Before we proceed, a disclaimer, that I am invested and biased.

All information presented in this thread, should be consumed with a pinch of salt (maybe two)🧂

This is not a buy or sell recommendation

Please do your own due-diligence and you will live happily ever after!

All information presented in this thread, should be consumed with a pinch of salt (maybe two)🧂

This is not a buy or sell recommendation

Please do your own due-diligence and you will live happily ever after!

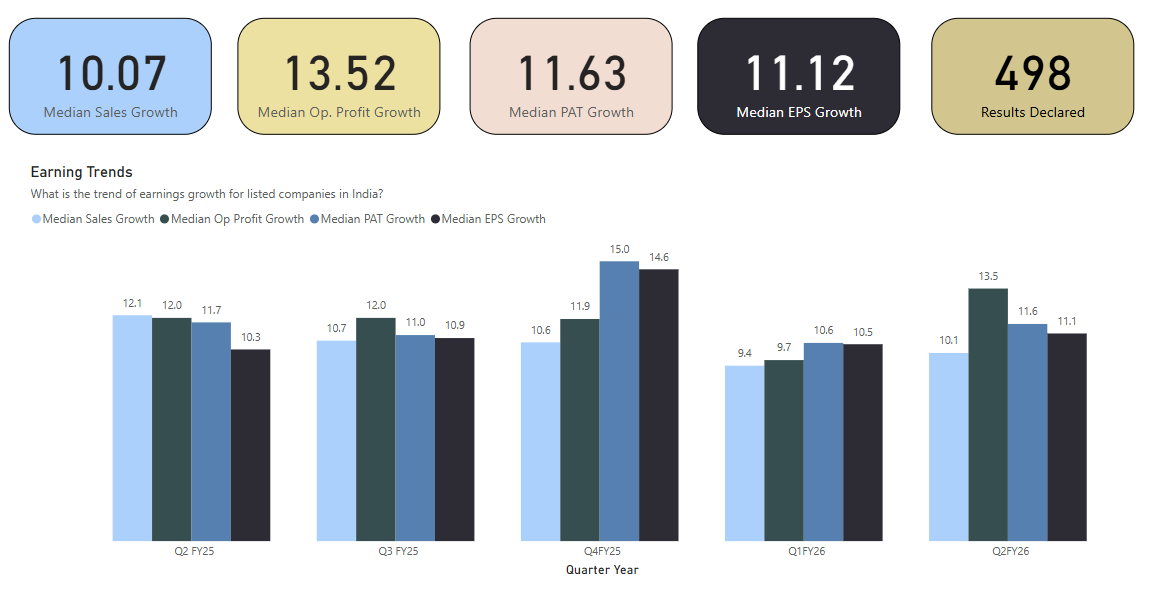

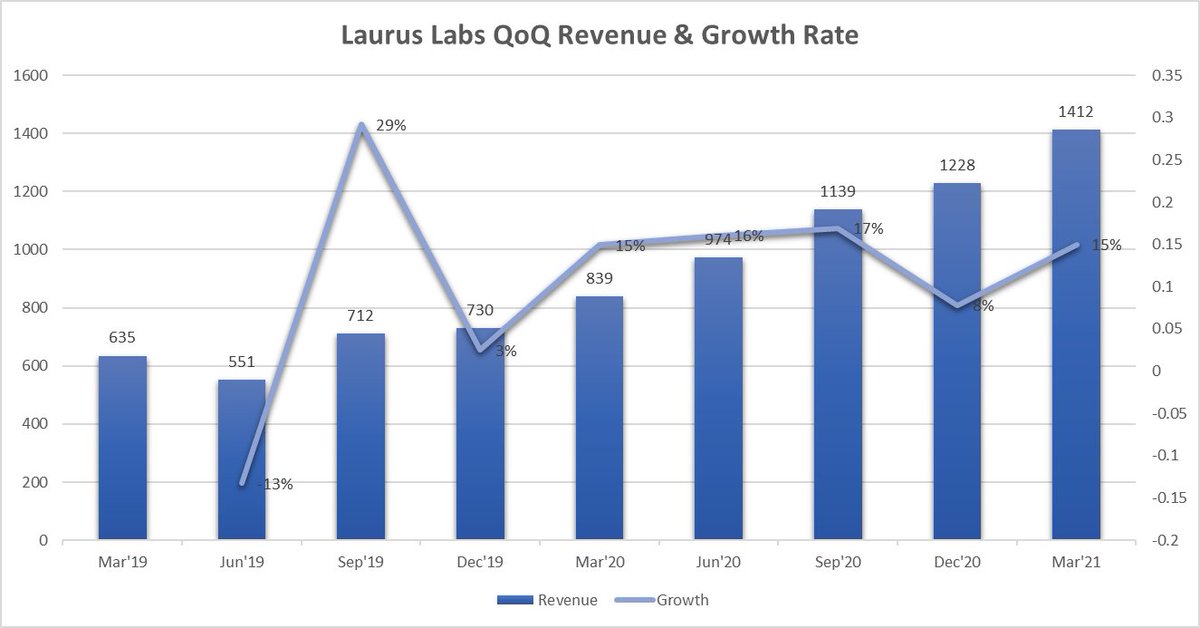

Lets zoom out first and look at QoQ topline chart for #LaurusLabs

As evident from the above chart, Laurus has reported 3 quarters of negative topline growth

Jun'21 ➡️ -9%

Sep'21 ➡️ -6%

Dec'21 ➡️ -14%

Jun'21 ➡️ -9%

Sep'21 ➡️ -6%

Dec'21 ➡️ -14%

If you zoom out a bit more, beyond the last three quarters, Laurus Reported 7 straight quarters of consecutive QoQ growth

Sep'19 ➡️ 29%

Dec'19 ➡️ 3%

Mar'20 ➡️ 15%

Jun'20 ➡️ 16%

Sep'20 ➡️ 17%

Dec'20 ➡️ 8%

Mar'21 ➡️ 15%

Sep'19 ➡️ 29%

Dec'19 ➡️ 3%

Mar'20 ➡️ 15%

Jun'20 ➡️ 16%

Sep'20 ➡️ 17%

Dec'20 ➡️ 8%

Mar'21 ➡️ 15%

Let's first analyze what were the reasons behind 7 quarters of consecutive growth rates.

