Thread: Gains Network Analysis, #FrenchChart, Tokenomics (Very Interesting Protocol!)

🧵📈

@GainsNetwork_io $GNS is a fascinating protocol on Polygon that offers leveraged trading of crypto, forex, and- potentially soon- stocks and indices... (cont.)

1/x

🧵📈

@GainsNetwork_io $GNS is a fascinating protocol on Polygon that offers leveraged trading of crypto, forex, and- potentially soon- stocks and indices... (cont.)

1/x

It is ostensibly similar to @GMX_IO, which I did a big thread on recently as well, but the two protocols are actually very different in how they work…

The main difference is that Gains Network offers SYNTHETIC leveraged trading, so... (cont.)

2/x

The main difference is that Gains Network offers SYNTHETIC leveraged trading, so... (cont.)

2/x

..this means they can offer tons of different crypto pairs, forex, stocks, indices, etc.

This model does not require liquidity to be provided in the assets people are trading… all trades are settled via $DAI that comes from burning/minting of the protocol token- $GNS.

3/x

This model does not require liquidity to be provided in the assets people are trading… all trades are settled via $DAI that comes from burning/minting of the protocol token- $GNS.

3/x

This is really a revolutionary idea with wide-ranging implications, and is reminiscent of the extremely popular ‘Mirror Protocol’ on the Terra ecosystem.

This thread will go over the @GainsNetwork_io protocol in depth and offer some thoughts and analysis on it.

4/x

This thread will go over the @GainsNetwork_io protocol in depth and offer some thoughts and analysis on it.

4/x

The info in it comes from the Gains Network Docs, their Medium page, very helpful answers their Discord members provided me when I hit them up with some questions, and finally- this excellent interview with protocol founder ‘Seb’- from @CRE8RDAO:

5/x

5/x

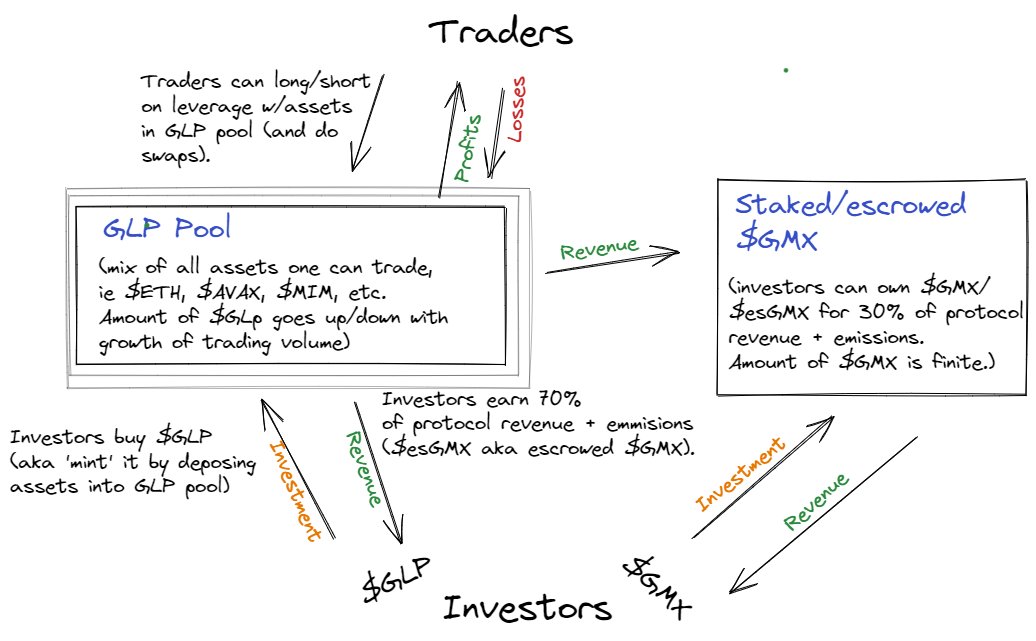

Here is the #FrenchChart I produced attempting to diagram the way the protocol works.

I should add that it- and this thread- could contain inaccuracies if I am misunderstanding something.

Plz assume I am a dump ape and double check all yourself! 🙏:)

6/x

I should add that it- and this thread- could contain inaccuracies if I am misunderstanding something.

