Asset price valuation models are becoming memes.

Here’s why & how it matters to you as an investor 👇

Here’s why & how it matters to you as an investor 👇

First, some label definitions so we’re on the same page:

An “asset” is any instrument that transfers ownership of value across time & space.

An “asset” is any instrument that transfers ownership of value across time & space.

For a thing to be an asset it needs to satisfy at least 3 basic conditions:

1/ limited supply

2/ durability

3/ social agreement that the thing can be used to represent value

1/ limited supply

2/ durability

3/ social agreement that the thing can be used to represent value

Most fiat currencies, stocks, bonds, real estate satisfy these conditions to various extent through various means, thus are counted as assets.

Many fungible & non-fungible crypto tokens can also be counted as assets, depending on how well they satisfy these 3 conditions.

Many fungible & non-fungible crypto tokens can also be counted as assets, depending on how well they satisfy these 3 conditions.

Condition #3 is crucial— an asset needs some type of social agreement to have value. The social agreement may or may not be based on underlining utility of the asset (as we’ll talk abt in a sec, increasingly it’s NOT).

Ultimately these social agreements are memes— our collective truth or delusion, depending on your perspective.

Take stocks. A key social agreement that supports stock prices is (roughly):

stock price × total shares = value of the company

Take stocks. A key social agreement that supports stock prices is (roughly):

stock price × total shares = value of the company

Stock price valuation models all try to estimate the right-hand side of this equation— using discounted cash flow, asset & liability calculation, network effect estimates…you name it— while taking the equation as a given.

Few pause to consider the fact that this equation is in fact a make-believe, i.e. meme.

In old days when companies still paid dividends, the equation was more based in truth, cuz if a company did well, it had tangible benefits to shareholders in the form of more dividends paid.

In old days when companies still paid dividends, the equation was more based in truth, cuz if a company did well, it had tangible benefits to shareholders in the form of more dividends paid.

No so much anymore. Dividend payout ratio— percentage of firms’ earnings that are paid as dividends— of S&P has dropped by 20 pp since 1950s.

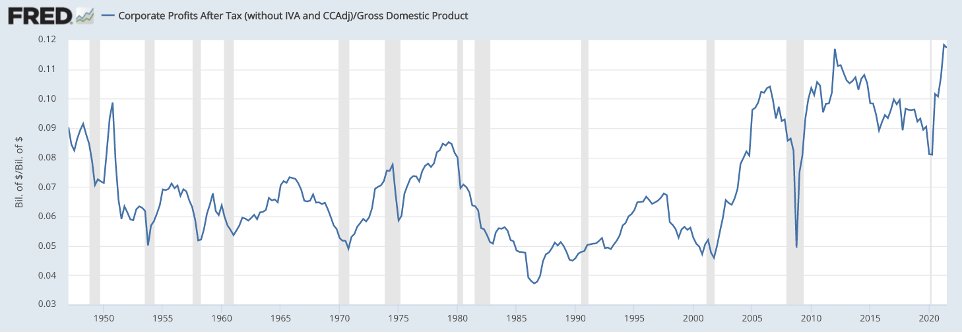

Is this because firms are doing poorly? Not at all. Firm profits (as percent of total economic pie) have gone up over time.

The decoupling btw firm performance & shareholder benefit is esp acute for tech companies. Dividend payout rate of public IT companies is < 15%. A company like Amazon has never paid a cent in its ~30 yrs of existence.

If you own 1 share of AMZN stock, you don’t directly get any utility out of Amazon growth. Whether the company is profitable or not is irrelevant to your income. Your shared company “ownership” is in name only.

https://twitter.com/TaschaLabs/status/1485092961134153732?s=20

You say, but that’s b/c growth companies are better off reinvesting earnings to grow more. Benefits to shareholders will be from stock price going up.

Sure. But that doesn’t negate the fact that the real reason $AMZN price goes up when Amazon company does well is b/c we’re all buying into the collective meme that says:

stock price × total shares = value of the company

stock price × total shares = value of the company

even though the condition for this equation to hold has become increasingly tenuous b/c of companies like Amazon.

In other words, new generation of public companies is actively violating the collective make-believe about stock valuation while taking advantage of the same make-believe.

In other, other words, your gain from AMZN stock doesn’t come from the company, but from other mkt participants who buy into the same valuation meme & are thus willing to buy shares from you at higher price when the company does well.

W/o the shared valuation meme, your stock price wouldn’t go up, despite the fact that it’s increasingly detached from reality.

Imagine the alternative scenario where instead of the pretense of company “ownership” that stocks give, we simply have an index that mirrors Amazon growth for people to bet on (such indices exist actually).

This is no different from sports betting or horse race betting. Except your opponents are not people who bet on other horses in the same race but future buyers & sellers of the same stock.

Any gain you may have comes from other mkt participants, who either bet in opposite direction or are willing to bet even higher price than you w/ hope that the index goes up even more so they, too, can sell higher.

It’s easy to see that the rule of such index is entirely arbitrary. And yet it’ll work just as well as any growth stock as long as players all accept the same meme.

Why is this important to you as an investor?

Why is this important to you as an investor?

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter .)

B/c it’s always useful to know the nature of the game you’re playing, so that you understand how the game rules may change in different circumstances, rather than blindly following common sense, i.e. mega meme, w/o thinking.

Take the useless “governance tokens” in DeFi. Those don’t even pretend to be ownership shares & offer no yields or dividends. People joke abt them often & yet prices are not zero. Why?

B/c they’re inheriting the same social agreement as in growth stocks w/ no tangible benefits to shareholders. As long as mkt participants all agree on the arbitrary meme that “token price × total supply = value of the protocol”, the token would behave similarly to stocks.

And same as before, in what’s essentially a horse betting game, your gains come from other mkt participants rather than from economic values generated by the protocol itself.

So when you bet on governance tokens w/o utility, you’re implicitly betting that our collective valuation meme will persist, even though it has no basis in reality.

Powerful memes, reality based or not, can indeed persist for long time & serve useful function of maintaining social (or market) order. I don’t see anything wrong w/ that.

Many communities around world still believe that God is an angry old man who leaves no misdeeds unpunished, yet somehow loves you. You may question the truth of such meme. But you can’t deny it does a good job holding many a society together.

Still, it seems reasonable to assume that valuation memes w/ some basis in reality will tend to be more enduring than those w/o.

If the relationship of “token price × total supply = value of the protocol” is to become something more robust than a figment of collective imagination, devs should indeed do something to create active linkage btw left-hand side & right-hand side of the equation.

It could take the form of profit sharing w/ token holders similar to dividends, but it doesn’t have to. In fact the easiest way could be to program an emission/burn schedule that reflects how well the project is doing.

Select a relevant KPI (key performance indicator)-- e.g. TVL, total txns processed, total relays performed, depending on the application— pick a frequency of measurement & tie the KPI to available token supply.

Any lie is more powerful & enduring when there’s an element of truth in it. Asset valuation meme is no exception.

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @TaschaLabs

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future articles. Be civil.

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @TaschaLabs

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future articles. Be civil.

• • •

Missing some Tweet in this thread? You can try to

force a refresh