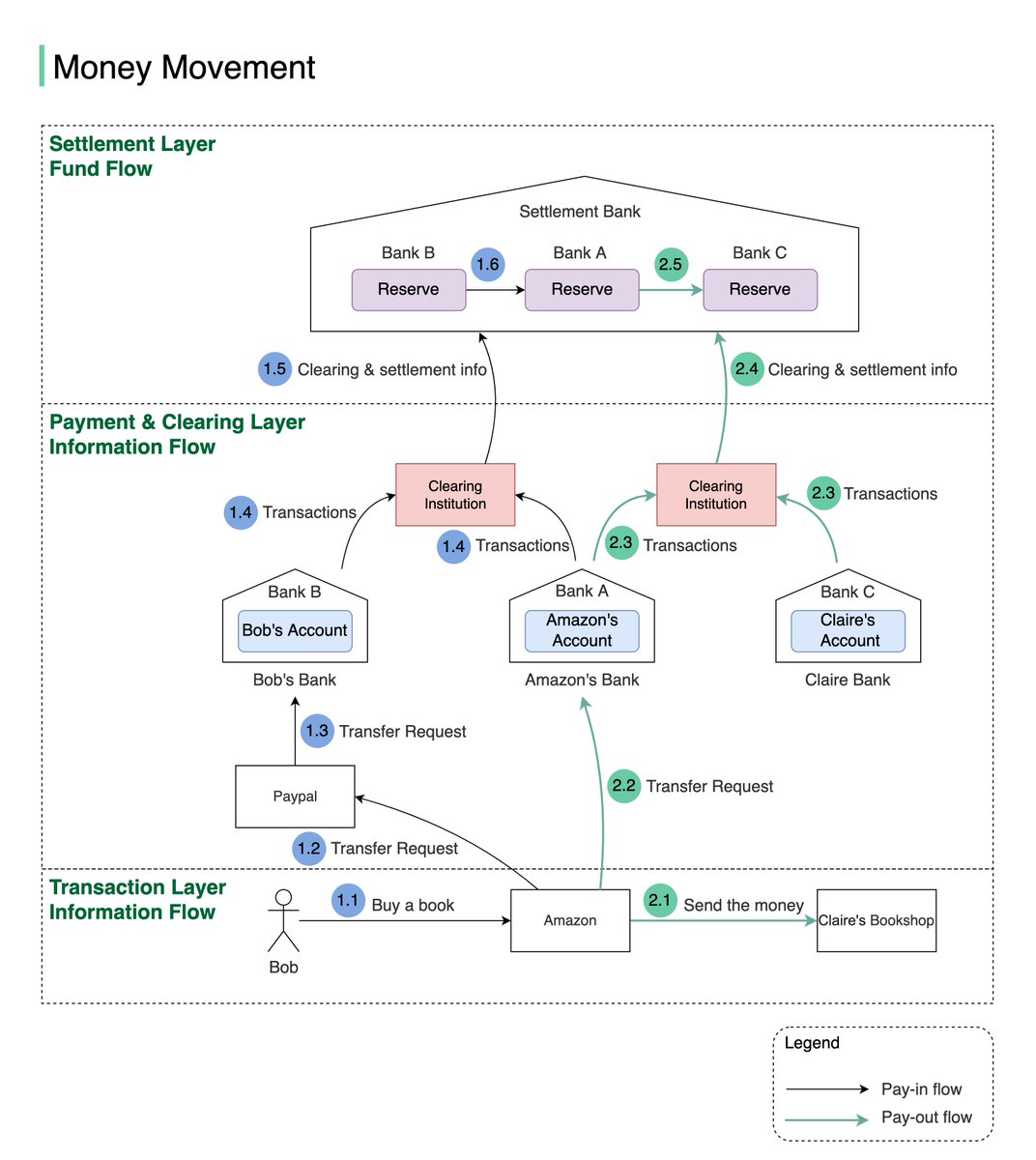

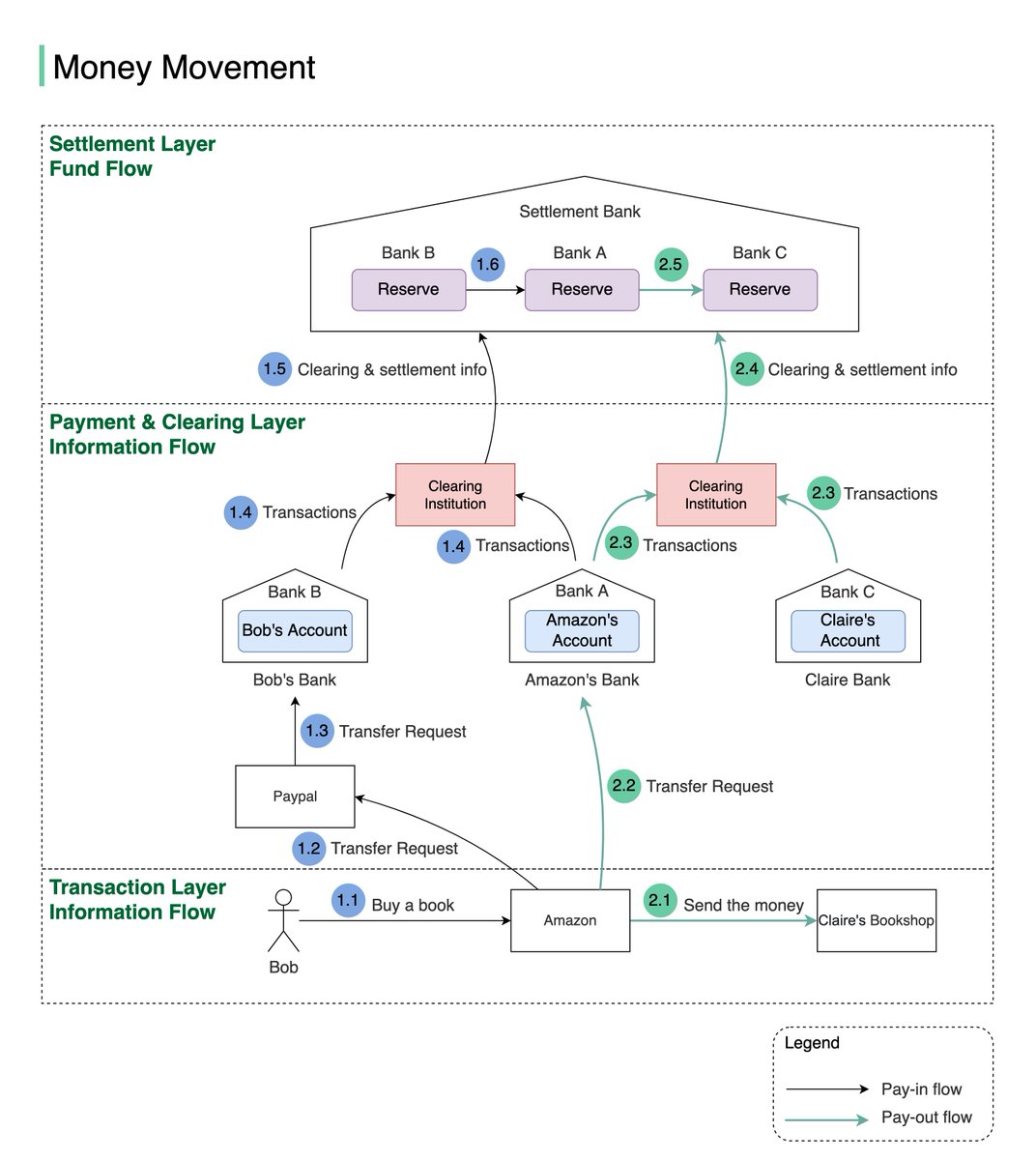

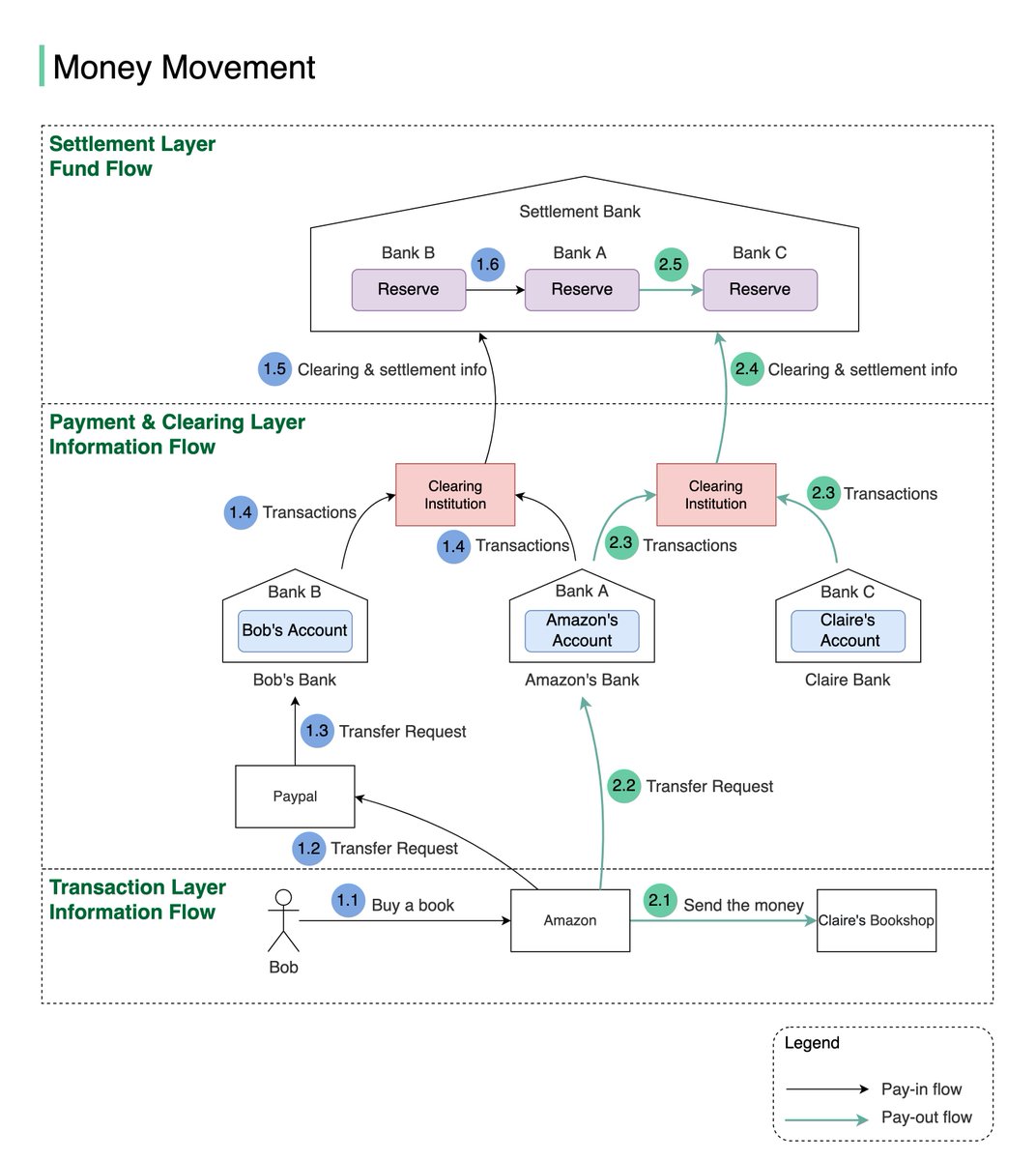

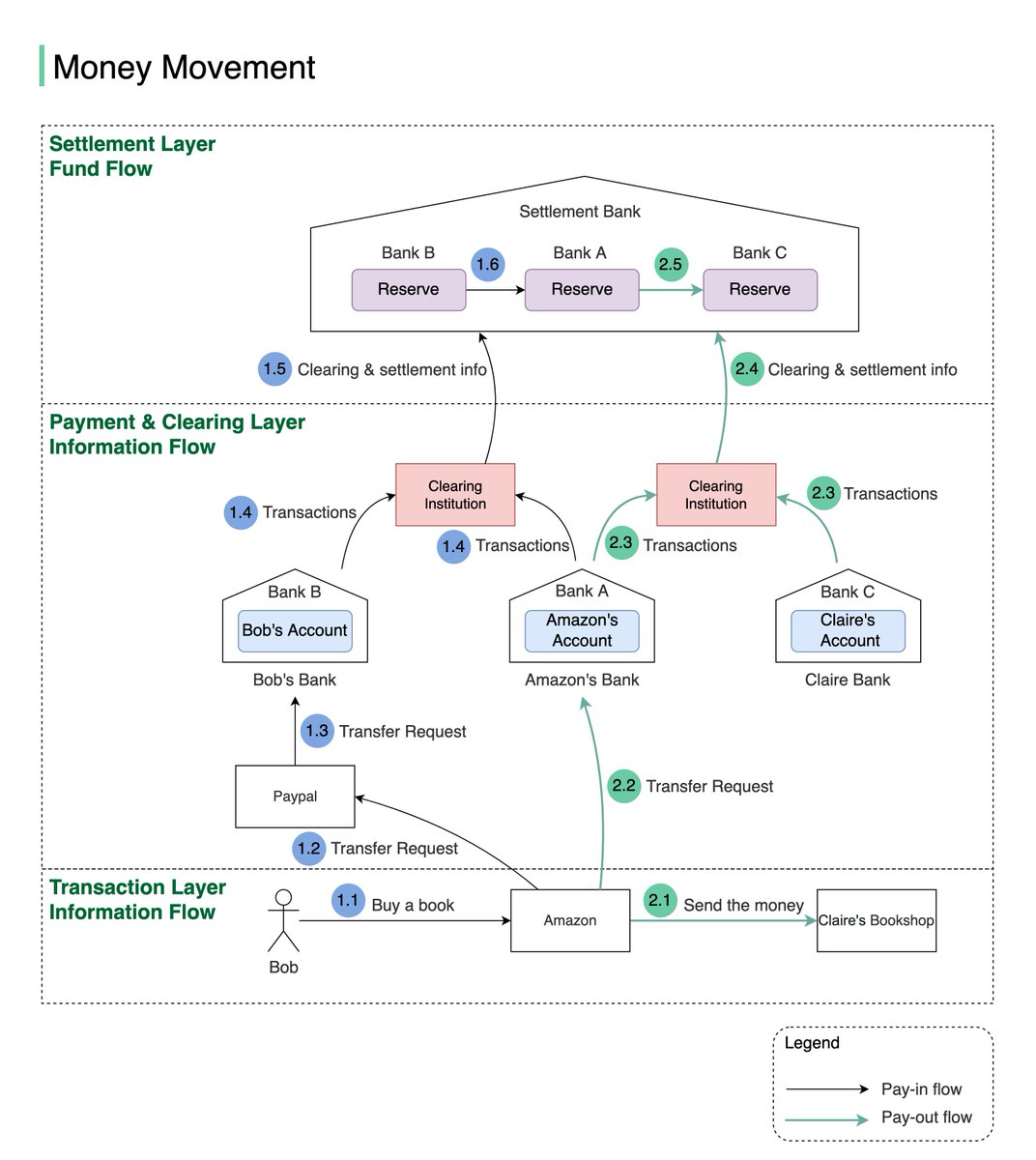

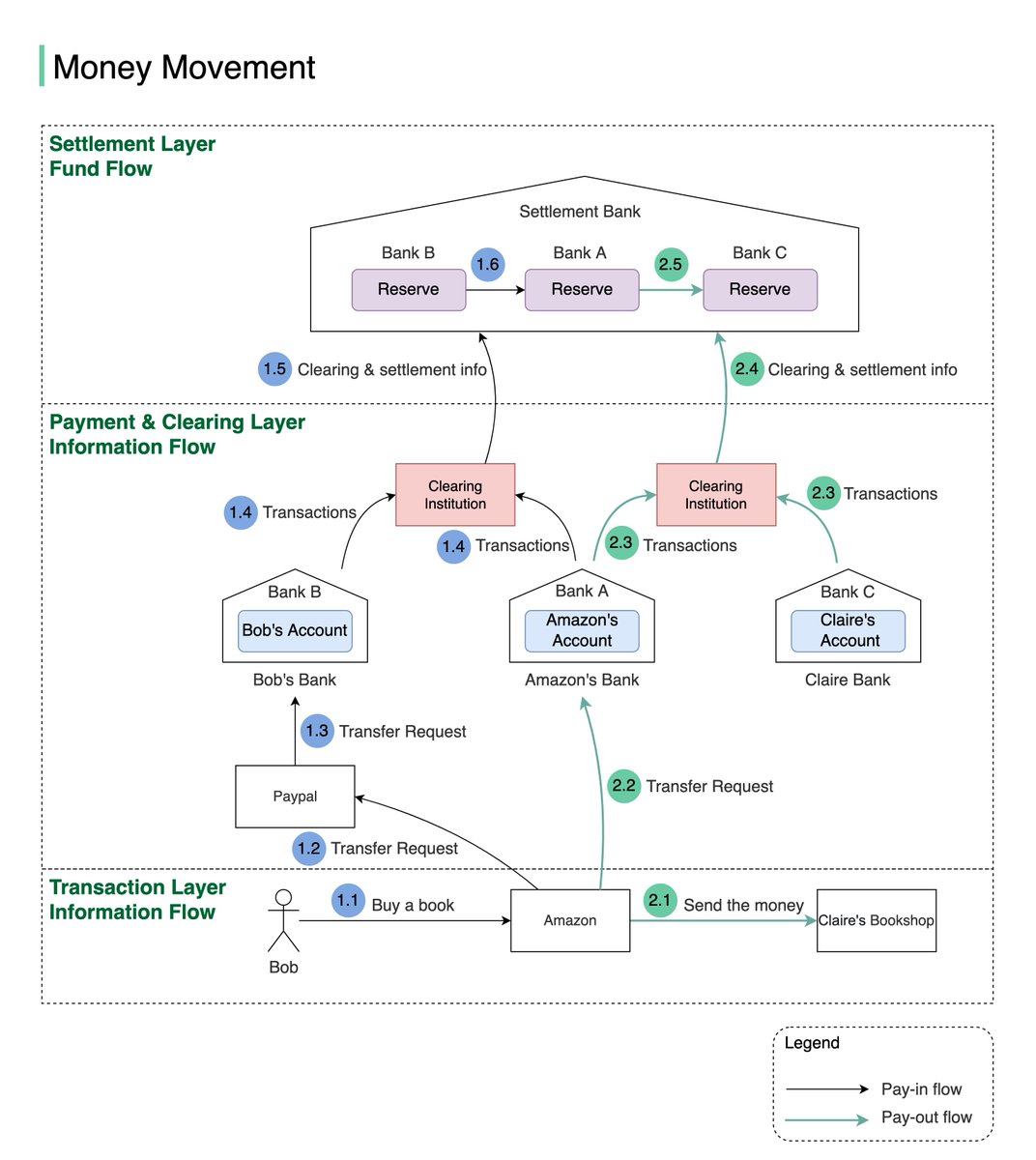

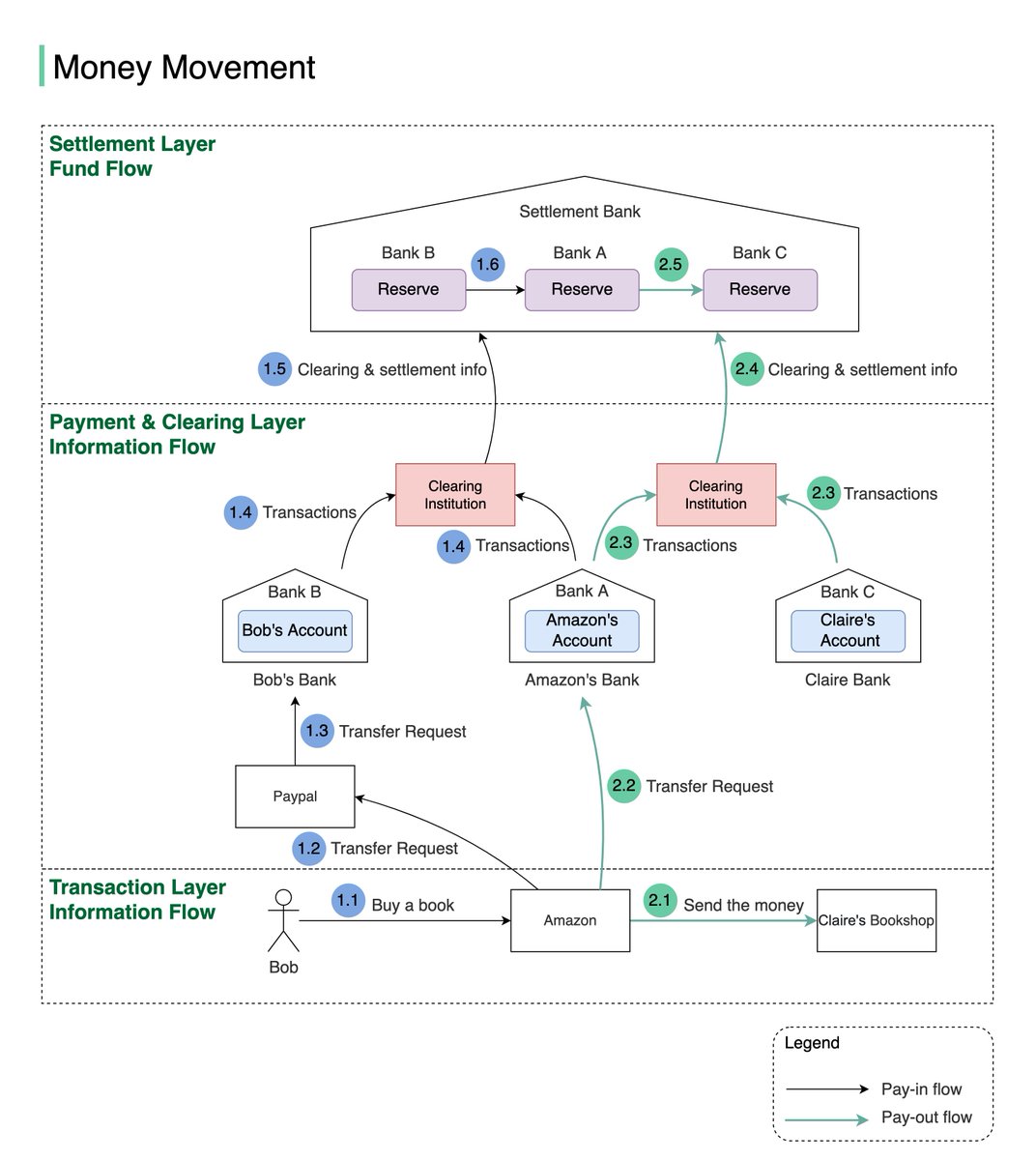

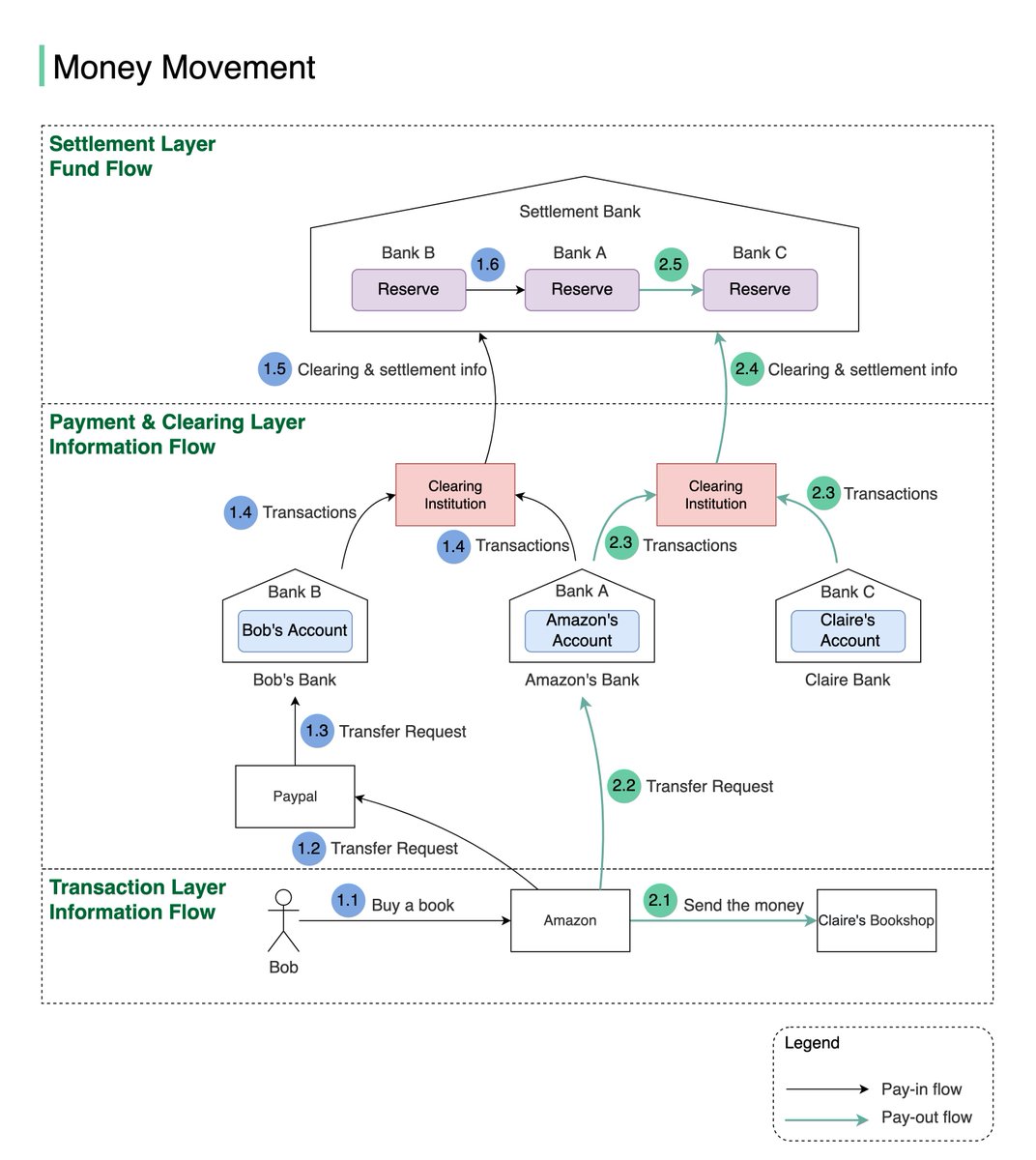

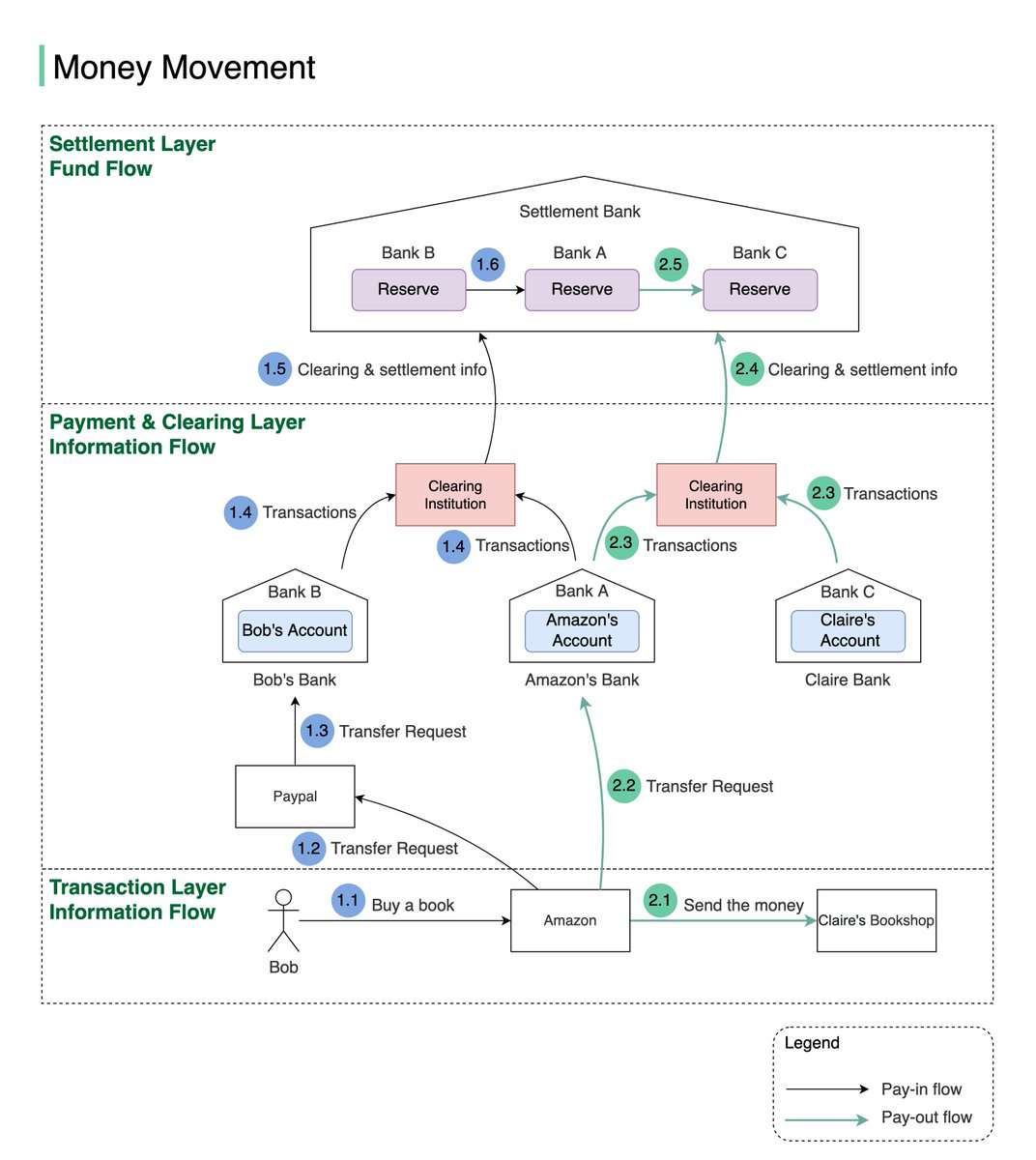

In the diagram below, we have three layers:

- Transaction layer: where the online purchases happen

- Payment and clearing layer: where the payment instructions and transaction netting happen

- Settlement layer: where the actual money movement happen 2/6

- Transaction layer: where the online purchases happen

- Payment and clearing layer: where the payment instructions and transaction netting happen

- Settlement layer: where the actual money movement happen 2/6

You can see the information flow and fund flow are separated. In the info flow, the money seems to be deducted from one bank account and added to another bank account, but the actual money movement happens in the settlement bank at the end of the day. 4/6

Because of the asynchronous nature of the info flow and the fund flow, reconciliation is very important for data consistency in the systems along with the flow. 5/6

It makes things even more interesting when Bob wants to buy a book in the Indian market, where Bob pays USD but the seller can only receive INR. 6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh