Solana/Wormhole need to come up with 120,000 ETH to restore the 'pegging'.

There's a good chance they're not going to say where the 120,000 ETH is coming from.

1. Undisclosed loan from crypto exchanges with customers Ethereum.

2. Crash the price of ETH to reduce costs.

There's a good chance they're not going to say where the 120,000 ETH is coming from.

1. Undisclosed loan from crypto exchanges with customers Ethereum.

2. Crash the price of ETH to reduce costs.

3. Use money that has been raised recently to slowly buy back the missing ETH.

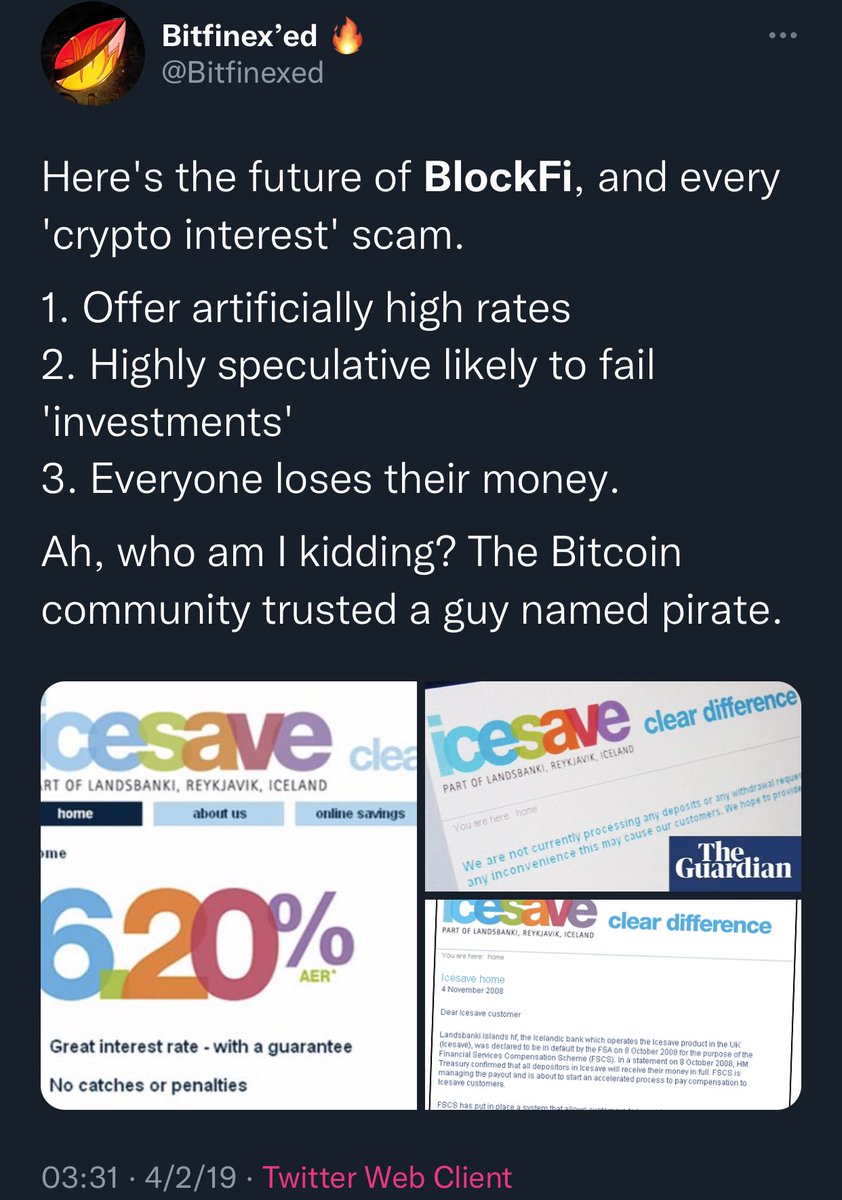

Bitfinex/Tether fraud is a good candidate to help Solana with #1. Bitfinex/Tether has a history of loaning out customers crypto for a fee, to traders and people trying to get forked tokens cheap.

Bitfinex/Tether fraud is a good candidate to help Solana with #1. Bitfinex/Tether has a history of loaning out customers crypto for a fee, to traders and people trying to get forked tokens cheap.

One thing that people miss, a lot of the funding raises in crypto are shared among multiple entities, as they don't want confidence to be shaken. If one crypto firm needs help, another one that may have just raised a bunch of money, will bail them out in secret.

Block One bailed out Bitfinex in 2019 with $500 million dollars after the NYAG made the Bitfinex losses public. Bitfinex helped Block One raise the billion dollars by facilitating a fraudulent wash trading scam a year or so earlier. integrafec.com/post/eos-ico

So, with the "Solana Wormhole" Hack, expect a bailout to be worked around in secret to restore confidence. Good chance that there will be some announcements of new raises, too, as this "hack" shortens the time needed between raises to continue the Ponzis.

Oh, and it may be worthwhile to have some people contact the Ontario Teachers Pensions fund administrator to let them know to stop sending money to a fraudulent Ponzi scheme.

When Bitfinex had an $850 million dollar hole in their US dollar balance sheet in October 2018, Bitfinex filled in the hole by using customers Bitcoin to settle Tether redemptions, that's why you saw Tether 'redeem' around $700 million Tethers in late 2018.

However, this made Bitfinex short on customers bitcoin, with Bitcoin at $6000.

The solution was for Bitfinex to suddenly crash the price of Bitcoin in late 2018 to around half, and then slowly buy back the Bitcoin over time. That allowed them to fill the hole for less real money

The solution was for Bitfinex to suddenly crash the price of Bitcoin in late 2018 to around half, and then slowly buy back the Bitcoin over time. That allowed them to fill the hole for less real money

In my opinion it’s unlikely that the price of ethereum can rise much until this hole is filled. If they manipulate the prices of ethereum upwards too much, it increases the size of the hole. It’s better for them to tank the prices then start filling it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh