1. Conventional wisdom goes that broking industry volumes drop off the cliff during bear markets. Angel data reveals that while volumes do decline, this is generally a temporary phenomenon.

This is NOT to say that broking is not cyclical (it is), but the cyclicality might not be as bad as we think it is. Do note that this data includes cash segment volumes from which brokers dont earn anything so take it with a pinch of salt.

What the management told us that it isn't. Why? Yes the new users (Tier 2/3 towns) are not as remunerative as the older ones (Tier 1). But why is this something NOT to worry about??

Because what we got to know in today's concall is that eveen though ARPU is lower, the acquisition cost & opex for these customers is even lower which is why they are able to grow maintaining cost to income ratio, improving margins.

These customers spend less, but are also less disproportionately less expensive to acquire resulting in margin expansion.

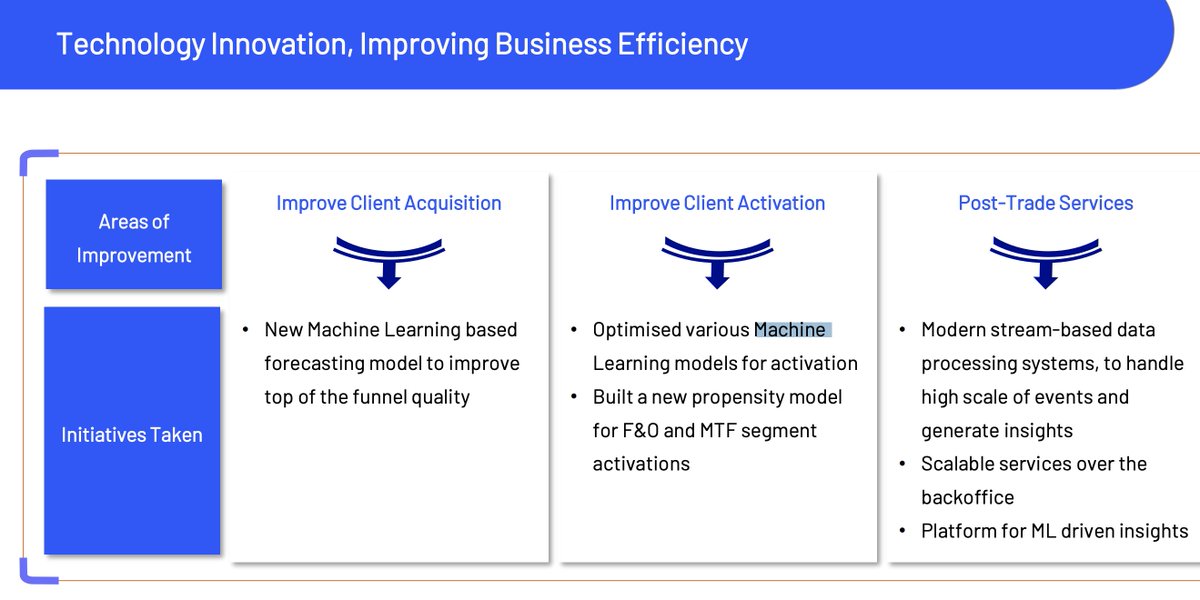

3. The super app is ready & under beta testing. Will be rolled out in April-22. Will focus on user journeys. Machine learning has already resulted in better client activation (37% to 39% improvement).

This is expected to improve even more with the superapp. The super app will also enable angel to focus a lot more on different user journeys like mutual funds, insurance, broking, lending etc & thus evolve from being a pureplay broker.

4. The distribution income is now 2% of revenues. this used to be 1% some quarters ago. All of this flows directly to bottomline & expands margins. This should improve markedly after launch of new user journeys on super app.

<End of thread>

Hope you enjoyed learning about angel. Journey to superapp looks to be going well.

Hope you enjoyed learning about angel. Journey to superapp looks to be going well.

• • •

Missing some Tweet in this thread? You can try to

force a refresh