Plz assume I am a dump ape and double check all yourself! 🙏:)

6/x

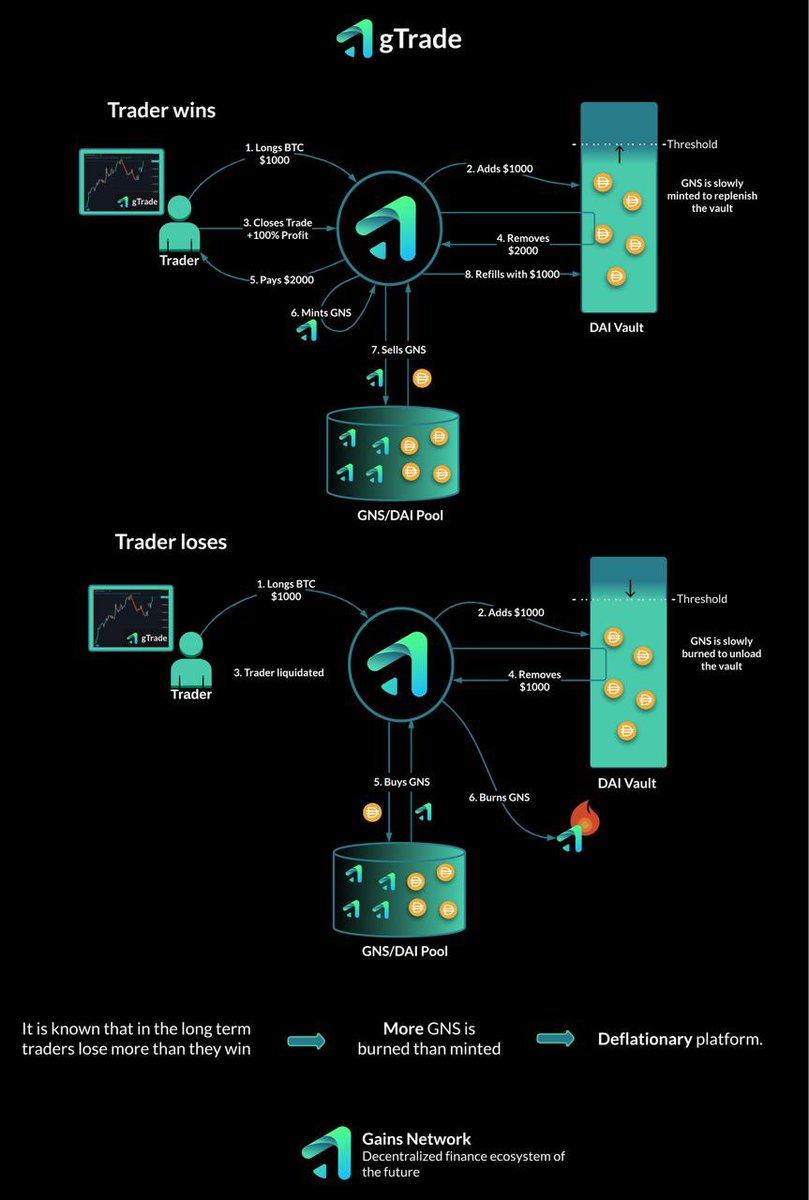

In that vein, I’ll also add a couple diagrams from Gains Network themselves to this tweet and the next one...

They break down the way the protocol works, and the protocol's tokenomics, and are very well done...

7/x

They break down the way the protocol works, and the protocol's tokenomics, and are very well done...

7/x

Basically the way the protocol works is that traders can use $DAI as collateral to take out leveraged trades on various crypto pairs, forex pairs, and (soon apparently) stocks and indices....

8/x

8/x

Investors can provide liquidity for these synthetic trades by depositing:

a) $DAI in the DAI pool (currently 25% APY), or...

b) $GNS/ $DAI LP tokens in the $GNS/ $DAI pool, currently earning 100%+ APY (these LP tokens are from @QuickswapDEX).

9/x

a) $DAI in the DAI pool (currently 25% APY), or...

b) $GNS/ $DAI LP tokens in the $GNS/ $DAI pool, currently earning 100%+ APY (these LP tokens are from @QuickswapDEX).

