1/ Peloton's predicament is an opportunity to practice your unit economics skills.

"Average net monthly connected fitness churn, which Peloton uses to measure retention of connected fitness subscribers, ticked up to 0.73% from 0.52% a year earlier." cnbc.com/amp/2021/08/26…

"Average net monthly connected fitness churn, which Peloton uses to measure retention of connected fitness subscribers, ticked up to 0.73% from 0.52% a year earlier." cnbc.com/amp/2021/08/26…

2/ Gross Margin: 32.6%

Bill Gurley: "There is a huge difference between companies with high gross margins and those with lower gross margins. Using the DCF framework, you cannot generate much cash from a revenue stream that is saddled with large, variable costs."

Bill Gurley: "There is a huge difference between companies with high gross margins and those with lower gross margins. Using the DCF framework, you cannot generate much cash from a revenue stream that is saddled with large, variable costs."

3/ Assume to keep the math simple that Peloton ARPU is $39 a month. How high can customer acquisition cost (CAC) be and generate 10% ROIC? Remember, any equipment subsidy is part of CAC.

You are "solving for" CAC. Invert!

Extra credit: estimate unaddressed TAM & CAC impact.

You are "solving for" CAC. Invert!

Extra credit: estimate unaddressed TAM & CAC impact.

4/ TAM is hard to determine since it requires predictions about the future.

If you encounter someone who claims you can value a stock without making predictions about the future, RUN!!!

Seth Klarman: "You must predict the future, yet the future is not reliably predictable.”

If you encounter someone who claims you can value a stock without making predictions about the future, RUN!!!

Seth Klarman: "You must predict the future, yet the future is not reliably predictable.”

5/ Simba: "Is TAM best thought of as a probability distribution with a range of possible outcomes?

Mufasa: "Exactly. But there are clues. For example, a rising CAC is a sign you are starting to reach a TAM ceiling. Everything is connected in the Great Circle of Unit Economics."

Mufasa: "Exactly. But there are clues. For example, a rising CAC is a sign you are starting to reach a TAM ceiling. Everything is connected in the Great Circle of Unit Economics."

6/ Simba: "So Peloton can be valued on a per subscriber bottoms up basis like a cable or mobile operator?"

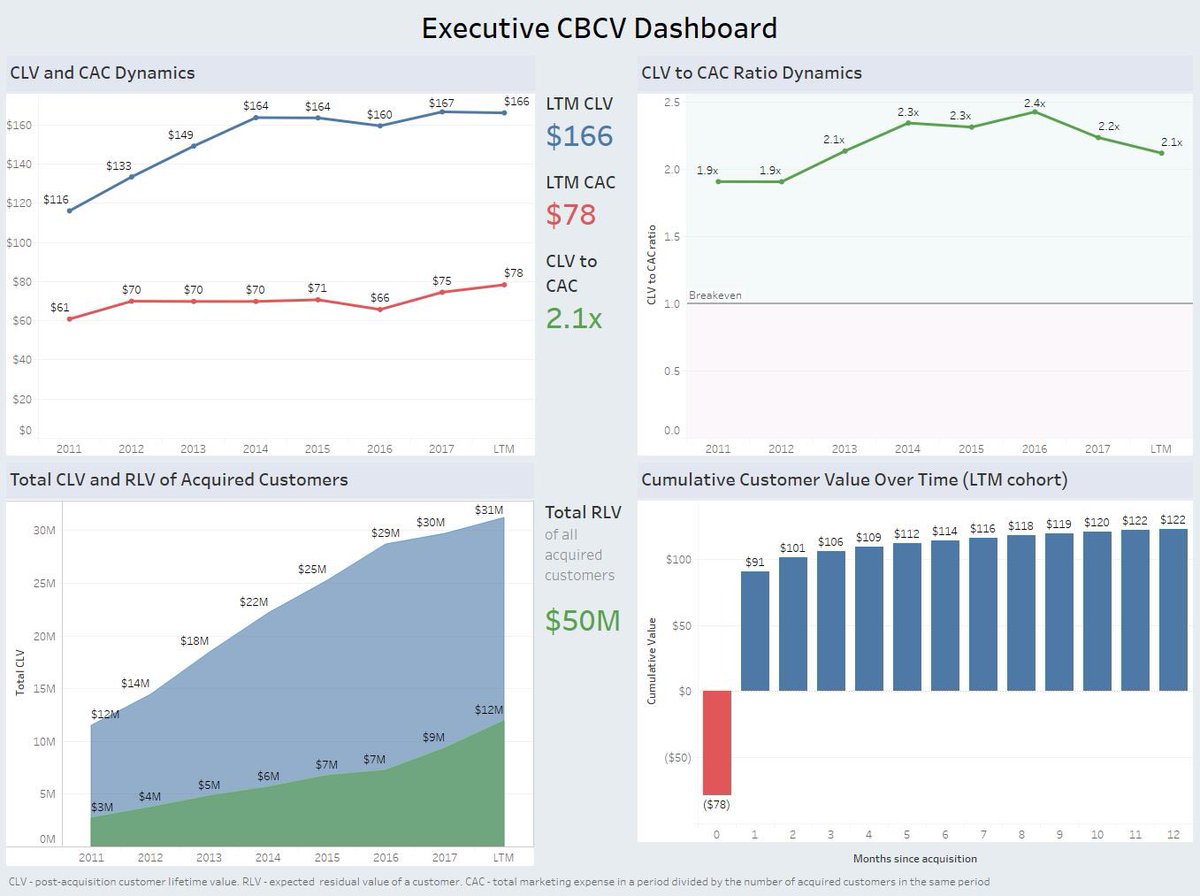

Mufasa: "Any business can be valued that way. The sum of the value of all present and future customers is equal to the value of the business. As Rza often says: 'CREAM.'"

Mufasa: "Any business can be valued that way. The sum of the value of all present and future customers is equal to the value of the business. As Rza often says: 'CREAM.'"

7/ Simba: "I've heard you say you have a feel for how unit economics factors interact."

Mufasa: "We have instrumented our processes and hired data scientists for a reason. Any CBCV variable can kill you. For example, ignoring what happens below the gross margin line is deadly."

Mufasa: "We have instrumented our processes and hired data scientists for a reason. Any CBCV variable can kill you. For example, ignoring what happens below the gross margin line is deadly."

• • •

Missing some Tweet in this thread? You can try to

force a refresh