0/ Friday saw the most on-chain liquidations ever, hitting a record $200M.

In today’s Delphi Daily, we explore the rash of liquidations, temp check the current market signals, and examine @FantomFDN’s climbing TVL.

For more 🧵👇

In today’s Delphi Daily, we explore the rash of liquidations, temp check the current market signals, and examine @FantomFDN’s climbing TVL.

For more 🧵👇

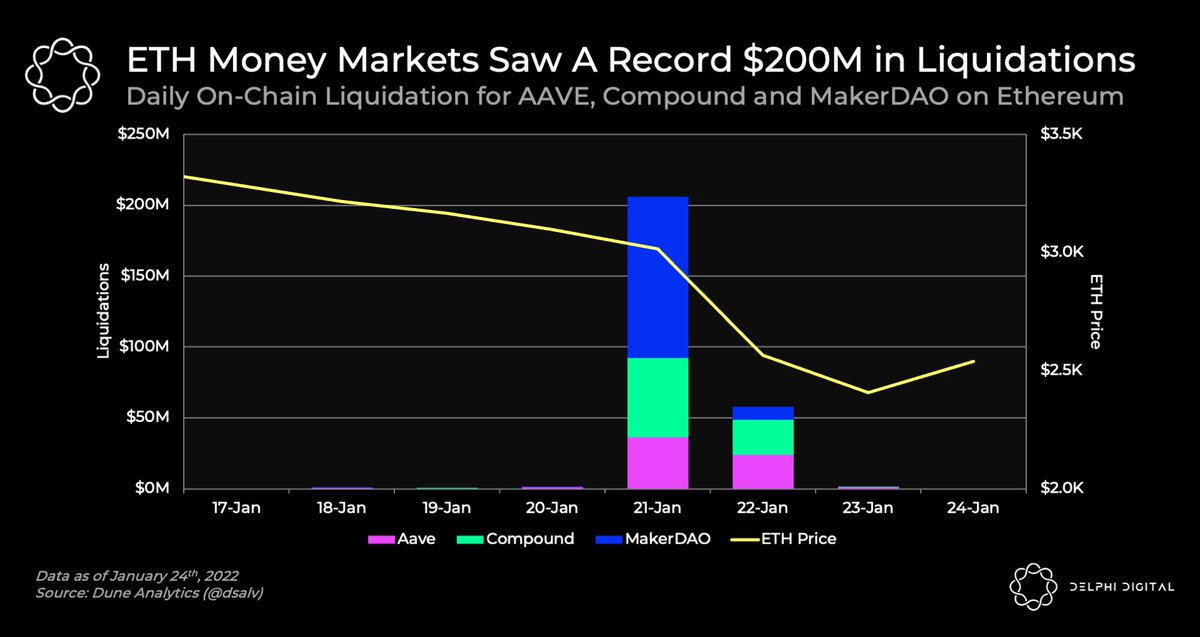

1/ As a major correction sent ETH falling from $3.2k to $2.5k in the past week, on-chain liquidations surged as positions started to hit their liquidation point.

Last Friday, money markets on ETH experienced their largest liquidation event to date, amounting to over $200m.

Last Friday, money markets on ETH experienced their largest liquidation event to date, amounting to over $200m.

2/ @MakerDAO was responsible for more than 50% of liquidations stated above.

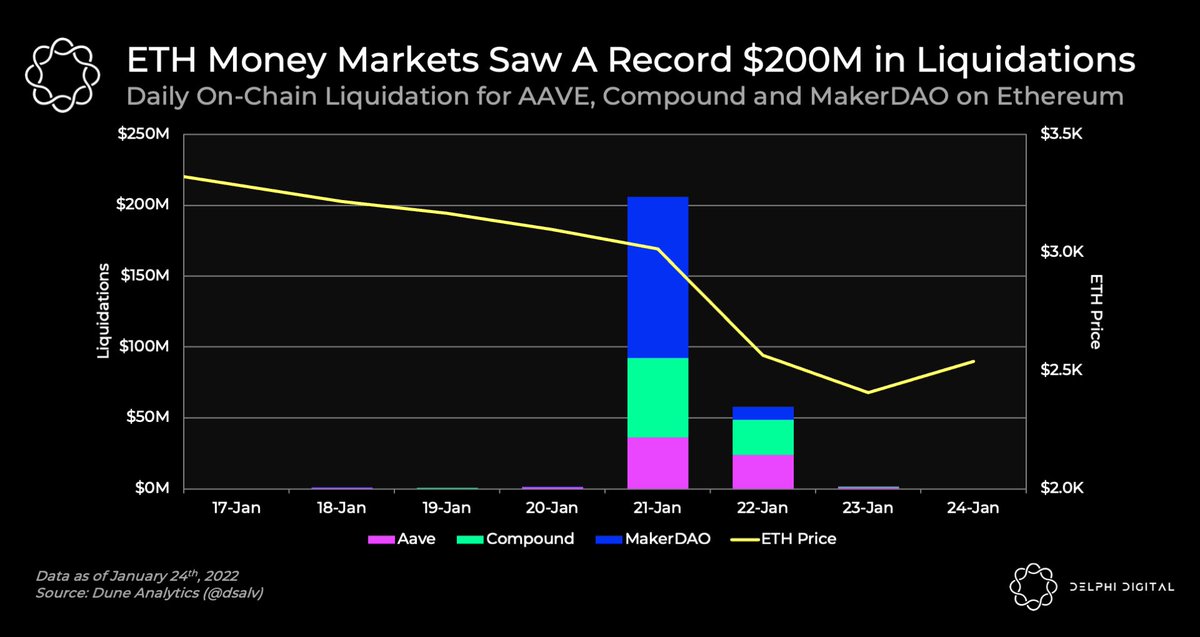

Maker stands to profit from all the liquidation events happening recently.

MakerDAO charges a liquidation penalty to the vault owners if the value of their collateral reaches its liquidation price.

Maker stands to profit from all the liquidation events happening recently.

MakerDAO charges a liquidation penalty to the vault owners if the value of their collateral reaches its liquidation price.

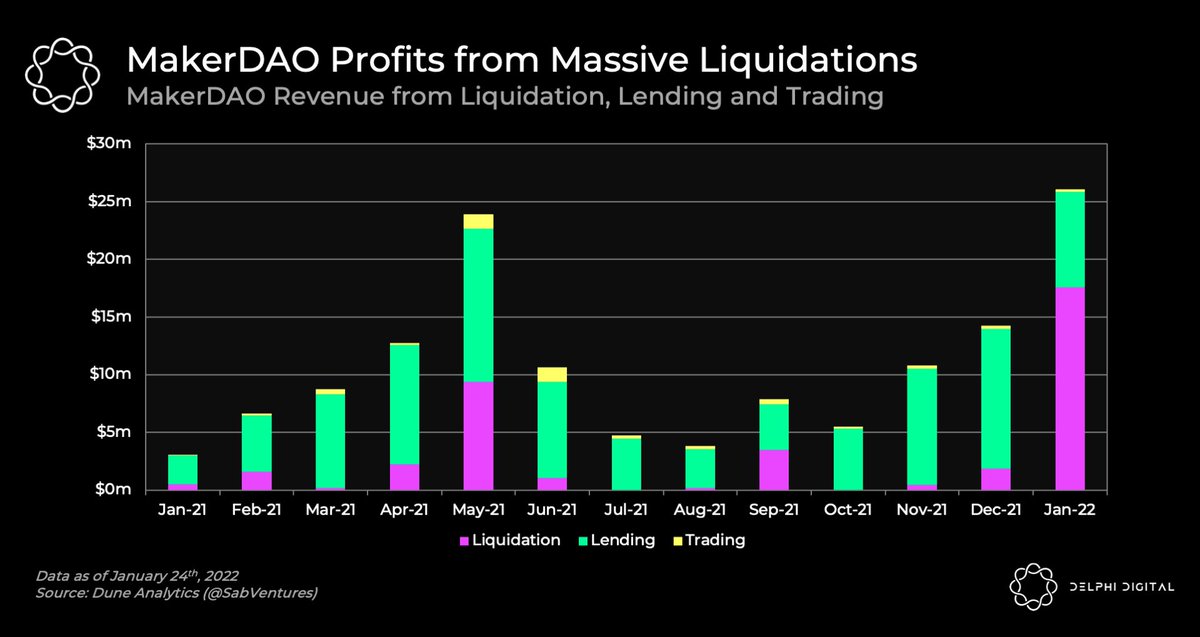

3/ Open interest moved down as the markets turned bearish from hints of impending rate hikes.

BTC and ETH futures OI have contracted by $6B and $3.1B, respectively, since their peaks in November.

All eyes will be on the upcoming Jan FOMC happening on January 25th and 26th.

BTC and ETH futures OI have contracted by $6B and $3.1B, respectively, since their peaks in November.

All eyes will be on the upcoming Jan FOMC happening on January 25th and 26th.

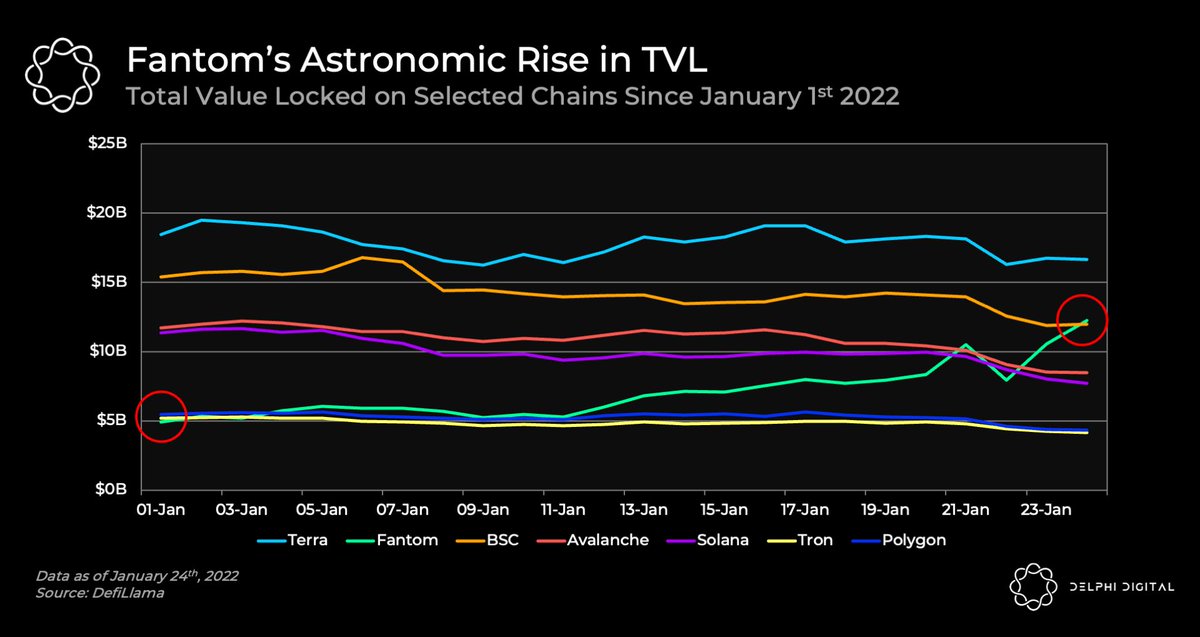

4/ @FantomFDN started the year at the 8th spot in TVL rankings by chain.

Since then, it has climbed up to the 3rd spot, with the flippening of BSC occurring earlier today.

Since then, it has climbed up to the 3rd spot, with the flippening of BSC occurring earlier today.

5/ Tweets of the day!

Illuvium Private Beta Registration Opens!

Illuvium Private Beta Registration Opens!

https://twitter.com/illuviumio/status/1485504909521059843

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh