Thrilled to see the launch of @IRENA’s report on the geopolitics of hydrogen: bit.ly/33wQOxz

It has been a pleasure to serve as the lead author and work with a great team under the guidance of @ElizabethSPress

#TheHydrogenFactor #IRENA12A

It has been a pleasure to serve as the lead author and work with a great team under the guidance of @ElizabethSPress

#TheHydrogenFactor #IRENA12A

It is hard to summarize all of the ideas in the report in a thread, but here are some of the key themes. 🧵

1) In 2017, just one country (Japan) had a national hydrogen strategy. Today, more than 30 countries have one or are preparing one.

2) Hydrogen is already a major industry. Current annual hydrogen sales represent a market value of approximately USD 174 billion, which already exceeds the value of annual LNG trade.

3) Hydrogen is set for major acceleration. In decarbonization scenarios, its sales could grow x5 and it could come to represent 12% of final energy consumption by 2050. Most of that hydrogen would be green hydrogen.

4) Global efforts should focus on the applications that provide the most immediate advantages and enable economies of scale, particularly in the coming years. This includes refineries, steel, international shipping and long-haul aviation.

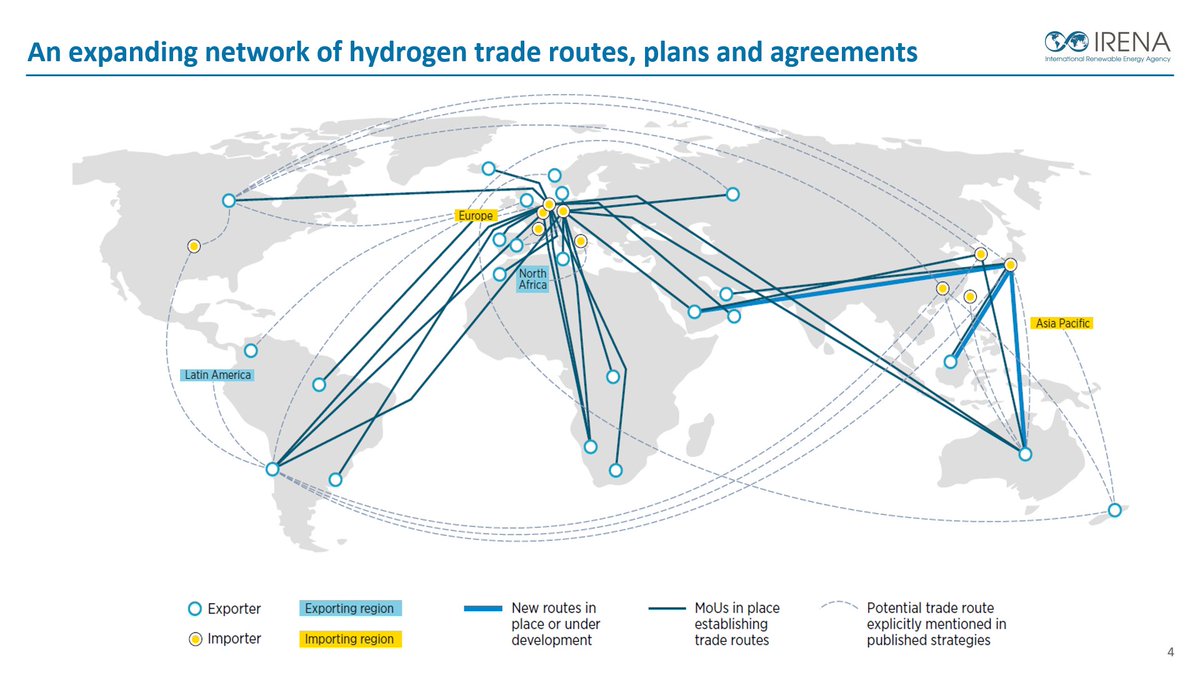

5) Hydrogen could become an internationally traded commodity. Driven by transport costs, a dual market for hydrogen is likely to emerge: a regional market, traded through pipelines, and a global market for ammonia, methanol, and other liquid fuels.

6) Countries are forging deals to establish the first trading routes and initial trial shipments have been carried out. For prospective importers/exporters, hydrogen diplomacy is becoming a standard fixture of economic diplomacy.

7) Hydrogen has the potential to disrupt energy value chains. The hydrogen business will be more competitive and less lucrative than oil and gas.

8) Green hydrogen has the potential to create a new class of energy exporters. Rather than just exporting hydrogen, regions with abundant renewables could attract new energy-intensive industries and become sites of green industrialization.

9) Hydrogen offers a transition pathway for fossil fuel exporters. They can leverage existing infrastructure, a skilled workforce and existing trade relations. However, hydrogen will not fully compensate for expected loss in revenues.

10)The 2020s could be the era of the big race for technology leadership. For key pieces of equipment such as electrolysers and fuel cells, Europe and Japan dominate innovation, but China is well positioned in manufacturing.

The thread continues here:

https://twitter.com/thijsvandegraaf/status/1482351049319014412

• • •

Missing some Tweet in this thread? You can try to

force a refresh