Earlier this month, Messari released an incredibly comprehensive 165 page research report highlighting key trends, companies, & projects to watch across the crypto landscape, including predictions for 2022.

Too much to read?

Heres a TL;DR👇🏻

Too much to read?

Heres a TL;DR👇🏻

Investment Themes

1. Institutional trust is collapsing

“Half of Millenials & Gen X investors said it would “take a miracle” to retire”

“70% of Americans disapprove of Congress”

Prediction: “Things will get worse before they get better in the “real” world”

1. Institutional trust is collapsing

“Half of Millenials & Gen X investors said it would “take a miracle” to retire”

“70% of Americans disapprove of Congress”

Prediction: “Things will get worse before they get better in the “real” world”

2. Crypto is inevitable

“Web3 is an unstoppable force in the long term.”

“Young people are keen to invest in tech that disrupts older generations preferred institutions.”

Prediction: “Crypto will be an order of magnitude larger by 2030”

“Web3 is an unstoppable force in the long term.”

“Young people are keen to invest in tech that disrupts older generations preferred institutions.”

Prediction: “Crypto will be an order of magnitude larger by 2030”

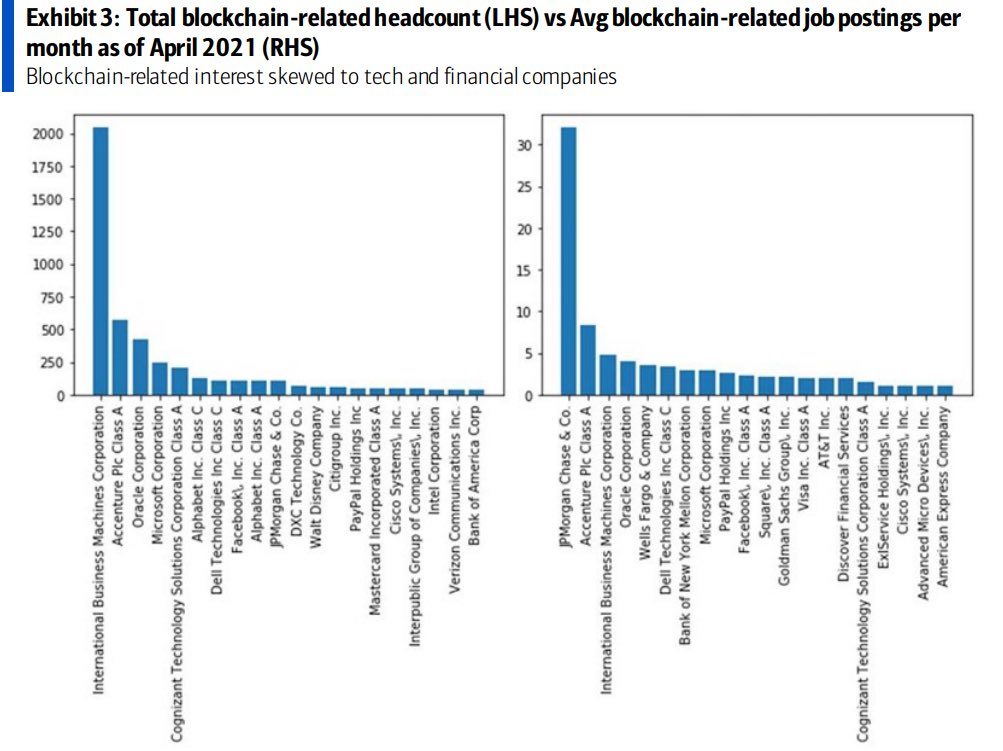

3. Bridges, NFTs, & DAOs

3 main areas are particularly underdeveloped in Web3: NFTs, DAOs, & bridges

Prediction: “NFT infra will be one of the hottest areas in 2022”

“2022 will be the year of DAO tooling”

“Protocols that help move assets fluidly will inherit the virtual earth”

3 main areas are particularly underdeveloped in Web3: NFTs, DAOs, & bridges

Prediction: “NFT infra will be one of the hottest areas in 2022”

“2022 will be the year of DAO tooling”

“Protocols that help move assets fluidly will inherit the virtual earth”

People to watch in 2022

Kyle Samani (Multicoin)

Su Zhu (3AC)

CMS Holdings

Emilie Choi (Coinbase)

Devin Finzer (OpenSea)

Dan Robinson (Paradigm)

Dave White (Paradigm)

Jeff Zirlin (Axie)

Jay Graber (Bluesky)

Tess Rinearson (Twitter)

Kristin Smith (The Blockchain Association)

…

Kyle Samani (Multicoin)

Su Zhu (3AC)

CMS Holdings

Emilie Choi (Coinbase)

Devin Finzer (OpenSea)

Dan Robinson (Paradigm)

Dave White (Paradigm)

Jeff Zirlin (Axie)

Jay Graber (Bluesky)

Tess Rinearson (Twitter)

Kristin Smith (The Blockchain Association)

…

Katie Haun (a16z)

Hester Peirce (SEC Commissioner)

Do Kwon (Terraform Labs)

Honorable Mentions:

Balaji Srinivasan (Former CTO of Coinbase)

Sam Bankman-Fried (CEO of FTX, Alameda Research)

Ryan Sean Adams (Bankless)

David Hoffman (Bankless)

Hester Peirce (SEC Commissioner)

Do Kwon (Terraform Labs)

Honorable Mentions:

Balaji Srinivasan (Former CTO of Coinbase)

Sam Bankman-Fried (CEO of FTX, Alameda Research)

Ryan Sean Adams (Bankless)

David Hoffman (Bankless)

Thoughts on $BTC

1. King stays

“1. It’s not likely for $ETH to be the worlds best virtual computer & the best money at the same time

2. Crypto’s largest monetary network will be bigger than its biggest “tech” company”

Prediction: The chance of a flippening in 2022 is 20%

1. King stays

“1. It’s not likely for $ETH to be the worlds best virtual computer & the best money at the same time

2. Crypto’s largest monetary network will be bigger than its biggest “tech” company”

Prediction: The chance of a flippening in 2022 is 20%

2. $BTC clean energy

“BTC’s energy consumption is only a “problem” because most politicians are stupid, lazy, or dishonest”

“Some of the worlds cheapest clean energy sources are “off-grid” just waiting to be tapped.”

Prediction: $BTC mining will propel the use of clean energy

“BTC’s energy consumption is only a “problem” because most politicians are stupid, lazy, or dishonest”

“Some of the worlds cheapest clean energy sources are “off-grid” just waiting to be tapped.”

Prediction: $BTC mining will propel the use of clean energy

3. Is Peter Schiff okay?

“With stocks at nose-bleed levels, bonds yielding negative returns, & inflation here to stay, $BTC remains the best bet liquid bet on the institutional rotation to SOV assets”

Prediction: $$ goes brrrrr.. buy everything, especially $BTC

“With stocks at nose-bleed levels, bonds yielding negative returns, & inflation here to stay, $BTC remains the best bet liquid bet on the institutional rotation to SOV assets”

Prediction: $$ goes brrrrr.. buy everything, especially $BTC

American Crypto Policy

1. Taxes

“Crypto’s decentralized tooling, lack of exchange reporting standards, & evolving financial models make it difficult to track taxable income each year.”

Prediction: We will see no clarity on dozens of crypto tax reporting issues from the IFS

1. Taxes

“Crypto’s decentralized tooling, lack of exchange reporting standards, & evolving financial models make it difficult to track taxable income each year.”

Prediction: We will see no clarity on dozens of crypto tax reporting issues from the IFS

https://twitter.com/twobitidiot/status/1449709658529280003

2. Crypto is bad for (Bad) business

“The whole “crypto is for criminals” schtick is categorically false”

“Illicit activity compromises just 0.34% of crypto transactions, lower than the illicit activity in “regulated” services”

Prediction: Illicit use will continue to decline

“The whole “crypto is for criminals” schtick is categorically false”

“Illicit activity compromises just 0.34% of crypto transactions, lower than the illicit activity in “regulated” services”

Prediction: Illicit use will continue to decline

3. Battle for privacy

“digital privacy rights are an afterthought to policy makers”

“The worst parts of the infrastructure bill, & the 6050i reporting provision put the industry in a precarious position.”

Prediction: “Both provisions are ripe for constitutional challenges”

“digital privacy rights are an afterthought to policy makers”

“The worst parts of the infrastructure bill, & the 6050i reporting provision put the industry in a precarious position.”

Prediction: “Both provisions are ripe for constitutional challenges”

Market infrastructure

1. Payment Innovations

“Every time i send a usdc payment to fund an investment, I weep tears of joy I didn’t have to initiate a wire through a bank”

We now have unique protocols for payroll integrations, streaming payments, & quadratic payouts.

1. Payment Innovations

“Every time i send a usdc payment to fund an investment, I weep tears of joy I didn’t have to initiate a wire through a bank”

We now have unique protocols for payroll integrations, streaming payments, & quadratic payouts.

2. CeFi vs TradFi

“Banks, trading desks, asset managers, they can all enter crypto, & probably will. But the game is basically over”

“Crypto is simply bigger, faster, more aggressive, & unshackled by the distractions of maintaining 50 yr old TradFi infra”

Prediction: It’s over

“Banks, trading desks, asset managers, they can all enter crypto, & probably will. But the game is basically over”

“Crypto is simply bigger, faster, more aggressive, & unshackled by the distractions of maintaining 50 yr old TradFi infra”

Prediction: It’s over

3. ICOs

“They’ve crossed a line from being naive to intentionally misleading, & someone needs to call out the lies.”

“Token sales have actually performed better as a class of investment than the S&P - by an order of magnitude.”

“They’ve crossed a line from being naive to intentionally misleading, & someone needs to call out the lies.”

“Token sales have actually performed better as a class of investment than the S&P - by an order of magnitude.”

NFTs & Web3

1. NFTs

“NFTs represent verifiably scarce, portable, & programmable pieces of digital property.”

“The potential for NFTs is unlimited as blockchains become global ledgers for both virtual & physical property”

Prediction: NFTs are the building blocks for the future

1. NFTs

“NFTs represent verifiably scarce, portable, & programmable pieces of digital property.”

“The potential for NFTs is unlimited as blockchains become global ledgers for both virtual & physical property”

Prediction: NFTs are the building blocks for the future

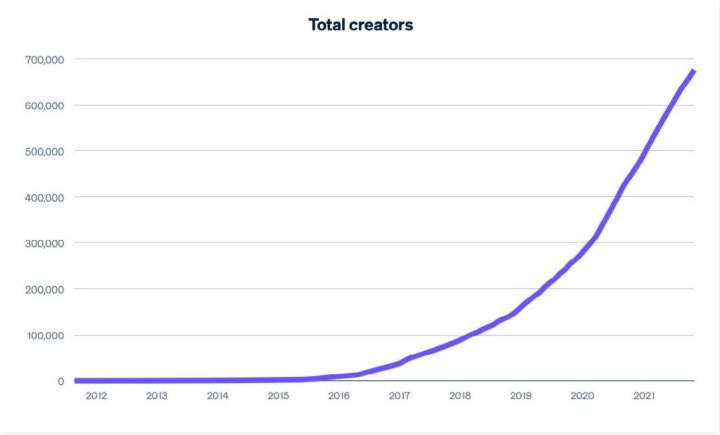

2. Fan Tokens

“Fan tokens could be what helps crypto cross into mainstream adoption”

“If digital art & PFPs is good news for visual artists, fan tokens unlock a value stream for the entertainment industry”

Prediction: Fan tokens will lead to a resurgence of creativity

“Fan tokens could be what helps crypto cross into mainstream adoption”

“If digital art & PFPs is good news for visual artists, fan tokens unlock a value stream for the entertainment industry”

Prediction: Fan tokens will lead to a resurgence of creativity

3. Collateralization

“Unique assets are less liquid than fungible assets by definition. This creates challenges when it comes to price discovery for NFTs & virtual asset collateralization.”

Prediction: “This will be one of the most important areas of NFT infra in years ahead”

“Unique assets are less liquid than fungible assets by definition. This creates challenges when it comes to price discovery for NFTs & virtual asset collateralization.”

Prediction: “This will be one of the most important areas of NFT infra in years ahead”

Defi 2.0

1. Algo stablecoins

“Following a hype cycle in Q4 2020, algo stablecoins crashed. But we’re seeing a renaissance in the sector today, powered by fractional reserve stablecoins & protocol controlled value”

Prediction: Algo stables pose a credible threat to $DAI

1. Algo stablecoins

“Following a hype cycle in Q4 2020, algo stablecoins crashed. But we’re seeing a renaissance in the sector today, powered by fractional reserve stablecoins & protocol controlled value”

Prediction: Algo stables pose a credible threat to $DAI

2. Non pegged stablecoins

“We’ve witnessed a rise in $ pegged coins that solve crypto’s volatility bug. Early iterations have presented a new problem, they’ve dollarized our blockchains, & put the entire economy at risk”

Prediction: Dollar independence is the future

“We’ve witnessed a rise in $ pegged coins that solve crypto’s volatility bug. Early iterations have presented a new problem, they’ve dollarized our blockchains, & put the entire economy at risk”

Prediction: Dollar independence is the future

3. Protocol owned liquidity

“LPs are more like locusts than humble farmers”

“Some projects realized yield farming 1.0 was unsustainable. Instead of creating native token farms, they began to create “liquidity as a service” schemes that rented liquidity from other protocols”

“LPs are more like locusts than humble farmers”

“Some projects realized yield farming 1.0 was unsustainable. Instead of creating native token farms, they began to create “liquidity as a service” schemes that rented liquidity from other protocols”

ETH, Layers, & Bridges

1. Layer 1 Valuations

“Decentralization & architectural soundness have become secondary properties at best & willfully ignored in the mercenary dominant market of 2021.”

Prediction: $ETH dominance among L1’s will fall to <50% as value leaks to L2 tokens

1. Layer 1 Valuations

“Decentralization & architectural soundness have become secondary properties at best & willfully ignored in the mercenary dominant market of 2021.”

Prediction: $ETH dominance among L1’s will fall to <50% as value leaks to L2 tokens

2. ZK scaling

“ZK might be the only solution that will enable crypto to scale to billions of users, & it provides the privacy guarantee institutions need to participate in blockchains so they protect customer data”

Prediction: $ETH L1 txs account for <20% of tx’s by end of 2022

“ZK might be the only solution that will enable crypto to scale to billions of users, & it provides the privacy guarantee institutions need to participate in blockchains so they protect customer data”

Prediction: $ETH L1 txs account for <20% of tx’s by end of 2022

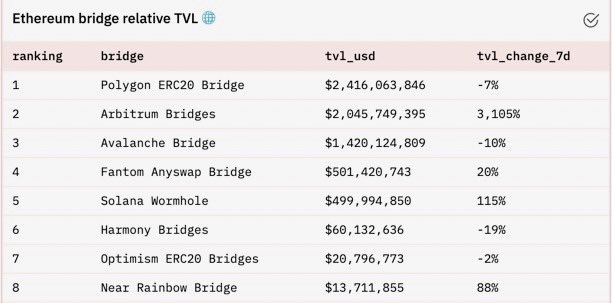

3. Bridges

“A multichain world isn’t the future, it’s the present.”

“The world of blockchains resembles the physical world today, defined by nations with their own economies, governed by their own rules.”

Prediction: L1 <> L2 bridges will have higher volume than CEX’s in 5 yrs

“A multichain world isn’t the future, it’s the present.”

“The world of blockchains resembles the physical world today, defined by nations with their own economies, governed by their own rules.”

Prediction: L1 <> L2 bridges will have higher volume than CEX’s in 5 yrs

• • •

Missing some Tweet in this thread? You can try to

force a refresh