A few days ago, Vitalik Buterin made an appearance on the BanklessHQ podcast, where he breaks down major milestones completed in 2021 as well as the “Endgame” for $ETH, a multi-step roadmap that aims to bring full scalability to $ETH

How far have we come.. & what comes next?🧁

How far have we come.. & what comes next?🧁

2021 has undoubtedly been the year of $ETH.

When questioned about the milestones in 2021, the first Vitalik brings up is the rise of NFTs.

“The rise of NFTs was something really fascinating to see, & i think its brought a lot of people into the crypto space.”

When questioned about the milestones in 2021, the first Vitalik brings up is the rise of NFTs.

“The rise of NFTs was something really fascinating to see, & i think its brought a lot of people into the crypto space.”

“We actually are giving people who are creating art new business models. We’re giving the creators of this thing thats very valuable & often has a hard time getting business models a new way to actual get funding.”

To get an idea of just how staggering this growth has been, let’s take a look at the numbers.

In 2020, total sales for NFTs reached $340 million. In 2021, total sales reached $16 billion, representing 43-fold growth in just one year.

In 2020, total sales for NFTs reached $340 million. In 2021, total sales reached $16 billion, representing 43-fold growth in just one year.

The next milestone Vitalik brings up is the rise of DAOs.

“We’ve been seeing more and more DAOs that are doing interesting things, experimenting w different governance algorithms & doing things in the real world.”

“We’ve been seeing more and more DAOs that are doing interesting things, experimenting w different governance algorithms & doing things in the real world.”

2021 was an incredible year for DAOs.

In just 12 months, DAOs’ treasuries went up 40x, from $400M in January to $16B by December 2021.

Meanwhile, participants in DAOs went up 130x, from 13k in January to 1.6 million by December 2021.

In just 12 months, DAOs’ treasuries went up 40x, from $400M in January to $16B by December 2021.

Meanwhile, participants in DAOs went up 130x, from 13k in January to 1.6 million by December 2021.

Next up, we have the Layer 2 scaling ecosystem.

“The progress we have seen in Layer 2 scaling I think has been really amazing, over the course of this past year we have seen L2’s go from theory to practice.”

“The progress we have seen in Layer 2 scaling I think has been really amazing, over the course of this past year we have seen L2’s go from theory to practice.”

“At the beginning of 2021 there were only one or two L2s on mainnet and only supported a couple of applications, & now we have this thriving ecosystem & people are really experiencing what a L2 $ETH looks like first hand.”

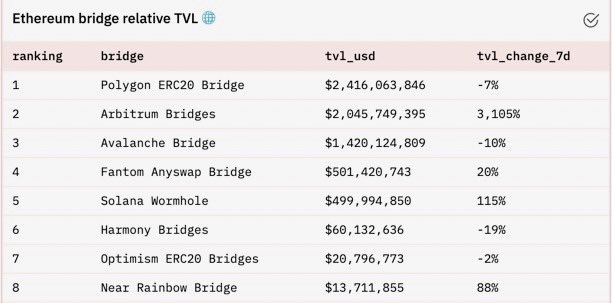

Over the past year, the total value locked (TVL) in L2 solutions has grown over 1,200% from $48M to nearly $6B and reached an all-time high of $7.16B in late November

On top of the significant growth within various sectors of $ETH, there have also been major accomplishments & upgrades at the protocol level.

The first of which mentioned by Vitalik is the Beacon Chain.

The first of which mentioned by Vitalik is the Beacon Chain.

“The Beacon Chain has proved itself. Its turned from being very early thing into an increasingly mature ecosystem. It also had its very first hard fork, which added the basic scaffolding needed for light client support which is an important trial run for the merge.”

The Beacon Chain, which launched on December 1st, 2020, introduces Proof-of-Stake to $ETH, & is used to coordinate an expanded network of shards & validators.

It has amassed 8,902,643 ($33B) of $ETH staked & has 278,222 active validators.

It has amassed 8,902,643 ($33B) of $ETH staked & has 278,222 active validators.

Ethereum’s transition to PoS, referred to as “The Merge”, is intended to offer many benefits: more security, more democratic governance, & significantly more efficient usage of resources.

Additionally, this will result in increased throughput, shorter tx times, & lower tx fees.

Additionally, this will result in increased throughput, shorter tx times, & lower tx fees.

Beyond the merge, we have “The Surge”, which is intended to bring massive scalability to rollups through sharding.

Rollups are solutions that perform transaction execution outside the main Ethereum chain (layer 1) but post transaction data on layer 1.

Rollups are solutions that perform transaction execution outside the main Ethereum chain (layer 1) but post transaction data on layer 1.

Rollups are showing significant reducing fees for $ETH, with Optimism & Arbitrum providing fees that are 3-8x lower than Ethereum’s base layer itself, & ZK rollups, which have better data compression have fees 40-100x lower than the base layer.

However, these fees are still too expensive for many users.

Existing rollups today use transaction call data. In order to give a short term boost to rollup capacity & reduced costs, the cost of transaction call data needs to be decreased.

Existing rollups today use transaction call data. In order to give a short term boost to rollup capacity & reduced costs, the cost of transaction call data needs to be decreased.

A temporary solution for making rollups cheaper is explored in EIP-4488.

Technical TLDR: EIP-4488 reduces the call data cost from 16 to 3 gas per byte, with a cap in calldata per block to mitigate security risks.

End-user TLDR: Rollup overhead decreases, thus lowering L2 fees.

Technical TLDR: EIP-4488 reduces the call data cost from 16 to 3 gas per byte, with a cap in calldata per block to mitigate security risks.

End-user TLDR: Rollup overhead decreases, thus lowering L2 fees.

https://twitter.com/protolambda/status/1466114606036889613

At the same time, Ethereum will begin basic sharding implementation.

Sharding refers to splitting a database into multiple instances.

The $ETH blockchain will be split up into 64 separate shards (starting with 4 shards at first)

Sharding refers to splitting a database into multiple instances.

The $ETH blockchain will be split up into 64 separate shards (starting with 4 shards at first)

Sharding is a good way to scale while keeping things decentralized.

With shard chains, validators only need to store/run data for the shard they’re validating.

This will significantly reduce hardware reqs for running nodes & eventually let you run $ETH on a PC or phone.

With shard chains, validators only need to store/run data for the shard they’re validating.

This will significantly reduce hardware reqs for running nodes & eventually let you run $ETH on a PC or phone.

Along with sharding comes a massive overhaul in the way state is stored on $ETH.

This is where “The Verge” comes into play.

The verge aims to introduce stateless clients to $ETH.

This is where “The Verge” comes into play.

The verge aims to introduce stateless clients to $ETH.

Currently, $ETH is a sequential chain of blocks where one is completed on top of another in linear fashion.

This leads to traffic jams & overall inefficiency in data processing.

With sharding, however, each shard has its own independent state.

This leads to traffic jams & overall inefficiency in data processing.

With sharding, however, each shard has its own independent state.

Transactions are delegated to different shards for processing, so rather than the entire network processing the same transaction, parallel computing increases efficiency by allowing the work to be split up & executed concurrently.

This is where verkle trees come into play. Similar to merkle trees, you submit data into a tree, & make a short proof of any single piece.

The diff is that a merkle tree requires 1 kilobyte, while a verkle tree requires less than 150 bytes, which make stateless clients viable

The diff is that a merkle tree requires 1 kilobyte, while a verkle tree requires less than 150 bytes, which make stateless clients viable

Next up, we have “The Purge”, which will eliminate historical data on $ETH

According to specification described in EIP-4444, Ethereum clients will be obliged to discard data over one year in age.

According to specification described in EIP-4444, Ethereum clients will be obliged to discard data over one year in age.

The Purge will provide numerous benefits for $ETH including:

-Reducing hardware requirements for nodes

-Allows clients to remove code that deals exclusively with legacy transactions

-Reduce bandwidth on the network (clients need to sync less data)

-Reducing hardware requirements for nodes

-Allows clients to remove code that deals exclusively with legacy transactions

-Reduce bandwidth on the network (clients need to sync less data)

• • •

Missing some Tweet in this thread? You can try to

force a refresh