Last week, Ark Invest released their latest annual report, titled “Big Ideas 2022”.

The report highlights key areas of disruptive innovation and developing technologies that are poised to overthrow legacy systems, as well as predictions for their growth by 2030.

Here’s a TLDR:

The report highlights key areas of disruptive innovation and developing technologies that are poised to overthrow legacy systems, as well as predictions for their growth by 2030.

Here’s a TLDR:

Digital Wallets

“Digital wallets could become leading platforms for offline & online commerce, adding $12k net value per user.”

“These wallets could also serve as on ramps to Web3 assets, such as NFTs.”

Ark forecasts each digital wallet user in the US could be worth $22.5k

“Digital wallets could become leading platforms for offline & online commerce, adding $12k net value per user.”

“These wallets could also serve as on ramps to Web3 assets, such as NFTs.”

Ark forecasts each digital wallet user in the US could be worth $22.5k

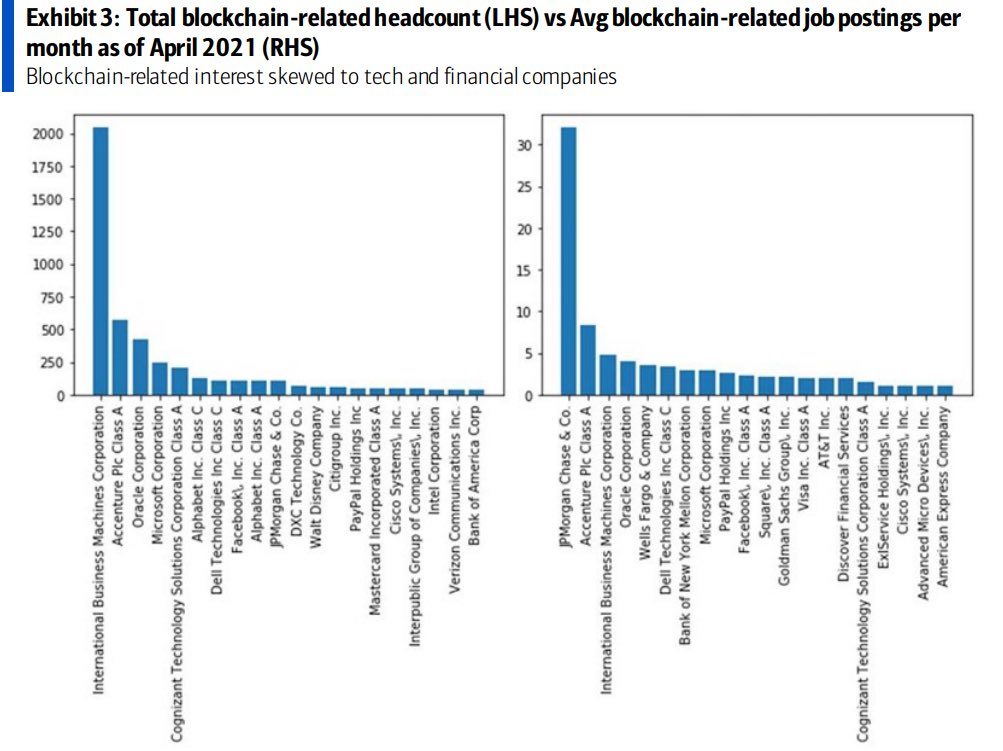

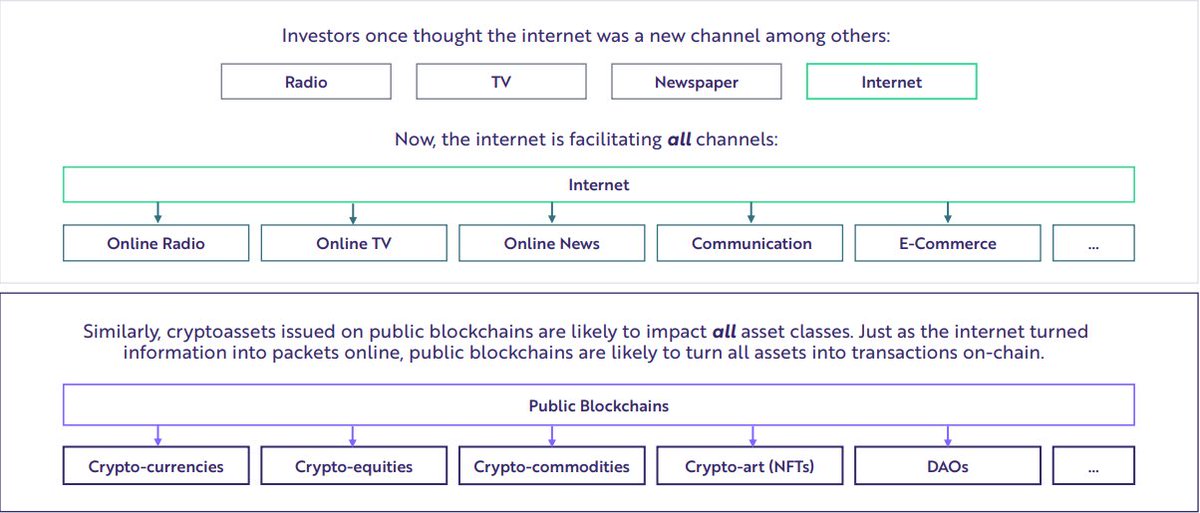

Blockchains

“Public blockchains shift the distribution of trust, replacing institutions that rely on centralized authorities w decentralized, open-source software.”

“Just as the internet turned info into packets online, blockchains will turn all assets into tx’s on chain.

“Public blockchains shift the distribution of trust, replacing institutions that rely on centralized authorities w decentralized, open-source software.”

“Just as the internet turned info into packets online, blockchains will turn all assets into tx’s on chain.

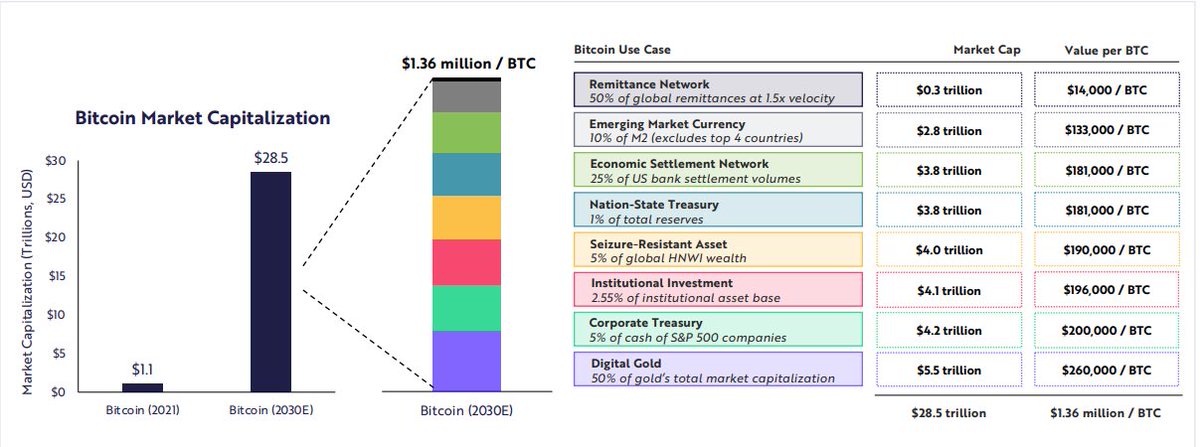

1/Bitcoin:

Empowering a monetary revolution

“BTCs market cap still represents a fraction of global assets & is likely to scale as nation states adopt as legal tender.”

According to Ark’s predictions, 1 $BTC could exceed $1,000,000 by 2030.

Empowering a monetary revolution

“BTCs market cap still represents a fraction of global assets & is likely to scale as nation states adopt as legal tender.”

According to Ark’s predictions, 1 $BTC could exceed $1,000,000 by 2030.

2/Bitcoin

BTC is maturing

“Despite increased exuberance as BTC scaled to a record high price, on-chain data suggests holders are focused on the long term.”

“Long term investors hold 13.5m $BTC, with more than 500k addresses exhibiting long term holding behavior.”

BTC is maturing

“Despite increased exuberance as BTC scaled to a record high price, on-chain data suggests holders are focused on the long term.”

“Long term investors hold 13.5m $BTC, with more than 500k addresses exhibiting long term holding behavior.”

3/Bitcoin

BTC is taking market share as a global settlement network

“Bitcoin’s cumulative transfer volume increased by 463% in a year, from $2.3 trillion in 2020 to $13.1 trillion in 2021.”

“In 2021, Bitcoin’s annual settlement volume surpassed Visa’s payments volume.”

BTC is taking market share as a global settlement network

“Bitcoin’s cumulative transfer volume increased by 463% in a year, from $2.3 trillion in 2020 to $13.1 trillion in 2021.”

“In 2021, Bitcoin’s annual settlement volume surpassed Visa’s payments volume.”

4/Bitcoin

Attracting institutions

“BTC’s institutional holder base appears to be broadening after the launch of more regulated products & adoption by corporations & nation-states.”

“Exchange traded products, countries, & corporations held 8% of BTC’s supply as of Nov 2021”

Attracting institutions

“BTC’s institutional holder base appears to be broadening after the launch of more regulated products & adoption by corporations & nation-states.”

“Exchange traded products, countries, & corporations held 8% of BTC’s supply as of Nov 2021”

5/Bitcoin

Revolutionizing energy production

“According to our research, BTC mining will encourage & generate more electricity from carbon-free sources.”

“Energy sources like wind & solar could meet a larger percentage of grid demand if BTC mining impacts the utility grid.”

Revolutionizing energy production

“According to our research, BTC mining will encourage & generate more electricity from carbon-free sources.”

“Energy sources like wind & solar could meet a larger percentage of grid demand if BTC mining impacts the utility grid.”

1/Ethereum

A financial revolution

“DeFi provides interoperability & transparency while minimizing intermediaries & counter-party risk.”

“Eth is the preferred collateral in DeFi & unit of account in NFTs, suggesting it is likely to capture a portion of the $123T money supply.”

A financial revolution

“DeFi provides interoperability & transparency while minimizing intermediaries & counter-party risk.”

“Eth is the preferred collateral in DeFi & unit of account in NFTs, suggesting it is likely to capture a portion of the $123T money supply.”

2/Ethereum

Smart contracts are usurping TradFi

Smart contracts enable users to replicate functions seen in TradFi, with reduced counter-party risk.

Banking >> Compound

Exchange >> Uniswap

Brokerage >> Metamask

Management >> Yearn

Insurance >> Nexus Mutual

Derivatives >> DYDX

Smart contracts are usurping TradFi

Smart contracts enable users to replicate functions seen in TradFi, with reduced counter-party risk.

Banking >> Compound

Exchange >> Uniswap

Brokerage >> Metamask

Management >> Yearn

Insurance >> Nexus Mutual

Derivatives >> DYDX

3/Ethereum

Crypto powered finance may scale more efficiently than TradFi

“Smart contract based financial transactions settle in near real-time almost anywhere in the world. Revenue per employee illustrates DeFi’s efficiency relative to that of traditional finance.”

Crypto powered finance may scale more efficiently than TradFi

“Smart contract based financial transactions settle in near real-time almost anywhere in the world. Revenue per employee illustrates DeFi’s efficiency relative to that of traditional finance.”

4/Ethereum

DAOs & governance

“DAOs are replacing centralized, hierarchical corporate structures with decentralized communities.”

TradFi corporations are permissioned, costly, & opaque while DAOs are permissionless, frictionless, & transparent.

DAOs & governance

“DAOs are replacing centralized, hierarchical corporate structures with decentralized communities.”

TradFi corporations are permissioned, costly, & opaque while DAOs are permissionless, frictionless, & transparent.

5/Ethereum

Stablecoins

“Stablecoins are fueling trading, lending, & payments, & have increased nearly 5x during 2021.”

“Stablecoins account for 95% of total outstanding debt on Compound & 22% of total liquidity on Uniswap.”

Stablecoins

“Stablecoins are fueling trading, lending, & payments, & have increased nearly 5x during 2021.”

“Stablecoins account for 95% of total outstanding debt on Compound & 22% of total liquidity on Uniswap.”

6/Ethereum

ETH’s TAM

“Eth could displace many TradFi services & compete as global money.”

“As financial services move on-chain, decentralized networks will take share from existing financial intermediaries.”

Ark forecasts that ETH’s market cap could exceed $20T within 10 yrs

ETH’s TAM

“Eth could displace many TradFi services & compete as global money.”

“As financial services move on-chain, decentralized networks will take share from existing financial intermediaries.”

Ark forecasts that ETH’s market cap could exceed $20T within 10 yrs

1/Web3

Internet Revolution

“As consumers spend more time online, the importance of digital assets is likely to increase considerably as consumer spending shifts to virtual worlds.”

“By 2030, we expect Web3 to depress annual offline consumption by $7.3 trillion.”

Internet Revolution

“As consumers spend more time online, the importance of digital assets is likely to increase considerably as consumer spending shifts to virtual worlds.”

“By 2030, we expect Web3 to depress annual offline consumption by $7.3 trillion.”

2/Web3

Ownership

“We believe virtual ecosystems will thrive if users can own, as opposed to rent, digital assets.”

“In Web2, end users face restrictions on products or services.. In contrast, decentralized blockchains allow users to store & trade assets on a secondary market.”

Ownership

“We believe virtual ecosystems will thrive if users can own, as opposed to rent, digital assets.”

“In Web2, end users face restrictions on products or services.. In contrast, decentralized blockchains allow users to store & trade assets on a secondary market.”

3/Web3

NFTs

“NFTs allow us to verify the ownership of digital assets on public blockchains. They usurp the power of centralized platforms to house, control, & verify assets.”

“In 2021, NFTs generated $21B in sales & unique buyers soared 8-fold to 700k.”

NFTs

“NFTs allow us to verify the ownership of digital assets on public blockchains. They usurp the power of centralized platforms to house, control, & verify assets.”

“In 2021, NFTs generated $21B in sales & unique buyers soared 8-fold to 700k.”

4/Web3

Reinventing collecting

“Collectibles & art account for 75% of sales on $ETH, while sales in virtual worlds like Sandbox account for less than 25%.”

“NFT demand in virtual worlds could exceed that of art, especially as they begin to exhibit more utility in games.”

Reinventing collecting

“Collectibles & art account for 75% of sales on $ETH, while sales in virtual worlds like Sandbox account for less than 25%.”

“NFT demand in virtual worlds could exceed that of art, especially as they begin to exhibit more utility in games.”

5/Web3

NFTs will blur the line between consumption & investment

“NFTs offer a marketplace where users can invest in assets & engage in P2P txs. NFT buyers & sellers determine prices on blockchains instead of data aggregation platforms, allowing for new forms of monetization.”

NFTs will blur the line between consumption & investment

“NFTs offer a marketplace where users can invest in assets & engage in P2P txs. NFT buyers & sellers determine prices on blockchains instead of data aggregation platforms, allowing for new forms of monetization.”

6/Web3

Blockchain gaming enable entertainment & monetization simultaneously

In the same way that free to play gaming revolutionized pay to play models, play to earn gaming will take over the industry and allow gamers to make money while they do what they love.

Blockchain gaming enable entertainment & monetization simultaneously

In the same way that free to play gaming revolutionized pay to play models, play to earn gaming will take over the industry and allow gamers to make money while they do what they love.

7/Web3

If Web3 proliferates, the monetization rate of online spending should approach that of offline spending by 2030.

“Our research suggests that the monetization of time spent online will grow at a compound annual rate of 19% with Web3 but only 8% w/o Web3 by 2030.”

If Web3 proliferates, the monetization rate of online spending should approach that of offline spending by 2030.

“Our research suggests that the monetization of time spent online will grow at a compound annual rate of 19% with Web3 but only 8% w/o Web3 by 2030.”

8/Web3

Thanks to Web3, annual online expenditures could reach $12.5T by 2030.

“W/o Web3, online expenditures is likely to grow at an annual rate of 16%, from $1.4T in 2021 to $5.2T in 2030. With Web3, annual online expenditures are likely to grow at a rate of 28% to $12.5T.”

Thanks to Web3, annual online expenditures could reach $12.5T by 2030.

“W/o Web3, online expenditures is likely to grow at an annual rate of 16%, from $1.4T in 2021 to $5.2T in 2030. With Web3, annual online expenditures are likely to grow at a rate of 28% to $12.5T.”

These threads take me a considerable amount of time to research & compile, so if you enjoyed it, please consider shooting me a follow & retweeting this thread.

For those that are interested, the full report from Ark can be found here:

research.ark-invest.com/hubfs/1_Downlo…

Pastry out🧁

For those that are interested, the full report from Ark can be found here:

research.ark-invest.com/hubfs/1_Downlo…

Pastry out🧁

• • •

Missing some Tweet in this thread? You can try to

force a refresh