It is the National Startup Day🇮🇳

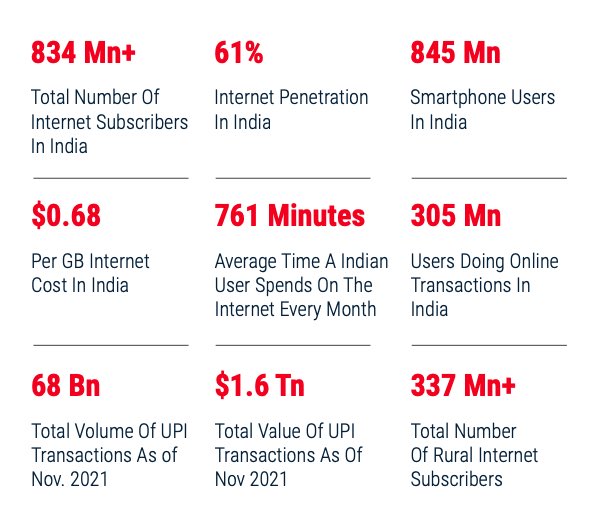

And We have some strong numbers for you to see!

So here is a Thread on the Indian Tech Startup that you must read! 🧵🧵👇🏻

#startupindia #investing

@caniravkaria

And We have some strong numbers for you to see!

So here is a Thread on the Indian Tech Startup that you must read! 🧵🧵👇🏻

#startupindia #investing

@caniravkaria

A Snapshot of the Startup Ecosystem of India:

• 57,000 Startups launched so far

• $112Bn Funds Raised between 2014-2021

• 85 Startups are Unicorns

• 4,413 Startups are Funded

• $283Bn+ is the combined value of Indian Unicorns

• 919 M&As recorded between 2014-21

• 57,000 Startups launched so far

• $112Bn Funds Raised between 2014-2021

• 85 Startups are Unicorns

• 4,413 Startups are Funded

• $283Bn+ is the combined value of Indian Unicorns

• 919 M&As recorded between 2014-21

• Highest Capital Inflow Ever!

• $42 Bn raised in 2021

• There is a 252% surge in funding amount YOY basis

• There is also a 66% surge in deals signed compared to 2020

• $42 Bn raised in 2021

• There is a 252% surge in funding amount YOY basis

• There is also a 66% surge in deals signed compared to 2020

• A staggering 108 deals above $100Mn were signed in 2021 alone

• Venture Capital Across all Funding Stages more than Doubled In 2021

• Seed Stage Funding crossed $1Bn , an increase of 180% YOY

• Venture Capital Across all Funding Stages more than Doubled In 2021

• Seed Stage Funding crossed $1Bn , an increase of 180% YOY

• Bengaluru remained the top destination for Seed Stage, Growth Stage and Late Stage funding

• Delhi NCR was the top destination for Bridge Stage Funding

• Delhi NCR was the top destination for Bridge Stage Funding

Here are the Top 5 Fastest Growing Startup Cities in terms of the number of Deal Count in India 🇮🇳

• Hyderabad (3 Yr CAGR of 47%)

• Pune (3 Yr CAGR of 37%)

• Ahmedabad (3 Yr CAGR of 29%)

• Bengaluru (3 Yr CAGR of 25%)

• Delhi NCR ( 3 Yr CAGR of 22%)

• Hyderabad (3 Yr CAGR of 47%)

• Pune (3 Yr CAGR of 37%)

• Ahmedabad (3 Yr CAGR of 29%)

• Bengaluru (3 Yr CAGR of 25%)

• Delhi NCR ( 3 Yr CAGR of 22%)

Of the 2,487 investors which participated in Indian startup funding in 2021, 40% were angel & individual investors.

The Stats of Unicorns and Soonicorns in India

• Out of the 85 Unicorns, 8 are listed startups.

• Out of the 73 Soonicorns, 6 are listed startups.

• India has the 3rd Highest No. of Unicorns in the World, after USA(469) and China(169)

• 42 Unicorns were added in 2021 in India

• Out of the 85 Unicorns, 8 are listed startups.

• Out of the 73 Soonicorns, 6 are listed startups.

• India has the 3rd Highest No. of Unicorns in the World, after USA(469) and China(169)

• 42 Unicorns were added in 2021 in India

Here is the List of Upcoming India. tech Startup IPOs in 2022:

1) Delhivery

2) Ixigo

3) OYO Rooms

4) Droom

5) Mobikwik

6) Pharmeasy

7) Snapdeal

1) Delhivery

2) Ixigo

3) OYO Rooms

4) Droom

5) Mobikwik

6) Pharmeasy

7) Snapdeal

Because of a solid year for Startups in 2021, 2022 might see a drop in the average size ticket. But the picture is still looking good!

Happy National Startup Day🇮🇳

Happy Reading! 🙂

Happy National Startup Day🇮🇳

Happy Reading! 🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh