Trading EXPECTANCY

New entrants to markets have a strong general belief that High Accuracy is the secret to success in trading too. Why? Because such belief system works well in almost all aspects of our normal life but very clearly NOT in markets!

Curious to know WHY?

1/n

New entrants to markets have a strong general belief that High Accuracy is the secret to success in trading too. Why? Because such belief system works well in almost all aspects of our normal life but very clearly NOT in markets!

Curious to know WHY?

1/n

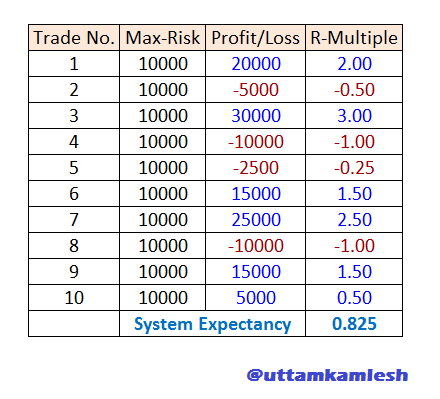

Concept of R - is a must to explain the concept of Expectancy. Now what is R?

R is simply abbreviation to 'Reward-to-Risk'.

Example - Suppose i took 10 trades and I lose at maximum Rs 10000 only in any stop loss hit.

2/n

R is simply abbreviation to 'Reward-to-Risk'.

Example - Suppose i took 10 trades and I lose at maximum Rs 10000 only in any stop loss hit.

2/n

Now if i make Rs 20000 in a trade i will say i made 20000/10000 = 2R today. If i lose Rs 5000 i will say i lost 0.5R today. Similarly, if i made Rs 30000 i will report it as 3R gain.

3/n

3/n

Similarly, if my risk is 1% of my capital and i make a profit of 3% that means i got 3R. As a trader we always talk in terms of Reward-to-Risk ratios, that is, in the language of R.

4/n

4/n

Now, let's see what is EXPECTANCY - It is simply the "mean R-multiple" of my trades under the system. In simpler words, Expectancy is the amount i would win on risking 1 rupee over a large number of trades.

5/n

5/n

Traditional Formula for calculation of

Expectancy = (Win Rate x Avg Win Size) - (Loss Rate x Avg Loss Size)

I don't use above formula at present as the outcome of above calculation is simply the mean-R value, which is much faster to calculate.

6/n

Expectancy = (Win Rate x Avg Win Size) - (Loss Rate x Avg Loss Size)

I don't use above formula at present as the outcome of above calculation is simply the mean-R value, which is much faster to calculate.

6/n

Theoretical Expectancy - is simply the 'mean-R' i get while back-testing the past trades of a system over a long time period. My study period for any intraday system is minimum 3 years & minimum 500 trades. For swing trading system its min. 10 years & min. 300 trades.

7/n

7/n

Practical Expectancy - is the Theoretical Expectancy further adjusted to all practical costs of trading as a business, i.e., slippages, various taxes, brokerages, laptop, internet, human errors, technical glitches, etc..

8/n

8/n

Critical Expectancy* - is the minimum Practical Expectancy required to recover from the worst case drawdown multiplied by a safety factor greater than 1, in next 100 trades.

Safety factor provides margin of safety from unexpected time-wise & depth-wise drawdowns in fut.

9/n

Safety factor provides margin of safety from unexpected time-wise & depth-wise drawdowns in fut.

9/n

Example - Drawdown of 15R in past 3 years data does not mean in future it cannot go to 25R, that's why the need for a safety factor.

10/n

10/n

Tradable Expectancy - must be much higher than the Critical Expectancy, that is, which can produce returns higher than FD returns which is the most basic opportunity cost to beat inflation.

11/n

11/n

Now you see why very high Expectancy systems are required to stay in the game for long because any surprise on inevitable drawdowns front either time-wise (trading costs accumulate) or depth-wise (negative compounding) can destabilize our system expectations & psychology.

12/n

12/n

Note - No trading literature has ever discussed 'Critical Expectancy' till date. This term & concept also is my contribution to the trading community.

13/n

13/n

Now would you start trading System-A with Tradable Expectancy of 1.0 but it generates only 10 trades a year? i.e., from 10 trades you are likely to make 10R only

or

you would prefer System-B which produces 100 trades a year with Tradable Expectancy of just 0.5.

14/n

or

you would prefer System-B which produces 100 trades a year with Tradable Expectancy of just 0.5.

14/n

In the later case you are likely to make 100x0.5 =50R.

So, you see FREQUENCY of trades per year is also very important factor in selecting a system to put money at.

There are more ways traders get screwed due to lack of accurate knowledge, will discuss one by one.

15/15

So, you see FREQUENCY of trades per year is also very important factor in selecting a system to put money at.

There are more ways traders get screwed due to lack of accurate knowledge, will discuss one by one.

15/15

If you liked the discussion, Like & Retweet to help wider audience.

#trading, #investing, #expectancy, #drawdown

#trading, #investing, #expectancy, #drawdown

• • •

Missing some Tweet in this thread? You can try to

force a refresh