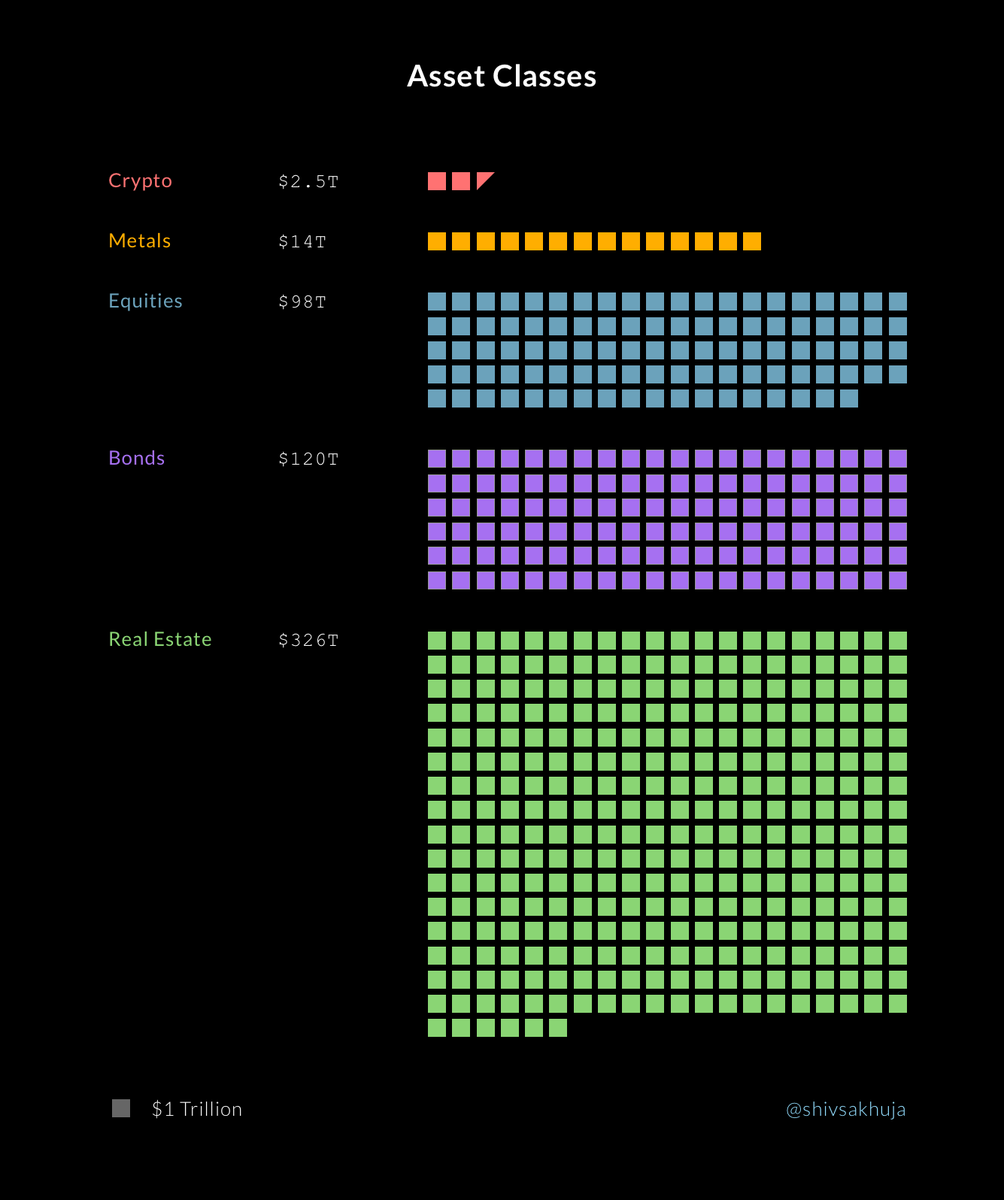

Here’s an infographic that shows the estimated size of various asset classes.

Crypto is only $2.5T

All these assets combined are > $500T.

Most of these assets will get tokenized over the next decade or two, and the protocols that tokenize them will capture a lot of that value.

Crypto is only $2.5T

All these assets combined are > $500T.

Most of these assets will get tokenized over the next decade or two, and the protocols that tokenize them will capture a lot of that value.

1/ Why would we want to tokenize assets like stocks?

– Globally accessible, tradeable 24/7/365

– Transparency

– Verifiable ownership (unlocks doors like voting / rewards)

– Programmable asset is infinitely more useful (collateral, derivatives, automation, direct transfers, etc)

– Globally accessible, tradeable 24/7/365

– Transparency

– Verifiable ownership (unlocks doors like voting / rewards)

– Programmable asset is infinitely more useful (collateral, derivatives, automation, direct transfers, etc)

2/ Why tokenize real-estate?

– Fractionalized investing

– Globally accessible, tradeable 24/7/365

– Diversification through bundling

– Add liquidity to illiquid market

– Reduced friction of transactions

– Plug into smart contracts to collateralize, create derivatives, etc

– Fractionalized investing

– Globally accessible, tradeable 24/7/365

– Diversification through bundling

– Add liquidity to illiquid market

– Reduced friction of transactions

– Plug into smart contracts to collateralize, create derivatives, etc

3/ The general idea is that programmable assets that can plug into smart contracts are infinitely more useful than the legacy versions of these assets.

4/ For example: @mirror_protocol already allows users to trade tokenized synthetic stocks

Unlike regular stocks on an exchange like the #NYSE, tokenized stocks can be:

- Traded globally 24/7/365 by anyone

- Farmed for yield (20-30%+ currently)

- Used in smart contracts

+++

Unlike regular stocks on an exchange like the #NYSE, tokenized stocks can be:

- Traded globally 24/7/365 by anyone

- Farmed for yield (20-30%+ currently)

- Used in smart contracts

+++

5/ Read our much more detailed thread about @mirror_protocol, including:

- A step-by-step guide on how it works

- How you can to use it to farm for rewards.

+++

- A step-by-step guide on how it works

- How you can to use it to farm for rewards.

+++

https://twitter.com/Momentum_6/status/1485628772313440262?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh