A global macro update.

Focusing on the daily swings might lead you to miss the forest for the trees, but we are still firmly in the secular Quadrant 1 here.

Vol has increased though, which means we are going to temporarily swing through Quadrant 4 and 3 at times.

1/7

Focusing on the daily swings might lead you to miss the forest for the trees, but we are still firmly in the secular Quadrant 1 here.

Vol has increased though, which means we are going to temporarily swing through Quadrant 4 and 3 at times.

1/7

The pace of growth of credit injection through the real economy has stalled to very low levels since mid-21.

This implies a weaker impulse to real growth and earnings until at least summer 2022...

2/7

This implies a weaker impulse to real growth and earnings until at least summer 2022...

2/7

...and a repricing down of inflation expectations too: basically, a still-okaysh nominal growth but on a clearly decelerating trend.

Lower inflation break-evens while the Fed embarks in a tightening exercise lead to higher front-end real interest rates, but...

3/7

Lower inflation break-evens while the Fed embarks in a tightening exercise lead to higher front-end real interest rates, but...

3/7

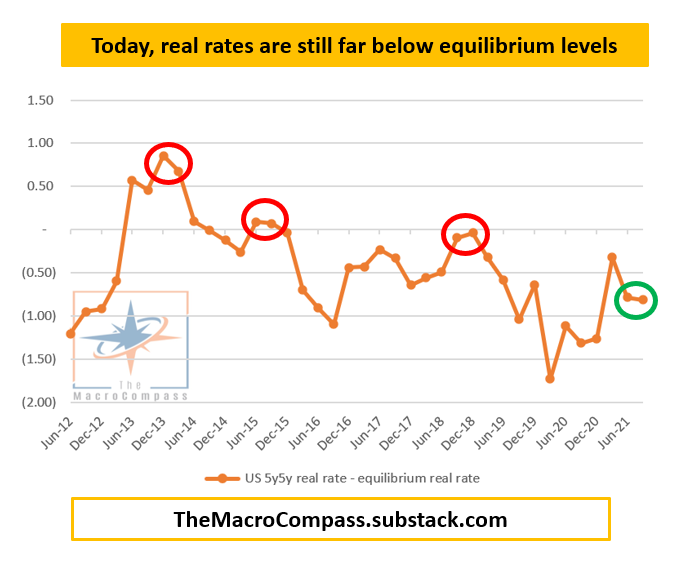

...I still argue policy is net-net at an easy level, making my base case the secular Quadrant 1 and not the scary Quadrant 4: why?

Because

A) 5y forward 5y real yields are still 70 bps below equilibrium levels

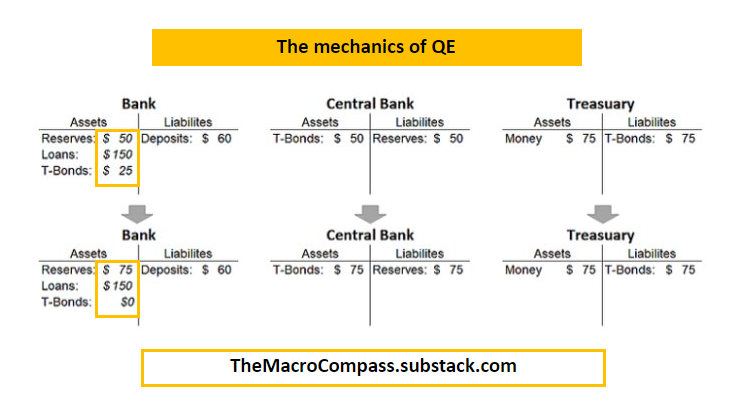

B) The Fed will implement QT in a pretty soft fashion in '22

4/7

Because

A) 5y forward 5y real yields are still 70 bps below equilibrium levels

B) The Fed will implement QT in a pretty soft fashion in '22

4/7

Tomorrow I will post a separate thread on what a ''soft QT'' looks like, but it's important to know the pace of monetary tightening is the key determinant rather than the tightening itself

Temporary episodes of risk-off (Quad4) and optimism (Quad3) will be frequent though

5/7

Temporary episodes of risk-off (Quad4) and optimism (Quad3) will be frequent though

5/7

The best tactical risk-reward trades here remain to buy long-end bonds (outright, or better against short-end bonds) on sell-offs and fade outsized ''the economy is booming and long-end nominal yields to the roof'' proxy trades.

See here

6/7

See here

https://twitter.com/MacroAlf/status/1480626722462740483?s=20

6/7

If you like my macro insights and you're not subscribed yet to my free macro newsletter The Macro Compass, you're missing out on my best macro pieces and investment ideas.

Please consider subscribing! :)

TheMacroCompass.substack.com

Please consider subscribing! :)

TheMacroCompass.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh