?

This will either reduce the workforce or reduce the worker’s pension in payment which will impact morale

Why put staff, who gave up retirement to help, in this position?

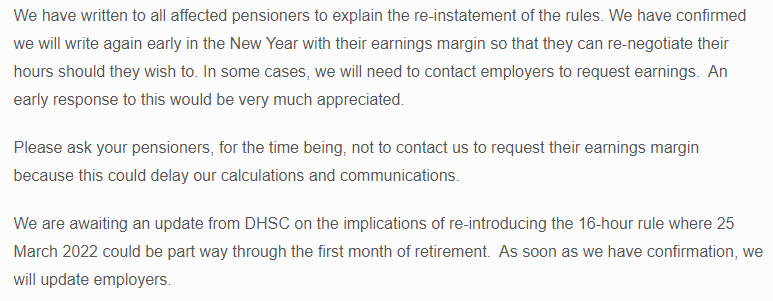

4) Details of the cessation of temporary abatement were announced to members some time ago nhsbsa.nhs.uk/pensioner-hub/…

An update was issued to employers on 10th January nhsbsa.nhs.uk/coronavirus-ac…

There has been plenty of time to rectify this, but nothing has yet been done

An update was issued to employers on 10th January nhsbsa.nhs.uk/coronavirus-ac…

There has been plenty of time to rectify this, but nothing has yet been done

5) It was good to see @GillFurnissMP ask to extend abatement suspension rules questions-statements.parliament.uk/written-questi…

There was, unfortunately, a disappointing response from Ed Argar who said "the Department will keep this under review"

There was, unfortunately, a disappointing response from Ed Argar who said "the Department will keep this under review"

6) The response is not good enough, time is running short, members are already making decisions based on this inaction

I've spoken to some who will be impacted and it's not surprising that they can't see themselves continuing to work after 25th March

I've spoken to some who will be impacted and it's not surprising that they can't see themselves continuing to work after 25th March

https://twitter.com/MMwithMM/status/1479569511871307780?s=20

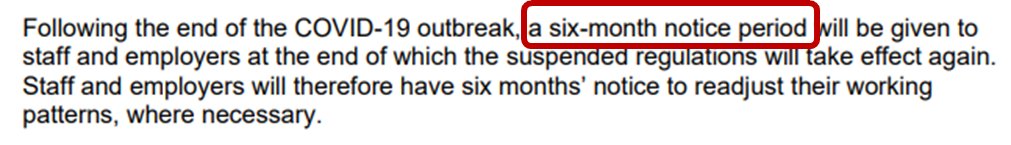

7) There is a really easy fix to this looming problem

Coronavirus Act 2020 includes provisions to allow an extension to any powers contained within the bill - just extend the rules

The original intention was for measures to extend 6 months post-pandemic

nhsbsa.nhs.uk/sites/default/…

Coronavirus Act 2020 includes provisions to allow an extension to any powers contained within the bill - just extend the rules

The original intention was for measures to extend 6 months post-pandemic

nhsbsa.nhs.uk/sites/default/…

8) It would be better to fix this problem now, rather than scratching heads in April as to why thousands left the NHS or cut theirs hours

No point reviewing the policy after they've gone

Big risk that doing nothing could trigger thousands of nurses and doctors to leave the NHS

No point reviewing the policy after they've gone

Big risk that doing nothing could trigger thousands of nurses and doctors to leave the NHS

9) This is the least we could do to help those who gave up their retirement to help us

Extending the suspension of abatement is a very simple & quick win

@mariacaulfield @BMA_Pensions @HCSANews @theRCN @rcpsych @goldstone_tony @ChrisCEOHopson @caspertown42 @RhonddaBryant

Extending the suspension of abatement is a very simple & quick win

@mariacaulfield @BMA_Pensions @HCSANews @theRCN @rcpsych @goldstone_tony @ChrisCEOHopson @caspertown42 @RhonddaBryant

• • •

Missing some Tweet in this thread? You can try to

force a refresh