The real growth started in Sep of 2019, when Laurus's topline grew from 551cr to 712cr

This was the first instance of their formulations capacity coming online.

It went largely unnoticed by the street as OPM was still 19% and ARV API revenues dominated their revenue pie.

This was the first instance of their formulations capacity coming online.

It went largely unnoticed by the street as OPM was still 19% and ARV API revenues dominated their revenue pie.

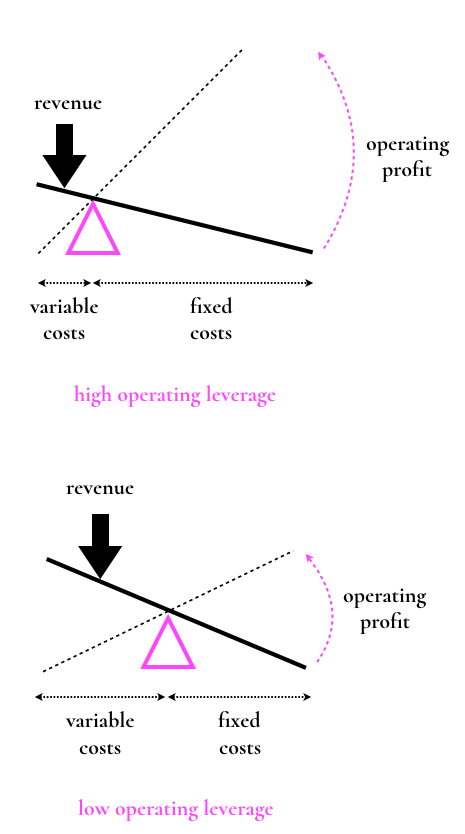

As new more capacities in formulations (FDF) started coming online, the topline grew each quarter but the bottom line grew faster (thanks to operating leverage)

Laurus was exceptionally placed to take advantage of Covid related tailwinds

1⃣ The company had just increased its FDF capacity

2⃣ End customers were stocking up ARV supplies, helping Laurus run those capacities at optimum utilization there by churning out more revenues

1⃣ The company had just increased its FDF capacity

2⃣ End customers were stocking up ARV supplies, helping Laurus run those capacities at optimum utilization there by churning out more revenues

This helped the firm report even higher margins (33%) and operating profit all thanks to economies of scale and operating leverage.

Now lets look at why the revenue has degrown QoQ for 3 quarters in a row

1⃣ The same factors that helped the firm during Covid are harming it now

Suppliers having stocked up ARV medications, do not need to order the same quantity again, leading to lesser utilization of capacity and negative effects of operating leverage setting in

Suppliers having stocked up ARV medications, do not need to order the same quantity again, leading to lesser utilization of capacity and negative effects of operating leverage setting in

2⃣ Increase in Input Costs

Laurus is heavily reliant on importing of solvents from China, over the last 3 quarters, the prices of solvents have increased considerably owing to supply chain issues and shut down of capacities in China

Laurus is heavily reliant on importing of solvents from China, over the last 3 quarters, the prices of solvents have increased considerably owing to supply chain issues and shut down of capacities in China

3⃣ Freight Costs

Worldwide freight and transport costs are up and that leads to higher transportation costs for Laurus which cannot be passed through immediately, there by leading to lower margins

Worldwide freight and transport costs are up and that leads to higher transportation costs for Laurus which cannot be passed through immediately, there by leading to lower margins

All these three factors combined help explain the decrease in topline for 3 quarters.

Now that we have understood the past, lets understand the present.

Where does Laurus makes money from in the present day?

Where does Laurus makes money from in the present day?

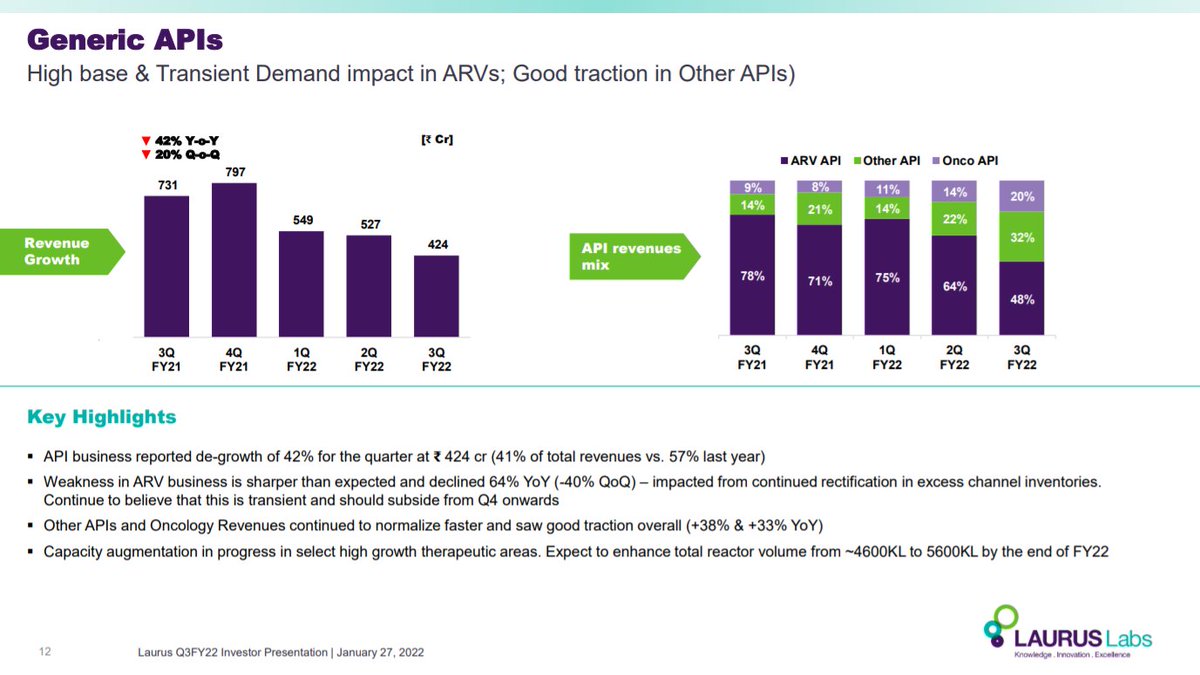

39% of Laurus's Revenue comes from ARV APIs which are used to treat HIV patients

There is a terminal risk to this revenue stream as better medications for HIV patients arrive in market in the next few years

There is a terminal risk to this revenue stream as better medications for HIV patients arrive in market in the next few years

However, Laurus is the lowest cost producer of ARV APIs globally

This will help them remain the last standing producer of these APIs until they become non-existent (which is still many years away) and remaining producers opt out

This is still a declining industry though

This will help them remain the last standing producer of these APIs until they become non-existent (which is still many years away) and remaining producers opt out

This is still a declining industry though

35% of Revenues come from FDF or Formulations

There is a misconception on the street that these capacities are only for ARVs when in fact these are fungible capacities

Laurus can choose to formulate either ARVs or anything else depending on the market forces

There is a misconception on the street that these capacities are only for ARVs when in fact these are fungible capacities

Laurus can choose to formulate either ARVs or anything else depending on the market forces

Increase in FDF capacity for Laurus is merely a way for it to forward integrate itself while it strengths its backward integration into APIs

This explains the increased investment into FDF capacity, much of which comes online in Q4FY22

This explains the increased investment into FDF capacity, much of which comes online in Q4FY22

16% of Revenues come from APIs other than ARVs

These are primarily divided into oncology and diabetic APIs

This is again effort on Laurus's part to remove its dependency on ARVs

These are primarily divided into oncology and diabetic APIs

This is again effort on Laurus's part to remove its dependency on ARVs

Finally, 11% of Revenues come from Synthesis business

This is your CDMO business which is growing fast, and I mean blazing fast, clocking in growth rates of over 63% YoY, 34% QoQ

This is your CDMO business which is growing fast, and I mean blazing fast, clocking in growth rates of over 63% YoY, 34% QoQ

Less than 1% of Revenues today come from Laurus Bio, which is their investment into recombinant proteins (acquisition of Richcore)

CAR-T etc. (other investments) do not generate any revenue (yet)

CAR-T etc. (other investments) do not generate any revenue (yet)

All Investing is done by looking at what the future beholds

If you're classifying Laurus as an ARV API company then you're still looking in the rear view mirror

If you're classifying Laurus as an ARV API company then you're still looking in the rear view mirror

So what does the future holds?

Before I tell you what the future holds, let me provide you with a disclaimer

Laurus is *NOT* your short term multibagger stock, you cannot get 10x returns by investing now

This is opposite to what several Momentum Grandmasters will tell you

Laurus is *NOT* your short term multibagger stock, you cannot get 10x returns by investing now

This is opposite to what several Momentum Grandmasters will tell you

If you're investing in hopes that this will give you anything more than 20% CAGR over 10 years, then I am sorry to tell you that you're investing in the wrong stock.

Even that 20% CAGR has several risk factors associated with it.

Even that 20% CAGR has several risk factors associated with it.

Having said that lets talk about where the growth will come from and why I am invested in the company.

Laurus's main investment thesis is their CDMO or synthesis offering, this is a high margin very sticky business which is growing very fast (even though it is only 11% of Revenues today)

The company has been investing in their formulations and Synthesis capabilities

Formulations will support the short term growth while Synthesis business will accelerate that revenue growth in medium term (~2 years)

Formulations will support the short term growth while Synthesis business will accelerate that revenue growth in medium term (~2 years)

Laurus has over 50 active projects in Synthesis space with a multi year contract in place

Laurus doesn't disclose how many of these projects are late stage (which are near to commercialization and has highest revenue potential)

Laurus doesn't disclose how many of these projects are late stage (which are near to commercialization and has highest revenue potential)

The company has a target of doing $1 Billion in Revenue by FY24 (~ 2 years from today) and I suspect Synthesis will be a big lever to achieve that target.

Lot of investors get excited about #LaurusBio but that at best is an optionality today and I do not see it aiding in any meaningful revenue generation by FY24

The formulations business supported by the R&D pipeline and Para IV filings should aid in achieving that $1 Billion Revenue target as well

Laurus spends 4% of Revenue on R&D and this figure is increasing YoY

Laurus spends 4% of Revenue on R&D and this figure is increasing YoY

Risks to that target topline of $1 Billion

1⃣ Any USFDA Observations (they have a clean track record though)

2⃣ Higher than expected deacceleration in ARV revenues

3⃣ Keyman Risk

1⃣ Any USFDA Observations (they have a clean track record though)

2⃣ Higher than expected deacceleration in ARV revenues

3⃣ Keyman Risk

So that was the complete analysis, I hope it helped you get some clarity.

Please do not get trapped by Momentum advisors and Excel Drag and Drop analysts advising on each quarterly increase in revenue.

Please do not get trapped by Momentum advisors and Excel Drag and Drop analysts advising on each quarterly increase in revenue.

Thank you and have a great day ahead!

• • •

Missing some Tweet in this thread? You can try to

force a refresh