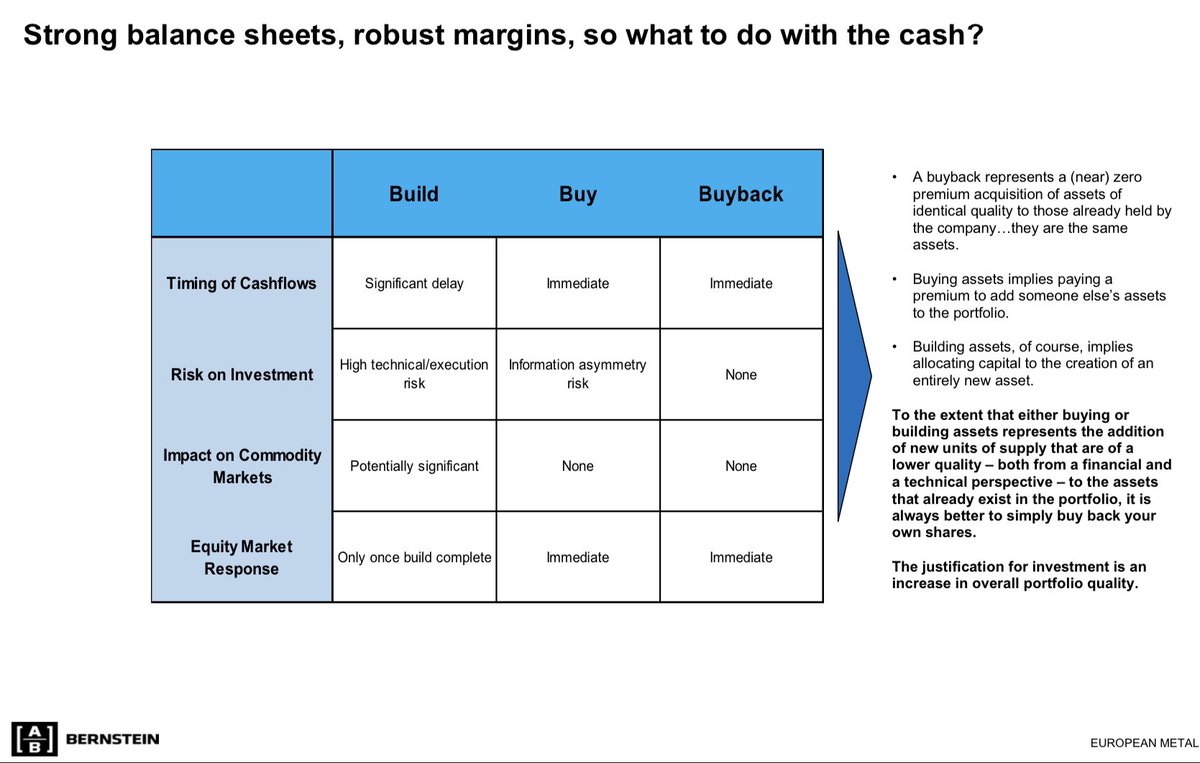

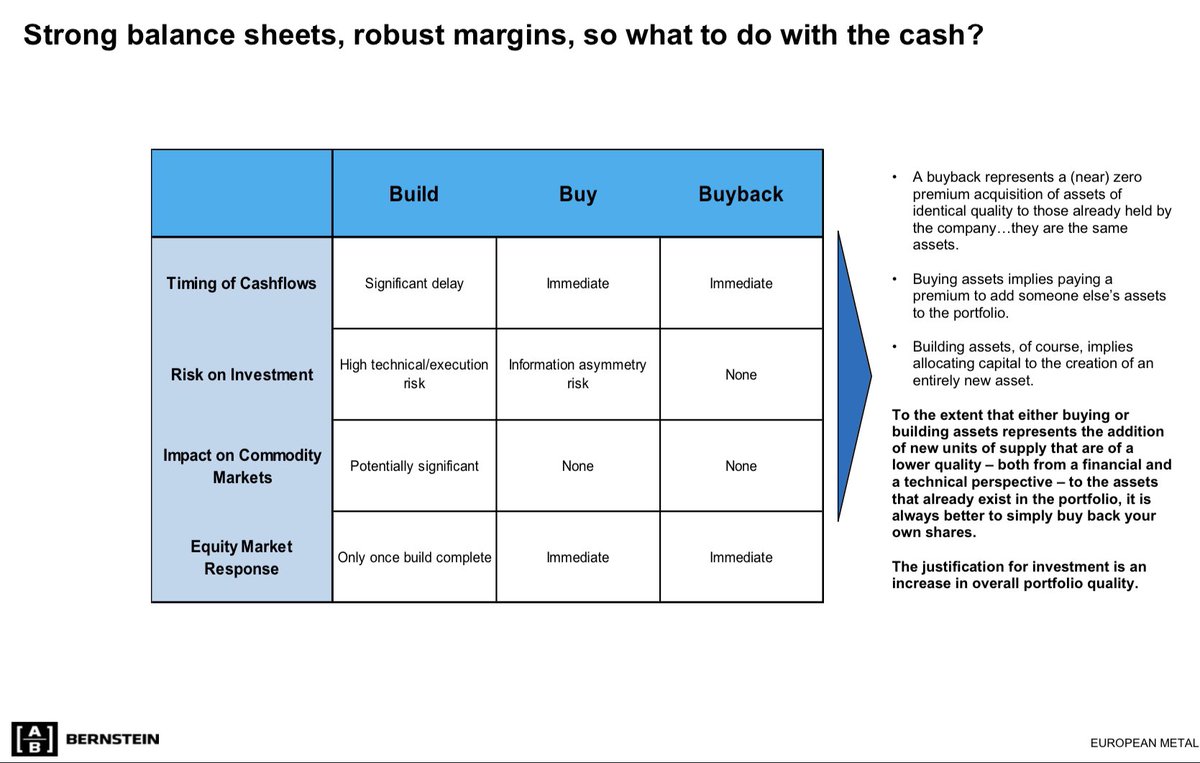

Make, buy or buyback….?

