Founder of Medifintech. #NHSpension specialist with an awesome team of experts (inc. @Jack__Needham) Saved members £millions🤯 Contact: admin@medifintech.co.uk

How to get URL link on X (Twitter) App

2) "Vast majority" are expected to fall within £40k allowance

2) "Vast majority" are expected to fall within £40k allowance

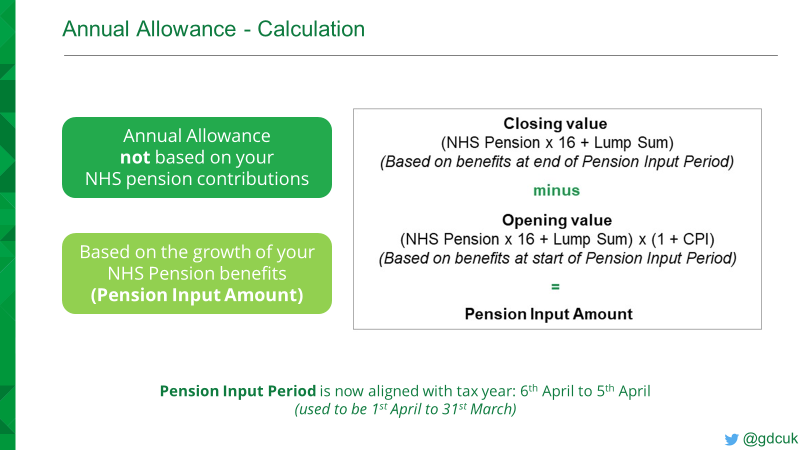

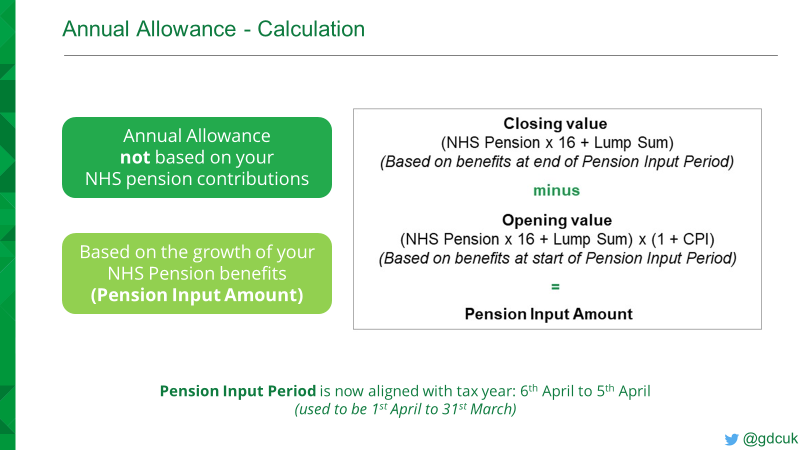

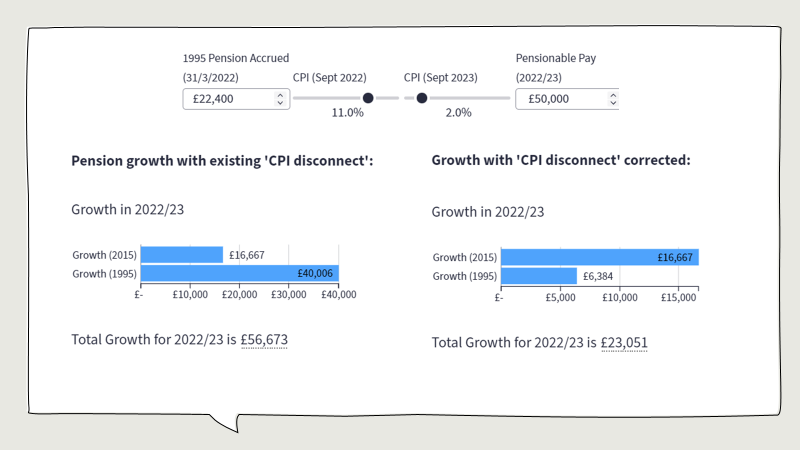

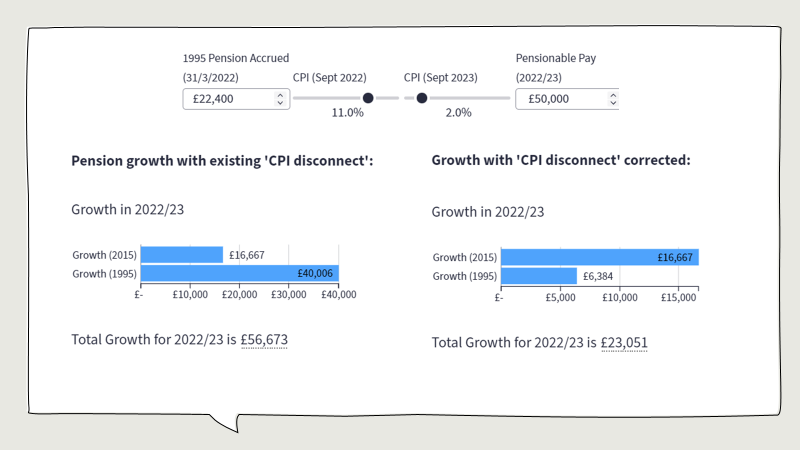

2) Quick reminder that Annual Allowance in #NHSpension is NOT based on contributions

2) Quick reminder that Annual Allowance in #NHSpension is NOT based on contributions

https://twitter.com/gdcuk/status/15166725295025111042) First of all, it felt cool going through the airport style security into Portcullis House lobby, seeing some of the more famous politicians milling around