9/x

When traders have profitable trades, they earn $DAI equaling their profit. When they lose, their collateral is lost to the DAI pool.

The DAI pool then mints/burns $GNS in equal proportion.

This seems redundant at first (why not just use the GNS/DAI pool only?) but...

10/x

The DAI pool then mints/burns $GNS in equal proportion.

This seems redundant at first (why not just use the GNS/DAI pool only?) but...

10/x

... apparently this dual-pool setup allows for a more smooth and efficient process.

Again- all of these trades are synthetic- and all ultimately roll back to the $GNS token.

11/x

Again- all of these trades are synthetic- and all ultimately roll back to the $GNS token.

11/x

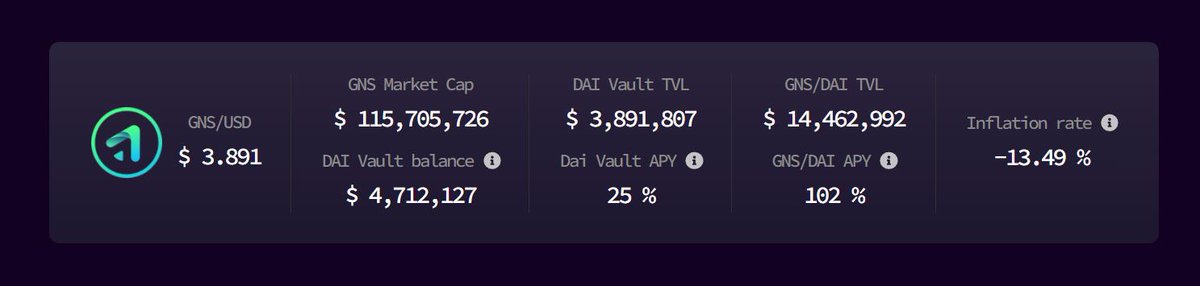

The idea is that- because historically leveraged traders typically end up slightly negative on average- the $GNS token will actually be deflationary.

Here is a screenshot of the dashboard, showing current market cap, pools, apy’s, and deflation rate for $GNS (13.49%):

12/x

Here is a screenshot of the dashboard, showing current market cap, pools, apy’s, and deflation rate for $GNS (13.49%):

12/x

Basically the idea is that investors can buy $GNS and benefit from its deflationary nature AND derive real, organic yield from the trading fees of the platform.

Again: GNS goal is purely organic yield to investors via a deflationary token (extremely powerful idea).

13/x

Again: GNS goal is purely organic yield to investors via a deflationary token (extremely powerful idea).

13/x

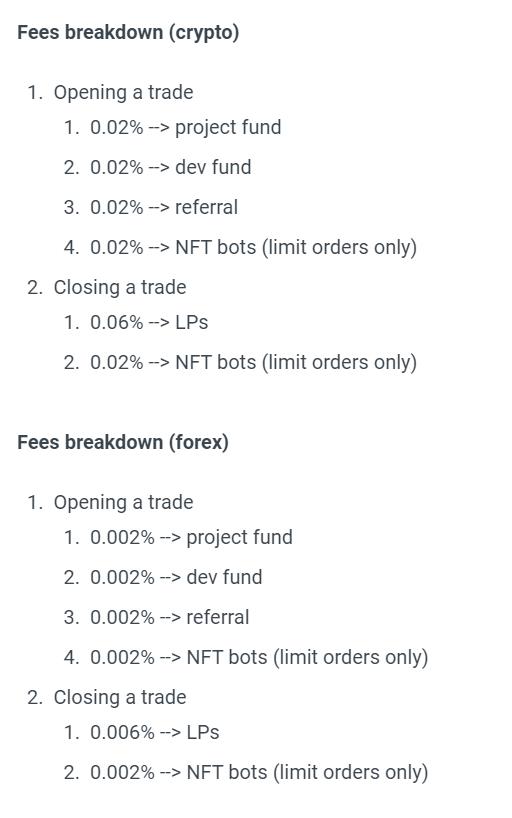

Here is a breakdown of the trading fees (see attached).

As you can see, investors can also buy GNS NFT’s that allow them to make money off of liquidation bots that liquidate underwater trades.

Supporters of the protocol can also earn referral fees for referring users.

14/x

As you can see, investors can also buy GNS NFT’s that allow them to make money off of liquidation bots that liquidate underwater trades.

Supporters of the protocol can also earn referral fees for referring users.

14/x

Here’s some additional notes I made of things Seb stated in the @CRE8RDAO interview:

-“On Gains Network you actually trade spot prices… not some derivatives price.”

-“Uses custom Chainlink oracle DON – uses average of 7 different sources (centralized exchanges, etc)"

15/x

-“On Gains Network you actually trade spot prices… not some derivatives price.”

-“Uses custom Chainlink oracle DON – uses average of 7 different sources (centralized exchanges, etc)"

15/x

"...this means no scam wicks… no slippage… etc” (see attached image)

-“One advantage is protocol can provide trading for things like DOGE without having to force their liquidity providers to actually own it.” (lol)

16/x

-“One advantage is protocol can provide trading for things like DOGE without having to force their liquidity providers to actually own it.” (lol)

16/x

Other benefits mentioned:

-Integration with TradingView so you can actually add indicators to the charts on the site.

-Site is mobile-responsive and they actually have some traders using it primarily via mobile.

17/x

-Integration with TradingView so you can actually add indicators to the charts on the site.

-Site is mobile-responsive and they actually have some traders using it primarily via mobile.

17/x

-Live chat on site – traders can talk to each other if they want

-Liquidations fully decentralized, handled by NFT bots - threshold at -90% profit.

-Docs state that “We don't have fees for keeping the trades open (no funding fee).”.

18/x

-Liquidations fully decentralized, handled by NFT bots - threshold at -90% profit.

-Docs state that “We don't have fees for keeping the trades open (no funding fee).”.

18/x

Conclusion:

Overall I think the protocol is really fascinating…

It seems that offering on-chain leveraged synthetic trading on all these different things represents an insanely large addressable market…

19/x

Overall I think the protocol is really fascinating…

It seems that offering on-chain leveraged synthetic trading on all these different things represents an insanely large addressable market…

19/x

It also makes me wonder how synthetic trading would affect non-synthetic trading if a synthetic trading outfit like this gets big enough… but to be honest I don’t understand the leveraged trading side of crypto well enough to venture any thoughts on that question…

20/x

20/x

It also seems as though the internal math and management of the protocol is of great importance, but again, that is a bit outside my wheelhouse...

As noted, GNS is very similar to GMX, so it will be interesting to see how they each grow going forward…

21/x

As noted, GNS is very similar to GMX, so it will be interesting to see how they each grow going forward…

21/x

I am still thinking through all this stuff, but... it seems to me that GMX is positioned to become an important ‘money lego’, because of how it is formulated, the benefits it can provide other protocols, structured products utilizing it, swaps, liquidity, etc...(cont.)

22/x

22/x

.. While with GNS it seems like it is more likely to remain more of a ‘standalone’ 800 lb gorilla…

As again, both have an addressable market of gargantuan size… so it seems the potential with both is nearly unlimited…

23/x

As again, both have an addressable market of gargantuan size… so it seems the potential with both is nearly unlimited…

23/x

I very much like everything I’ve learned about @GainsNetwork_io so far, and as a result I have taken a 1% position in $GNS :)

I may add to it, and if it eventually moons I may trim it a bit.

24/x

I may add to it, and if it eventually moons I may trim it a bit.

24/x

I hope this thread was helpful if you are interested in Gains Network!

If so please RT and follow! 😊

I will also add links to relevant and interesting resources on it below:

25/x

If so please RT and follow! 😊

I will also add links to relevant and interesting resources on it below:

25/x

Here is the @coingecko page for @GainsNetwork_io:

coingecko.com/en/coins/gains…

(also take note it had an earlier name when they first deployed to Ethereum before switching to Polygon and changing token)

26/x

coingecko.com/en/coins/gains…

(also take note it had an earlier name when they first deployed to Ethereum before switching to Polygon and changing token)

26/x

Relevant tweet from gigabrain @DefiMoon:

29/x

https://twitter.com/DefiMoon/status/1485888715453050884

29/x

And finally, the highly recommended @GainsNetwork_io evangelist @derpaderpederp :)

31/x

https://twitter.com/derpaderpederp/status/1482325200507224070

31/x

• • •

Missing some Tweet in this thread? You can try to

force a refresh