In any extractive industry this is a revolving question for shareholder, boards & managers once stable cash flows & a strong balance sheet have been established.

🧵

1/n

In any extractive industry this is a revolving question for shareholder, boards & managers once stable cash flows & a strong balance sheet have been established.

🧵

1/n

Make (develop) has significant potential to create value (something out of nothing) but comes with significant delay between cash-outflows & returns (15+y) & at risk of total capital loss. Which is why the market does not reward it.

2/…

2/…

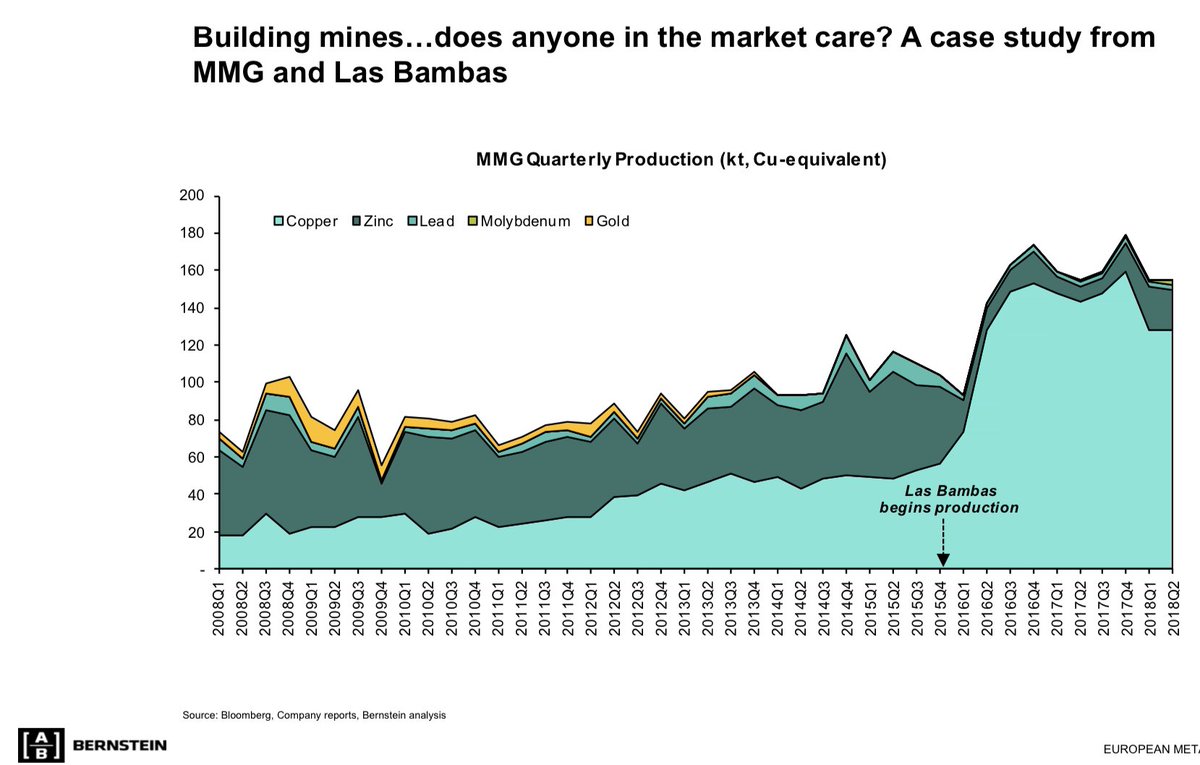

Take MMG & the Las Bambas project in #Peru. The market gave zero credit to MMG’s share price until the mine produced #copper. But it is true for the entire mining or resource SECTOR.

3/n

3/n

What about buying (not building)? There is less risk as cash outflows (payment) & cash inflows overlap somewhat. However, there is significant information asymmetry as sellers know more about the risks (perhaps off B/S) than the buyers.

4/n

4/n

Meanwhile, do NOT buy synergies «as sold» by a management teams without a significant capital allocation track record. Most managers want to build an empire & believe their own lies about synergies. Charlie explains that best with his 60+ years of experience.

5/n

5/n

And share buybacks? They are superior to both build or buy choices as they deliver immediate shareholder rewards. Nor do they carry litigation risk for boards (from angry shareholders) as they represents an acquisition of assets of identical quality to those already held.

6/n

6/n

To extent that buying or building assets represents an addition of new units of supply that are of a lower quality – both from a financial & a technical perspective – to assets that already exist in the portfolio, it is always better to simply buy back your own shares. Thx

7/7

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh