1/

Having No Plan

You need to think about why you are trading and set financial goals for yourself.

Is it for:

• Extra Money

• Career Change

Take the time to educate yourself and figure out what it is you want to achieve.

Having No Plan

You need to think about why you are trading and set financial goals for yourself.

Is it for:

• Extra Money

• Career Change

Take the time to educate yourself and figure out what it is you want to achieve.

2/ Following the Crowd

Twitter isn’t a place to get your trades.

Following the crowd without doing any analysis or research yourself will definitely get you burnt.

You can’t steal conviction in this game. It’s important to think about your own trading style.

Twitter isn’t a place to get your trades.

Following the crowd without doing any analysis or research yourself will definitely get you burnt.

You can’t steal conviction in this game. It’s important to think about your own trading style.

3/

Trading too often

When there are no setups, don’t force yourself to find one.

Trading often doesn’t mean you’ll make more.

You only need one good trade to work to recoup previous trade losses.

It takes skill, discipline, and patience to succeed.

Trading too often

When there are no setups, don’t force yourself to find one.

Trading often doesn’t mean you’ll make more.

You only need one good trade to work to recoup previous trade losses.

It takes skill, discipline, and patience to succeed.

4/

Emotional Trading

Emotions play a massive role in one’s success as a trader.

Don’t become attached to a trade. Look at things objectively.

If you having a bad day, week or month. Take time off and reevaluate your strategy.

Emotional Trading

Emotions play a massive role in one’s success as a trader.

Don’t become attached to a trade. Look at things objectively.

If you having a bad day, week or month. Take time off and reevaluate your strategy.

5/

Not Cutting losses quickly

Yes,

you will make mistakes and lose money. Get used to the fact of losing money

The point is, when the trade goes against you, get out and accept the (L)

Holding onto a trade cause you believe in it isn’t a strategy.

Not Cutting losses quickly

Yes,

you will make mistakes and lose money. Get used to the fact of losing money

The point is, when the trade goes against you, get out and accept the (L)

Holding onto a trade cause you believe in it isn’t a strategy.

6/

Not using Stop Losses

Do you drive a car without breaks?

I thought not.

Then you shouldn’t trade without

stop losses. It is reckless.

Stop losses prevent losses from becoming worse. They are part of risk management.

Make sure to use them.

Not using Stop Losses

Do you drive a car without breaks?

I thought not.

Then you shouldn’t trade without

stop losses. It is reckless.

Stop losses prevent losses from becoming worse. They are part of risk management.

Make sure to use them.

7/

Not Letting Winners Run

Selling too early is worse than cutting losses. Those gains you could have had hit much harder

The trend is your friend,

if a winner has hit your exit price, consider selling some and then ride the wave,

just…

adjust your stop losses higher up.

Not Letting Winners Run

Selling too early is worse than cutting losses. Those gains you could have had hit much harder

The trend is your friend,

if a winner has hit your exit price, consider selling some and then ride the wave,

just…

adjust your stop losses higher up.

8/

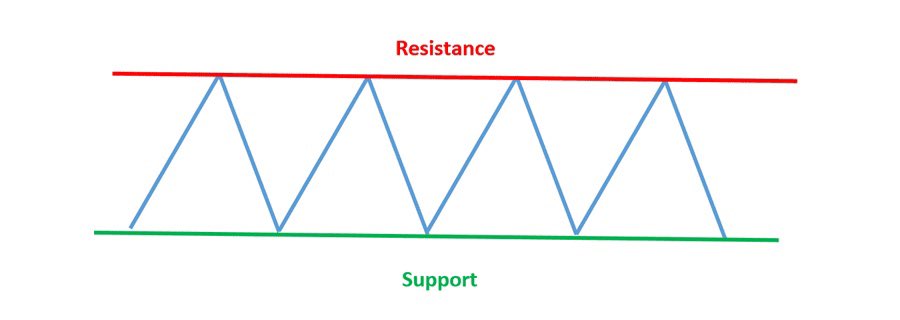

Not Having Entry/Exit Points

Decide before hand what the objective is for your trade and then stick to it.

Be strict with yourself.

Have price entry points to buy, add + have exit points to take profits or cut losses.

Not Having Entry/Exit Points

Decide before hand what the objective is for your trade and then stick to it.

Be strict with yourself.

Have price entry points to buy, add + have exit points to take profits or cut losses.

9/

Letting profitable Trades turn to losses.

It’s difficult to predict tops and bottoms, but plan your trades before you enter them.

It’s the worst kind of feeling watching gains evaporate and you sit and do nothing

In fact, watching gains disappear is the worst

Letting profitable Trades turn to losses.

It’s difficult to predict tops and bottoms, but plan your trades before you enter them.

It’s the worst kind of feeling watching gains evaporate and you sit and do nothing

In fact, watching gains disappear is the worst

10/

Not Recording your Trades

This allows you to go back to previous trade moments and analyze your mistakes and successes.

This is critical, we can’t remember how we were feeling 6 months ago about a specific stock.

Your journal will help you reflect.

Not Recording your Trades

This allows you to go back to previous trade moments and analyze your mistakes and successes.

This is critical, we can’t remember how we were feeling 6 months ago about a specific stock.

Your journal will help you reflect.

11/

Over leveraging

Start with your own money first and what you can afford to lose before you look to use leverage.

We all want to hit it big, but this is dangerous if you don’t know what you are doing.

Margin calls will wipe you out

Over leveraging

Start with your own money first and what you can afford to lose before you look to use leverage.

We all want to hit it big, but this is dangerous if you don’t know what you are doing.

Margin calls will wipe you out

12/

Guessing

If you are buying without understanding why, then you are playing a dangerous game.

Without putting in the work or educating yourself then you are just guessing.

With proper preparation you can set yourself up well.

Learn as much as possible 👇🏽

Guessing

If you are buying without understanding why, then you are playing a dangerous game.

Without putting in the work or educating yourself then you are just guessing.

With proper preparation you can set yourself up well.

Learn as much as possible 👇🏽

• • •

Missing some Tweet in this thread? You can try to

force a refresh