Here's everything you need to know about risk management in Crypto:

• Risk Management Frameworks from business, trading, and poker

• Risks in DeFi you're not even aware of

• Reducing risks w/o sacrificing too much yield

🧵

• Risk Management Frameworks from business, trading, and poker

• Risks in DeFi you're not even aware of

• Reducing risks w/o sacrificing too much yield

🧵

DeFi has around been around 1.5 years.

It carries many risks that TradFi doesn't.

And the most dangerous ones are the ones that even haven't happened yet.

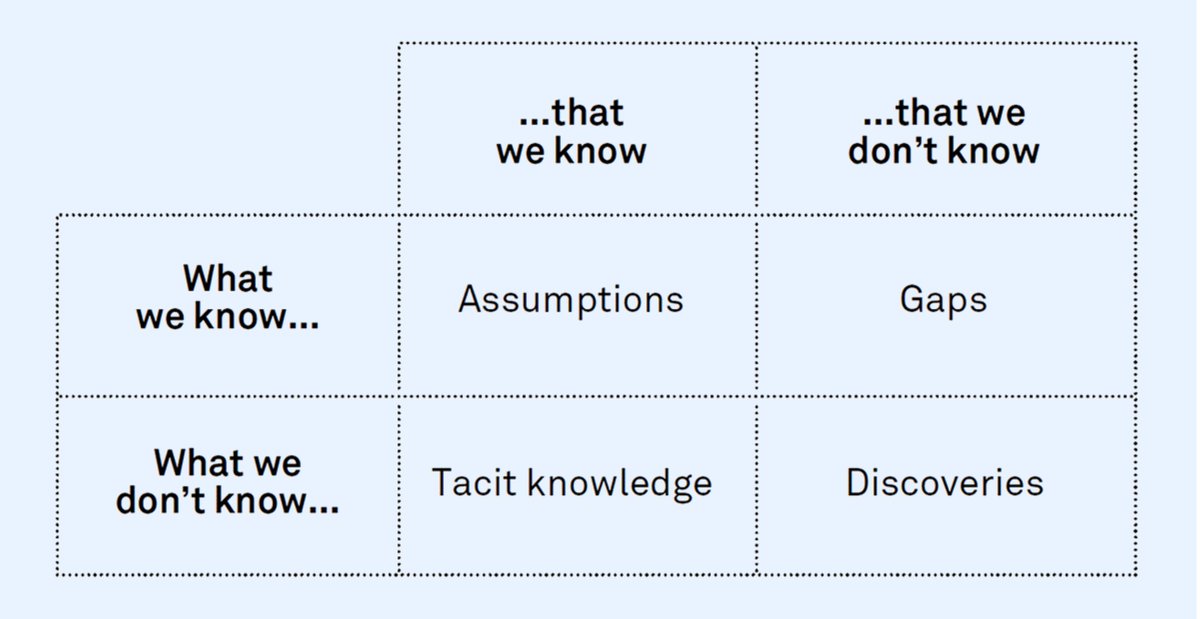

The best way to understand them is a framework called “Known, knowns” made famous by Donald Rumsfeld

It carries many risks that TradFi doesn't.

And the most dangerous ones are the ones that even haven't happened yet.

The best way to understand them is a framework called “Known, knowns” made famous by Donald Rumsfeld

Known, knowns

These are the risks that you are aware of and can prepare for.

Every DeFi project has smart contract risks.

How do you lower this risk?

You prepare by seeing if it has passed audits.

If it’s a fork, you research to see which project it was forked from.

These are the risks that you are aware of and can prepare for.

Every DeFi project has smart contract risks.

How do you lower this risk?

You prepare by seeing if it has passed audits.

If it’s a fork, you research to see which project it was forked from.

Knowns, unknowns

You know that the risks exist, but you can’t measure the impact.

Anon founders carry risks.

WHY are they anonymous?

• Is it because they value their safety and privacy like Satoshi?

• Or is it because they're hiding something?

You don't know.

You know that the risks exist, but you can’t measure the impact.

Anon founders carry risks.

WHY are they anonymous?

• Is it because they value their safety and privacy like Satoshi?

• Or is it because they're hiding something?

You don't know.

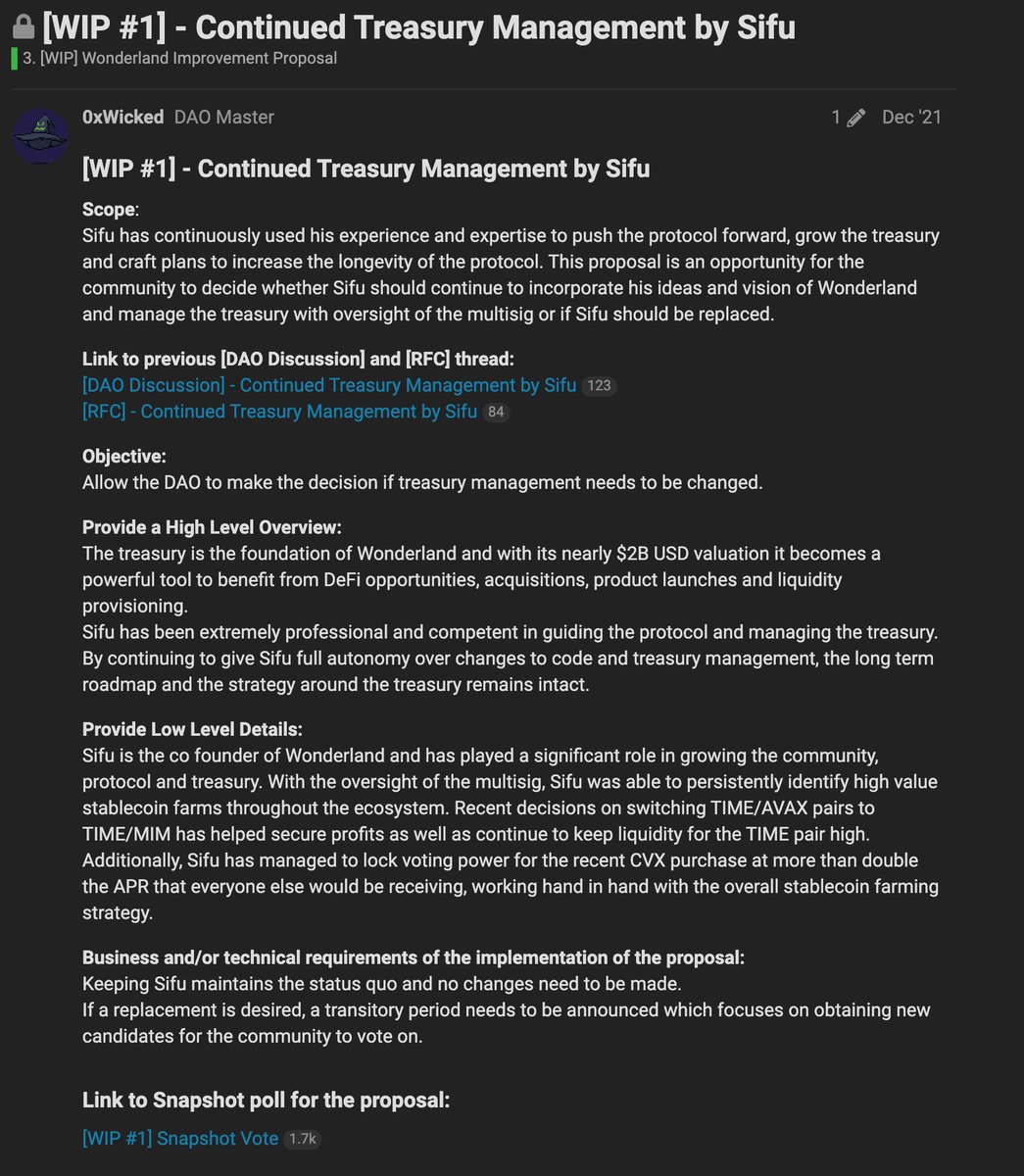

Another example is FAAS. (Farming as a Service)

You KNOW that so much of the returns are based on the farming ability.

But you DON'T know how effective their strategies will be, or how they'll survive a long bear market.

You don't know if their best farmers will stick around.

You KNOW that so much of the returns are based on the farming ability.

But you DON'T know how effective their strategies will be, or how they'll survive a long bear market.

You don't know if their best farmers will stick around.

Unknown, Knowns

The risks are KNOWN, but they are UNKNOWN to you.

• You should use a hardware wallet

• You should see if a protocol has been audited

• You should never enter your seed phrase anywhere.

• You shouldn’t give a smart contract “unlimited spend limit”

The risks are KNOWN, but they are UNKNOWN to you.

• You should use a hardware wallet

• You should see if a protocol has been audited

• You should never enter your seed phrase anywhere.

• You shouldn’t give a smart contract “unlimited spend limit”

These are common knowledge, but beginners might not know them yet.

Limit your exposure until you’ve mastered the best practices.

Limit your exposure until you’ve mastered the best practices.

Unknown, Knowns

Another interpretation is “you THINK you know, but you actually don't”

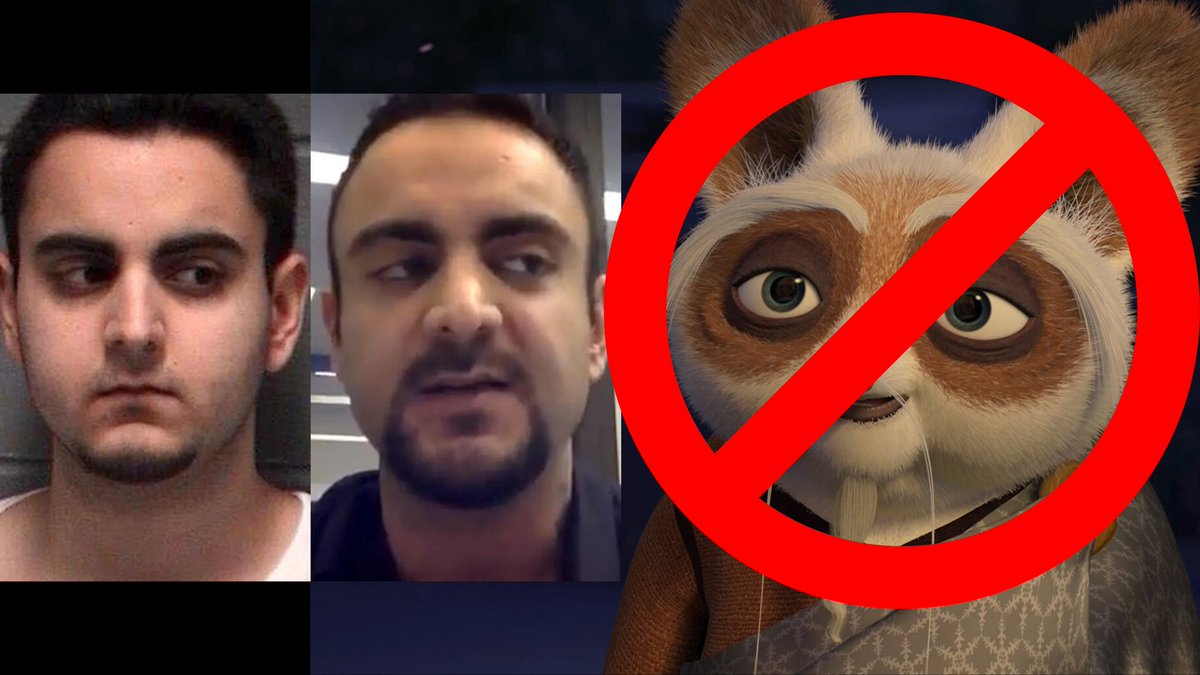

I thought that Sifu had a legitimate background.

I trusted Dani’s judgment bc of his reputation and track record.

It didn’t occur to me that Dani could’ve been a bad actor too.

Another interpretation is “you THINK you know, but you actually don't”

I thought that Sifu had a legitimate background.

I trusted Dani’s judgment bc of his reputation and track record.

It didn’t occur to me that Dani could’ve been a bad actor too.

Overconfidence in an Audit

Some people felt comfortable using @financegrim because it was audited.

However, the platform's smart contracts were exploited despite having an audit.

You thought that the audit made it safe when it was still vulnerable.

Some people felt comfortable using @financegrim because it was audited.

However, the platform's smart contracts were exploited despite having an audit.

You thought that the audit made it safe when it was still vulnerable.

Unknown, Unknowns

These are events you can't prepare for because their existence is unknown.

Here are some examples from the Real World

• The 9/11 Attack

• The Global Financial Crisis 2008

• The COVID 19 Impact

• The fall of the Soviet Union

These are events you can't prepare for because their existence is unknown.

Here are some examples from the Real World

• The 9/11 Attack

• The Global Financial Crisis 2008

• The COVID 19 Impact

• The fall of the Soviet Union

Black Swans in Crypto

• I knew about Smart Contract risks. BadgerDao was exploited due to a FRONT END attack /w their Cloudflare API’s.

• I use to be heavily invested in NANO in 2017. Their exchange partner, Bitgrail, was exploited. That crashed the price.

• I knew about Smart Contract risks. BadgerDao was exploited due to a FRONT END attack /w their Cloudflare API’s.

• I use to be heavily invested in NANO in 2017. Their exchange partner, Bitgrail, was exploited. That crashed the price.

• Oyster Pearl was a 2017 gem. No one could’ve predicted that the Founder would exploit THEIR OWN platform.

• The Dao, built on ETH, was exploited for $60m.

• Mt Gox exploit.

• Elon Musk FUD May, and crashing the market.

• The Dao, built on ETH, was exploited for $60m.

• Mt Gox exploit.

• Elon Musk FUD May, and crashing the market.

Categorizing Risks

One way to evaluate risks is to categorize them. Here are some.

• Smart Contract Risks: Popsicle Finance, PancakeBunny, and Grim Finance exploit.

• Front End Risks: BadgerDao getting their API hacked.

• Founder Risks: Founder’s sudden death or exit scam.

One way to evaluate risks is to categorize them. Here are some.

• Smart Contract Risks: Popsicle Finance, PancakeBunny, and Grim Finance exploit.

• Front End Risks: BadgerDao getting their API hacked.

• Founder Risks: Founder’s sudden death or exit scam.

• Regulation Risks: ETH gets classified as a Security!

• Competition Risks: A protocol that improves. Netflix → Blockbuster.

• Partner Risks: 2016 a DAO had ETH Stolen. ETH didn't do anything wrong, yet they suffered.

• Competition Risks: A protocol that improves. Netflix → Blockbuster.

• Partner Risks: 2016 a DAO had ETH Stolen. ETH didn't do anything wrong, yet they suffered.

Have you thought of these risks?

• Satoshi’s alive. He dumps his Bitcoin.

• More government bans.

• Governments issue stable coins.

• Whale manipulation

• USDT not being backed

• a Founder is doxxed. It’s a deep fake / paid actor.

• China invades Taiwan

• Satoshi’s alive. He dumps his Bitcoin.

• More government bans.

• Governments issue stable coins.

• Whale manipulation

• USDT not being backed

• a Founder is doxxed. It’s a deep fake / paid actor.

• China invades Taiwan

Risk Management Best Practices

It’s impossible to predict every risk that can happen.

But there are some best practices to help protect your downside.

• Never put more than 15% into a single investment.

It’s impossible to predict every risk that can happen.

But there are some best practices to help protect your downside.

• Never put more than 15% into a single investment.

• Always Take Profits. Take a % off when it 2x's. Put it into stablecoins or a long term investment.

• Never put in more money than you can afford to lose.

• Never borrow money to invest. No credit cards. No student loans. No exceptions.

• Never use leverage.

• Never put in more money than you can afford to lose.

• Never borrow money to invest. No credit cards. No student loans. No exceptions.

• Never use leverage.

• Beware of adding additional risks such as using auto compounding protocols. (Pancakebunny and Grim Finance both got exploited)

• If it was exploited once, chances are that it’ll be exploited again. Pancakebunny / Cream finance.

• If it was exploited once, chances are that it’ll be exploited again. Pancakebunny / Cream finance.

• Know when to fold your hand and cut your losses. If it’s down by 50%, it can go down by another 45%.

• Timing. You have an edge when you enter a protocol early. Don't fomo.

• While audits aren't a guarantee, a protocol is safer with one. Look at @Rekthq leadership

• Timing. You have an edge when you enter a protocol early. Don't fomo.

• While audits aren't a guarantee, a protocol is safer with one. Look at @Rekthq leadership

• A balanced portfolio. High risk protocol = max 5%.

• Don’t overestimate your own abilities.

• Diversify your ecosystems. Only investing in FTM projects is a concentrated risk on FTM.

• Study cognitive biases. (Hint: My next thread)

• Don’t overestimate your own abilities.

• Diversify your ecosystems. Only investing in FTM projects is a concentrated risk on FTM.

• Study cognitive biases. (Hint: My next thread)

Study Game Theory

• People tend to act in their own self-interest, despite the cry for 3,3.

• You don't know what the game creator's true intentions are.

It's kinda like Squid Games.

They entered thinking it was a children's game for money.

Reality? It was a death match.

• People tend to act in their own self-interest, despite the cry for 3,3.

• You don't know what the game creator's true intentions are.

It's kinda like Squid Games.

They entered thinking it was a children's game for money.

Reality? It was a death match.

Have a LONGER investment time horizon.

Most of you are getting rekt'd because you're trying to "make it" in less than a year.

That's causing you to take on more risks than you should.

Be patient.

Your probability of making is way higher if you stretch it to 3+ cycles.

Most of you are getting rekt'd because you're trying to "make it" in less than a year.

That's causing you to take on more risks than you should.

Be patient.

Your probability of making is way higher if you stretch it to 3+ cycles.

And finally, practice good security

• Use a hardware wallet /w Metamask

• NEVER type your seed phrase

• Secure your seed phrases

• Access sites via bookmarks

• Use a separate laptop for transactions

• 2FA everywhere (Google not text)

• Keep coins off exchanges

• Use VPN

• Use a hardware wallet /w Metamask

• NEVER type your seed phrase

• Secure your seed phrases

• Access sites via bookmarks

• Use a separate laptop for transactions

• 2FA everywhere (Google not text)

• Keep coins off exchanges

• Use VPN

It LOOKS like everyone's making it. (survivorship bias.)

You don't know everyone's situation

Some Whales were able to buy ETH at $50. Now they play /w house money.

Others have successful businesses / skills to fall back on.

+ plenty of LARP's

You don't know everyone's situation

Some Whales were able to buy ETH at $50. Now they play /w house money.

Others have successful businesses / skills to fall back on.

+ plenty of LARP's

Other aspects of risk::

• Time horizon / age

• Risk tolerance

• Net worth

• Cashflow

• Assets outside of Crypto

• Monthly expenses

• Experience investing

• Obligations (kids / mortgage)

• How much time a day to research

All this should be a part of your thinking

• Time horizon / age

• Risk tolerance

• Net worth

• Cashflow

• Assets outside of Crypto

• Monthly expenses

• Experience investing

• Obligations (kids / mortgage)

• How much time a day to research

All this should be a part of your thinking

Are the Risks Worth it?

Probably not.

TBH, most people are better off with a plan like this:

• 50% BTC / 50% ETH.

• Dollar cost average.

• And wait 10+ years.

Most ppl don't have the discipline / emotions / edges needed to succeed.

Probably not.

TBH, most people are better off with a plan like this:

• 50% BTC / 50% ETH.

• Dollar cost average.

• And wait 10+ years.

Most ppl don't have the discipline / emotions / edges needed to succeed.

Did you enjoy this?

I'm slowly figuring out my own style of writing, and have more interesting threads coming.

Follow me @thedefiedge

Also, check out my newsletter at TheDeFiEdge.com for my long-form writings.

I'm slowly figuring out my own style of writing, and have more interesting threads coming.

Follow me @thedefiedge

Also, check out my newsletter at TheDeFiEdge.com for my long-form writings.

This thread took a ridiculous amount of time to research and write (and visiting painful memories haha).

Please help me out by liking and retweeting the 1st tweet below

Please help me out by liking and retweeting the 1st tweet below

https://twitter.com/thedefiedge/status/1488193098702331913

• • •

Missing some Tweet in this thread? You can try to

force a refresh