Real Estate : On the Move?

Here’s our Sunday Analysis of the Indian Real Estate Sector.

A thread below🧵🧵🧵👇🏻

#investing #realestateinvestment

@caniravkaria @ishmohit1 @Gautam__Baid @sahil_vi @academy_share

Here’s our Sunday Analysis of the Indian Real Estate Sector.

A thread below🧵🧵🧵👇🏻

#investing #realestateinvestment

@caniravkaria @ishmohit1 @Gautam__Baid @sahil_vi @academy_share

(1/16)

Ready for an Upmove?

Here are some triggers:

• Improved Affordability:

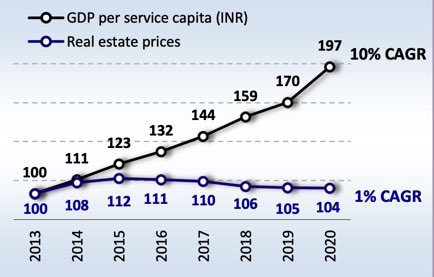

The last spike in Real estate prices came back in 2009-14. After this the prices have remained the same but the Income posted a steady growth of 8-10% CAGR since 2011

Ready for an Upmove?

Here are some triggers:

• Improved Affordability:

The last spike in Real estate prices came back in 2009-14. After this the prices have remained the same but the Income posted a steady growth of 8-10% CAGR since 2011

(2/16)

• A trend of falling interest rates has made it easy to finance homes and thus improving buying sentiments.

• The effective int rate for the first time home buyer is 3.9%

• Gap between Rental yields & Effective rate is 90bp, enticing people to opt for owning home

• A trend of falling interest rates has made it easy to finance homes and thus improving buying sentiments.

• The effective int rate for the first time home buyer is 3.9%

• Gap between Rental yields & Effective rate is 90bp, enticing people to opt for owning home

(3/16)

How Inventory levels affect Rise in Price:

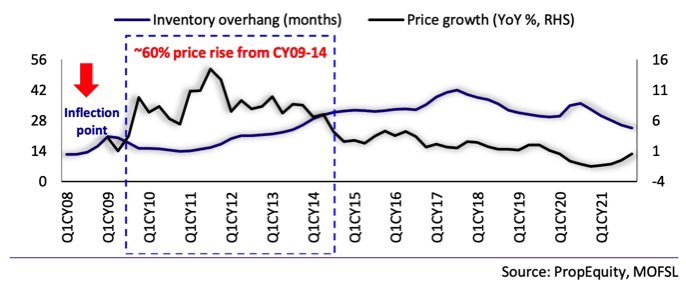

• Inventory level was at around 12-18 months in 2008 which was an inflection point for sharp price hikes that followed.

• Property prices rose by 60% across cities from 2009-14, until the levels went up to 32-33 months

How Inventory levels affect Rise in Price:

• Inventory level was at around 12-18 months in 2008 which was an inflection point for sharp price hikes that followed.

• Property prices rose by 60% across cities from 2009-14, until the levels went up to 32-33 months

(4/16)

• The inventory levels are currently at 23 months which is healthy but not low enough(~15 months) to start having a Price rise.

• As you can see below ~15 months inventory acted as an inflection point for rise in the price of Real Estate from 2009-14.

• The inventory levels are currently at 23 months which is healthy but not low enough(~15 months) to start having a Price rise.

• As you can see below ~15 months inventory acted as an inflection point for rise in the price of Real Estate from 2009-14.

(5/16)

A sharp Demand Recovery:

First half of 2021 saw a sharp recovery in demand. Jan-March 2021 was the best quarter

in the last 5-6 years, with total sales of 72,000 units across the top seven cities.

The impact of 2nd wave was less, which gave the confidence in the industry

A sharp Demand Recovery:

First half of 2021 saw a sharp recovery in demand. Jan-March 2021 was the best quarter

in the last 5-6 years, with total sales of 72,000 units across the top seven cities.

The impact of 2nd wave was less, which gave the confidence in the industry

(6/16)

Urbanisation: Creating Demand

• As per reports, India will need 6.2Cr houses in urban cities to meet the needs of the population by 2030

• Rise in Nuclear family will add another 2.8Cr houses demand by 2030

Urbanisation: Creating Demand

• As per reports, India will need 6.2Cr houses in urban cities to meet the needs of the population by 2030

• Rise in Nuclear family will add another 2.8Cr houses demand by 2030

(7/16)

Can we have another 2008-14 period?

• Same characteristics of improved affordability and lower int rates

• Customers are realising that there is little room for price correction so demand is rising.

• Developers to keep launch discipline by keeping a watch on demand

Can we have another 2008-14 period?

• Same characteristics of improved affordability and lower int rates

• Customers are realising that there is little room for price correction so demand is rising.

• Developers to keep launch discipline by keeping a watch on demand

(8/16)

Three way attack!

• Demonetisation: Affected the flow of investments coming into the sector through developers

• GST : 12% GST on sale of Under Construction Units, which made cost averse buyers not buy these units

Three way attack!

• Demonetisation: Affected the flow of investments coming into the sector through developers

• GST : 12% GST on sale of Under Construction Units, which made cost averse buyers not buy these units

(9/16)

RERA: It brought an end to pre launch sales, meaning developers had to be sure of the viability of the project

• Escrow Account creation stopped cross funding of projects

• Developers are dealt with heavy fines in case of delay in launch

RERA: It brought an end to pre launch sales, meaning developers had to be sure of the viability of the project

• Escrow Account creation stopped cross funding of projects

• Developers are dealt with heavy fines in case of delay in launch

(10/16)

Let’s look at the financial health of 4 Listed Companies:

1) Oberoi Realty

2) DLF

3) Godrej Properties

4) Macrotech Developers (Lodha)

Let’s look at the financial health of 4 Listed Companies:

1) Oberoi Realty

2) DLF

3) Godrej Properties

4) Macrotech Developers (Lodha)

(11/16)

• OBER has the lowest Debt to Equity(0.2), it also has the lowest gross debt amount(₹15Bn)

• Cost of Debt is lowest of GPL(6.7%) & highest of Lodha(11.3%)

• OBER has the best margin profile due to high margin in luxury segment and lower overheads

• OBER has the lowest Debt to Equity(0.2), it also has the lowest gross debt amount(₹15Bn)

• Cost of Debt is lowest of GPL(6.7%) & highest of Lodha(11.3%)

• OBER has the best margin profile due to high margin in luxury segment and lower overheads

(12/16)

• As per Valuations: Lodha and Oberoi Realty currently the most attractive.

• Lodha is offering favourable growth opportunities and Oberoi sales have improved majorly which can have incremental effect on its future project plans and development

• As per Valuations: Lodha and Oberoi Realty currently the most attractive.

• Lodha is offering favourable growth opportunities and Oberoi sales have improved majorly which can have incremental effect on its future project plans and development

(13/16)

Strong footing of listed developers:

• The listed developers are all set to double their pre sales over the next 5 years.

• The market share of top 10 listed players has increased threefold since 2017

• 60% of developers have exited the market since 2017

Strong footing of listed developers:

• The listed developers are all set to double their pre sales over the next 5 years.

• The market share of top 10 listed players has increased threefold since 2017

• 60% of developers have exited the market since 2017

(14/16)

NBFC crisis gave a boost to listed and organised developers.

• The crisis led to lending limitations for unorganised developers.

• The new lending was largely received by big players

• Even now when demand is rising, NBFCs will continue to focus on Top Players

NBFC crisis gave a boost to listed and organised developers.

• The crisis led to lending limitations for unorganised developers.

• The new lending was largely received by big players

• Even now when demand is rising, NBFCs will continue to focus on Top Players

(15/16)

• Listed peers have a better inventory numbers which is around 15-20months

• Due to this and strong demand, they are successful in hiking the price and passing the inflation factor to customers.

• Listed peers have a better inventory numbers which is around 15-20months

• Due to this and strong demand, they are successful in hiking the price and passing the inflation factor to customers.

(16/16)

Key Risks:

• Rising Commodity Prices affecting margins. Even passing the rise in price to customers will have an affect on affordability, which will ultimately impact the demand.

• Interest Rate Hike: Govts across are stepping in to control inflation using tapering.

Key Risks:

• Rising Commodity Prices affecting margins. Even passing the rise in price to customers will have an affect on affordability, which will ultimately impact the demand.

• Interest Rate Hike: Govts across are stepping in to control inflation using tapering.

• • •

Missing some Tweet in this thread? You can try to

force a refresh