A Thread on #FairchemOrganics 🧵

Like & Retweet For better Reach!

Price : ₹ 1880 ⚗️🧪

Topics Covered

1. Company Overview

2. Business Segments

3. What are Oleochemicals ?

4. What are Nutraceuticals?

5. Manufacturing Facilities

6. Raw Materials

7. Value Chain for oleochemicals

Like & Retweet For better Reach!

Price : ₹ 1880 ⚗️🧪

Topics Covered

1. Company Overview

2. Business Segments

3. What are Oleochemicals ?

4. What are Nutraceuticals?

5. Manufacturing Facilities

6. Raw Materials

7. Value Chain for oleochemicals

8. Value chain for Nutraceuticals

9. Natural Vitamin E

10. Margins Hierarchy

11. Revenue Breakup

12. Cyclicality In Vitamin E industry

13. Entry Barriers

14. Financials

9. Natural Vitamin E

10. Margins Hierarchy

11. Revenue Breakup

12. Cyclicality In Vitamin E industry

13. Entry Barriers

14. Financials

1. Company Overview

Fairchem Organics Ltd. is engaged in the business of manufacturing of Oleochemicals and Nutraceuticals for the past 25 years

Fairchem is the one of the only manufacturers of Linoleic Acid and Dimer Acid in India

Fairchem Organics Ltd. is engaged in the business of manufacturing of Oleochemicals and Nutraceuticals for the past 25 years

Fairchem is the one of the only manufacturers of Linoleic Acid and Dimer Acid in India

Manufacturing process uses by-products of vegetable oils to create value added products

The products manufactured are generally 0.5-2% composition of the final product.

2. Business Segments :

The company is involved in manufacturing of Oleochemicals and (natural) Tocopherols

The products manufactured are generally 0.5-2% composition of the final product.

2. Business Segments :

The company is involved in manufacturing of Oleochemicals and (natural) Tocopherols

and Sterols i.e. intermediate for nutraceuticals

Products in Oleochemicals: Dimer Acid, Linoleic Acid, Other Fatty Acids

Products in Nutraceuticals: Natural Tocopherols and Sterols used for making Vitamin E supplements

Products in Oleochemicals: Dimer Acid, Linoleic Acid, Other Fatty Acids

Products in Nutraceuticals: Natural Tocopherols and Sterols used for making Vitamin E supplements

3. What are Oleochemicals?

Oleochemicals are derived from plant and animal fats which acts as a natural substitute over petrochemical products

Applications: Paint and Coatings, Feed Industry, Soap and Personal Care, Cosmetics

Oleochemicals are derived from plant and animal fats which acts as a natural substitute over petrochemical products

Applications: Paint and Coatings, Feed Industry, Soap and Personal Care, Cosmetics

4. What are Nutraceuticals?

The term “nutraceutical” combines the two words of “nutrient,” which is a nourishing food component, and “pharmaceutical,” which is a medical drug.

Nutraceutical products can be considered non-specific biological therapies used to promote general

The term “nutraceutical” combines the two words of “nutrient,” which is a nourishing food component, and “pharmaceutical,” which is a medical drug.

Nutraceutical products can be considered non-specific biological therapies used to promote general

well-being, control symptoms, and prevent malignant processes

Application: Dietary Supplements(vitamins, proteins, herbal), Functional Food and Beverages and Pharmaceuticals.

Application: Dietary Supplements(vitamins, proteins, herbal), Functional Food and Beverages and Pharmaceuticals.

5.Manufacturing Facilities:

The company has a manufacturing plant setup at Sanand, Ahmedabad.

It has 72,000 MT capacity of processing raw materials

6. Raw Materials

Company manufactures high value products through processing waste from vegetable oil refineries.

The company has a manufacturing plant setup at Sanand, Ahmedabad.

It has 72,000 MT capacity of processing raw materials

6. Raw Materials

Company manufactures high value products through processing waste from vegetable oil refineries.

Acid Oils and Deodorizer distillate are two raw materials procured by company

The Quality of raw material is uneven as it is procured from different geographies, the company has expertise in using uneven quality of raw material to develop quality consistent products

The Quality of raw material is uneven as it is procured from different geographies, the company has expertise in using uneven quality of raw material to develop quality consistent products

7.Value Chain for oleochemicals

Dimer Acid: Prepared from unsaturated fatty acids obtained from vegetable oil. It offers improved bonding and used as curing agents for anti corrosive coatings and acts as a primer for metals

Dimer Acid: Prepared from unsaturated fatty acids obtained from vegetable oil. It offers improved bonding and used as curing agents for anti corrosive coatings and acts as a primer for metals

Linoleic Acid: It is designed especially to produce fast drying protective coating having lighter colour

Other Fatty Acids: Distilled fatty acids, Palmitic acid, monobasic acid are some products having application in soaps, paints and textile industry

Other Fatty Acids: Distilled fatty acids, Palmitic acid, monobasic acid are some products having application in soaps, paints and textile industry

8.Value chain for Nutraceuticals :

Tocopherols:

Tocopherols are used as oleochemical intermediates for manufacturing natural vitamin E

Only method of manufacturing Natural Vitamin E is through vacuum distillation of the raw material which is a by-product of vegetable oil refining

Tocopherols:

Tocopherols are used as oleochemical intermediates for manufacturing natural vitamin E

Only method of manufacturing Natural Vitamin E is through vacuum distillation of the raw material which is a by-product of vegetable oil refining

Tocopherols are either mixed or concentrated

Sterols:

Sterols are derived while distillation of Deodorizer distillate

Sterols are used in manufacturing of Cortico steroids and food additives

Cortico steroids finds applications in asthma treatment, allergies and other pharma app

Sterols:

Sterols are derived while distillation of Deodorizer distillate

Sterols are used in manufacturing of Cortico steroids and food additives

Cortico steroids finds applications in asthma treatment, allergies and other pharma app

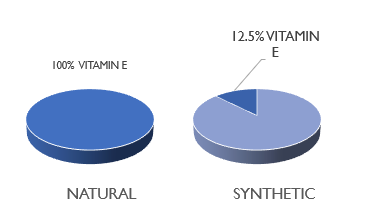

9. Natural Vitamin E

Vitamins are classified as natural and synthetic

The tocopherols manufactured are used in formulation of natural vitamin E

One of the major benefits on natural over synthetic is natural vitamin is absorbed faster by the system then the synthetic

Vitamins are classified as natural and synthetic

The tocopherols manufactured are used in formulation of natural vitamin E

One of the major benefits on natural over synthetic is natural vitamin is absorbed faster by the system then the synthetic

10. Margins Hierarchy

Vitamin E and Other formulations>Concentrated Tocopherols and Sterols>Mixed tocopherols and sterols> Dimer Acid> Linoleic Acid> Other Fatty Acids

Vitamin E and Other formulations>Concentrated Tocopherols and Sterols>Mixed tocopherols and sterols> Dimer Acid> Linoleic Acid> Other Fatty Acids

11. Revenue Breakup

Historically, Nutraceuticals contributed >30% of the total Revenues, Today the contribution from the segment stands at 3%

Reason for this- Drop in Vitamin E prices and Demand

Historically, Nutraceuticals contributed >30% of the total Revenues, Today the contribution from the segment stands at 3%

Reason for this- Drop in Vitamin E prices and Demand

12. Cyclicality In Vitamin E industry

Vitamin E industry is cyclical in nature with 3-4 years of high demand and low demand for next consecutive years

The prices fell more than 40% in past years and have reached the bottom zone, trend reversal is expected from here.

Vitamin E industry is cyclical in nature with 3-4 years of high demand and low demand for next consecutive years

The prices fell more than 40% in past years and have reached the bottom zone, trend reversal is expected from here.

13. Entry Barriers

1. Procurement of Raw material

2. High quality requirements by customers

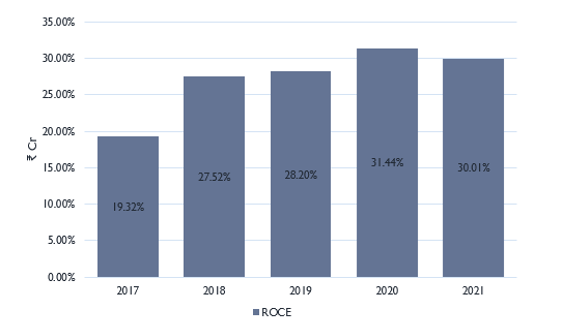

14. Financials

EBITDA margins & Revenues

1. Procurement of Raw material

2. High quality requirements by customers

14. Financials

EBITDA margins & Revenues

• • •

Missing some Tweet in this thread? You can try to

force a refresh